Tokenized Gold vs. On-Chain Gold: Understanding the Difference and What Investors Need to Know

The digital transformation of gold investing is accelerating, but the terminology can be confusing. Investors often encounter the phrases tokenized gold and on-chain gold, sometimes used interchangeably, yet there are critical distinctions that matter for both security and strategy. As blockchain adoption reshapes the commodity landscape, understanding these nuances is essential for anyone considering exposure to gold-backed tokens on the blockchain.

Defining Tokenized Gold vs. On-Chain Gold

Tokenized gold refers to a specific class of digital tokens issued on a blockchain, each representing direct ownership of a fixed amount of physical gold held by a regulated custodian. For example, one token might equal one troy ounce or one gram of London Good Delivery gold stored in an audited vault. The core promise: every token is fully backed by real, redeemable metal, with proof-of-reserves verifiable on-chain.

On-chain gold, meanwhile, is a broader umbrella term for any representation of gold whose ownership and transfer are recorded on a blockchain. This includes tokenized gold but also encompasses synthetic or derivative products that may not have direct physical backing. In practice, when investors discuss “on-chain gold, ” they are usually referring to tokenized assets like PAXG or XAUt – but it’s worth noting that not all on-chain representations offer the same redemption rights or security guarantees.

“Tokenization unlocks new levels of liquidity and transparency for traditional assets like gold – but only if you understand what you’re actually buying. “

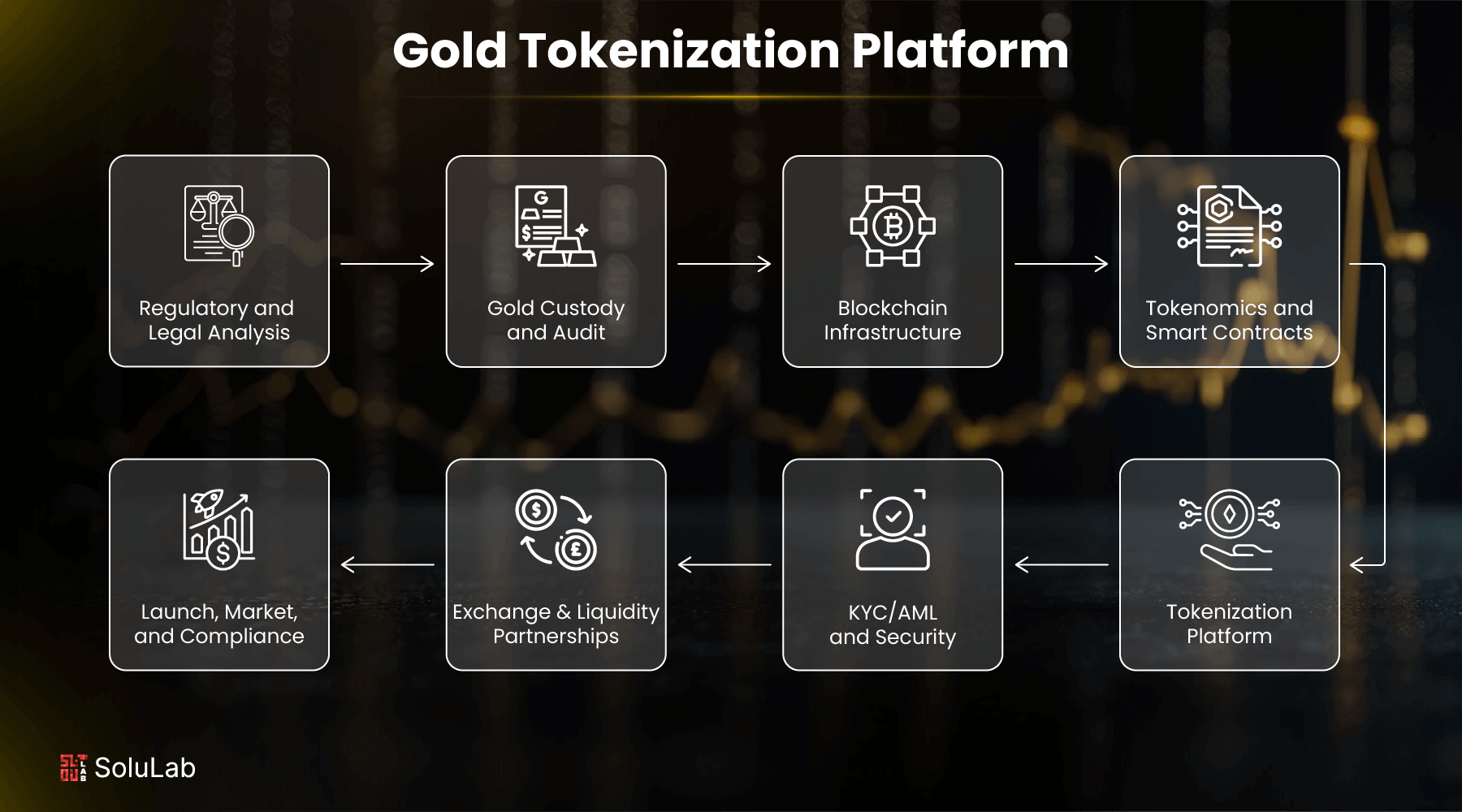

How Tokenized Gold Works: Custody, Redemption, and Transparency

The essence of tokenized gold lies in its structure: each token is an IOU for real-world bullion stored by a trusted custodian (such as Brink’s or Malca-Amit). Leading platforms provide:

- Audited proof-of-reserves: Public records confirm every token is matched 1: 1 with physical bars.

- Redemption options: Some issuers allow individual investors to redeem tokens for physical delivery (often subject to minimums), while others focus on institutional scale.

- Fractional ownership: Buy as little as 0.01 gram – impossible with traditional bar purchases.

- Learn more about auditing and verification of tokenized gold here.

This structure sharply contrasts with traditional ETFs or unallocated accounts, where you own shares in a fund rather than direct claims on bullion. With tokenized gold, your rights are enforced by smart contracts and visible in real time via public blockchains.

The Investor’s Perspective: Key Benefits and Risks

Key Advantages and Risks: Tokenized Gold vs. On-Chain Gold

-

Direct Ownership and Redemption: Tokenized gold (e.g., PAX Gold (PAXG), Tether Gold (XAUt)) offers holders a direct claim on physical gold, often redeemable for gold bars stored in secure vaults. In contrast, some on-chain gold synthetics (such as Synthetix sXAU) track gold prices without direct physical backing.

-

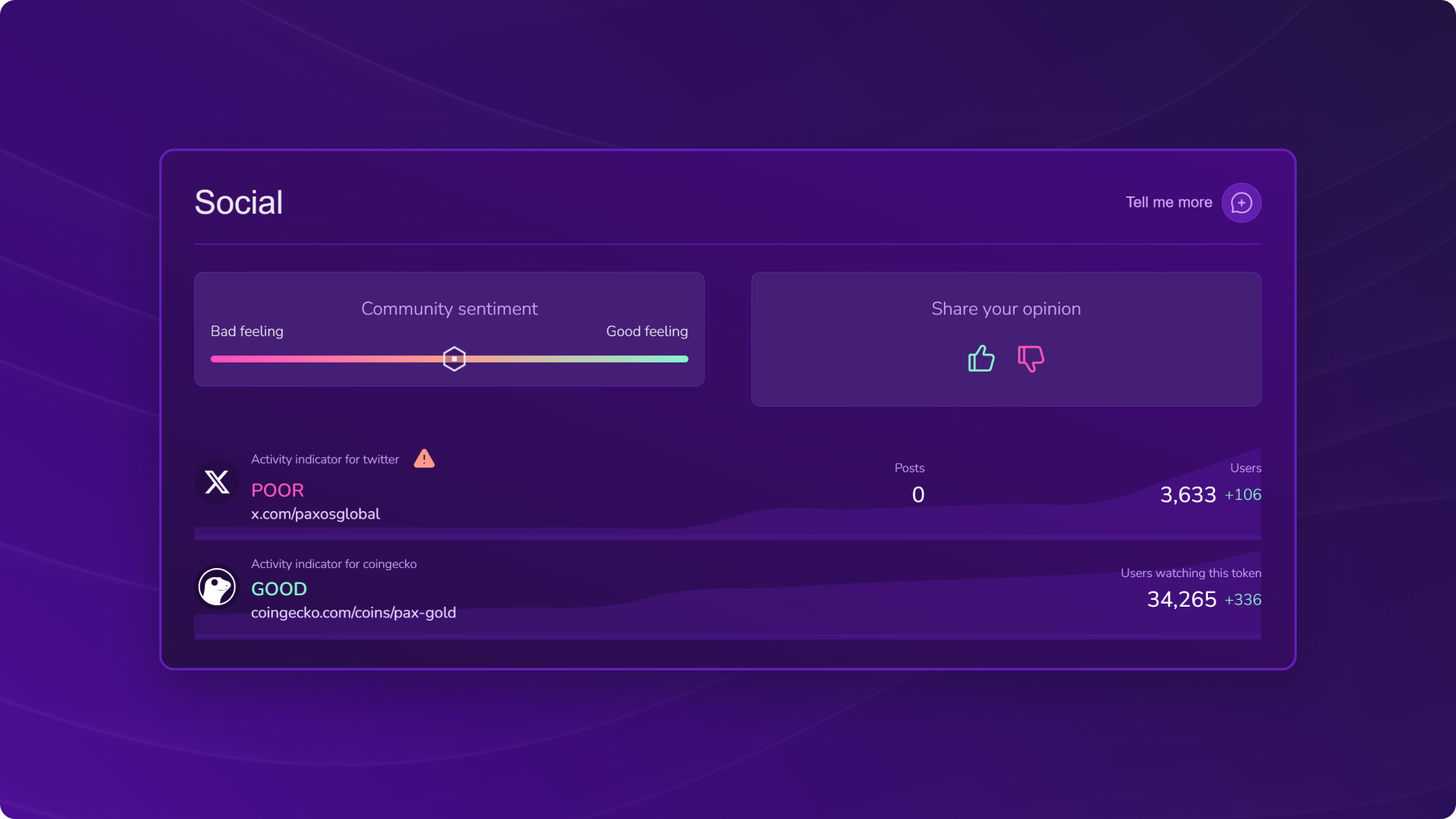

Transparency and Security: Both tokenized gold and on-chain gold synthetics leverage blockchain technology for transparent, immutable transaction records. However, tokenized gold projects often provide third-party audits and real-time proof of reserves, enhancing trust for investors.

-

Liquidity and Accessibility: Tokenized gold tokens (like PAXG and XAUt) can be traded 24/7 on major crypto exchanges (e.g., Binance, Kraken), providing high liquidity and global accessibility. On-chain gold synthetics also offer liquidity, especially within DeFi platforms, but may depend on protocol-specific markets.

-

Fractional Ownership: Both models allow investors to own small fractions of gold, lowering entry barriers. Tokenized gold typically represents specific amounts (e.g., 1 PAXG = 1 troy ounce), while synthetics can represent any divisible value tracked on-chain.

-

Risks: Custodial and Counterparty: Tokenized gold relies on trusted custodians to store physical gold. Risks include potential mismanagement or insolvency of custodians. On-chain synthetics, while avoiding physical custody, introduce smart contract and protocol risks, such as code vulnerabilities or platform failures.

-

Regulatory Considerations: Tokenized gold projects are subject to varying regulations depending on jurisdiction, which may impact investor protections and redemption rights. On-chain synthetics may face less direct regulation but can be affected by evolving legal frameworks for DeFi and synthetic assets.

The surge in popularity around tokenized commodities, especially as spot prices reach new highs, reflects several investor priorities:

- 24/7 Global Liquidity: Unlike OTC markets or ETFs limited by trading hours, tokenized gold trades around the clock across exchanges worldwide.

- No Geographic Barriers: Anyone with internet access can buy or sell fractional amounts instantly – no need for intermediaries or cross-border paperwork.

- Sovereign Ownership: Private keys control your holdings; you avoid counterparty risk from brokers or banks.

- Explore how tokenized gold is transforming safe haven investing here.

This democratization comes with new risks. While theft risk shifts from vaults to digital wallets (think phishing attacks instead of armed robbery), regulatory clarity remains uneven across jurisdictions. Additionally, not every “gold-backed” token offers transparent redemption terms; always review issuer documentation carefully before investing.

For investors weighing tokenized gold vs on-chain gold, the devil is in the details. The most robust products offer full transparency, real-time proof of reserves, and straightforward redemption mechanics. However, some on-chain gold tokens are synthetic IOUs without direct physical backing, these carry different risk profiles, including exposure to smart contract vulnerabilities or issuer insolvency.

Security Considerations: Physical vs Digital Risks

Physical gold is vulnerable to theft, storage costs, and logistical hurdles. Tokenized gold eliminates many of these issues by leveraging blockchain security and global accessibility. Yet digital assets introduce their own risks, cyberattacks, private key mismanagement, and platform exploits can all jeopardize holdings. Investors must weigh:

Practical Security Tips for Storing Tokenized Gold

-

Use Reputable Custodians and Platforms: Always purchase and store tokenized gold through well-known, regulated platforms such as PAX Gold (PAXG), Tether Gold (XAUt), or Augminted Gold. These platforms provide transparency, regular audits, and secure custody of the underlying physical gold.

-

Enable Two-Factor Authentication (2FA): Activate 2FA on all accounts associated with your tokenized gold, including exchanges and wallets. Use authentication apps like Google Authenticator or Authy for enhanced security over SMS-based 2FA.

-

Regularly Monitor Platform Audits and Proof-of-Reserves: Choose platforms that publish independent audits and proof-of-reserves, such as PAXG and XAUt. Regularly review these reports to verify the backing of your tokens by real gold.

-

Stay Vigilant Against Phishing and Scams: Only access tokenized gold platforms through official websites or trusted apps. Double-check URLs, avoid clicking on suspicious links, and be wary of unsolicited messages or offers.

-

Understand Regulatory Protections: Ensure your chosen platform complies with relevant regulations in your jurisdiction. Platforms like PAX Gold and XAUt are issued by regulated entities, providing additional investor protection.

Custodian reputation is paramount. Only engage with issuers who publish regular audit reports and maintain transparent vaulting arrangements. And remember: not your keys, not your gold. Self-custody provides sovereignty but demands technical diligence.

Redemption Rights and Real-World Use

The ability to redeem tokens for physical bullion underpins trust in tokenized gold markets. Leading platforms allow holders to exchange tokens for London Good Delivery bars (subject to minimums and fees), or sometimes claim unallocated Loco London positions. Retail investors should scrutinize redemption terms: Are there minimum thresholds? What jurisdictions are supported? How are delivery logistics handled?

This contrasts sharply with synthetic or derivative on-chain gold products that may lack any redemption pathway entirely, these function more like price trackers than true asset-backed tokens.

“Redemption is the ultimate test of a gold-backed token’s integrity. If you can’t claim the metal, you’re holding a promise, not the asset. “

Tokenized Gold in DeFi and Portfolio Diversification

As decentralized finance (DeFi) matures, tokenized gold is increasingly used as collateral for lending protocols or yield strategies, an innovation impossible with physical bullion or traditional ETFs. This integration unlocks liquidity but also introduces new risks tied to smart contract code and platform governance.

Diversification remains a core principle. Tokenized commodities let investors blend traditional safe-haven assets with blockchain-native opportunities, balancing upside potential with defensive positioning in volatile markets.

What Investors Need to Know Before Buying

- Understand what you’re buying: Is the token fully backed by physical metal? Are audits public?

- Review redemption policies: Can you actually take delivery? What are the costs?

- Assess platform security: Who controls custody? What safeguards are in place?

- Stay informed on regulation: Jurisdictional changes can impact asset rights overnight.

- See our step-by-step guide for first-time buyers here.

The future of gold-backed tokens blockchain innovation will hinge on investor trust, anchored by transparency, regulatory clarity, and robust custody solutions. For those seeking liquid exposure to one of humanity’s oldest stores of value via cutting-edge technology, understanding these distinctions isn’t just prudent, it’s essential for secure growth through smart diversification.