Tokenized Commodity ETFs vs. Traditional ETFs: Key Differences Explained

Tokenized commodity ETFs are rapidly emerging as a disruptive force in global finance, promising to reshape how investors access gold, oil, and other real assets. As of Q2 2025, the tokenized gold market alone has reached a record $19.2 billion in trading volume, outpacing several mid-tier traditional gold ETFs. This surge is more than a passing trend: it reflects fundamental shifts in technology, regulation, and investor demand.

What Sets Tokenized Commodity ETFs Apart?

The core distinction lies in the underlying architecture. Traditional commodity ETFs are structured as regulated investment funds holding physical commodities or futures contracts. Investors buy shares on centralized exchanges like NYSE or LSE, with settlement typically taking two days via clearinghouses.

In contrast, tokenized commodity ETFs represent fund shares as blockchain tokens. These tokens are issued and traded on decentralized platforms such as Ethereum, enabling features like 24/7 trading, instant settlement, and fractional ownership down to minuscule units. BlackRock’s recent move to tokenize its flagship ETFs signals that institutional players are taking this innovation seriously.

The Technology Behind Tokenization

Tokenization leverages smart contracts to encode ETF shares into digital tokens that exist natively on blockchains. This allows for seamless transfer between wallets without intermediaries, unlike traditional systems that rely on layers of custodians and transfer agents.

The benefits are tangible: investors gain direct control over their assets, transactions settle instantly rather than over multiple days, and global participation is possible without the friction of legacy financial rails. However, these advantages come with new risks around private key management and evolving regulatory frameworks.

Key Benefits: Tokenized vs. Traditional Commodity ETFs

-

24/7 Trading Access: Tokenized commodity ETFs, such as BlackRock’s tokenized funds on Ethereum, can be traded around the clock, unlike traditional ETFs limited to stock exchange hours.

-

Instant Settlement: Tokenized ETFs settle instantly on blockchain networks, reducing counterparty risk and eliminating the typical T+2 settlement lag found in traditional ETFs.

-

Fractional Ownership: Tokenization enables investors to purchase small fractions of ETF shares, making high-value commodities like gold more accessible than with traditional ETFs, which may require whole-share purchases.

-

Enhanced Transparency: Blockchain-based ETFs offer real-time, immutable records of transactions and holdings, providing greater transparency compared to traditional ETF structures.

-

Global Accessibility: Tokenized commodity ETFs can be accessed by investors worldwide with an internet connection, bypassing regional restrictions and intermediaries common in traditional markets.

-

Regulatory Maturity: Traditional commodity ETFs benefit from established regulatory frameworks and investor protections, while tokenized ETFs are still navigating evolving compliance landscapes.

Regulation and Trust: Where Do Tokenized Commodity ETFs Stand?

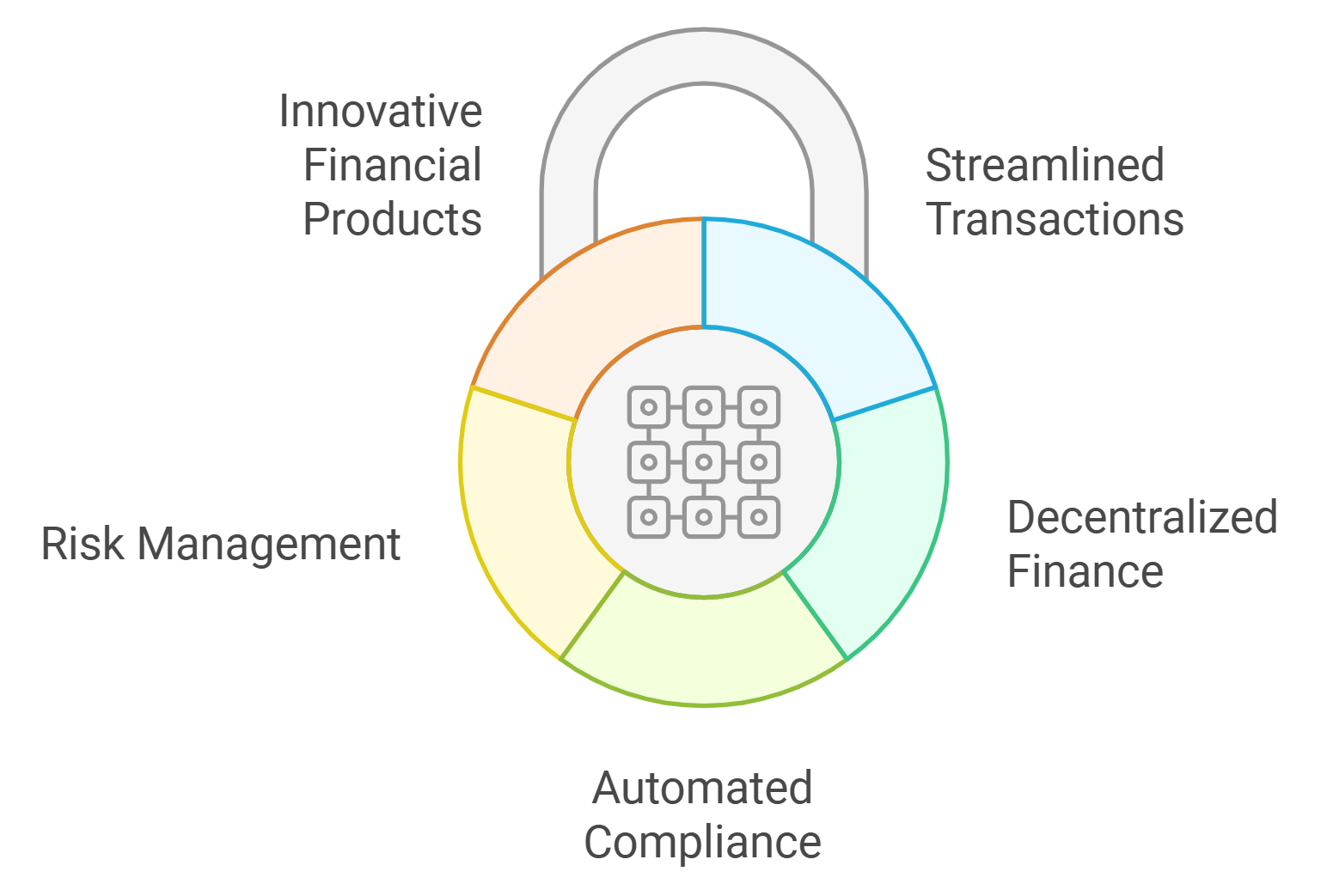

Traditional ETFs operate within mature regulatory environments, think SEC oversight in the US or FCA regulation in the UK, which offers a high degree of investor protection and transparency. This institutional trust has been critical to the growth of the ETF market over the past two decades.

By comparison, tokenized commodity ETFs exist at the intersection of finance and crypto law. While some issuers seek regulatory clarity by partnering with licensed custodians or obtaining special approvals, others operate in more ambiguous jurisdictions. The regulatory gap is narrowing but remains a key consideration for risk-averse investors.

Market Momentum: Tokenized Gold Hits $19.2 Billion in Q2 2025

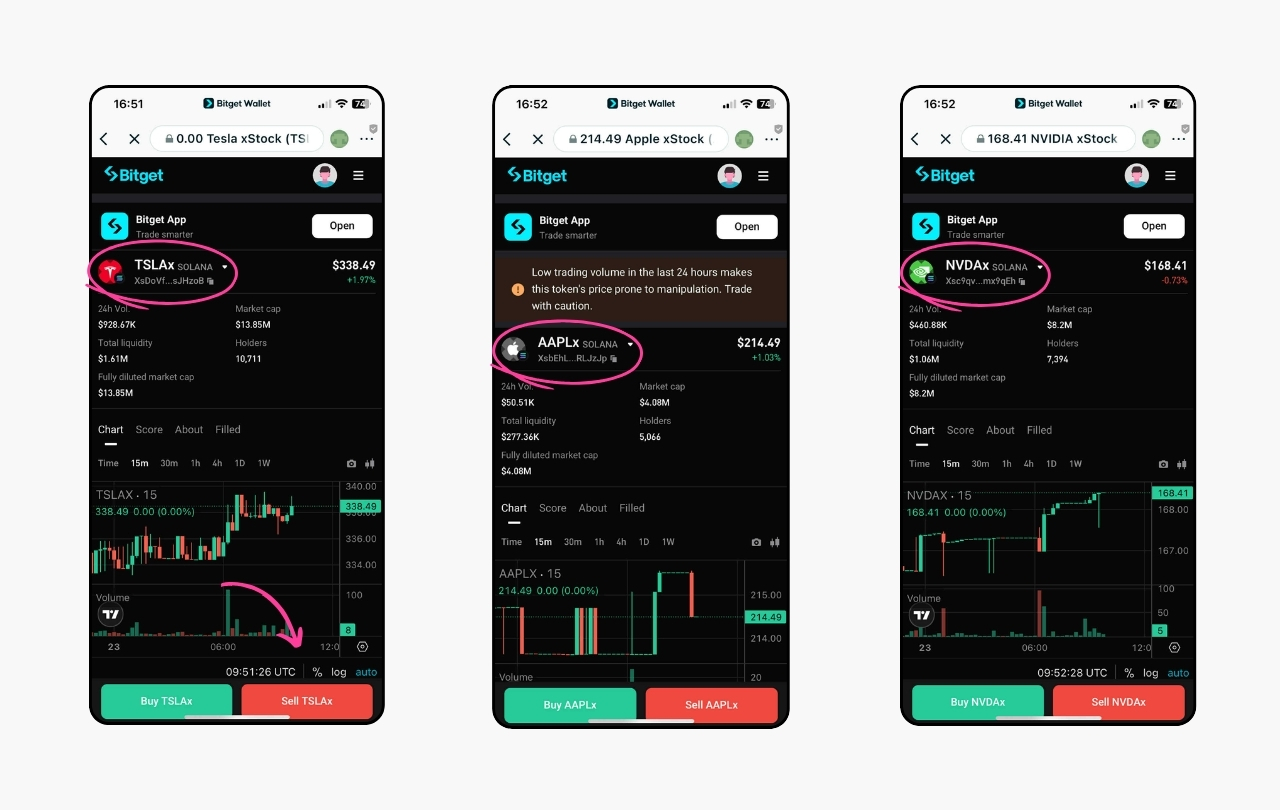

This year’s record-breaking $19.2 billion trading volume for tokenized gold highlights growing mainstream acceptance. Fractional ownership has enabled broader participation, from retail investors buying micro-shares to institutions seeking cross-border liquidity outside standard trading hours.

The ability to trade tokenized commodity ETFs around the clock is a fundamental shift. Unlike traditional ETFs, which are limited to exchange hours and can face liquidity constraints during global events, tokenized ETFs offer continuous access and rapid settlement. For commodities like gold and oil, which are influenced by geopolitical shocks and macroeconomic news at any hour, this flexibility is particularly valuable.

Transparency is another area where tokenized commodity ETFs excel. Every transaction is recorded immutably on the blockchain, making it possible for investors to verify fund holdings and movements in real time. This contrasts with the more opaque reporting cycles of traditional ETFs, where portfolio updates may lag days or weeks behind actual trades.

Risks and Challenges: Not All That Glitters Is Tokenized Gold

Despite their promise, tokenized commodity ETFs are not without risks. Regulatory uncertainty remains, jurisdictions differ on how these assets should be classified and taxed. While some platforms partner with established custodians to enhance trust, others operate with less oversight, increasing counterparty risk.

Security is also paramount. Investors must safeguard private keys; loss or theft can result in irreversible loss of assets. Additionally, smart contract vulnerabilities have been exploited in other DeFi sectors, rigorous auditing and best practices are essential for any platform offering tokenized ETFs.

Comparing Risks: Tokenized vs. Traditional Commodity ETFs

-

Regulatory Uncertainty: Tokenized commodity ETFs face evolving and sometimes unclear regulatory frameworks, especially across jurisdictions, while traditional ETFs benefit from established oversight by authorities like the SEC or ESMA.

-

Counterparty and Smart Contract Risks: Tokenized ETFs rely on smart contracts and blockchain infrastructure, introducing risks of code vulnerabilities or exploits. Traditional ETFs depend on established custodians and clearinghouses, which have a long track record but are not immune to operational risks.

-

Liquidity and Market Access: Tokenized commodity ETFs can offer 24/7 trading and fractional ownership, but may suffer from lower liquidity and fragmented markets compared to traditional ETFs, which are traded on major exchanges with deep liquidity during market hours.

-

Settlement and Custody Risks: Tokenized ETFs settle instantly on blockchains, but users must manage digital wallets and private keys, exposing them to loss or theft. Traditional ETFs use established settlement systems and custodians, reducing direct custody risks for investors.

-

Transparency and Asset Backing: Tokenized ETFs offer enhanced on-chain transparency, but verifying the real-world backing of tokens can be challenging. Traditional ETFs are subject to regular audits and disclosures, providing clarity on underlying assets.

Liquidity and Accessibility: Lower Barriers for a New Generation

The surge to $19.2 billion in tokenized gold trading volume demonstrates that liquidity is rapidly improving for these products. Fractionalization enables participation at nearly any investment size, a stark contrast to some traditional funds that require minimum lot sizes or have high entry fees.

This democratization extends globally; anyone with a digital wallet can access these markets without intermediaries or restrictive geographic barriers. For investors in emerging economies or those seeking hedges outside their local currency, this can be transformative.

Looking Ahead: Will Tokenized Commodity ETFs Overtake Traditional Offerings?

The momentum behind crypto ETFs vs traditional ETFs is unmistakable, especially as blue-chip players like BlackRock enter the fray. Yet widespread adoption will hinge on regulatory harmonization, continued improvements in blockchain infrastructure, and investor education around both benefits and pitfalls.

For now, tokenized commodity ETFs offer unique advantages: 24/7 markets, transparency via public blockchains, fractional ownership opportunities, and instant settlement, all while allowing exposure to real-world assets like gold that remain foundational in diversified portfolios.

As institutions experiment with both models side by side, and as retail adoption accelerates, the next few years will be pivotal for the evolution of global commodity investing.