How Tokenized Gold Is Transforming Portfolio Diversification for Crypto Investors

For decades, gold has been the cornerstone of prudent portfolio diversification. Now, as blockchain technology matures, tokenized gold is redefining how crypto investors access and utilize this age-old asset. By merging the stability of physical gold with the agility of digital assets, tokenized gold is rapidly becoming a preferred choice for those seeking to reduce risk while maintaining exposure to growth opportunities in the digital economy.

Understanding Tokenized Gold: The New Standard for Digital Gold Assets

Tokenized gold refers to blockchain-based tokens that are each backed by a specific quantity of physical gold held in secure vaults. Leading examples such as PAX Gold (PAXG) and Tether Gold (XAUt) have set industry standards for transparency and reliability. Each token represents direct ownership or claim on real-world bullion, typically audited and stored by trusted custodians. This structure eliminates much of the friction associated with traditional gold investing – no need for personal storage, insurance, or complex logistics.

Unlike ETFs or gold certificates, which often come with layers of intermediaries and potential counterparty risk, tokenized gold offers a transparent, tamper-resistant ledger of ownership on the blockchain. This innovation brings together the timeless value of gold and the efficiency of decentralized finance, making it possible for more investors to participate securely and efficiently.

Key Benefits of Tokenized Gold for Crypto Investors

Top Advantages of Tokenized Gold for Crypto Investors

-

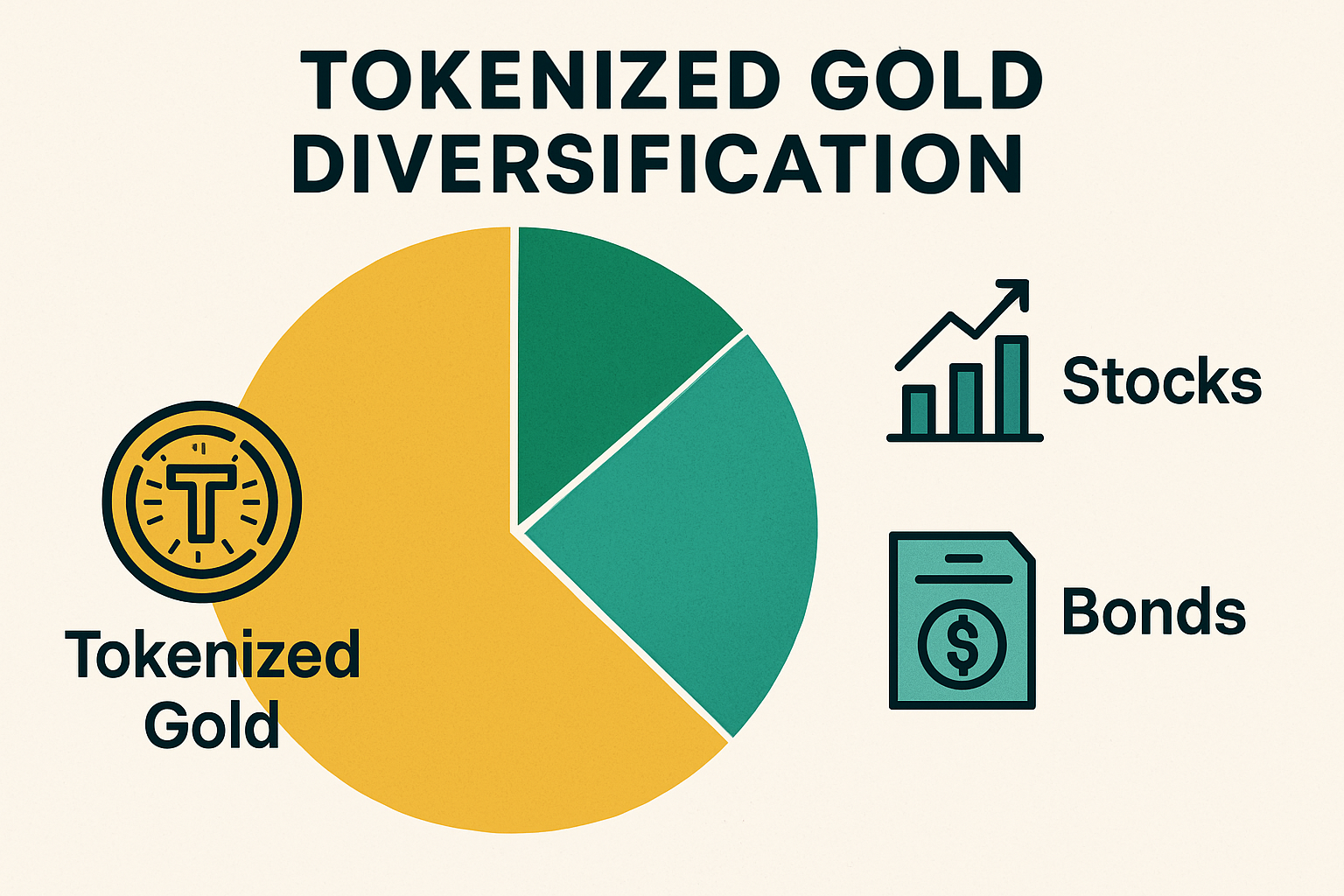

Enhanced Portfolio Diversification: Tokenized gold offers a low or negative correlation with both traditional financial assets and cryptocurrencies, making it an effective hedge against crypto market volatility and helping reduce overall portfolio risk.

-

Fractional Ownership and Accessibility: Unlike traditional gold, tokenized gold platforms such as PAX Gold (PAXG) and Tether Gold (XAUt) allow investors to purchase small fractions of a gold bar, lowering the entry barrier and enabling broader participation.

-

24/7 Global Trading: Tokenized gold can be bought or sold anytime, anywhere on major crypto exchanges, providing far greater liquidity and flexibility than physical gold, which is limited by market hours and location.

-

Integration with DeFi Ecosystems: Tokenized gold assets can be used as collateral or for yield generation in decentralized finance (DeFi) applications, offering additional earning opportunities while maintaining exposure to gold’s stability.

-

Lower Costs and Increased Efficiency: By eliminating many intermediaries, tokenized gold platforms reduce storage, insurance, and transaction fees compared to physical gold, making it a cost-effective alternative for investors.

-

Transparency and Direct Ownership: Leading tokenized gold products provide full transparency regarding gold reserves and direct, verifiable ownership of the underlying physical gold, often stored in secure, audited vaults.

Tokenized gold offers several compelling advantages for crypto investors:

- Diversification and Risk Mitigation: Gold’s historic low correlation with both equities and cryptocurrencies makes it a proven hedge in times of market stress. Integrating tokenized gold into a crypto-heavy portfolio can help reduce overall volatility and drawdowns. According to recent studies, Tether Gold has acted as a hedge against low to moderate financial stress and even as a safe haven under extreme conditions.

- Fractional Ownership: Investors are no longer required to purchase whole ounces or bars. Tokenized platforms allow users to buy fractional amounts – sometimes as little as one-thousandth of an ounce – democratizing access to this asset class. This feature is especially attractive to retail participants seeking to diversify without large capital outlays.

- 24/7 Global Access and Liquidity: Unlike traditional markets that operate on limited hours, blockchain commodities like tokenized gold can be traded around the clock. This means enhanced liquidity and price discovery, allowing investors to respond instantly to macroeconomic events.

- Lower Costs and Transparency: With reduced intermediary fees and no need for physical storage or insurance on the investor’s part, tokenized gold often comes with lower total costs. The blockchain’s open ledger ensures full transparency regarding token issuance and backing reserves.

Tokenized Gold in Action: Real-World Growth and Institutional Interest

The market for tokenized gold has expanded quickly in recent years. As of October 2025, the total market capitalization of tokenized gold exceeds $2 billion, reflecting not only robust retail demand but also increasing institutional participation. This growth is underpinned by rising confidence in blockchain-based custody solutions and regulatory clarity in key jurisdictions.

Major players such as PAXG and XAUt have become staples on leading exchanges and DeFi platforms, where they serve both as a store of value and as collateral for decentralized lending and yield strategies. The ability to use tokenized gold within DeFi ecosystems further enhances its appeal, offering investors both stability and potential returns without sacrificing liquidity.

How Tokenized Gold Unlocks New Portfolio Strategies

The integration of tokenized gold allows for more sophisticated portfolio construction. Crypto investors can now blend high-growth assets like Bitcoin or Ethereum with stable, inflation-resistant holdings like tokenized gold – all within a single digital wallet. This seamless diversification was previously unimaginable without crossing multiple asset classes and platforms.

Moreover, tokenized gold’s compatibility with DeFi protocols enables investors to lend or stake their holdings and earn yield, leveraging their positions without sacrificing safety or liquidity. This stands in stark contrast to traditional gold investments, which typically generate no income unless physically leased or rehypothecated by financial institutions.

As regulatory frameworks mature and blockchain infrastructure becomes more robust, the prospects for tokenized gold continue to brighten. Institutions are beginning to treat digital gold assets as a core holding rather than a speculative play. This shift is driven by the unique blend of transparency, liquidity, and direct ownership rights that tokenized gold provides. For family offices and conservative funds, the ability to audit reserves on-chain and move allocations instantly, without the friction of legacy settlement systems, offers a level of agility previously unavailable to gold investors.

Retail adoption is also accelerating. Platforms now allow users to buy, sell, or even spend gold tokens in real time, with settlement measured in seconds rather than days. The global nature of blockchain commodities means that investors in emerging markets can gain exposure to gold’s defensive properties without navigating traditional banking hurdles or capital controls. For many, this is not just a matter of convenience but of financial sovereignty.

Challenges and Considerations

Despite its advantages, tokenized gold is not without risks. Investors must carefully assess the credibility of custodians, the quality of audits, and the transparency of token issuance. Not all gold tokens are created equal, due diligence is critical. Regulatory uncertainty in some jurisdictions may also impact access or create compliance hurdles for certain investors.

Liquidity, while vastly improved over physical gold markets, can still vary between platforms and tokens. It’s important to monitor trading volumes and understand any redemption mechanisms if direct conversion to physical gold is desired. Additionally, smart contract vulnerabilities remain a concern in any blockchain-based asset, underscoring the need for rigorous security practices.

The Future of Portfolio Diversification with Tokenized Gold

Looking ahead, the role of tokenized gold in portfolio diversification is poised to grow further. As interoperability between blockchains improves and more regulated on-ramps emerge, we can expect broader adoption among both retail and institutional investors. The ability to combine gold’s time-tested defensive characteristics with the composability of digital assets opens up new frontiers in risk management and capital efficiency.

Ultimately, tokenized gold represents a pragmatic evolution for those seeking to hedge crypto volatility without abandoning the growth potential of blockchain-based finance. By thoughtfully integrating gold tokens into their strategies, investors can build portfolios that are not only more resilient but also better positioned for the demands of a rapidly changing global market.