How Tokenized Gold Works: On-Chain Yield, Security, and 24/7 Access Explained

Tokenized gold is rapidly redefining the landscape of digital asset investing, merging the timeless value of physical gold with the flexibility and transparency of blockchain technology. As of today, PAX Gold (PAXG) is trading at $4,000.03, offering investors digital tokens that represent direct ownership of physical gold stored in secure, insured vaults. This approach not only makes gold more accessible but also introduces powerful new features such as on-chain yield, enhanced security, and 24/7 liquidity that traditional gold markets simply can’t match.

How Tokenized Gold Works: Digital Ownership, Real-World Backing

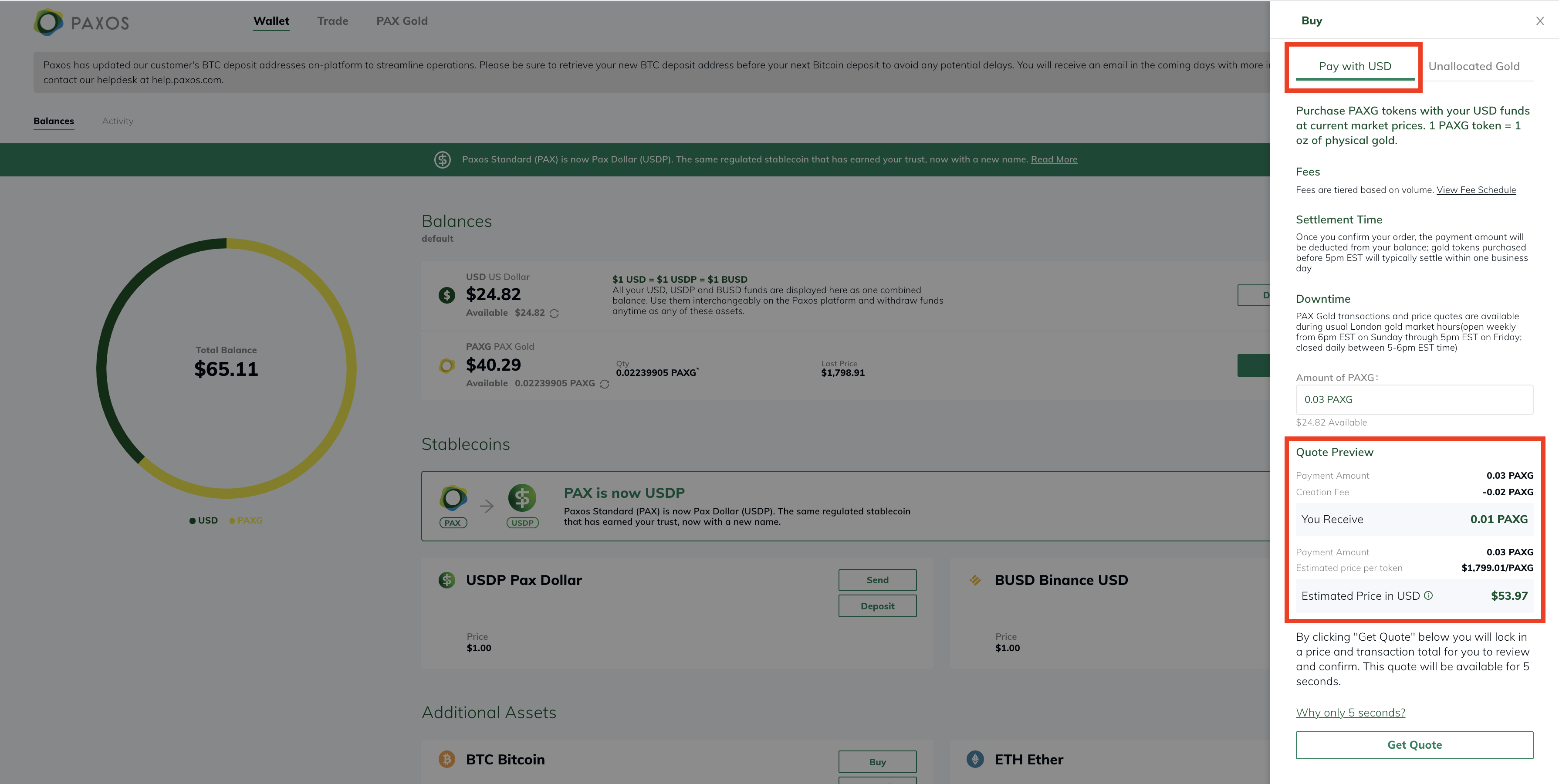

At its core, tokenized gold involves converting physical gold into digital tokens on a blockchain. Each token typically represents a precise amount of gold – for example, one PAXG token equals one fine troy ounce of gold held in a professional vault. The key innovation lies in blockchain’s ability to record, transfer, and verify ownership instantly, eliminating the friction and cost of physical delivery or paper-based certificates.

Unlike traditional gold investments, where minimum purchase sizes and storage logistics can be barriers, fractional gold ownership becomes straightforward with tokenization. Investors can buy, sell, or transfer even small fractions of a gold bar, democratizing access to this centuries-old store of value.

On-Chain Yield: Earning While Holding Gold

One of the most compelling advantages of gold-backed tokens is the emergence of on-chain yield opportunities. In the decentralized finance (DeFi) ecosystem, holders of tokenized gold can put their assets to work in a variety of ways:

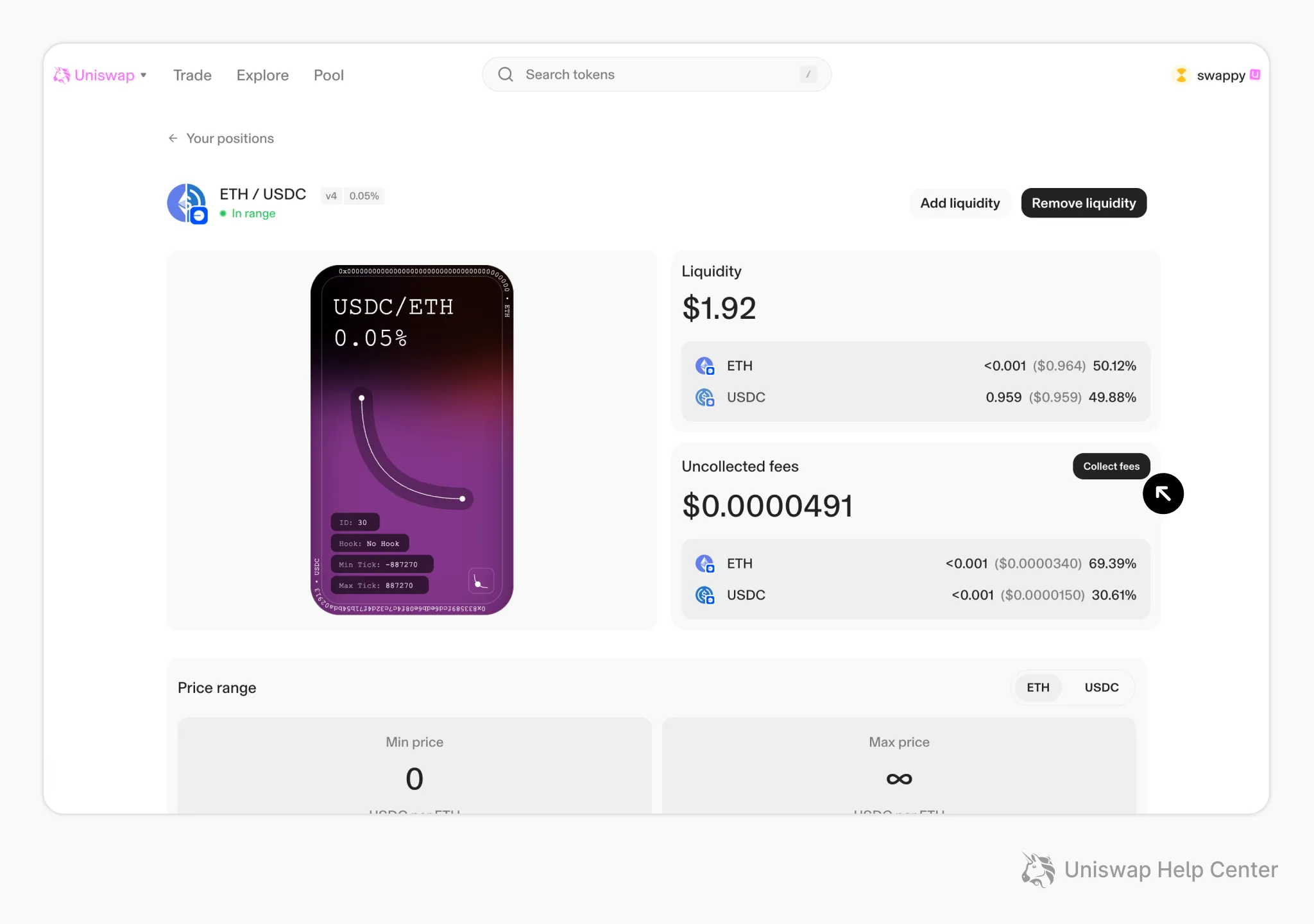

- Liquidity provision: By supplying PAXG to pools like Uniswap’s PAXG/USDC, investors earn a share of trading fees while maintaining exposure to gold’s price movements.

- Staking and lending: Platforms such as Alchemy enable users to stake their tokenized gold, earning stable yields through mechanisms like cross-market arbitrage and asset lending.

This dynamic stands in stark contrast to physical gold, which traditionally offers no yield unless leased to a third party. With tokenized gold, yield generation becomes a native feature of the asset class, aligning with the broader trend of making all assets more productive in the digital age. For a deeper dive into these opportunities, see the analysis at TokenInsight.

Blockchain Gold Security: Vaults, Audits, and Proof of Reserves

Security is non-negotiable when it comes to digital gold investing. Leading issuers of gold-backed tokens adhere to strict protocols to ensure every token is fully backed by real, physical gold. For example, RBC Group stores its gold in certified vaults in the UAE and UK, with full insurance and on-demand verification for investors. Regular third-party audits and on-chain proof of reserves further bolster trust, allowing anyone to independently verify that each token corresponds to a specific quantity of gold in secure storage.

This transparency is a game-changer. Investors no longer have to rely solely on issuer promises; they can consult public audit reports or check blockchain records in real-time. For a technical breakdown of how reserve transparency is advancing in this space, see this research report.

Security is not just about storage, but also about regulatory compliance and risk management. Leading tokenized gold platforms operate in regulated jurisdictions, ensuring that both the physical and digital aspects of the asset are protected under robust legal frameworks. This multi-layered approach makes tokenized gold a compelling alternative for risk-conscious investors seeking exposure to gold without the logistical headaches of physical delivery.

Stay tuned for the next section, where we’ll explore how tokenized gold’s 24/7 access and liquidity are reshaping global gold markets, and how investors can take advantage of these features to optimize their portfolios.

PAX Gold (PAXG) Price Prediction 2026-2031

Forecasts based on current $4,000.03 price, tokenized gold adoption, and market trends

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,800.00 | $4,150.00 | $4,500.00 | +3.7% | Range-bound with gold market, DeFi yield grows |

| 2027 | $3,900.00 | $4,350.00 | $4,900.00 | +4.8% | Broader adoption of tokenized gold, moderate gold appreciation |

| 2028 | $4,100.00 | $4,600.00 | $5,300.00 | +5.7% | Bullish gold cycle, integration in more DeFi protocols |

| 2029 | $4,250.00 | $4,850.00 | $5,750.00 | +5.4% | Regulatory clarity, increased institutional demand |

| 2030 | $4,400.00 | $5,100.00 | $6,200.00 | +5.2% | Tokenized assets mainstream, gold as digital collateral |

| 2031 | $4,600.00 | $5,350.00 | $6,700.00 | +4.9% | Continued gold token growth, possible new competition |

Price Prediction Summary

PAX Gold (PAXG) is projected to steadily appreciate in line with both physical gold prices and the growing adoption of tokenized assets. The minimum price scenario reflects stable gold markets and cautious adoption, while the maximum scenario factors in bullish gold cycles, mainstream DeFi integration, and robust institutional demand. As tokenized gold becomes a global standard for digital gold ownership and on-chain yield, PAXG’s price is expected to outperform traditional gold in periods of high crypto adoption and innovation.

Key Factors Affecting PAX Gold Price

- Physical gold price trends (macroeconomics, inflation, geopolitics)

- Adoption of tokenized gold in DeFi and global markets

- Regulatory developments governing tokenized assets

- Security and transparency of gold reserves (audits, proof-of-reserves)

- Competition from other tokenized commodities or stablecoins

- Technological improvements in blockchain infrastructure

- Institutional and retail investor demand for digital gold alternatives

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

24/7 Access and Liquidity: Gold Markets Without Borders or Clocks

Tokenized gold fundamentally changes how and when investors can access gold markets. Unlike traditional exchanges that close on weekends or during holidays, blockchain platforms operate around the clock. This means you can buy, sell, or transfer PAX Gold (PAXG) at $4,000.03 any time of day, wherever you are in the world. For active traders and institutions, this flexibility is a game-changer, enabling real-time portfolio adjustments in response to macroeconomic events, geopolitical shocks, or sudden shifts in market sentiment.

Liquidity is another major advantage. Tokenized gold is traded on a growing number of decentralized and centralized platforms, ensuring tight spreads and rapid execution. This stands in sharp contrast to the illiquidity and delays often encountered in the physical gold market, especially for smaller investors or those seeking fractional exposure. Blockchain’s transparent settlement rails mean trades clear instantly, with no need for intermediaries or slow-moving paperwork.

Key Advantages of Tokenized Gold Over Traditional Gold

-

Robust Security and Transparency: Leading issuers such as RBC Group store physical gold in certified, insured vaults and provide on-chain proof of reserves, with regular third-party audits ensuring each token is fully backed by real gold.

-

24/7 Global Access and Liquidity: Tokenized gold like PAX Gold (PAXG) can be traded anytime on major exchanges and DeFi platforms, offering continuous liquidity and enabling investors to respond instantly to market movements—unlike traditional gold markets with restricted hours.

-

Fractional Ownership and Lower Barriers: Tokenized gold enables fractional purchases, so investors can own any amount, even less than one gram, making gold investment accessible without the need for large capital outlays or dealing with physical delivery.

-

Reduced Storage and Transaction Costs: With blockchain-based tokens, investors avoid the high costs and logistics of storing, transporting, or insuring physical gold, as these are managed by professional custodians and reflected in the token’s value.

Optimizing Portfolios With Digital Gold

For both individual and institutional investors, the ability to seamlessly integrate gold-backed tokens into a broader digital asset portfolio unlocks new diversification strategies. You can rebalance between crypto assets, stablecoins, and tokenized gold in a single wallet interface – all without leaving the blockchain ecosystem. The result is a more agile approach to risk management and capital deployment.

Fractional gold ownership also means that even modest portfolios can benefit from gold’s historical role as a hedge against inflation and financial instability. Whether you’re allocating $100 or $1 million, tokenized gold lets you fine-tune your exposure with surgical precision.

The regulatory landscape continues to evolve, but top-tier issuers are already setting high standards for compliance, insurance, and transparency. As adoption grows, expect further innovation around yield generation, collateralization, and cross-chain interoperability – all while retaining the core promise: each token remains fully backed by audited, securely stored physical gold.

Looking Ahead: The Future of Gold-Backed Tokens

The convergence of blockchain technology and precious metals is still in its early innings, but momentum is building. As of today’s market snapshot, PAXG is holding steady at $4,000.03, reflecting both gold’s enduring appeal and the growing trust in tokenized models. The next wave of development will likely see deeper integration with DeFi protocols, more sophisticated risk management tools, and broader institutional participation.

For forward-thinking investors, digital gold investing is no longer a theoretical concept – it’s a practical reality. Whether you’re seeking on-chain yield, global liquidity, or simply a more secure way to hold gold, tokenization offers a compelling alternative to legacy systems. The key is to choose reputable issuers, understand the mechanics of on-chain security, and stay informed as the regulatory framework matures.

As always, volatility is a tool, not a threat. Tokenized gold gives you more ways than ever to use that tool strategically – whether you’re hedging against uncertainty or capitalizing on new opportunities in the evolving digital commodity landscape.