How to Buy Tokenized Gold: Step-by-Step Guide for 2024

Tokenized gold has rapidly evolved into a mainstream investment vehicle, merging the age-old appeal of physical gold with the accessibility and transparency of blockchain technology. As of October 29,2025, top assets like PAX Gold (PAXG) and Tether Gold (XAUT) are trading at $3,980.47 and $3,969.18 respectively, reflecting both the stability of gold and the dynamic nature of digital markets. For investors seeking to diversify their portfolios with blockchain gold tokens, understanding the secure step-by-step process is essential.

Why Buy Tokenized Gold in 2024?

The surge in tokenized gold investment in 2024 is driven by several pragmatic factors. Tokenized gold provides fractional ownership, meaning you can buy as little as $10 worth, and instant settlement on-chain. Unlike traditional gold ETFs or physical bullion, these digital tokens are directly backed by audited reserves held in secure vaults, offering both transparency and liquidity.

This flexibility lowers barriers for retail investors while maintaining institutional-grade security. With current market volatility and inflation concerns, many see tokenized gold as a resilient hedge that fits seamlessly into both crypto-native and traditional portfolios.

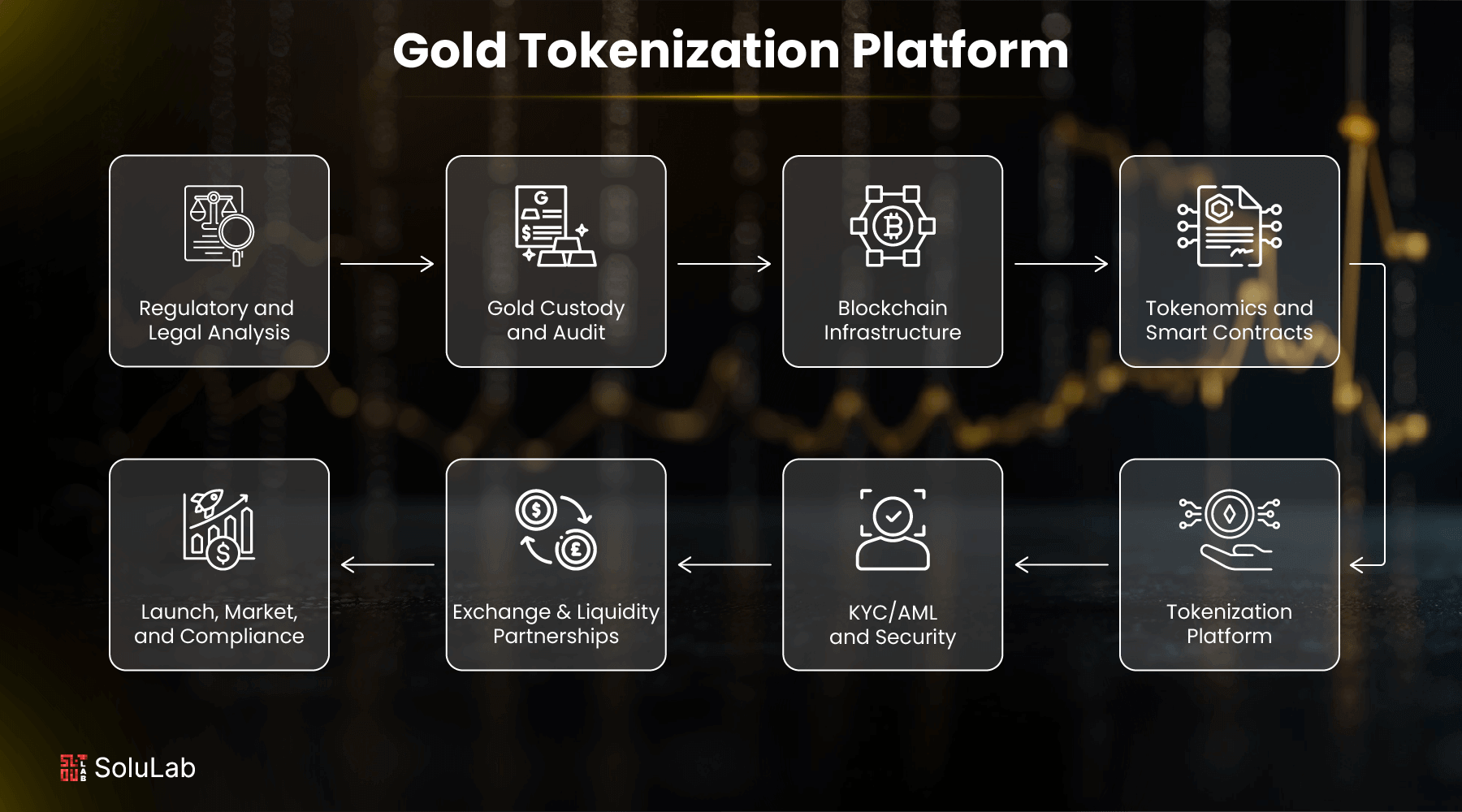

Step-by-Step Guide: How to Buy Tokenized Gold Securely

The process for buying tokenized gold is straightforward but requires careful due diligence at each stage to ensure your assets are protected and compliant with regulations. Below is a detailed breakdown of each critical step:

1. Research Reputable Tokenized Gold Providers and Platforms

Your first move should be to identify established providers offering genuine asset-backed digital gold tokens. Leading examples include PAXG and XAUT, both widely traded on regulated exchanges like Coinbase, Binance, or Kraken. Look for platforms with transparent ownership structures, clear redemption policies (if you ever want to convert tokens back into physical bullion), robust security protocols, and positive user reviews.

2. Verify Regulatory Compliance and Asset Backing of the Token

Not all digital gold tokens are created equal. Before committing funds, verify that your chosen provider operates under reputable regulatory oversight, such as New York’s Department of Financial Services or Swiss FINMA, and that their tokens are fully backed by physical gold held in audited vaults (often with serial numbers published online). This step dramatically reduces counterparty risk and ensures your investment is more than just a paper claim.

Setting Up Your Digital Infrastructure

After confirming your provider’s legitimacy, it’s time to prepare your digital infrastructure for receiving and storing blockchain-based gold assets securely.

3. Set Up a Compatible Digital Wallet for Blockchain Gold Tokens

You’ll need a wallet that supports Ethereum-based ERC-20 tokens (the standard for most tokenized commodities). Options range from hardware wallets like Ledger or Trezor, for maximum security, to reputable software wallets such as MetaMask or Trust Wallet if you prioritize convenience. Always enable two-factor authentication (2FA) where possible to further protect your holdings from unauthorized access.

The Next Steps: Funding Your Account and Making Your First Purchase

This brings you halfway through the onboarding process toward owning digital gold securely on-chain. In the next section we’ll cover completing KYC/AML verification requirements, funding your account efficiently, executing your first purchase at current market rates (PAXG: $3,980.47; XAUT: $3,969.18), then safely storing and monitoring your holdings over time.

PAX Gold (PAXG) Price Prediction 2026-2031

Professional Outlook for Tokenized Gold Assets Based on Current Market and Adoption Trends (2025 Baseline: $3,980.47)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,850.00 | $4,120.00 | $4,350.00 | +3.5% | Stable growth as tokenized gold adoption continues; regulatory clarity improves access. |

| 2027 | $3,900.00 | $4,250.00 | $4,600.00 | +3.2% | Increased institutional participation; gold price volatility reflected on-chain. |

| 2028 | $3,980.00 | $4,400.00 | $4,850.00 | +3.5% | Broader integration with DeFi and fintech; competition from new tokenized assets. |

| 2029 | $4,050.00 | $4,570.00 | $5,100.00 | +3.9% | Steady demand as digital gold becomes mainstream; potential for minor regulatory headwinds. |

| 2030 | $4,200.00 | $4,750.00 | $5,350.00 | +3.9% | Macro uncertainty boosts gold demand; tokenized gold seen as hedge in digital portfolios. |

| 2031 | $4,300.00 | $4,950.00 | $5,600.00 | +4.2% | Widespread acceptance in traditional and crypto markets; strong store-of-value narrative. |

Price Prediction Summary

PAX Gold (PAXG) is expected to exhibit steady, moderate price appreciation from 2026 to 2031, closely tracking the underlying gold market with slight premiums due to growing digital adoption and utility. Minimum and maximum ranges account for both conservative and bullish scenarios, with average annual growth rates of around 3-4%, reflecting gold’s historical performance and the increasing role of tokenized assets in diversified portfolios.

Key Factors Affecting PAX Gold Price

- Underlying gold price movements and macroeconomic cycles

- Adoption of tokenized gold in both retail and institutional portfolios

- Regulatory developments governing digital assets and tokenized commodities

- Technological improvements in blockchain custody, redemption, and trading platforms

- Competition from other tokenized precious metals or stablecoins

- Integration with DeFi and broader crypto-financial infrastructure

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

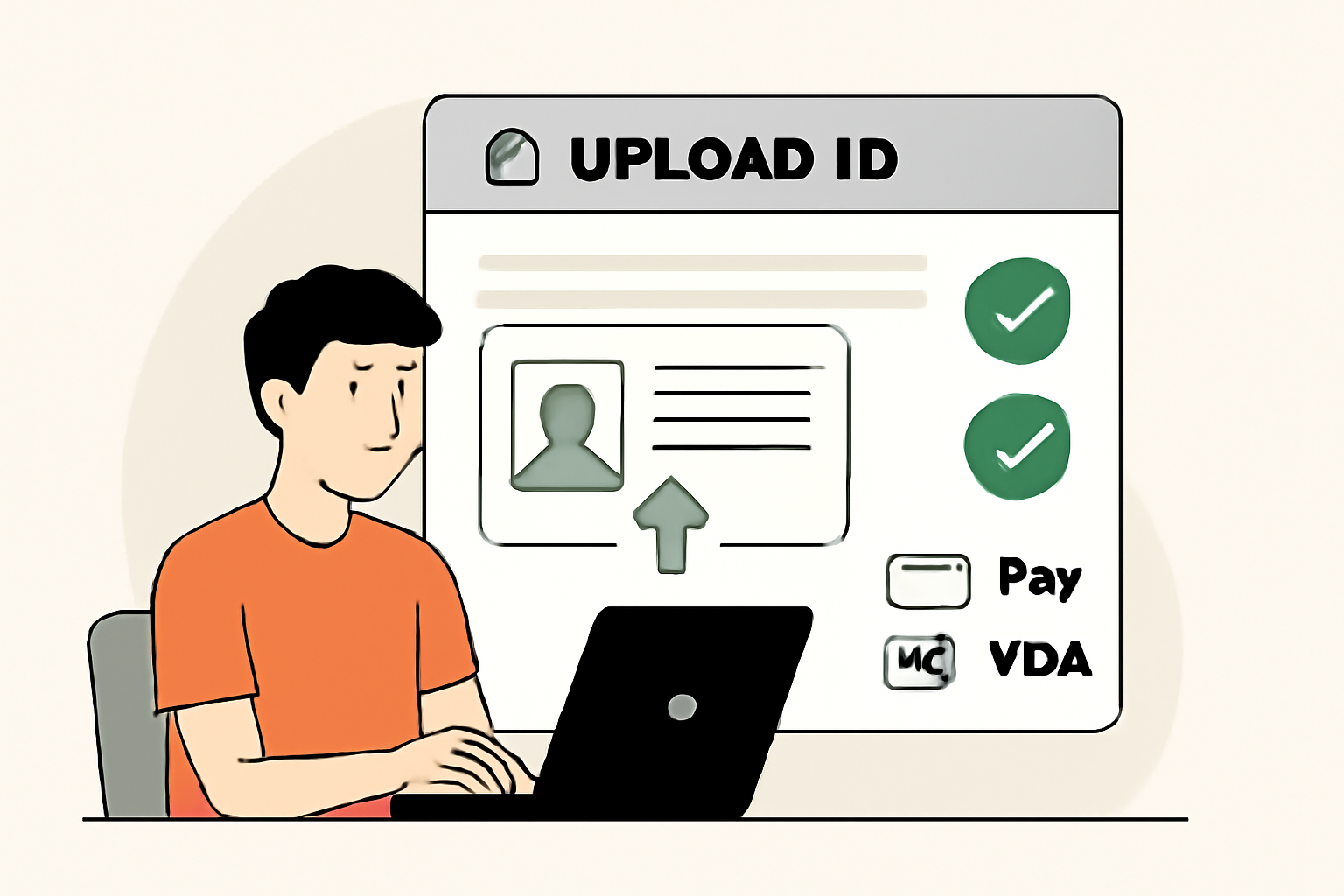

4. Complete KYC/AML Verification and Fund Your Account

Before you can purchase tokenized gold, most reputable platforms require you to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This process typically involves submitting a government-issued ID, proof of address, and sometimes a selfie for identity verification. While this might feel like an extra step, it’s essential for regulatory compliance and helps protect your account from fraud.

Once verified, you’ll need to fund your account. Most platforms accept fiat deposits via bank transfer or credit card, as well as popular cryptocurrencies such as USDT or ETH. Funding with crypto is often faster but may incur blockchain network fees. Double-check the deposit methods supported by your chosen platform and be mindful of any minimum funding requirements or transaction fees.

5. Purchase, Store, and Monitor Your Tokenized Gold Holdings Securely

With your account funded and wallet ready, navigate to the gold token trading section of your selected platform. Enter the amount of PAXG or XAUT you wish to buy, remembering their current prices are $3,980.47 for PAXG and $3,969.18 for XAUT as of October 29,2025, and confirm your purchase details before executing the trade.

Your purchased tokens will appear in your wallet almost instantly after settlement. For long-term security, consider transferring them to a non-custodial hardware wallet where you control the private keys rather than leaving them on an exchange. Regularly monitor your holdings using blockchain explorers or portfolio tracking apps; this provides transparency into both balances and any movement of your assets.

Best Practices for Tokenized Gold Investors in 2024-2025

- Stay Informed: Track real-time price movements, like PAXG at $3,980.47, to time entries or exits strategically.

- Diversify: While tokenized gold is resilient, consider it as part of a balanced portfolio including other digital assets.

- Understand Fees: Be aware of trading spreads, withdrawal charges, and potential redemption fees if converting tokens back to physical bullion.

- Keep Records: Maintain detailed records for tax reporting; many jurisdictions treat digital gold tokens differently than traditional bullion.

- Avoid Phishing: Only interact with official websites or apps, bookmark them, and never share private keys or recovery phrases.

Where to Learn More About Blockchain Gold Tokens

The landscape evolves rapidly, regulatory frameworks shift and new products launch frequently. To deepen your understanding or compare providers’ nuances in detail, check out our comprehensive guides:

- Step-by-Step Guide for First-Time Buyers

- Tokenized Gold vs On-Chain Gold: Key Differences

- Portfolio Diversification with Tokenized Gold

If you want exposure to gold’s stability without sacrificing liquidity or accessibility, especially at current prices, tokenized gold makes an excellent addition to both crypto-native and traditional portfolios alike.