Tokenized Silver: Market Trends, Use Cases, and Future Outlook

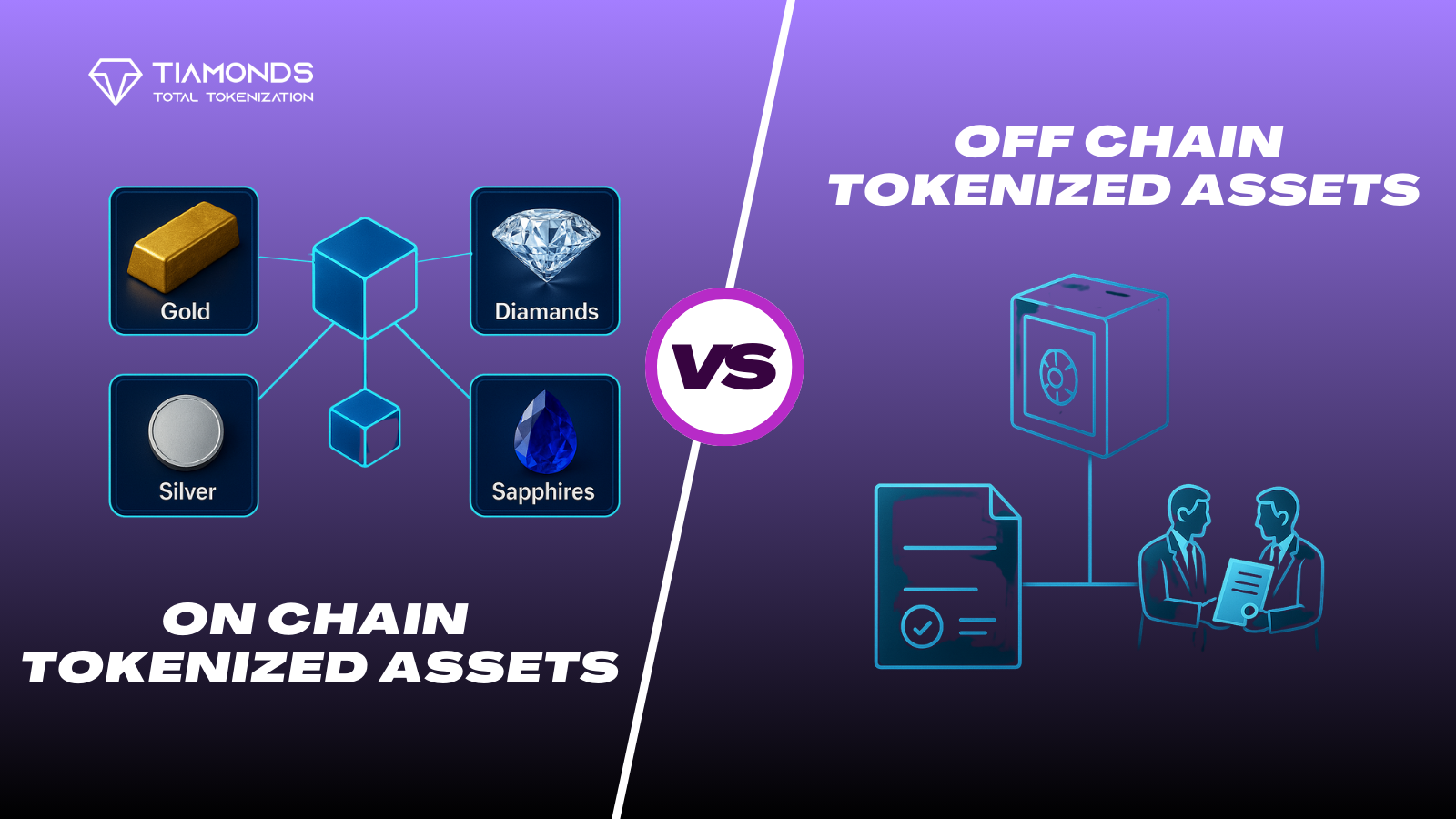

Tokenized silver is rapidly redefining how investors access and interact with the precious metals market. By leveraging blockchain technology, tokenized silver transforms physical bullion into digital assets, each token representing a specific amount of silver stored in secure vaults. This innovation enables fractional ownership, seamless 24/7 trading, and unparalleled transparency for both retail and institutional investors. As of September 2025, the iShares Silver Trust (SLV) trades at $38.20, reflecting growing investor interest in silver as both an industrial and investment asset.

Silver-Backed Tokens: Market Momentum in 2025

The tokenized silver market has witnessed robust expansion this year, reaching an estimated capitalization of $200 million. While gold-backed tokens still dominate the sector with a market cap of $2.57 billion, silver’s growing presence signals a broadening appetite for digital commodities among global investors (coinlaw.io). The surge is fueled by several factors:

- Accessibility: Tokenization allows fractional ownership, lowering entry barriers for smaller investors who previously could not afford whole bars or coins.

- Liquidity: Silver-backed tokens can be traded around the clock on digital exchanges, offering a level of liquidity that traditional bullion markets struggle to match.

- Transparency: Blockchain records every transaction immutably, ensuring traceability from mine to marketplace. This is particularly significant given rising concerns about ethical sourcing and sustainability (metex.exchange).

“Tokenized commodities are shattering traditional ownership models by making physical assets accessible to anyone with an internet connection. “

Diverse Use Cases Driving Adoption

The appeal of silver-backed tokens extends beyond mere investment. Key use cases are emerging that position tokenized silver as a versatile asset within the broader digital economy:

Key Use Cases for Tokenized Silver

-

Fractional Investing: Tokenized silver enables investors to purchase fractions of physical silver, lowering the entry barrier and making silver accessible to a broader audience. This democratizes silver investment beyond traditional large-scale buyers.

-

DeFi Collateral: Silver-backed tokens can be used as collateral on established decentralized finance (DeFi) platforms, allowing users to secure loans or participate in yield-generating strategies while maintaining exposure to silver prices.

-

Supply Chain Transparency: Blockchain-based silver tokens provide end-to-end traceability, ensuring ethical sourcing and authenticity from mine to market. This transparency supports compliance and responsible investing.

-

Enhanced Liquidity: Tokenized silver can be traded 24/7 on digital asset exchanges, offering greater liquidity and flexibility compared to traditional silver markets.

-

Global Accessibility: Digital silver tokens can be bought and sold by investors worldwide, bypassing geographic and regulatory barriers often associated with physical silver trading.

1. Fractional Ownership: Investors can now own fractions of a troy ounce rather than purchasing entire bars or coins. This democratizes access and enables tailored portfolio construction (metex.exchange).

2. Enhanced Liquidity: Unlike traditional markets that operate within limited hours, digital platforms facilitate 24/7 trading of tokenized silver, ensuring investors can react instantly to market developments.

3. Supply Chain Transparency: Blockchain’s immutable ledger provides end-to-end verification of each token’s backing metal source, addressing regulatory scrutiny and ESG mandates.

4. DeFi Collateralization: As decentralized finance matures, silver-backed tokens are increasingly accepted as collateral for loans or yield-generating strategies (tradersunion.com). This flexibility unlocks new avenues for capital efficiency without liquidating core holdings.

The Current Price Landscape: SLV at $38.20 Sets the Tone

The market price of $38.20 per share for SLV, with a modest daily gain of and $0.21 ( and 0.5530%), anchors sentiment across both traditional and tokenized silver markets. This price stability underlines investor confidence amid macroeconomic uncertainty and persistent inflationary pressures worldwide.

iShares Silver Trust (SLV) Price Prediction 2026–2031

Forecast based on current market trends, tokenization growth, and silver fundamentals as of September 2025

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $34.50 | $39.80 | $45.00 | +4.2% | Potential consolidation after 2025 rally; tokenized silver demand stabilizes |

| 2027 | $36.20 | $41.90 | $48.30 | +5.3% | Industrial use and DeFi collateralization drive steady gains |

| 2028 | $37.50 | $44.30 | $52.00 | +5.7% | Broader institutional adoption of tokenized commodities |

| 2029 | $39.00 | $46.70 | $56.00 | +5.4% | Global DeFi integration, improved supply chain transparency |

| 2030 | $41.00 | $49.30 | $60.50 | +5.6% | Regulatory clarity and ESG investment boost inflows |

| 2031 | $42.80 | $52.10 | $65.00 | +5.7% | Tokenized assets mainstream, silver use in tech/green energy expands |

Price Prediction Summary

The SLV price outlook remains broadly positive through 2031, with average prices expected to rise steadily as tokenization, industrial demand, and digital asset adoption grow. While volatility is likely—especially due to regulatory and macroeconomic shifts—the long-term trend is supported by silver’s dual role as an industrial and investment metal, and by innovations in blockchain-based ownership.

Key Factors Affecting iShares Silver Trust Stock Price

- Growth of tokenized silver and broader real-world asset tokenization.

- Industrial demand for silver (electronics, solar, medical).

- Use of silver-backed tokens as DeFi collateral.

- Global economic growth and inflation trends.

- Regulatory developments for digital assets and commodities.

- Institutional adoption of digital commodities and blockchain.

- Technological advances in trading and supply chain transparency.

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

This convergence between physical spot prices and their digital representations is fostering greater trust in tokenized commodities overall, a development closely watched by institutional allocators seeking both liquidity and real-world asset exposure.

Regulatory clarity remains a pivotal theme as the tokenized silver market matures. Jurisdictions like the UAE, Singapore, and select EU states are proactively shaping frameworks that balance investor protection with technological innovation. However, regulatory fragmentation persists globally, posing challenges for platforms seeking cross-border scale. The ongoing evolution of legal standards is expected to catalyze broader institutional adoption and more robust secondary market activity as compliance barriers ease (hootlegal.com).

Technological advancements are also accelerating the integration of silver-backed tokens into mainstream finance. Improved custody solutions, real-time auditing protocols, and user-friendly interfaces have all contributed to growing trust in digital commodities. As a result, silver tokens are increasingly used in innovative financial products, ranging from automated portfolio management tools to on-chain lending markets. The ability to transfer ownership instantly and fractionally has even sparked interest among corporate treasuries seeking alternative stores of value.

Challenges and Headwinds

Despite its promise, the tokenized silver ecosystem faces several hurdles. Market liquidity for some tokens remains thin compared to their gold counterparts, partly due to lower initial capital inflows and fewer exchange listings. Furthermore, interoperability between blockchains and legacy financial systems is still a work in progress, limiting seamless movement between digital and traditional asset classes.

Another key consideration is custodial risk. Investors must scrutinize how issuers store physical silver and ensure that each token is genuinely redeemable for its underlying asset. Transparent third-party audits are essential for maintaining confidence, especially as new entrants join the space.

Strategic Outlook: What’s Next for Tokenized Silver?

The future trajectory of tokenized commodities trends, particularly for silver-backed tokens, hinges on continued innovation across three fronts: regulatory harmonization, market infrastructure upgrades, and education initiatives targeting both retail and institutional audiences. As these pillars strengthen, analysts expect the market capitalization of tokenized silver to grow well beyond its current $200 million threshold, potentially mirroring gold’s digital ascent.

For investors tracking price action, $38.20 per share for SLV serves as both a psychological anchor and a benchmark for evaluating digital alternatives. As macroeconomic volatility persists into late 2025, driven by shifting interest rates and industrial demand, silver’s dual role as an investment hedge and industrial input could further amplify demand for its tokenized form.

Strategic Factors for Evaluating Tokenized Silver

-

Regulatory Compliance and Jurisdiction: Ensure the tokenized silver platform operates under clear regulatory frameworks (e.g., US, EU, Singapore, UAE) and provides investor protections. Regulatory clarity affects legal recourse and asset security.

-

Physical Silver Custody and Auditing: Verify that each token is truly backed by physical silver, with independent audits and secure storage (e.g., Brinks, Loomis). Transparency in custody reduces counterparty and fraud risk.

-

Platform Reputation and Track Record: Choose established platforms with a proven history, such as Tether Gold (XAUT) for gold and Kinesis Silver (KAG) for silver. Reputation signals reliability and operational resilience.

-

Transparency and On-Chain Verification: Confirm that token issuance, transfers, and backing reserves are transparent and verifiable on public blockchains (e.g., Ethereum, Stellar). On-chain data enhances trust and reduces information asymmetry.

-

Fee Structure and Cost Efficiency: Compare minting, redemption, storage, and trading fees across platforms. Lower costs improve net returns, but beware of hidden charges.

Ultimately, the convergence of blockchain technology with real-world assets like silver signals a paradigm shift in how value is stored, transferred, and utilized across global markets. By anticipating regulatory shifts and adapting to emerging infrastructure standards now, forward-thinking investors can position themselves at the forefront of this evolving landscape, achieving exposure not only to precious metals but also to the next era of digital finance.