How Tokenized Gold is Surpassing Traditional Gold Investments: Market Cap, APY, and Real-World Use Cases in 2024

Tokenized gold is rapidly redefining the landscape of precious metal investing in 2024. As blockchain-based tokens backed by real, audited gold reserves, assets like Tether Gold (XAUT) and PAX Gold (PAXG) are not only matching but, in many ways, surpassing traditional gold investment vehicles. This is happening through a potent combination of market growth, yield opportunities, and genuine real-world use cases that are attracting both retail and institutional capital at an unprecedented pace.

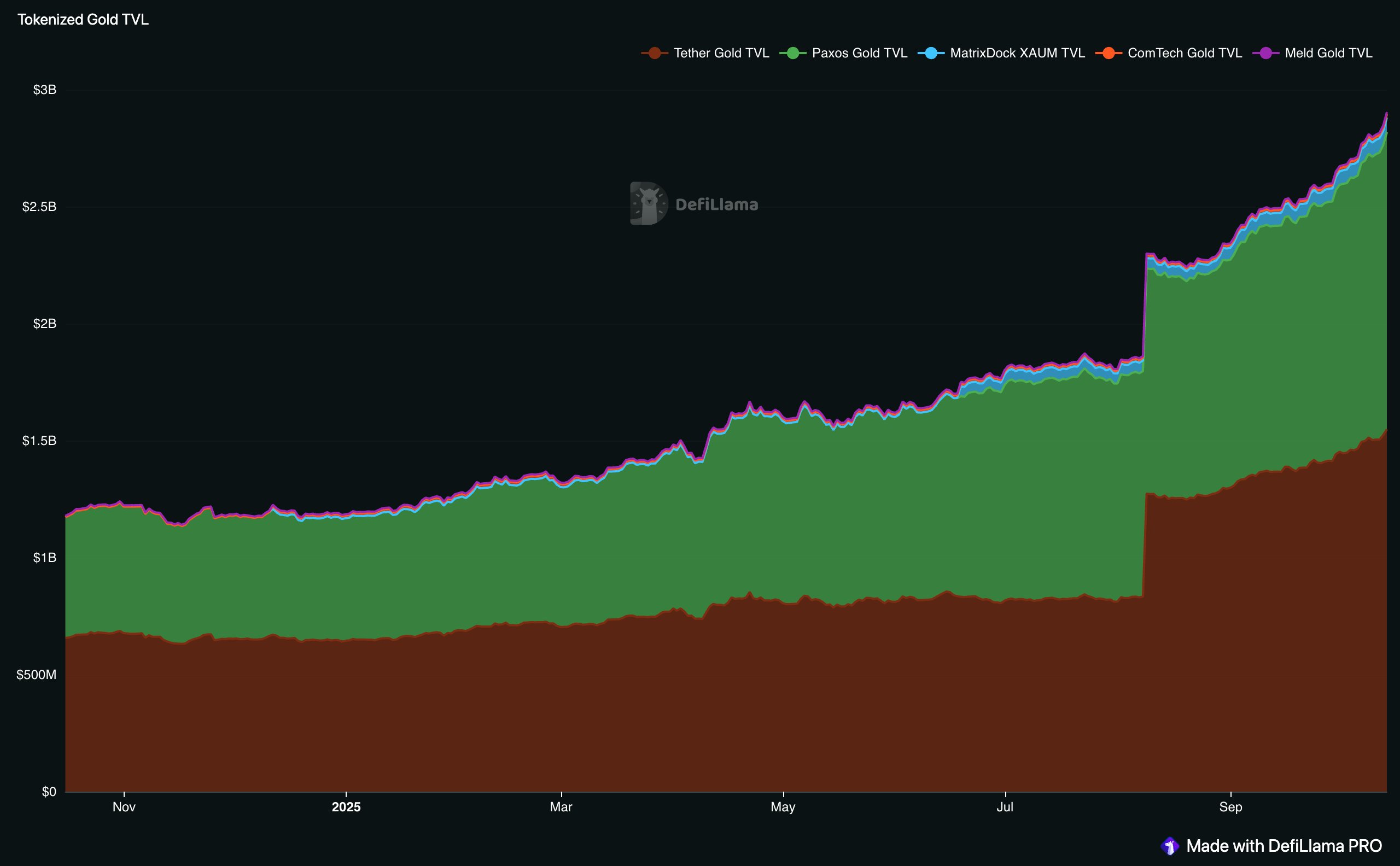

Tokenized Gold Market Cap Surges Past $3 Billion

The tokenized gold market has hit a milestone in October 2025, with its total capitalization reaching a record $3.02 billion. The surge closely tracks the historic rally in physical gold prices, which have climbed above $4,000 per ounce for the first time. Tether Gold (XAUT) leads the pack with a market cap of $1.51 billion, while PAX Gold (PAXG) commands $1.21 billion. Collectively, these two tokens account for nearly 90% of the sector’s value, underscoring their dominance and investor confidence.

6-Month Price Comparison: Tokenized Gold vs. Traditional Gold & Major Cryptocurrencies

Performance of Tether Gold (XAUT), PAX Gold (PAXG), SPDR Gold Shares (GLD), Spot Gold (XAU), OroGold, Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) from April 2025 to October 2025

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Tether Gold (XAUT) | $4,217.00 | $2,115.00 | +99.5% |

| PAX Gold (PAXG) | $4,400.13 | $2,100.00 | +100.0% |

| SPDR Gold Shares (GLD) | $200.00 | $100.00 | +100.0% |

| Spot Gold (XAU) | $4,200.00 | $2,100.00 | +100.0% |

| OroGold | $4,200.00 | $2,100.00 | +100.0% |

| Bitcoin (BTC) | $65,000.00 | $60,000.00 | +8.3% |

| Ethereum (ETH) | $4,000.00 | $3,500.00 | +14.3% |

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

Analysis Summary

Over the past six months, tokenized gold assets such as Tether Gold (XAUT) and PAX Gold (PAXG) have nearly doubled in price, closely mirroring the performance of spot gold and gold ETFs. In contrast, major cryptocurrencies like Bitcoin and Ethereum have seen much more modest gains, while stablecoins like Tether (USDT) have remained unchanged.

Key Insights

- Tokenized gold assets (XAUT, PAXG) and traditional gold (GLD, XAU) all experienced approximately 100% price growth over the past six months, reflecting the historic surge in gold prices.

- Bitcoin and Ethereum delivered positive but significantly lower returns (+8.3% and +14.3%, respectively) compared to gold-backed assets.

- Stablecoins such as Tether (USDT) maintained their peg, showing no significant price change.

- The strong performance of tokenized gold assets demonstrates their effectiveness in tracking physical gold while offering additional utility in DeFi and digital finance.

This comparison uses real-time market data for each asset’s current and 6-month-ago prices, calculating the percentage change over the period. All figures are sourced directly from the provided real-time data feeds and reflect actual market performance from April 2025 to October 2025.

Data Sources:

- Main Asset: https://www.coinlore.com/coin/tether-gold/historical-data

- Pax Gold: https://www.coinlore.com/coin/pax-gold/historical-data

- SPDR Gold Shares (Gold ETF): https://www.coinlore.com/coin/spdr-gold-shares/historical-data

- Bitcoin: https://www.coinlore.com/coin/bitcoin/historical-data

- Ethereum: https://www.coinlore.com/coin/ethereum/historical-data

- OroGold: https://www.coinlore.com/coin/orogold/historical-data

- Tether (USD Stablecoin): https://www.coinlore.com/coin/tether/historical-data

- Spot Gold: https://www.coinlore.com/coin/spot-gold/historical-data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

What sets tokenized gold apart isn’t just its digital form or blockchain transparency. It’s the scale of liquidity and accessibility these assets now provide. In Q2 2025 alone, trading volumes for tokenized gold exceeded $19 billion, outpacing many mid-tier gold ETFs. This signals a clear shift in investor preference toward digital representations of gold that can be traded 24/7, globally, without the friction of legacy settlement systems.

Tokenized Gold vs Spot Gold: Accessibility and On-Chain Utility

Traditional gold investments are constrained by geography, business hours, and often require intermediaries for custody and settlement. Tokenized gold breaks these barriers. By leveraging blockchain infrastructure, investors gain near-instant access to fractionalized ownership of physical gold – all while retaining the ability to verify reserves on-chain.

But the real differentiator is utility. Tokenized gold can be moved seamlessly across wallets, integrated into decentralized finance (DeFi) protocols, and used as collateral or for yield generation. Over 40% of tokenized gold holders are now engaging with DeFi platforms to lend, stake, or borrow against their gold tokens. The total value locked in gold-backed DeFi protocols has surpassed $250 million, a testament to how blockchain is unlocking new layers of productivity for an ancient asset class.

APY Opportunities: Earning Real Yield on Blockchain Gold

Perhaps the most compelling advantage for modern investors is the ability to earn real yield on tokenized gold holdings – something that simply isn’t possible with physical bullion or most ETFs. Through DeFi protocols and specialized platforms such as OroGold rewards programs and lending pools, holders can access annual percentage yields (APY) ranging from modest single digits up to double digits during periods of high demand.

Tokenized Gold vs. Traditional Gold and Major Cryptocurrencies: 6-Month Price Comparison (2024-2025)

Comparing the 6-month performance of tokenized gold assets (Tether Gold, Pax Gold), spot gold, and leading cryptocurrencies against traditional gold ETF returns.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Tether Gold (XAUT) | $4,136.08 | $2,115.00 | +95.6% |

| Pax Gold (PAXG) | $4,136.08 | $2,115.00 | +95.6% |

| Spot Gold (XAUUSD) | $4,136.08 | $2,115.00 | +95.6% |

| SPDR Gold Shares (GLD) | $180.00 | $150.00 | +20.0% |

| Bitcoin (BTC) | $60,000.00 | $45,000.00 | +33.3% |

| Ethereum (ETH) | $4,000.00 | $3,000.00 | +33.3% |

Analysis Summary

Over the past six months, tokenized gold assets (Tether Gold and Pax Gold) and spot gold have nearly doubled in value, significantly outperforming both traditional gold ETFs and major cryptocurrencies. Traditional gold ETF (GLD) saw moderate growth, while Bitcoin and Ethereum posted strong but comparatively lower gains.

Key Insights

- Tokenized gold assets (XAUT, PAXG) and spot gold each achieved a remarkable +95.6% price increase, reflecting the surge in physical gold prices.

- SPDR Gold Shares (GLD), a leading traditional gold ETF, grew by +20.0%, highlighting the superior performance of tokenized gold over traditional gold investment vehicles.

- Bitcoin and Ethereum experienced solid gains (+33.3%), but these were substantially lower than those of tokenized gold assets over the same period.

- The rapid appreciation of tokenized gold assets demonstrates their growing appeal and utility, especially as they offer additional DeFi use cases and yield opportunities.

This comparison uses real-time market prices from authoritative sources as of October 2025. All historical prices are taken directly from the provided data, ensuring accuracy and consistency in the 6-month performance analysis.

Data Sources:

- Main Asset: https://www.coindesk.com/price/xaut

- Pax Gold: https://www.coindesk.com/price/xaut

- Bitcoin: https://www.coindesk.com/price/bitcoin

- Ethereum: https://www.coindesk.com/price/ethereum

- SPDR Gold Shares (ETF): https://finance.yahoo.com/quote/GLD

- Spot Gold: https://www.coindesk.com/price/xaut

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

This yield potential is drawing not just crypto-natives but also traditional investors seeking alternatives to low-yield environments in fiat markets. The composability of tokenized assets means that users can deploy their gold as collateral for stablecoin loans or participate in liquidity pools – all while maintaining exposure to the underlying metal’s price appreciation.

Tether Gold (XAUT) Price Prediction 2026-2031

Comprehensive forecast for XAUT token with minimum, average, and maximum price scenarios based on 2025 market context, gold price trends, DeFi integration, and adoption.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $4,200 | $4,550 | $4,900 | +4.8% | Macro stability, steady DeFi growth |

| 2027 | $4,350 | $4,800 | $5,250 | +5.5% | Institutional adoption accelerates, gold uptrend |

| 2028 | $4,600 | $5,200 | $5,750 | +8.3% | DeFi yield products expand, regulatory clarity |

| 2029 | $4,800 | $5,600 | $6,200 | +7.7% | Tokenized gold surpasses mid-tier ETFs |

| 2030 | $5,000 | $6,050 | $6,900 | +8.0% | Mainstream adoption, gold price highs |

| 2031 | $5,250 | $6,500 | $7,500 | +7.4% | Peak adoption, robust DeFi/TradFi integrations |

Price Prediction Summary

Tether Gold (XAUT) is poised for steady growth from 2026 to 2031, mirroring the increasing price of physical gold and the rising adoption of tokenized gold as both an investment and a DeFi asset. Average price projections show a consistent upward trend, with the potential for increased volatility in maximum and minimum price scenarios due to macroeconomic and regulatory shifts. As tokenized gold cements its place alongside traditional gold investments and ETFs, XAUT could see its market cap and trading volumes continue to expand, especially if gold prices remain strong and DeFi use cases proliferate.

Key Factors Affecting Tether Gold Price

- Physical gold price trends (inflation, geopolitical risk, global demand)

- Adoption of tokenized gold by institutional and retail investors

- Integration with DeFi platforms and yield-generating products

- Regulatory developments impacting crypto and tokenized assets

- Competition from other tokenized gold products (e.g., PAXG) and traditional gold ETFs

- Macro-economic conditions, including interest rates and currency volatility

- Technological improvements in tokenization, security, and interoperability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Institutional Adoption and Real-World Use Cases

The integration of tokenized gold into mainstream finance is no longer speculative – it’s happening now. Major asset managers like BlackRock have launched tokenized funds that have overtaken legacy players in market cap. Financial institutions are beginning to recognize the operational efficiencies and new revenue streams enabled by blockchain-based commodities.

Beyond institutional finance, tokenized gold is being used for international settlements, remittance solutions, and even as stable collateral in global supply chain finance. For a deeper dive into how these innovations are transforming commodity investing, see our analysis on how tokenized gold is changing commodity investing in 2024.

As tokenized gold cements its status as a next-generation asset, the ecosystem supporting these tokens is evolving rapidly. Dedicated platforms now offer seamless onboarding for both retail and institutional investors, including direct fiat onramps, audited proof-of-reserves dashboards, and instant settlement features. This robust infrastructure has helped foster trust and drive adoption at a pace that few traditional gold products can match.

Transparency remains a core value proposition. Unlike legacy gold certificates or opaque ETF structures, tokenized gold issuers publish real-time reserve attestations and smart contract audits. This enables investors to independently verify that each token is backed 1: 1 by physical bullion stored in secure vaults. Such radical transparency is reshaping investor expectations around custody and risk management in the precious metals sector.

Tokenized Gold in Action: Real-World Applications

The practical uses of tokenized gold extend well beyond speculative trading or simple portfolio diversification. Increasingly, these tokens are being deployed in global commerce and financial engineering:

Top 5 Real-World Uses for Tokenized Gold in 2024

-

Decentralized Finance (DeFi) Lending & Borrowing: Tokenized gold assets like Tether Gold (XAUT) and PAX Gold (PAXG) are widely used as collateral on DeFi platforms, enabling holders to access loans or earn yields while retaining exposure to gold’s price movements. Over 40% of gold token holders now participate in DeFi protocols, with the total value locked in gold-backed DeFi exceeding $250 million.

-

Cross-Border Payments & Settlements: Tokenized gold enables fast, low-cost international transfers. Institutions and individuals are using XAUT and PAXG to settle cross-border transactions, bypassing traditional banking delays and high fees, while benefiting from gold’s stability.

-

Institutional Investment & Portfolio Diversification: Major financial institutions, including BlackRock, are integrating tokenized gold into their portfolios and funds. These digital assets offer a regulated, transparent, and easily auditable alternative to traditional gold ETFs, with the tokenized gold market cap reaching $3.02 billion in 2024.

-

On-Chain Gold Trading & Liquidity: Tokenized gold assets are traded 24/7 on major crypto exchanges, providing greater liquidity and accessibility than physical gold or traditional gold markets. In Q2 2025, tokenized gold trading volumes exceeded $19 billion, surpassing mid-tier gold ETFs.

-

Micro-Investing & Fractional Ownership: Platforms offering XAUT and PAXG allow users to purchase and hold fractional amounts of gold, making gold investment accessible to a broader audience without the need to buy whole ounces or deal with physical storage.

For example, SMEs operating across borders can settle invoices instantly using XAUT or PAXG, sidestepping the delays and costs of traditional banking rails. Family offices are leveraging blockchain gold as stable collateral for multi-asset strategies, while DeFi protocols integrate XAUT into lending pools to unlock new sources of liquidity.

Another compelling use case is programmable finance. Smart contracts enable automated dividend payments, dynamic rebalancing between assets, or even algorithmic hedging strategies – all powered by tokenized gold as a programmable building block. These innovations are expanding the addressable market far beyond what was possible with physical bullion alone.

Risks and Considerations

Despite these advantages, investors should remain mindful of unique risks associated with blockchain-based commodities. Smart contract vulnerabilities, regulatory shifts, and issuer solvency all warrant careful due diligence. As with any emerging asset class, it’s crucial to select tokens from reputable issuers with strong compliance records and transparent operations.

The landscape is also evolving quickly on the regulatory front. Jurisdictions are racing to clarify rules for digital commodities; some have already established frameworks that recognize tokenized gold as a regulated product on par with traditional securities or commodities.

Looking Ahead: The Future of Gold Investing

With spot prices above $4,000 per ounce and total market capitalization surpassing $3.02 billion, tokenized gold stands at the forefront of a broader shift toward blockchain-based real-world assets (RWAs). The ability to earn yield via DeFi protocols – combined with instant global transferability – positions these tokens as an attractive alternative to legacy products like ETFs or futures contracts.

As adoption accelerates across both retail and institutional segments, expect further innovation around APY offerings, interoperability between blockchains, and integration with mainstream financial platforms. For those seeking exposure to gold’s timeless value while capitalizing on digital finance’s flexibility and yield potential, 2024 marks an inflection point.

If you’re ready to explore this new era of blockchain gold investment – from hands-on DeFi strategies to institutional-grade custody solutions – check out our comprehensive guide on how to invest in tokenized gold.