How to Invest in Tokenized Gold: A Step-by-Step Guide for Beginners in 2024

Tokenized gold is rewriting the rules of gold investing in 2024. Forget the hassles of vaults, delivery, or high minimums – blockchain-powered gold tokens let you buy, sell, and trade real gold with just a few taps. As of September 30,2025, PAX Gold (PAXG) is trading at $3,854.01, reflecting both market demand and the underlying value of physical bullion stored in secure vaults. If you’re looking to diversify your portfolio or hedge against inflation with a modern twist, understanding how to invest in tokenized gold is essential.

What Is Tokenized Gold and Why Does It Matter?

Tokenized gold represents ownership of physical gold on the blockchain. Each token is backed by actual bullion – usually stored in professional vaults – and can be bought or sold as easily as any cryptocurrency. The advantages are clear: fractional ownership, 24/7 liquidity, transparent audits, and seamless integration into DeFi protocols for earning passive income.

The top players in this space include PAX Gold (PAXG) and Tether Gold (XAUT), both offering direct exposure to real-world assets without the logistical headaches of traditional commodities markets.

PAX Gold (PAXG) Holds Firm at $3,854.01: What This Means for New Investors

With PAXG’s current price at $3,854.01, investors gain access to a digital asset that tracks the spot price of physical gold while enjoying blockchain-level flexibility. Unlike ETFs or futures contracts, tokenized gold lets you own fractions as small as 0.01 ounces – lowering barriers to entry and democratizing access.

This isn’t just about convenience; it’s about control and transparency. Every PAXG token is linked to a specific serial-numbered London Good Delivery bar held in Brink’s vaults. You can verify your holdings on-chain at any time.

Your Step-by-Step Guide: How to Invest in Tokenized Gold

Diving into tokenized gold doesn’t require technical wizardry – just a bit of due diligence and a few straightforward steps:

- Choose a Reputable Platform: The first step is selecting where you’ll buy your tokens. Leading exchanges like Coinbase support PAXG and XAUT with robust security standards.

- Create and Verify Your Account: Complete KYC requirements to ensure regulatory compliance and unlock trading features.

- Fund Your Account: Deposit fiat currency or crypto assets like USDT/USDC to purchase your chosen gold token.

- Buy Tokenized Gold: Place an order for PAXG at its current price ($3,854.01) or XAUT depending on your preference.

- Secure Your Tokens: Transfer them to a non-custodial wallet if you value self-custody, or leave them on-platform for easy trading/liquidity access.

The beauty of tokenized gold? You can start with as little as $10 worth, no need to shell out thousands for a full ounce!

The Power of Fractional Ownership and DeFi Integration

This new model doesn’t just make it easier to buy into gold; it opens up yield-generation opportunities through DeFi protocols that accept PAXG as collateral for lending or liquidity pools.

PAX Gold (PAXG) Price Prediction 2026–2031

Forecasting the performance of tokenized gold based on current 2025 trends, market adoption, and evolving blockchain integration.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,750 | $3,900 | $4,100 | +1.2% | Stable gold prices with steady tokenization adoption |

| 2027 | $3,700 | $4,000 | $4,300 | +2.6% | Increased institutional interest and DeFi integration |

| 2028 | $3,850 | $4,120 | $4,450 | +3.0% | Mature DeFi market, moderate gold appreciation |

| 2029 | $3,900 | $4,250 | $4,600 | +3.2% | Broader RWA tokenization, regulatory clarity |

| 2030 | $4,000 | $4,400 | $4,800 | +3.5% | Bullish scenario: global economic uncertainty drives gold demand |

| 2031 | $4,100 | $4,550 | $5,000 | +3.4% | Expansion of tokenized asset markets, increased mainstream adoption |

Price Prediction Summary

PAXG is expected to maintain a stable upward trajectory, closely tracking the value of physical gold while benefiting from increased adoption of tokenized assets and integration into DeFi platforms. Minimum prices reflect potential bearish scenarios or periods of gold market correction, while maximum prices account for bullish trends and accelerated adoption. Average yearly price growth is projected between 1–3.5%, in line with historical gold appreciation and growing crypto market participation.

Key Factors Affecting PAX Gold Price

- Physical gold price trends, as PAXG is pegged to gold.

- Adoption of tokenized assets by both retail and institutional investors.

- Regulatory developments impacting both gold and digital assets.

- Advancements in DeFi and integration of PAXG into financial products.

- Macro-economic factors, such as inflation, geopolitical tensions, and global demand for safe-haven assets.

- Competition from other tokenized gold products and stablecoins.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re ready to act fast but manage risk smartly, my core philosophy, now’s the time to explore this rapidly evolving sector before institutional adoption pushes prices even higher.

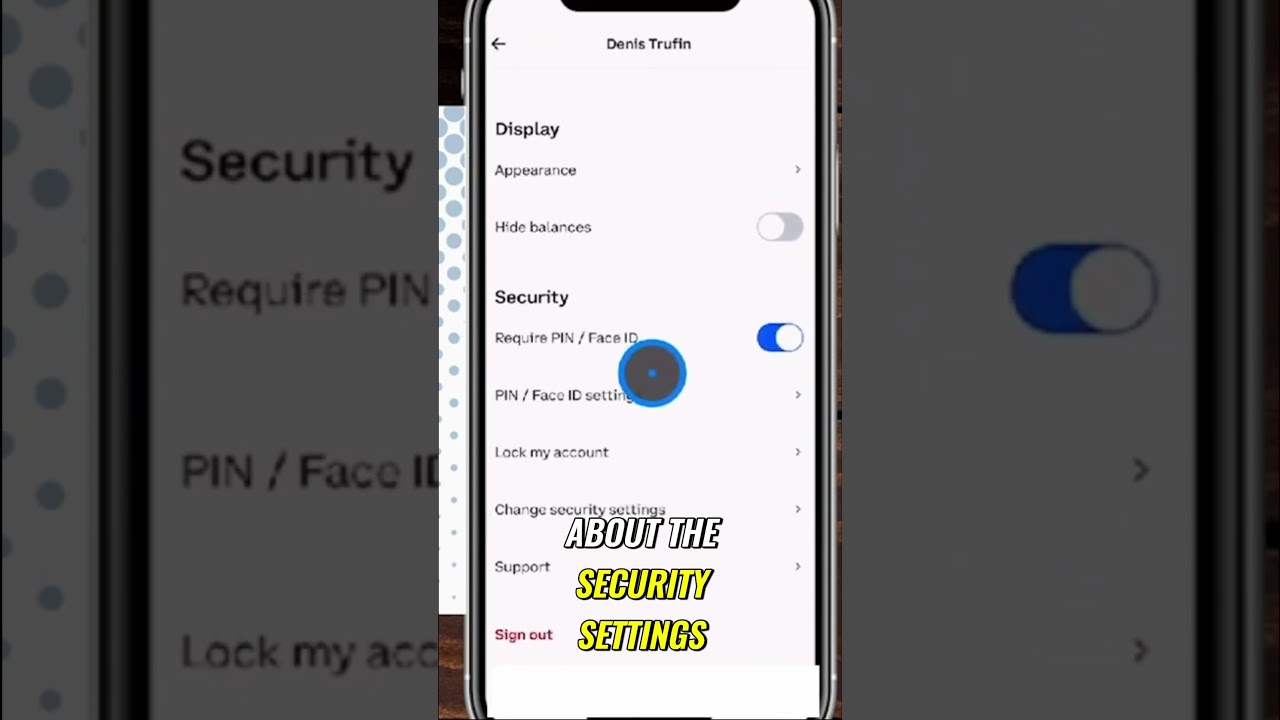

Security is another major advantage for those who invest in tokenized gold. Top-tier platforms provide regular audits, insurance coverage, and transparent proof-of-reserves, reducing counterparty risk compared to legacy gold products. This means you’re not just trusting the blockchain, you’re trusting a system built on verifiable, real-world assets.

Key Risks to Watch Before You Buy Gold Tokens

While the benefits are compelling, tokenized gold isn’t risk-free. Regulatory uncertainty lingers as governments refine their stance on crypto commodities. Smart contract vulnerabilities could expose users to technical risks if platforms aren’t properly audited. And while leading tokens like PAXG are backed 1: 1 by physical bullion, always check for independent third-party audits and clear redemption mechanisms before committing capital.

Top 5 Risks of Tokenized Gold & How to Reduce Them

-

Counterparty Risk: If the issuer or custodian fails, your gold tokens may lose value. Mitigation: Choose established issuers like PAX Gold (PAXG) and Tether Gold (XAUT), which back tokens with audited, securely stored gold.

-

Platform Security Breaches: Hacks or technical failures on trading platforms can lead to loss of assets.Mitigation: Use reputable exchanges like Coinbase with robust security measures, and enable two-factor authentication.

-

Lack of Regulatory Clarity: Regulatory changes may affect tokenized gold’s legality or your ability to redeem tokens.Mitigation: Stay updated on regulations in your country and invest through platforms that comply with major financial authorities.

-

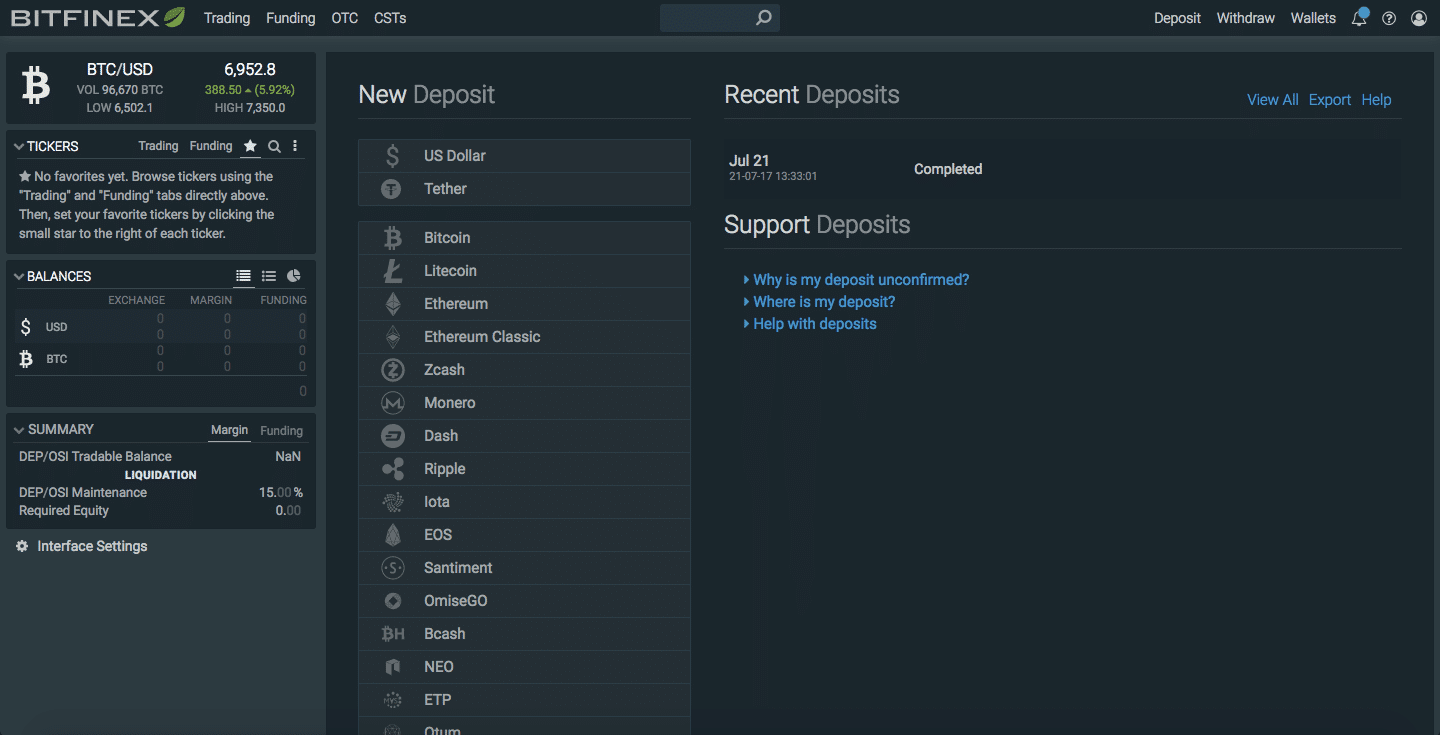

Redemption and Liquidity Issues: Not all platforms guarantee easy conversion of tokens to physical gold or cash.Mitigation: Verify redemption policies and liquidity on platforms like Kraken or Bitfinex, which support tokenized gold trading.

-

Smart Contract Vulnerabilities: Bugs in token smart contracts can expose your investment to risks.Mitigation: Invest in tokens with audited smart contracts and transparent technical documentation, such as PAXG and XAUT.

Liquidity is generally strong for major tokens such as PAXG and XAUT, but smaller projects can have thin order books, leading to slippage or wider spreads. Stick with established names and reputable exchanges to avoid these pitfalls.

How Tokenized Gold Fits Into a Modern Portfolio

Tokenized gold is more than just a digital novelty, it’s a dynamic portfolio tool. Allocating even 5-10% of your holdings into PAX Gold at $3,854.01 can add stability during market turbulence while preserving upside potential if gold rallies further. Plus, the ability to trade 24/7 or deploy your tokens in DeFi protocols delivers flexibility that traditional bullion simply can’t match.

The integration with decentralized finance is where things get truly exciting. Imagine earning yield by supplying your PAXG as collateral or participating in liquidity pools, without ever leaving the safety net of physical gold exposure. As DeFi matures, expect even more ways to put your digital bullion to work.

Final Thoughts: Is Now the Time To Buy Tokenized Gold?

The market has spoken, tokenized gold isn’t just a passing trend; it’s fast becoming an essential part of the modern investor’s toolkit. With PAX Gold (PAXG) holding steady at $3,854.01, accessibility has never been better for both retail investors and institutions seeking real asset exposure without traditional barriers.

If you want exposure to one of humanity’s oldest stores of value but demand 21st-century convenience and transparency, now is the time to act. Do your research, choose trusted platforms, and start small, then scale up as you gain confidence navigating this new frontier of crypto commodities.