How Tokenized Gold Works: Platforms, Issuers, and Integration with DeFi

Tokenized gold is rapidly redefining how investors access and interact with one of humanity’s oldest stores of value. By representing physical gold on the blockchain through digital tokens, this innovation combines the stability and legacy of gold with the transparency, liquidity, and programmability of crypto assets. Today’s tokenized gold market is shaped by leading platforms and issuers, each offering unique solutions for integrating gold-backed crypto tokens into decentralized finance (DeFi) ecosystems.

How Tokenized Gold Is Created: From Vault to Blockchain

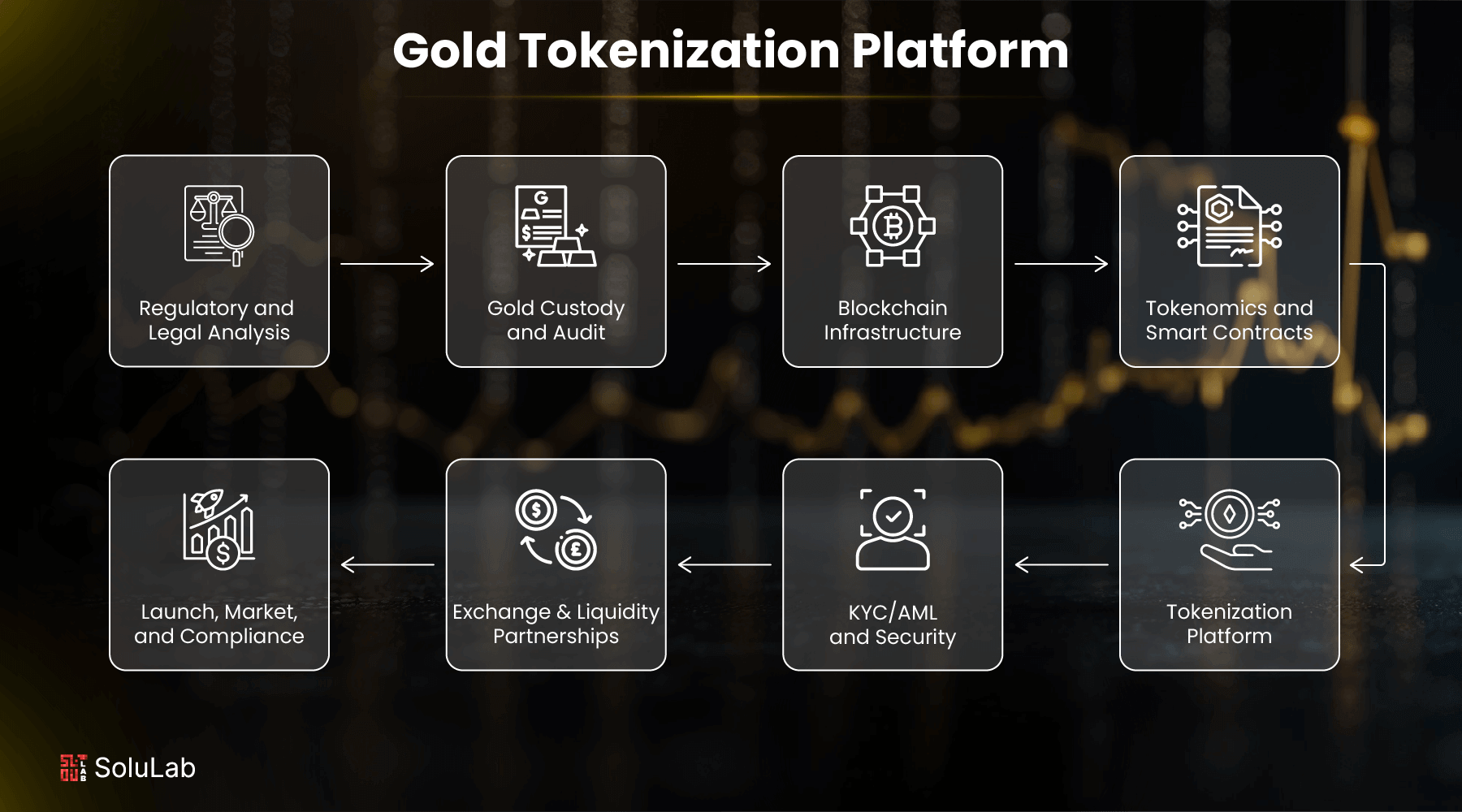

The process begins with trusted custodians securing physical gold in high-security vaults. Platforms such as Paxos Gold (PAXG) and Tether Gold (XAUT) have set industry standards by ensuring that every token issued is backed 1: 1 by a specific amount of real gold. For example, each PAXG token represents exactly one troy ounce of London Good Delivery gold stored at Brink’s vaults in London. Similarly, XAUT tokens are tied to physical bars held in Swiss vaults and can be tracked down to their serial numbers for maximum transparency (source).

After verification, the custodian mints digital tokens on a public blockchain – typically Ethereum or Tron – that represent legal ownership of the underlying metal. Holders can redeem these tokens for physical delivery or convert them back into fiat currency or unallocated gold via issuer platforms like Paxos (source). This direct link between token and bullion is what gives tokenized gold its unique value proposition compared to traditional ETFs or futures contracts.

Major Platforms and Issuers Shaping the Market

Top 3 Tokenized Commodities Platforms

-

Paxos Gold (PAXG) — Each PAXG token is backed by one troy ounce of physical gold stored in Brink’s vaults in London. Issued by the regulated Paxos Trust Company, PAXG is widely integrated into DeFi platforms, enabling users to trade, lend, or redeem tokens for actual gold or fiat currency.

-

Tether Gold (XAUT) — Launched by the creators of USDT, XAUT represents one troy ounce of gold held in Swiss vaults. It is available on both Ethereum and Tron blockchains, offering flexibility and physical redemption options for token holders.

-

XAUm by Matrixdock — XAUm is a tokenized gold asset integrated with the Sui blockchain and tradable on decentralized exchanges like Momentum. It can be used as collateral on DeFi lending platforms such as Navi and AlphaLend, expanding gold’s utility in digital finance.

The competitive landscape for tokenized commodities platforms is evolving quickly, but some leaders have emerged:

- Paxos Gold (PAXG): Regulated by NYDFS, PAXG enables instant conversion between digital tokens and allocated/unallocated gold or fiat currency. Each PAXG can be traced directly to a specific bar in Brink’s vaults (source).

- Tether Gold (XAUT): Backed by one troy ounce per token in Swiss vaults, XAUT offers flexibility through availability on both Ethereum and Tron networks (source).

- XAUm by Matrixdock: As a new entrant focused on DeFi-native integration, XAUm leverages the Sui blockchain for seamless trading on decentralized exchanges like Momentum as well as use as collateral across DeFi lending protocols (source).

This diversity allows investors to choose products that best suit their needs – whether they prioritize regulatory oversight, technical flexibility, or DeFi-native features.

The Role of Tokenized Gold in DeFi Ecosystems

The integration of tokenized gold into DeFi has unlocked new possibilities for both individual and institutional investors. Unlike traditional bullion holdings that sit idle in vaults, tokenized gold can be put to work within decentralized protocols:

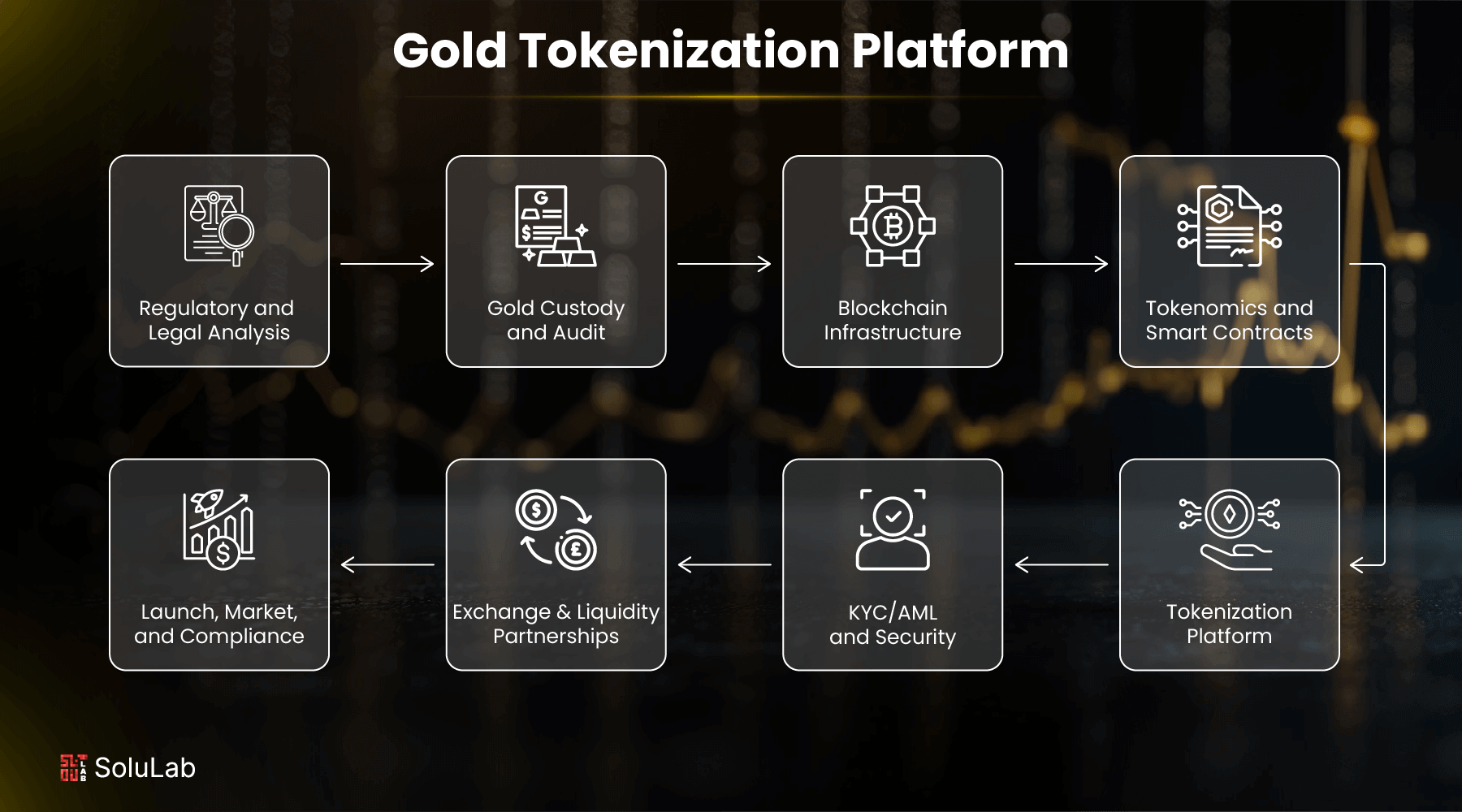

- Liquidity provision: By adding PAXG or XAUT to liquidity pools on DEXs such as Uniswap or Curve Finance, users earn trading fees while facilitating blockchain-based swaps between stablecoins and tokenized commodities.

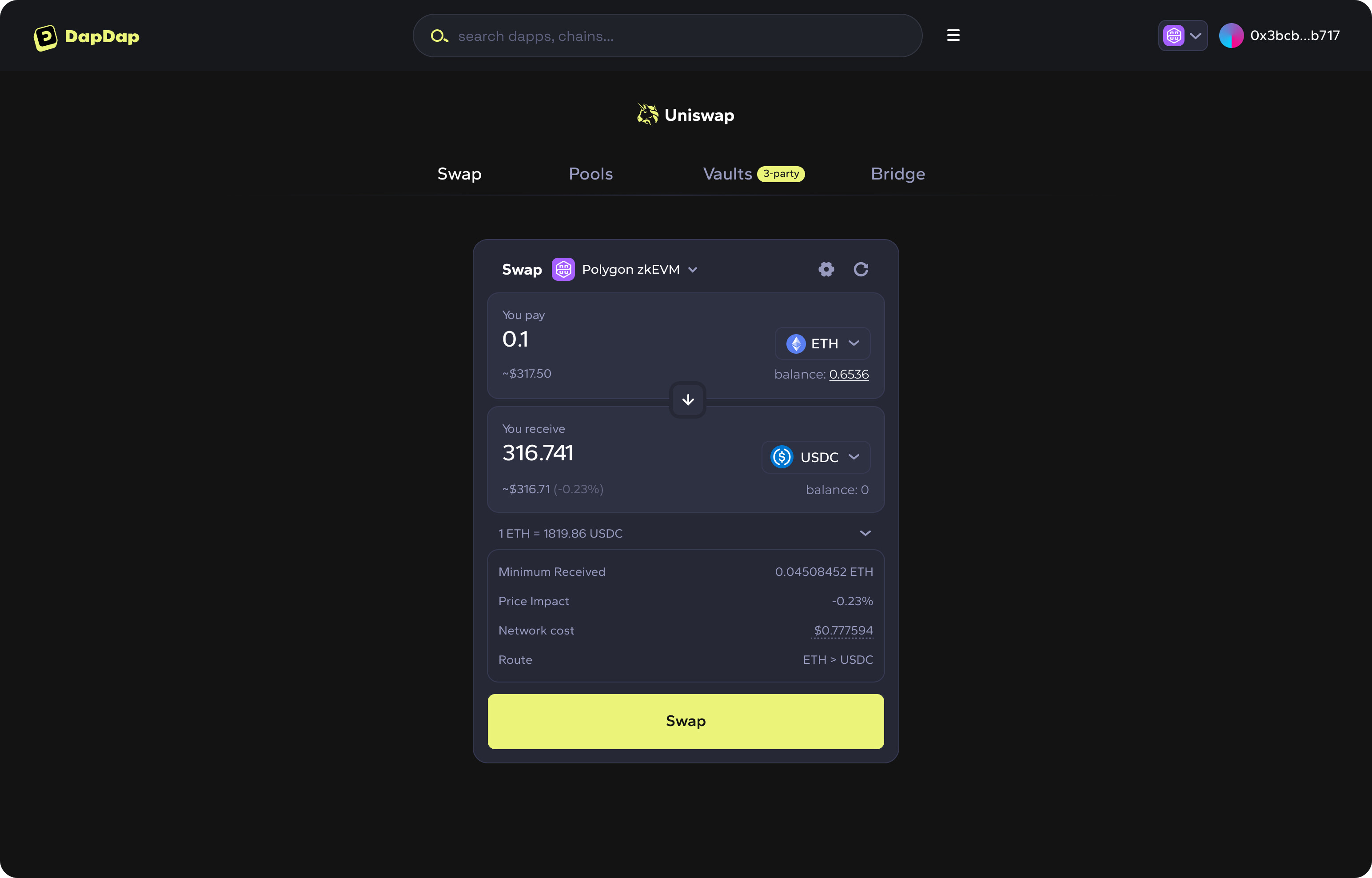

- Lending and borrowing: Platforms like Aave and Compound now accept PAXG as collateral, enabling users to borrow stablecoins against their holdings without selling their exposure to gold (source). This capital efficiency is especially attractive during periods of macroeconomic uncertainty.

- Yield generation: Through yield farming strategies involving tokenized gold pairs or staking programs offered by emerging protocols like Kinza Finance and AlphaLend, holders can transform a traditionally static asset into an income-generating tool.

The Advantages Driving Adoption – And Remaining Hurdles

The appeal of tokenized gold DeFi lies not just in technological novelty but also in tangible benefits:

Key Advantages of Tokenized Gold Investments

-

Fractional Ownership: Tokenized gold allows investors to buy small fractions of physical gold, making gold investment accessible to a wider audience without the need to purchase whole bars or coins.

-

Instant Liquidity and 24/7 Trading: Unlike traditional gold, tokenized gold can be traded on global crypto exchanges at any time, providing immediate liquidity and flexibility for investors.

-

Integration with DeFi Platforms: Holders can use tokenized gold as collateral for loans, participate in liquidity pools, or earn yield through DeFi protocols such as Aave, Compound, and Curve Finance.

-

Cost Efficiency: Digital gold tokens reduce overhead costs associated with physical gold, such as storage, insurance, and transportation, resulting in more cost-effective investment.

-

Global Accessibility: Blockchain-based gold tokens enable seamless, cross-border transactions without the need for intermediaries, democratizing access to gold investments worldwide.

– Fractional ownership lowers barriers for retail investors.

– Digital transactions reduce costs associated with storage and insurance.

– Blockchain enables borderless access without intermediaries.

Yet, while these advances are reshaping access to gold, they do not come without challenges. Regulatory uncertainty is a persistent concern, as rules for tokenized assets continue to evolve across jurisdictions. This creates a moving target for both issuers and investors, impacting everything from KYC requirements to the legal enforceability of token redemption (source).

Custodial risk is another factor that cannot be overlooked. Tokenized gold relies on trusted custodians to safeguard the underlying bullion. While leading platforms like Paxos and Tether publish regular audit reports and allow users to verify bar serial numbers, the possibility of mismanagement or insolvency remains a structural risk in any system where physical assets back digital claims (source).

The market is also becoming increasingly competitive. With new entrants like Matrixdock’s XAUm targeting DeFi-native users and established players innovating around transparency and interoperability, investors must carefully evaluate each product’s regulatory status, technical integrations, and track record before committing capital (source). This competition ultimately benefits end users by driving up standards for security and utility.

Transparency, Liquidity, and the Future of Blockchain Gold Trading

The promise of tokenized gold transparency stands out in this new asset class. Platforms provide real-time proof-of-reserves dashboards, on-chain tracking of token movements, and even public tools to verify the specific gold bars backing each token. This level of auditability surpasses what is typically available with traditional gold certificates or ETFs.

Tokenized gold liquidity is also improving rapidly as more DeFi protocols support PAXG, XAUT, and XAUm across major blockchains. The ability to instantly swap between gold-backed crypto tokens and stablecoins on decentralized exchanges gives investors flexibility that was previously unimaginable in physical precious metals markets.

Top DeFi Use Cases for Tokenized Gold

-

Lending and Borrowing: Platforms like Aave, Compound, and Curve Finance allow users to use tokenized gold (such as PAX Gold (PAXG) and Tether Gold (XAUT)) as collateral to borrow stablecoins or other crypto assets, increasing capital efficiency without liquidating gold holdings.

-

Liquidity Provision on DEXs: Tokenized gold can be supplied to liquidity pools on decentralized exchanges like Uniswap (e.g., PAXG/USDC pool), enabling users to earn trading fees and passive income while providing gold-backed liquidity to the market.

-

Yield Generation and Farming: By participating in DeFi protocols, holders of tokenized gold can engage in yield farming and staking strategies, transforming gold from a passive store of value into an income-generating asset. Platforms like Matrixdock and Momentum support such opportunities for assets like XAUm.

-

Fractional Ownership and Accessibility: Tokenized gold enables investors to purchase and hold small fractions of gold, lowering barriers to entry and making gold investment accessible globally through platforms such as Paxos Gold and Tether Gold.

-

Cross-Border Transfers and Payments: Blockchain-based tokenized gold facilitates fast, low-cost, and borderless transfers, allowing users to move gold-backed value internationally without intermediaries, leveraging the global reach of networks like Ethereum and Tron.

This dynamic environment means that blockchain gold trading is no longer just about speculation or passive holding. It’s about leveraging programmable money for hedging strategies, yield generation, cross-border settlement, and even micro-investments in fractional ounces, opening doors for both retail savers and institutional allocators.

What’s Next for Tokenized Commodities Platforms?

The next phase will likely see further integration between tokenized commodities platforms, traditional financial institutions, and emerging Web3 infrastructure. As regulatory clarity improves and custodial standards evolve, we can expect increased adoption by asset managers seeking uncorrelated returns or inflation hedges through blockchain-native vehicles.

The ongoing convergence of physical assets with digital finance isn’t just a trend, it’s a structural transformation that could redefine how value moves across borders for decades to come. For investors willing to navigate the risks alongside the rewards, tokenized gold offers an unprecedented blend of trust-minimized ownership, utility within DeFi ecosystems, and exposure to one of history’s most enduring safe havens.