How Tokenized Gold Is Changing DeFi: Yield, Collateral, and Real-World Asset Integration

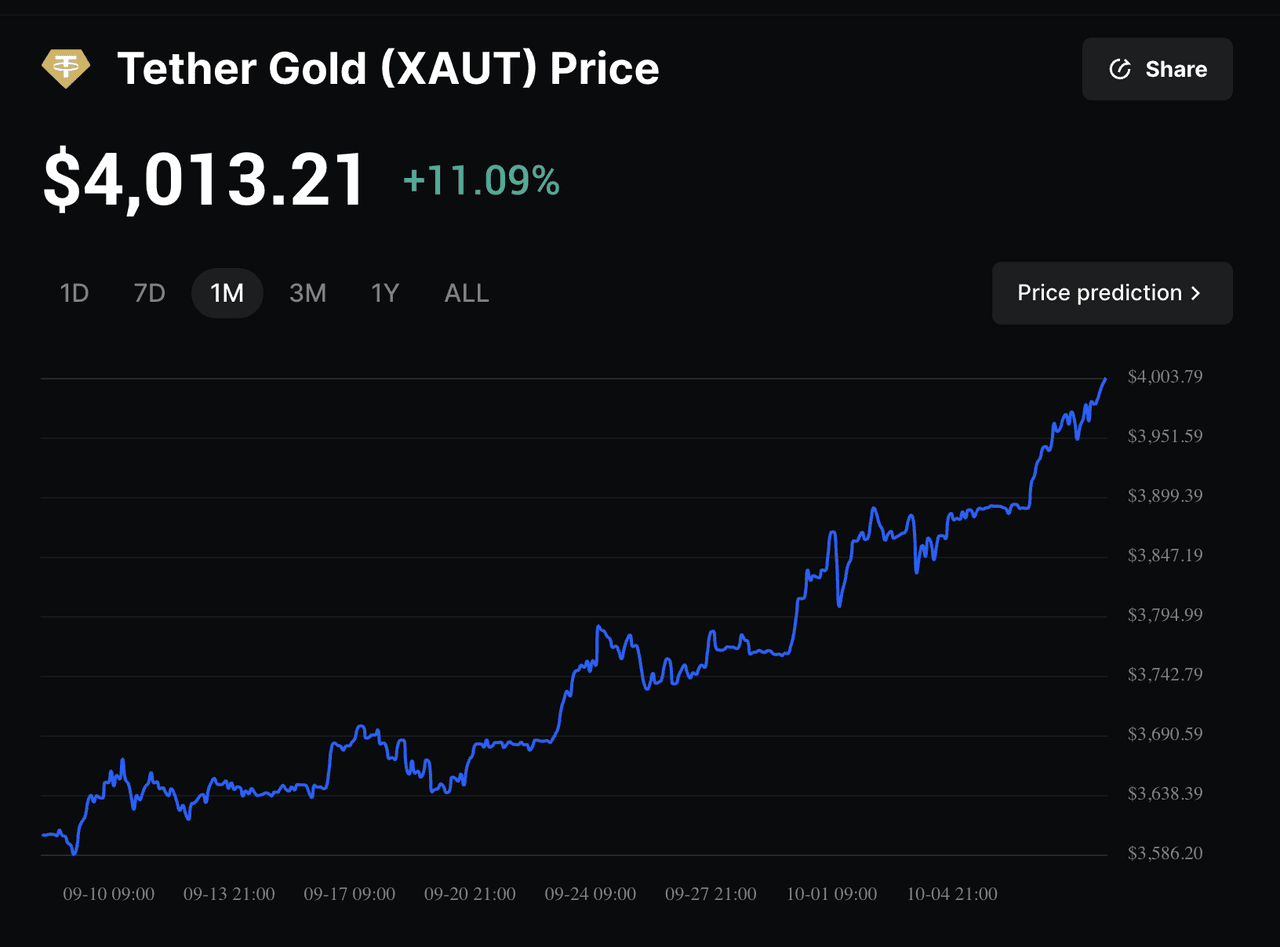

Tokenized gold is rapidly reshaping the decentralized finance (DeFi) ecosystem, unlocking new utility for one of humanity’s oldest stores of value. By representing physical gold on the blockchain as digital tokens, investors can now access yield opportunities, use gold-backed crypto as DeFi collateral, and participate in the broader movement of real world asset tokens. This convergence of tradition and technology is not just theoretical – it’s unfolding in real time, with leading gold tokens like PAX Gold (PAXG) trading at $3,974.60 and Tether Gold (XAUT) at $3,959.88 as of October 10,2025.

Tokenized Gold: From Physical Vaults to Blockchain Utility

The core innovation behind tokenized gold is simple yet profound: each digital token is backed 1: 1 by physical gold stored in secure vaults. This mechanism anchors the digital asset’s value in the real world, while providing all the advantages of blockchain-based assets: instant transferability, programmable utility, and composability within DeFi protocols.

Unlike traditional gold ETFs or certificates, tokenized gold can be deployed across decentralized platforms. Whether it’s PAXG, XAUT, or XAUm, these tokens are interoperable and can be integrated into smart contracts, lending pools, and automated market makers. This transforms gold from a passive, non-yielding asset into an active component of the digital economy.

Yield Generation: Earning on Digital Gold Holdings

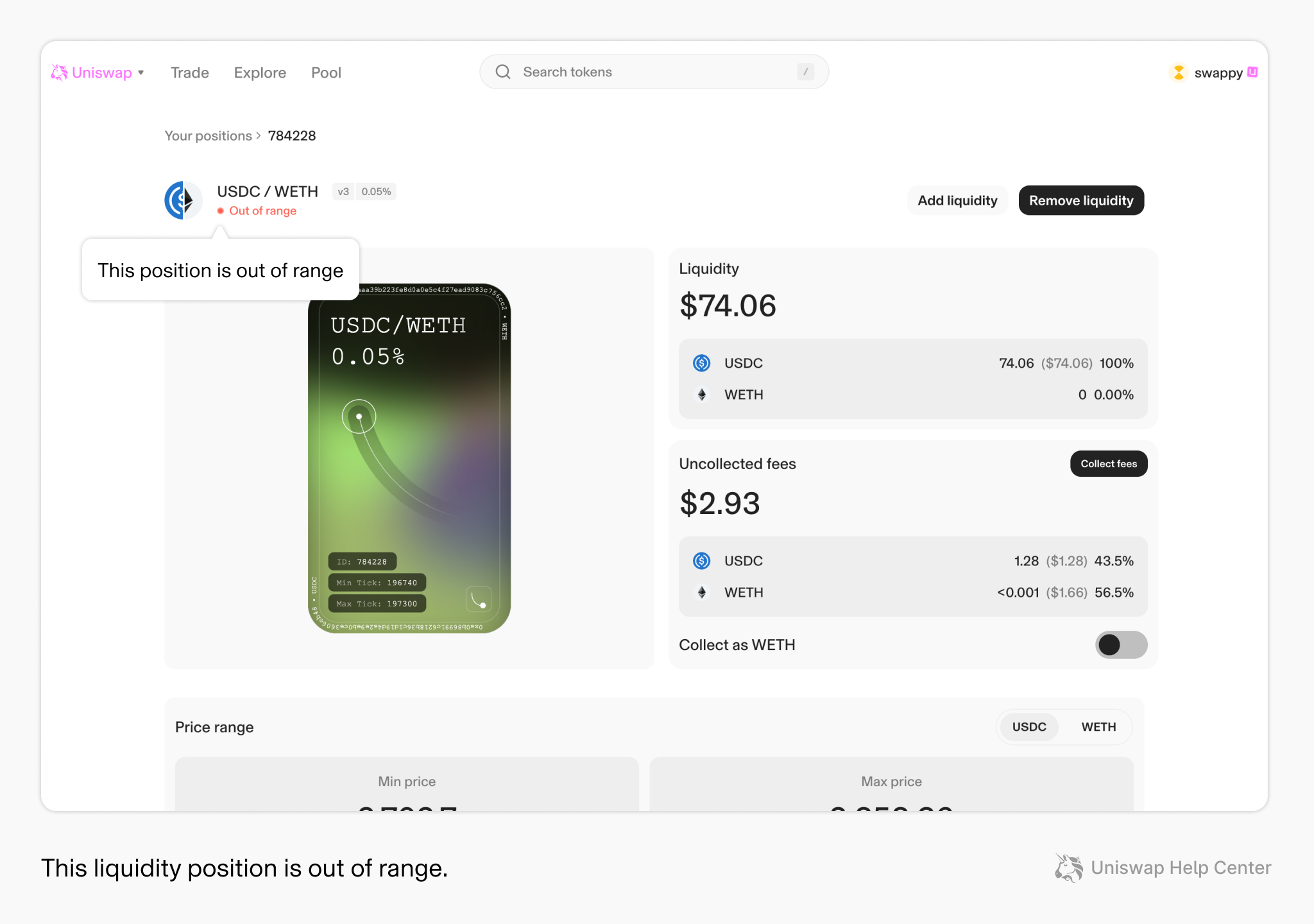

Perhaps the most compelling shift is the ability to generate yield on digital gold. DeFi platforms now allow users to provide gold-backed tokens as liquidity in pools such as PAXG/USDC on Uniswap, earning trading fees and, in some cases, additional incentives. This is a stark contrast to the legacy model, where gold sat idle in vaults, generating no income.

For example, as noted by TokenInsight, investors can deploy tokenized gold in DeFi strategies to capture passive returns without relinquishing exposure to gold’s price movements. The emergence of these yield opportunities is attracting both crypto-native users and traditional investors seeking alternatives to low-yield environments.

PAX Gold Technical Analysis Chart

Analysis by Sophie Delaney | Symbol: BINANCE:PAXGUSDT | Interval: 1h | Drawings: 6

Technical Analysis Summary

Draw an aggressive rising trend line from the start of October 5, 2025 (around $3,885) up to the local top on October 8, 2025 ($4,065). Overlay a sharp descending trend line from the top on October 8, 2025 ($4,065) down to the current level ($3,969) at October 10, 2025. Mark horizontal support at $3,968 (recent low and current price) and resistance at $4,071 (recent high). Use a rectangle to highlight the consolidation range between $3,960-$4,000 on October 9-10, 2025. Annotate a breakdown/bearish reversal event at the sharp drop from $4,040 to $3,980 on October 9, 2025. Place profit and stop-loss levels for high-risk trades just above $4,000 (profit) and below $3,960 (stop).

Risk Assessment: high

Analysis: Rapid shift from strong uptrend to sharp breakdown increases volatility and whipsaw risk. Tight stops and fast execution are crucial. The current price action is ideal for aggressive traders seeking volatility, but dangerous for passive holders.

Sophie Delaney’s Recommendation: For high-risk, short-term traders, look for scalp long opportunities above $3,960 with tight stops. Avoid holding if support fails. For most traders, wait for a clear reclaim of $4,000+ or confirmation of a bottom above $3,960.

Key Support & Resistance Levels

📈 Support Levels:

-

$3,960 – Critical local support at $3,960 (recent low, near current price). A break below here may trigger cascading stops.

strong

📉 Resistance Levels:

-

$4,071 – Major resistance at $4,071 (recent swing high). This is the level where the latest rally failed.

strong -

$4,000 – Psychological round-number and minor resistance. Likely to see profit-taking if price rebounds here.

moderate

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$3,965 – Potential high-risk long entry if $3,960 support holds and buyers step in. Fast scalp opportunity with tight stop.

high risk

🚪 Exit Zones:

-

$4,000 – Profit target on a bounce play back toward psychological resistance.

💰 profit target -

$3,955 – Stop-loss for aggressive long trades. Avoid major breakdown if $3,960 fails.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: N/A on chart, but expect volume spike during breakdown and at support test.

Would expect significant volume on the breakdown from $4,040 to $3,980. Monitor for confirmation on a reversal at $3,960.

📈 MACD Analysis:

Signal: Likely bearish momentum post-breakdown, but look for early bullish cross if price consolidates above $3,960.

Momentum is currently negative, but rapid reversals common in high-volatility gold token trades.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Sophie Delaney is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

DeFi Collateralization: Unlocking Liquidity Without Selling

Tokenized gold’s role as DeFi collateral is fundamentally changing how investors manage liquidity. Platforms like Aave’s Horizon and institutional DeFi lenders now accept gold-backed tokens as pristine collateral, enabling users to borrow stablecoins or other crypto assets against their holdings. This means investors can access liquidity without selling their gold or triggering taxable events, a significant advantage during periods of market uncertainty.

According to AltcoinDesk, tokenized real world asset tokens like PAXG are powering new lending models where gold’s stability and global recognition reduce risk for both borrowers and protocols. This innovation is driving capital efficiency and expanding the utility of gold beyond traditional finance.

Real-World Asset Integration: Bridging TradFi and DeFi

The integration of tokenized commodities into DeFi is part of the broader Real World Asset (RWA) movement. Projects such as Falcon’s RWA Engine are enabling gold and other tangible assets to be used directly in on-chain strategies, from liquidity pools to structured products. This bridges the gap between traditional finance and DeFi, offering new ways to diversify portfolios and manage risk.

As more protocols adopt RWA standards and compliance frameworks, tokenized gold stands at the forefront of this evolution. The result? A more liquid, transparent, and accessible market for gold that leverages the strengths of both physical assets and blockchain technology.

PAX Gold (PAXG) Price Prediction 2026-2031 with DeFi Integration Scenarios

Forecast based on tokenized gold adoption in DeFi, RWA integration, and evolving market conditions.

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,700 | $4,120 | $4,500 | +3.7% | DeFi adoption grows, gold remains stable; volatility contained by gold backing |

| 2027 | $3,850 | $4,300 | $4,850 | +4.4% | RWA integration deepens; more platforms accept PAXG/XAUT as collateral |

| 2028 | $4,000 | $4,530 | $5,200 | +5.3% | Macro uncertainty drives gold demand; increased tokenized gold liquidity |

| 2029 | $4,200 | $4,780 | $5,600 | +5.5% | Regulatory clarity boosts institutional use; DeFi protocols expand gold pools |

| 2030 | $4,350 | $5,050 | $6,000 | +5.6% | Tokenized gold mainstream in DeFi; enhanced yield options attract new capital |

| 2031 | $4,550 | $5,300 | $6,400 | +5.0% | Global RWA tokenization matures; gold-backed tokens key in DeFi lending |

Price Prediction Summary

PAX Gold (PAXG) is projected to see steady appreciation from 2026 to 2031, reflecting both gold market fundamentals and the expanding role of tokenized gold in DeFi. While price volatility is lower than typical cryptocurrencies due to gold backing, DeFi integration, RWA adoption, and regulatory clarity are expected to gradually increase demand and utility, resulting in moderate but consistent price growth. Bullish scenarios involve rapid DeFi and RWA adoption, while bearish cases reflect gold price corrections or regulatory headwinds.

Key Factors Affecting PAX Gold Price

- Gold price trends: PAXG closely tracks global gold market movements.

- DeFi adoption rate: More protocols using PAXG as collateral/yield asset boosts demand.

- RWA tokenization: Broader tokenization of real-world assets increases PAXG utility.

- Regulatory clarity: Supportive regulations accelerate institutional and retail use.

- Technology improvements: Better on-chain infrastructure and interoperability.

- Competition: Emergence of other gold-backed tokens (like XAUT) could affect market share.

- Macro environment: Geopolitical or economic uncertainty typically increases gold demand.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Tokenized gold’s influence is accelerating as DeFi protocols race to integrate robust, real-world collateral. This shift is visible in the rapid adoption of gold-backed crypto across lending, trading, and yield strategies. As gold tokens like PAXG and XAUT maintain their peg to physical bullion, they offer a unique blend of price stability and blockchain-native flexibility, qualities that are increasingly valued in a volatile macro environment.

Risks, Rewards, and Regulatory Frontiers

While tokenized gold unlocks new opportunities, it also introduces nuanced risks. Smart contract vulnerabilities, custody transparency, and cross-jurisdictional compliance remain active areas of scrutiny. Investors must consider the provenance of the underlying gold, where it is vaulted, who audits reserves, and how redemption mechanisms work. Platforms like PAXG and XAUT publish regular attestations and offer redemption paths for physical delivery, but due diligence is non-negotiable.

On the regulatory side, the trend toward real world asset tokens is drawing attention from policymakers. Jurisdictions are moving to clarify the legal status of tokenized commodities, with a focus on anti-money laundering (AML), know-your-customer (KYC) protocols, and investor protection. The evolving landscape means DeFi projects must balance innovation with robust compliance layers to ensure sustainable growth.

What’s Next? Scaling Tokenized Commodities in DeFi

The future of tokenized gold is intertwined with the broader trajectory of real-world asset integration. As DeFi infrastructure matures, expect to see:

Key Trends Shaping Tokenized Gold in DeFi

-

Yield Generation via DeFi Protocols: Tokenized gold assets like PAX Gold (PAXG) can be deployed in DeFi liquidity pools (e.g., Uniswap PAXG/USDC), allowing investors to earn trading fees and passive income while maintaining exposure to gold.

-

Collateralization in Lending Platforms: Gold-backed tokens are increasingly accepted as collateral on major DeFi lending protocols such as Aave. This enables users to borrow stablecoins or other crypto assets without selling their gold holdings, enhancing capital efficiency.

-

Integration of Real-World Assets (RWAs): The adoption of tokenized gold is part of the broader movement to bring real-world assets on-chain. Platforms like Falcon’s RWA Engine facilitate the use of tokenized gold in on-chain strategies, bridging traditional and decentralized finance.

-

Market Growth and Liquidity: The tokenized gold market is expanding, with leading tokens such as PAX Gold (PAXG) trading at $3,974.60 and Tether Gold (XAUT) at $3,959.88 as of October 10, 2025. This growth reflects increasing adoption and liquidity within DeFi ecosystems.

-

Enhanced Transparency and Security: Blockchain-based tokenized gold offers verifiable proof of reserves and transparent transaction histories, addressing traditional gold market concerns. Projects like PAX Gold provide on-chain auditability for physical gold backing.

Scalability is a key challenge, moving from millions to billions in tokenized commodity value will require advances in cross-chain interoperability, improved oracle solutions for real-time pricing, and more seamless on/off ramps between fiat, crypto, and physical redemption.

Additionally, as DeFi lending protocols diversify their collateral base beyond crypto-natives like ETH and stablecoins, gold-backed tokens are positioned to play a pivotal role in risk management. Their low volatility profile makes them attractive for decentralized money markets seeking to minimize systemic shocks.

“Let the data guide you. ” Tokenized gold’s real-time market data and on-chain transparency are setting new standards for asset verifiability in DeFi.

The Bottom Line: Tokenized Gold as a Catalyst for DeFi Maturity

With PAX Gold (PAXG) trading at $3,974.60 and Tether Gold (XAUT) at $3,959.88, tokenized gold is not just tracking the spot price, it’s actively shaping how value is stored, moved, and utilized in decentralized finance. The ability to generate yield on digital gold, unlock liquidity without selling, and plug physical assets into programmable protocols is fundamentally altering both investor behavior and protocol design.

As tokenized commodities DeFi continues to evolve, gold-backed crypto stands out as a bridge between legacy wealth preservation and cutting-edge financial engineering. For forward-thinking investors and builders alike, the integration of real world asset tokens like PAXG and XAUT signals a new era, where blockchain gold integration delivers both security and utility.