How to Invest in Tokenized Gold: Step-by-Step Guide for First-Time Buyers

Tokenized gold is rapidly emerging as a pragmatic entry point for both new and experienced investors seeking exposure to physical gold without the logistical hurdles of storage, insurance, and transportation. Instead of purchasing bars or coins, you can now own fractions of real gold directly on the blockchain, with transparent proof of ownership and 24/7 liquidity. For first-time buyers, the process may seem technical at first glance, but with the right guidance, investing in tokenized gold is straightforward and secure. This step-by-step guide will demystify the process using current market data and highlight key considerations every investor should know.

Understanding Tokenized Gold: What Makes It Different?

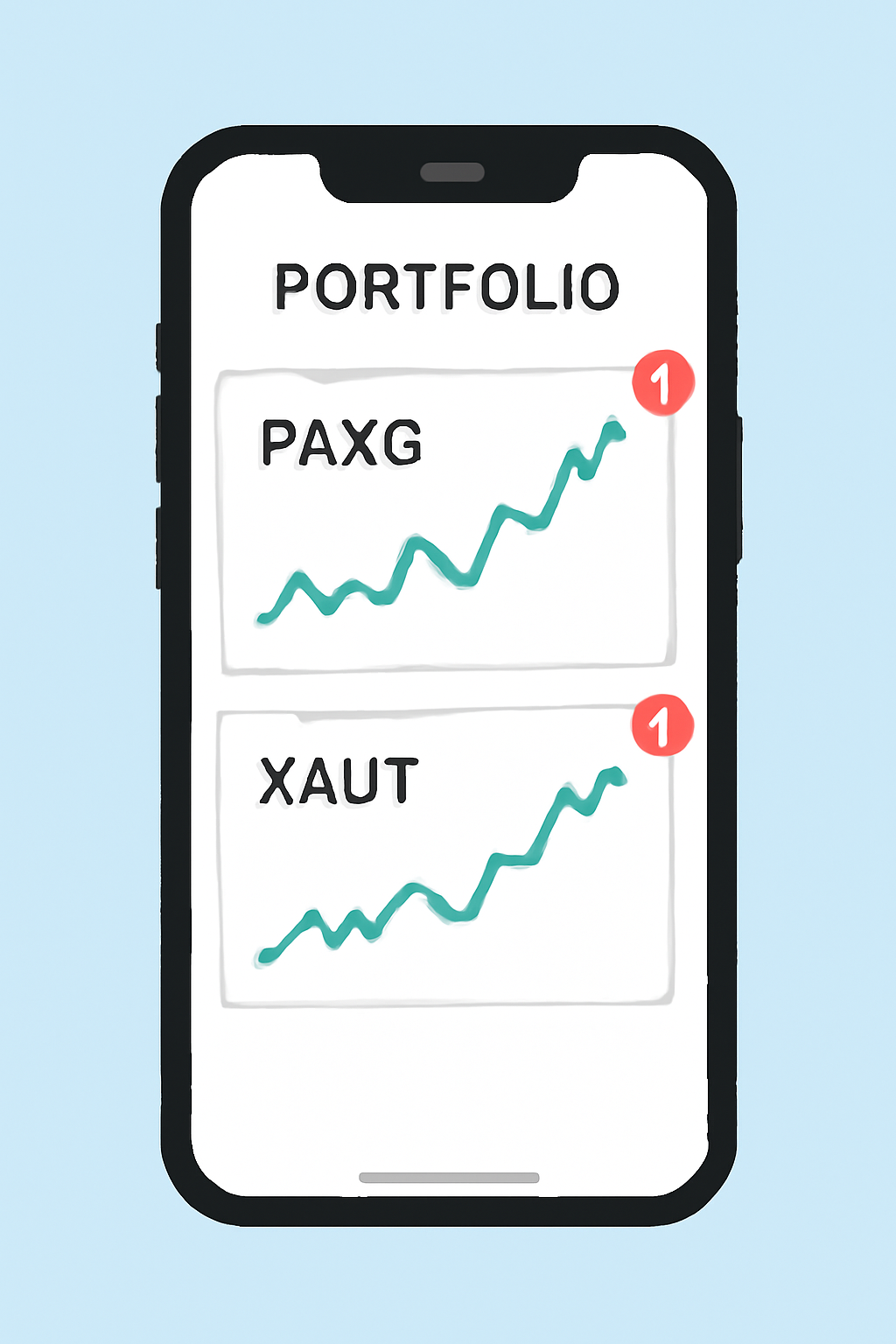

Gold tokenization involves converting physical gold into digital tokens that are secured on a blockchain. Each token typically represents a specific amount of physical gold – for example, PAX Gold (PAXG) tokens are backed by one fine troy ounce of London Good Delivery gold stored in professional vaults. At today’s price, PAXG trades at $3,872.00, while Tether Gold (XAUT) is priced at $3,875.25. These prices reflect real-time valuations and can be tracked around the clock.

The benefits are substantial: fractional ownership lowers barriers to entry; blockchain transparency enhances security; and global access means anyone with an internet connection can participate. Unlike traditional gold ETFs or certificates, tokenized gold gives you direct digital ownership rights that are verifiable on-chain (source).

Step 1: Choosing a Reputable Tokenized Gold Provider

Your first decision is selecting a trusted provider whose tokens are fully backed by audited reserves of physical gold. The two most established options for retail and institutional investors in 2025 are:

- PAX Gold (PAXG): Each token equals one fine troy ounce of physical gold stored in Brink’s vaults. Price today: $3,872.00.

- Tether Gold (XAUT): Backed by one troy ounce per token held in Swiss vaults. Current price: $3,875.25.

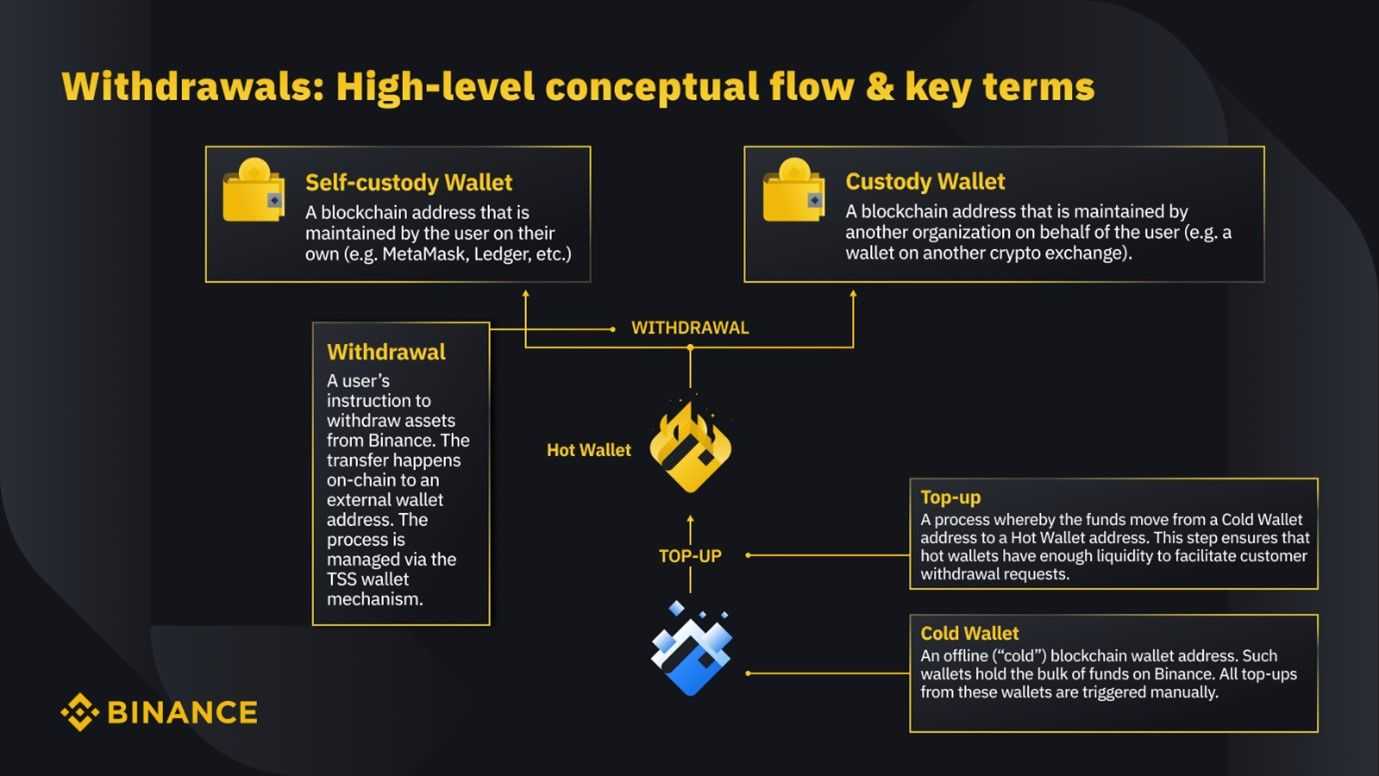

Both assets can be traded on major centralized exchanges like Binance and Coinbase or via decentralized platforms compatible with Ethereum-based tokens (source). Always verify that the provider publishes regular audits and complies with applicable regulations.

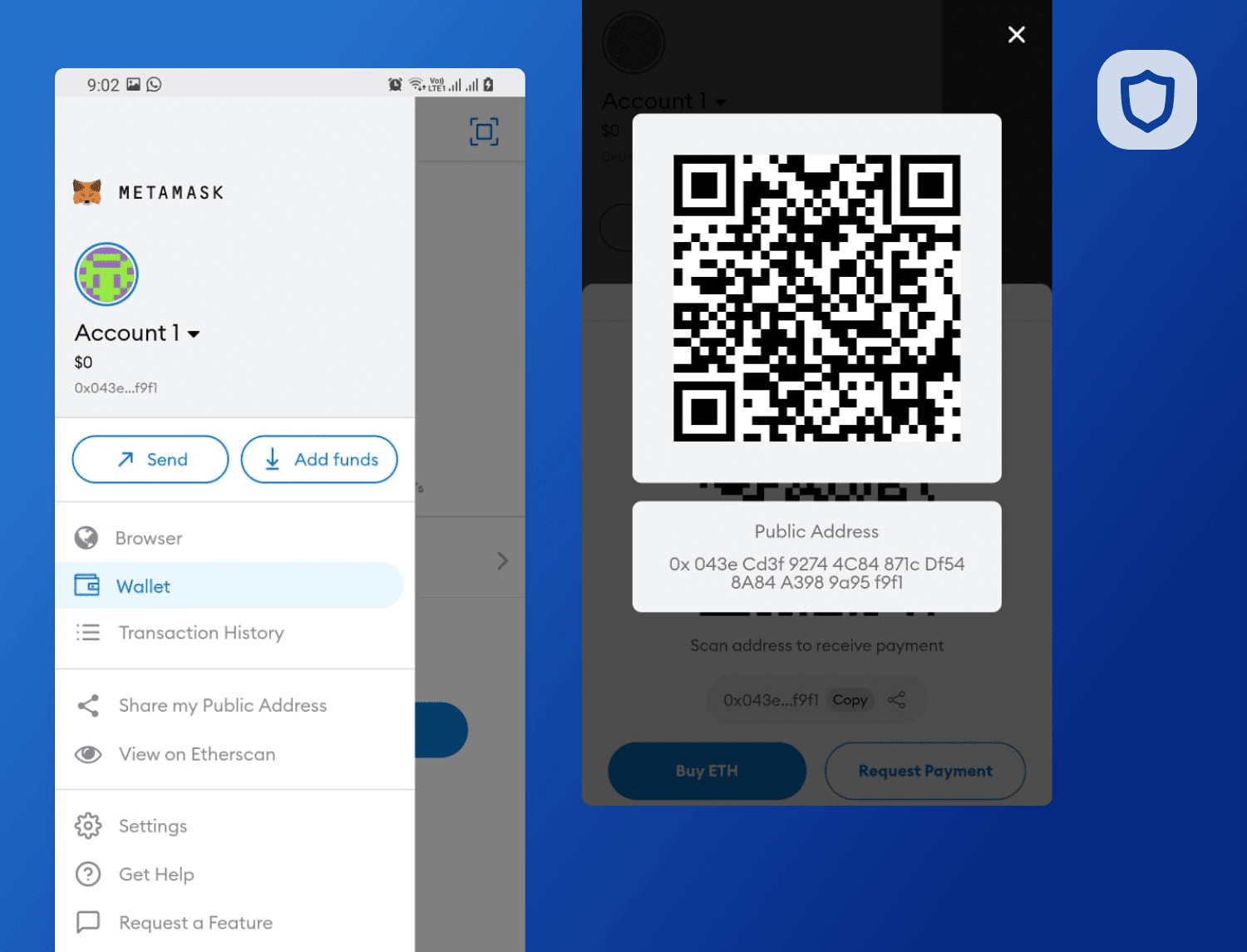

Step 2: Setting Up Your Digital Wallet for Blockchain Gold Tokens

You’ll need a secure digital wallet to store your blockchain-based gold tokens. Most leading options support ERC-20 tokens (the standard used by PAXG and XAUT): MetaMask, Trust Wallet, or hardware wallets like Ledger offer robust security features suitable for first-time buyers.

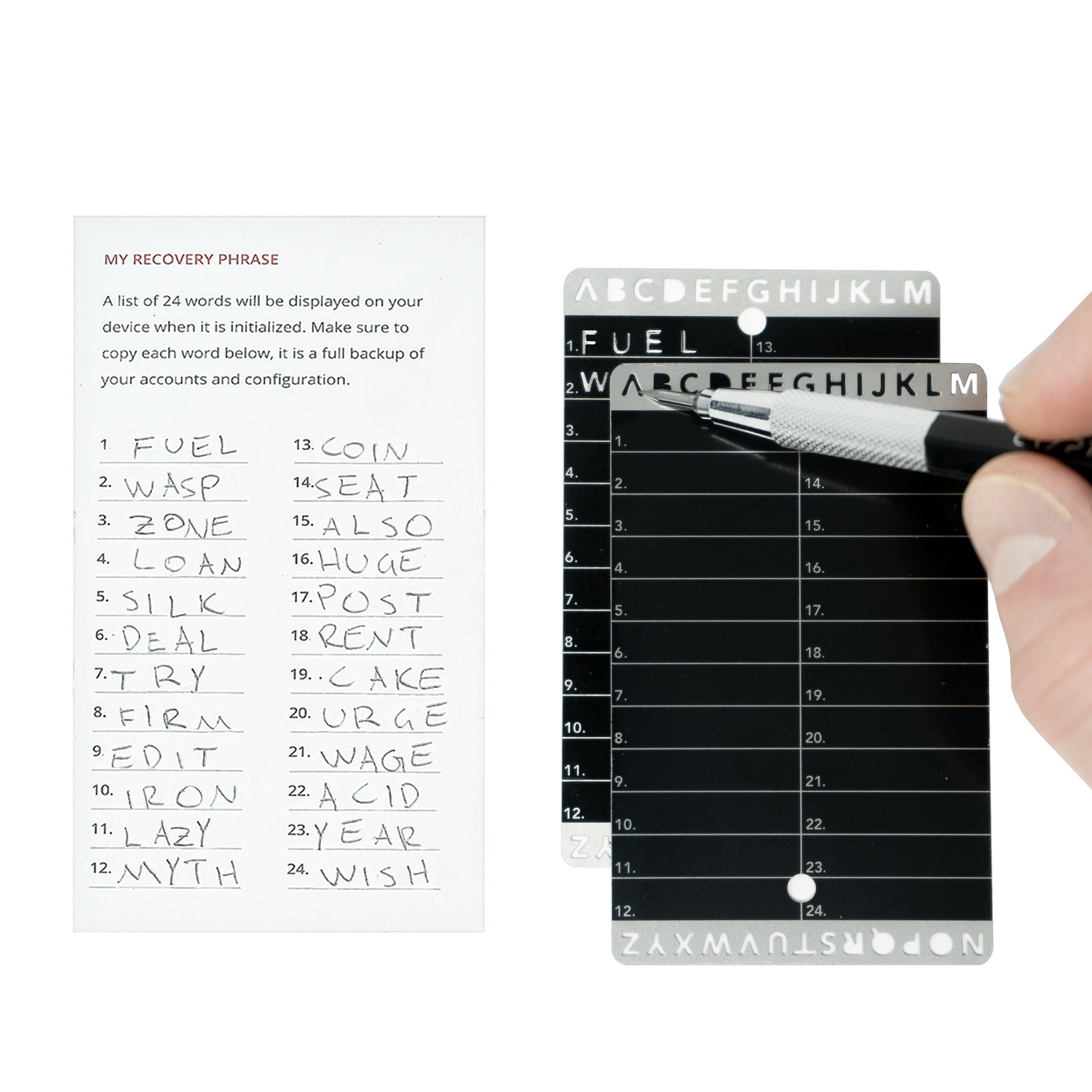

- Create your wallet: Follow the provider’s instructions carefully; always back up your recovery phrase securely offline.

- Add support for ERC-20 tokens: Ensure your wallet can display custom assets like PAXG or XAUT.

- Consider hardware wallets: For significant holdings or long-term storage, hardware wallets provide enhanced protection from online threats.

The Current Market Landscape: Prices and Trends (October 2025)

The current market environment reflects stable demand for digital commodities amid ongoing macroeconomic uncertainty. As of October 2025:

- PAX Gold (PAXG): $3,872.00

- Tether Gold (XAUT): $3,875.25

- PAXG’s 24-hour range: $3,860.57 – $3,904.15; XAUT’s range: $3,848.34 – $3,903.34.

- Barely perceptible daily changes ( and $0.54 for PAXG; and $21.11 for XAUT) signal relative price stability compared to other crypto assets.

This stability underscores why many investors view tokenized gold as an effective hedge against volatility elsewhere in their portfolios (source). Fractional ownership lets you invest any amount – from a few dollars to several thousand – making it accessible regardless of portfolio size.

PAX Gold (PAXG) vs Tether Gold (XAUT) Price Prediction 2026-2031

Professional Forecast Table for Tokenized Gold Assets | Based on 2025 Market Data

| Year | Asset | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Scenario |

|---|---|---|---|---|---|---|

| 2026 | PAXG | $3,650.00 | $3,950.00 | $4,300.00 | +2.0% | Continued gold adoption, stable macro environment |

| 2026 | XAUT | $3,660.00 | $3,955.00 | $4,310.00 | +2.1% | Similar trend to PAXG, slight premium due to Swiss vaulting |

| 2027 | PAXG | $3,700.00 | $4,070.00 | $4,500.00 | +3.0% | Increased DeFi integration, moderate inflation |

| 2027 | XAUT | $3,710.00 | $4,075.00 | $4,510.00 | +3.0% | Enhanced global access, regulatory clarity |

| 2028 | PAXG | $3,800.00 | $4,230.00 | $4,750.00 | +3.9% | Bullish market cycle, greater institutional adoption |

| 2028 | XAUT | $3,820.00 | $4,240.00 | $4,760.00 | +4.1% | Growing demand for tokenized commodities |

| 2029 | PAXG | $3,950.00 | $4,420.00 | $5,100.00 | +4.5% | Gold prices surge, tokenization mainstream |

| 2029 | XAUT | $3,970.00 | $4,430.00 | $5,110.00 | +4.5% | Increased use in cross-border transactions |

| 2030 | PAXG | $4,100.00 | $4,630.00 | $5,400.00 | +4.7% | Advanced DeFi products, wider retail access |

| 2030 | XAUT | $4,120.00 | $4,640.00 | $5,420.00 | +4.7% | Stable regulatory environment, higher liquidity |

| 2031 | PAXG | $4,200.00 | $4,800.00 | $5,650.00 | +3.7% | Mature tokenized gold market, steady growth |

| 2031 | XAUT | $4,220.00 | $4,815.00 | $5,670.00 | +3.8% | Sustained demand, integration with new platforms |

Price Prediction Summary

Both PAX Gold (PAXG) and Tether Gold (XAUT) are projected to follow a moderate upward trend, closely mirroring the underlying gold market while benefiting from increasing adoption of tokenized assets. Average prices are expected to grow 2-5% annually, with bullish scenarios driven by DeFi integration and global macroeconomic uncertainty. Both assets should maintain a tight price range due to their direct gold backing, but could see higher premiums if tokenization demand sharply increases.

Key Factors Affecting PAX Gold Price

- Underlying gold price movements (inflation, global economic stability)

- Pace of adoption for tokenized gold and DeFi applications

- Regulatory clarity and evolving compliance standards

- Technological improvements in blockchain security and interoperability

- Competitive landscape (new tokenized gold products, market entrants)

- Investor sentiment towards digital assets and commodities

- Liquidity and trading volume on major exchanges

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

A Practical Walkthrough: Funding Your Wallet and Buying Tokenized Gold

The next steps involve funding your wallet with cryptocurrency (typically Ethereum) and executing your purchase on an exchange:

- Select your exchange: Choose from trusted platforms listing PAXG/XAUT.

- Add funds: Transfer ETH from your bank or another wallet to fund your account.

- Buy tokens: Place an order for the desired amount of PAXG/XAUT at current prices ($3,872.00/$3,875.25).

Once your purchase is complete, your tokenized gold appears in your digital wallet almost instantly. Unlike traditional gold investments, there’s no waiting for delivery or dealing with intermediaries. You have verifiable, on-chain ownership of real physical gold, with the flexibility to sell or transfer 24/7.

Securing and Managing Your Tokenized Gold Investment

Security is paramount. After buying, always confirm that your tokens are visible in your wallet and double-check the contract address to ensure authenticity. For significant holdings or long-term storage, hardware wallets such as Ledger or Trezor are preferred by institutional investors for their robust offline protection.

- Backup your recovery phrase: Store it offline in a secure location, never online or in cloud storage.

- Enable two-factor authentication (2FA): For any exchange accounts or wallet apps you use.

- Monitor for phishing attempts: Always access exchanges and wallets through official URLs; avoid clicking on unsolicited links.

Key Security Practices for Storing Tokenized Gold

-

Use a Hardware Wallet for Long-Term Storage: Store your tokenized gold (such as PAX Gold (PAXG) or Tether Gold (XAUT)) in a hardware wallet like Ledger or Trezor to keep your private keys offline and protected from online threats.

-

Enable Two-Factor Authentication (2FA): Always activate 2FA on your exchange accounts and digital wallets (e.g., MetaMask, Trust Wallet) to add an extra layer of security against unauthorized access.

-

Safeguard Your Recovery Phrase: Write down your wallet’s recovery phrase (seed phrase) and store it in a secure, offline location. Never share it digitally or with anyone you do not trust completely.

-

Verify Platform Security and Regulatory Compliance: Only purchase tokenized gold from reputable, regulated providers such as Binance, Coinbase, or official project websites. Confirm the provider’s compliance with KYC/AML regulations to reduce fraud risk.

-

Regularly Update Wallet and Device Software: Keep your wallet apps and device operating systems up to date to patch vulnerabilities and benefit from the latest security enhancements.

-

Monitor Transactions on the Blockchain: Use blockchain explorers (e.g., Etherscan) to track your tokenized gold transactions and verify balances, ensuring transparency and early detection of suspicious activity.

If you plan to trade actively, keep only what you need in a hot wallet; move the remainder to cold storage. This approach minimizes risk while maintaining liquidity when needed.

Beyond Simple Holding: Using Tokenized Gold in DeFi

A unique advantage of blockchain gold tokens is their integration with decentralized finance (DeFi) protocols. Investors can lend their PAXG or XAUT for yield, use them as collateral for loans, or participate in liquidity pools, unlocking new layers of utility that physical gold simply cannot match (source).

- Lending: Supply PAXG/XAUT to earn passive income from borrowers.

- Borrows: Use tokenized gold as collateral to access stablecoins without selling your asset.

- Liquidity pools: Provide tokens to decentralized exchanges and earn a share of trading fees.

This versatility makes tokenized commodities especially attractive for diversified portfolios seeking both stability and growth potential.

Risks and Due Diligence: What First-Time Buyers Must Know

No investment is without risk, even tokenized gold. While blockchain transparency reduces some traditional risks (like counterfeit bars), you must still consider:

- Platform risk: What happens if the provider faces technical issues or regulatory challenges?

- Sovereign risk: Where is the underlying physical gold stored? Jurisdiction matters for legal claims.

- Market volatility: While less volatile than cryptocurrencies, tokenized gold still fluctuates based on global supply-demand dynamics and macroeconomic events.

Diversification remains key, tokenized gold should complement other assets rather than replace them entirely (source). Always conduct due diligence on providers’ audits, insurance coverage, and regulatory compliance before allocating substantial capital.

The Bottom Line: Modern Gold Ownership Is Now Global, and Fractional

The advent of tokenized commodities like PAX Gold (PAXG) at $3,872.00 and Tether Gold (XAUT) at $3,875.25 marks a fundamental shift in how investors access precious metals. With fractional ownership starting from just a few dollars, secure custody via blockchain technology, and seamless integration into DeFi ecosystems, first-time buyers have more options than ever before.

If you’re ready to invest in tokenized gold, or simply want to diversify beyond traditional markets, this guide gives you the actionable steps needed to get started safely and confidently. As adoption accelerates among both retail users and institutions worldwide, understanding how to buy tokenized gold will be an essential skill for any forward-thinking investor looking toward the future of commodity-backed crypto assets.