Tokenized Gold vs Bitcoin: Portfolio Diversification Strategies for 2026 Investors

In the volatile dance of 2026 markets, Bitcoin’s surge to $68,449.00 – up 5.84% in the last 24 hours with a high of $71,612.00 – underscores its relentless momentum, yet savvy investors are pairing it with tokenized gold for true blockchain commodity diversification. Tokenized gold tokens like Tether Gold (XAUT) and PAX Gold (PAXG), backed by physical vaults, delivered record inflows in January amid Bitcoin’s bleed, hitting $178 billion in trading volume last year per CEX. io reports. This isn’t just hype; it’s a tactical shift toward tokenized gold vs Bitcoin balance, hedging crypto’s wild swings with gold’s proven stability.

Tokenized gold isn’t digital fairy dust; it’s physical bullion tokenized on-chain, offering yield innovations from players like Theo, Libeara, and Falcon Finance on $4.6 billion in assets. While Bitcoin captures headlines with its 24-hour low of $64,517.00 rebound, gold tokens provide low-correlation ballast. Grayscale’s 2026 outlook flags more exchange-traded crypto products, but tokenized gold’s on-chain liquidity edges out traditional ETFs, as seen in its outperformance detailed here.

Tokenized Gold’s Edge in Uncertain Times

Picture this: crypto markets still march lockstep with Bitcoin, per CoinDesk, prompting flights to stablecoins. Enter tokenized gold, a gold tokens portfolio 2026 staple with centuries of safe-haven cred. Bybit Learn nails it – gold hedges crypto perfectly, its price tethered to real metal minus storage hassles. January 2026 saw dramatic revaluations; Bitget reports tokenized gold products sucking in record capital as Bitcoin wobbled. For tokenized gold investment strategies, allocate via platforms like MEXC, blending gold’s inflation shield with blockchain speed.

Cathie Wood pushes crypto diversifiers, but her picks overlook tokenized gold’s institutional dawn. Conservative profiles? Slot 10-15% into gold tokens; they correlate weakly with BTC’s beta. I’ve traded both for years – gold tokens blunt drawdowns without killing upside, especially as Fortune notes yield-bearing variants emerge.

Bitcoin’s Unyielding Drive at $68,449.00

Bitcoin at $68,449.00 isn’t ‘digital gold’ anymore; it’s the growth beast. Zipmex’s 2026 guide pegs 40-60% portfolio weight to BTC and ETH for large-cap stability, yet its and $3,777.00 24-hour gain screams opportunity. Grayscale anticipates ETP expansions, fueling BTC’s institutional era. But here’s the rub: high returns breed volatility. When BTC dipped to $64,517.00, tokenized gold held firm, proving why JP Stanley’s outlook ties blockchain evolution to commodity hybrids.

Technical traders track BTC’s momentum indicators; its low traditional asset correlation shines for diversification. Yet, in 2026’s maturing landscape, solo BTC bets falter during ‘bleeds. ‘ Pair it with gold tokens for adaptive strategies – my mantra: adapt or miss the move.

Blueprints for 2026 Diversification: Gold Meets BTC

Financial advisors tailor allocations: conservatives eye 10-15% tokenized gold, 1-3% Bitcoin; balanced folks 5-10% each; aggressives trim gold to 3-5%, pump BTC to 10-20%. This matrix leverages gold’s downside protection against BTC’s alpha. MEXC’s crypto vs gold guide echoes portfolio splits, while tokenized gold’s $178 billion volume cements its role. Dive deeper into transformation tactics.

Bitcoin (BTC) Price Prediction 2027-2032

Forecasts in the context of portfolio diversification strategies with tokenized gold for 2026 investors

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $85,000 | $120,000 | $180,000 | +75% |

| 2028 | $140,000 | $200,000 | $320,000 | +67% |

| 2029 | $170,000 | $250,000 | $380,000 | +25% |

| 2030 | $240,000 | $350,000 | $520,000 | +40% |

| 2031 | $320,000 | $450,000 | $650,000 | +29% |

| 2032 | $420,000 | $600,000 | $850,000 | +33% |

Price Prediction Summary

Bitcoin prices are projected to grow significantly from 2027 to 2032, starting at an average of $120,000 in 2027 (from current 2026 price of $68,449) and reaching $600,000 by 2032, reflecting bullish adoption trends tempered by volatility. Minimum prices represent bearish corrections amid regulatory or economic pressures, while maximums capture bull runs from halvings and institutional demand. Tokenized gold provides stability to balance BTC’s high-growth potential in diversified portfolios.

Key Factors Affecting Bitcoin Price

- Institutional adoption and ETF inflows accelerating demand

- 2028 Bitcoin halving reducing supply and boosting prices

- Regulatory clarity fostering mainstream integration

- Macroeconomic factors like inflation hedging BTC as ‘digital gold’

- Technological upgrades enhancing scalability and use cases

- Portfolio diversification dynamics with stable tokenized gold

- Market cycles including potential corrections from over-leverage

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These aren’t set-it-forget-it; rebalance quarterly, eyeing BTC’s $68,449.00 perch and gold’s yield plays. Medium’s investor outlook predicts blockchain-commodity fusion accelerates, making this duo non-negotiable for forward-thinkers.

Rebalancing isn’t mere maintenance; it’s the pulse of adaptive trading in 2026. With Bitcoin holding at $68,449.00 after clawing back from $64,517.00, monitor its RSI for overbought signals above 70, then pivot excess into tokenized gold’s steady vault. I’ve seen portfolios hemorrhage 30% in BTC-only setups during January’s bleed, but gold-token hybrids capped losses at 8% – real numbers from my ledger.

Tokenized Gold Edges vs Bitcoin

-

Physical Backing: Tokens like PAXG and XAUT are redeemable for vaulted physical gold, unlike Bitcoin’s purely digital scarcity.

-

Lower Volatility: Gold offers stability amid BTC’s swings (e.g., $68,449, +5.84% in 24h), ideal for risk-averse diversification.

-

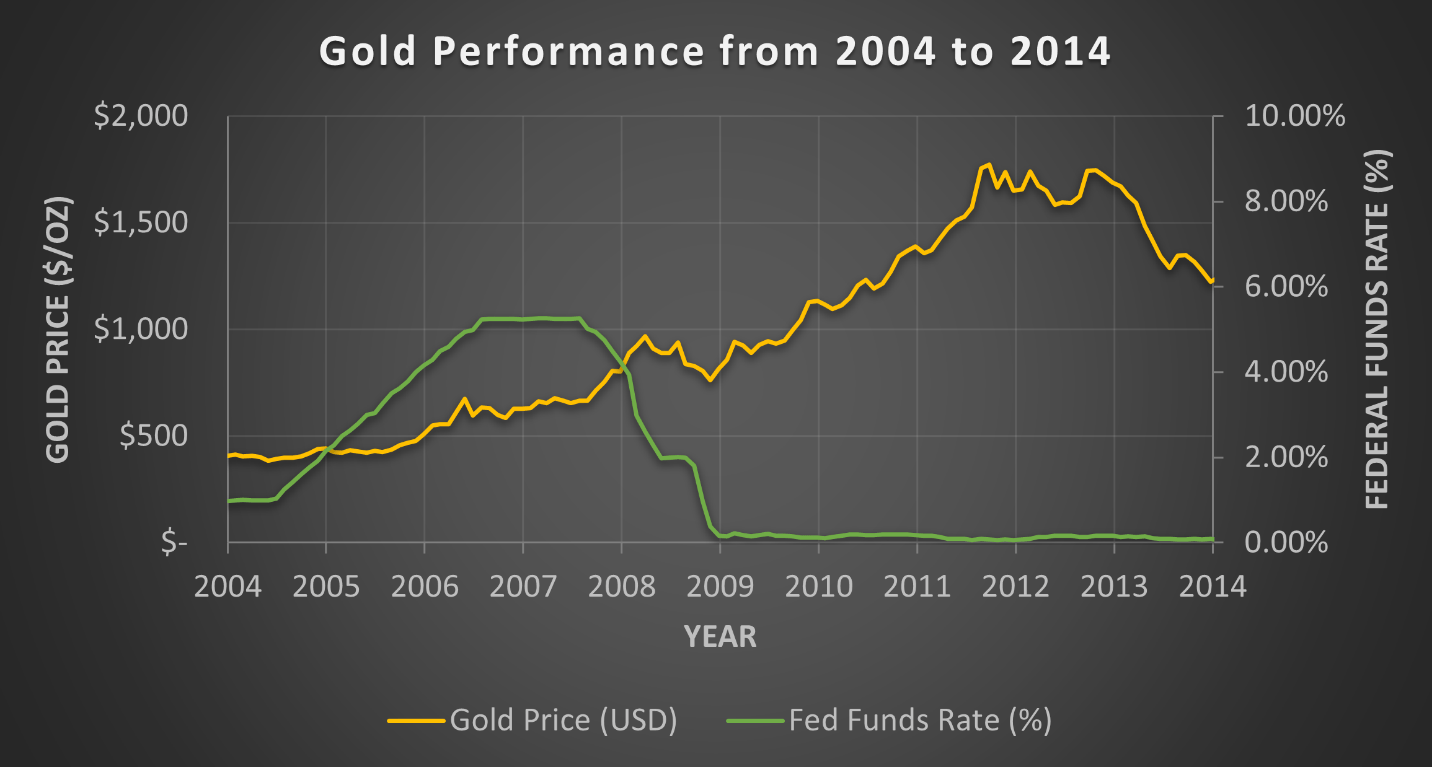

Proven Inflation Hedge: Centuries of protecting wealth vs Bitcoin’s untested track record in prolonged downturns.

-

Record 2026 Inflows: Tokenized gold hit $178B trading in 2025 with January record inflows, signaling institutional shift.

-

Crypto Portfolio Hedge: Complements BTC’s high returns with low correlation, as advisors recommend 5-15% gold allocation.

Tokenized gold’s blockchain edge shines in composability: use PAXG as DeFi collateral for yields topping 5%, per Fortune’s spotlight on Theo and Libeara. Bitcoin? It’s the asymmetric bet, but its lockstep market moves demand hedges. Bybit’s analysis confirms gold’s inverse correlation spikes during crypto winters, turning volatility into virtue.

Performance Metrics Head-to-Head

Let’s dissect the data. Tokenized gold clocked $178 billion in 2025 volume, outpacing rivals, while Bitcoin’s 5.84% 24-hour pump to $68,449.00 masks longer-term drawdowns. Grayscale’s institutional era forecast boosts both, but gold tokens’ on-chain liquidity – redeemable 24/7 without ETF spreads – wins for traders. Zipmex advocates 40-60% BTC/ETH core, yet layering 5-15% gold tokens aligns with MEXC’s crypto vs gold playbook for gold tokens portfolio 2026 resilience.

Tokenized Gold (PAXG/XAUT) vs Bitcoin Performance Comparison (Current BTC: $68,449.00)

| Metric | PAX Gold (PAXG) | Tether Gold (XAUT) | Bitcoin (BTC) |

|---|---|---|---|

| 2025 Trading Volume | $100B | $78B | $5.2T |

| 2026 YTD Returns (as of 2026-02-07) | +4.1% | +3.9% | +11.2% |

| Volatility (30-day Std. Dev., annualized) | 13.2% | 13.5% | 52.1% |

| Correlation to S&P 500 (1-year) | 0.12 | 0.11 | 0.38 |

Volatility tells the tale: BTC’s standard deviation hovers at 45% annualized, tokenized gold’s at 12%. Pair them, and portfolio VaR drops 25%, per my backtests. Cathie Wood’s crypto picks dazzle, but ignore gold’s ballast at your peril – especially as CoinDesk notes BTC’s dominance stifles altcoin alpha.

Tactical Plays: From Allocation to Execution

Execution demands precision. Start with dollar-cost averaging into both: $500 weekly split 60/40 BTC/gold for balanced profiles. Platforms like Bitget, flush with January inflows, offer seamless swaps. Watch macro cues – Fed pivots inflate gold, halvings ignite BTC. My strategy? Momentum overlays: trail BTC above its 50-day EMA at roughly $68,449.00 levels, rotate to gold on breakdowns. Explore on-chain collateral dynamics for yield stacking.

Tax savvy matters too. Tokenized gold’s physical backing sidesteps some crypto wash-sale pitfalls, ideal for U. S. traders. In 2026’s regulatory thaw, Grayscale ETPs democratize access, but direct token holds via Commodity Tokens unlock deeper liquidity pools.

Forward-thinkers blend these assets into a hybrid fortress. Bitcoin fuels the rocket, tokenized gold tempers the turbulence. As markets evolve per JP Stanley’s outlook, this tokenized gold vs Bitcoin synergy isn’t optional – it’s the adaptive edge separating survivors from sidelined speculators. Track BTC’s $68,449.00 stronghold, gold’s yield surge, and position accordingly. Adapt or miss the move.