How Tokenized Gold Works: From Vaulted Bullion to On-Chain Yield

Imagine owning a piece of gold not as a heavy bar locked away in a vault, but as a digital token you can trade 24/7, stake for yield, or use as collateral across the DeFi universe. That’s the promise of tokenized gold: a fast-growing fusion of tangible value and blockchain innovation that’s reshaping how investors interact with one of humanity’s oldest assets.

From Vaulted Bullion to Blockchain: The Mechanics of Tokenized Gold

The concept is elegantly simple: physical gold, typically stored in high-security, insured vaults, is represented by digital tokens on a blockchain. Each token corresponds to a precise amount of real gold, often one troy ounce or one gram, held by the issuer. For instance, Tether Gold (XAUt) tokens provide undivided ownership rights to specific bars of gold, each with its own serial number and full audit trail.

This approach delivers several advantages over traditional gold investments. First, it enables fractional ownership: instead of buying an entire bar, you can own just a sliver, lowering the barrier to entry for retail investors. Second, it unlocks liquidity; these tokens can be traded instantly on global crypto exchanges and DeFi platforms without waiting for banking hours or dealing with physical delivery logistics.

As of now, PAX Gold (PAXG), one of the leading gold-backed tokens, is trading at $3,896.82, reflecting both the current spot price of gold and surging demand for on-chain commodities. The market has seen remarkable growth in recent years, with tokenized gold surpassing $1 billion in total value locked, a clear signal that investors are embracing this digital evolution.

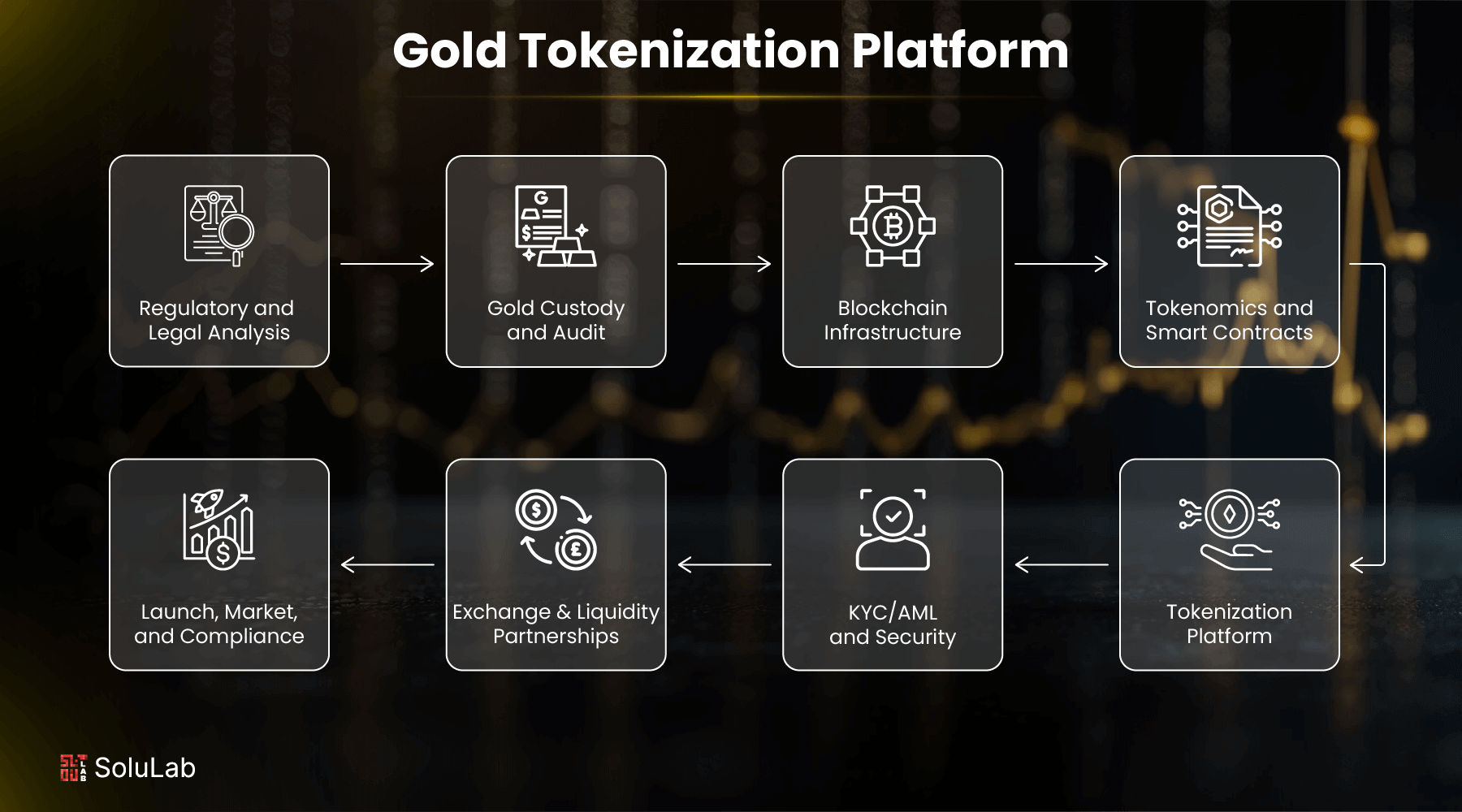

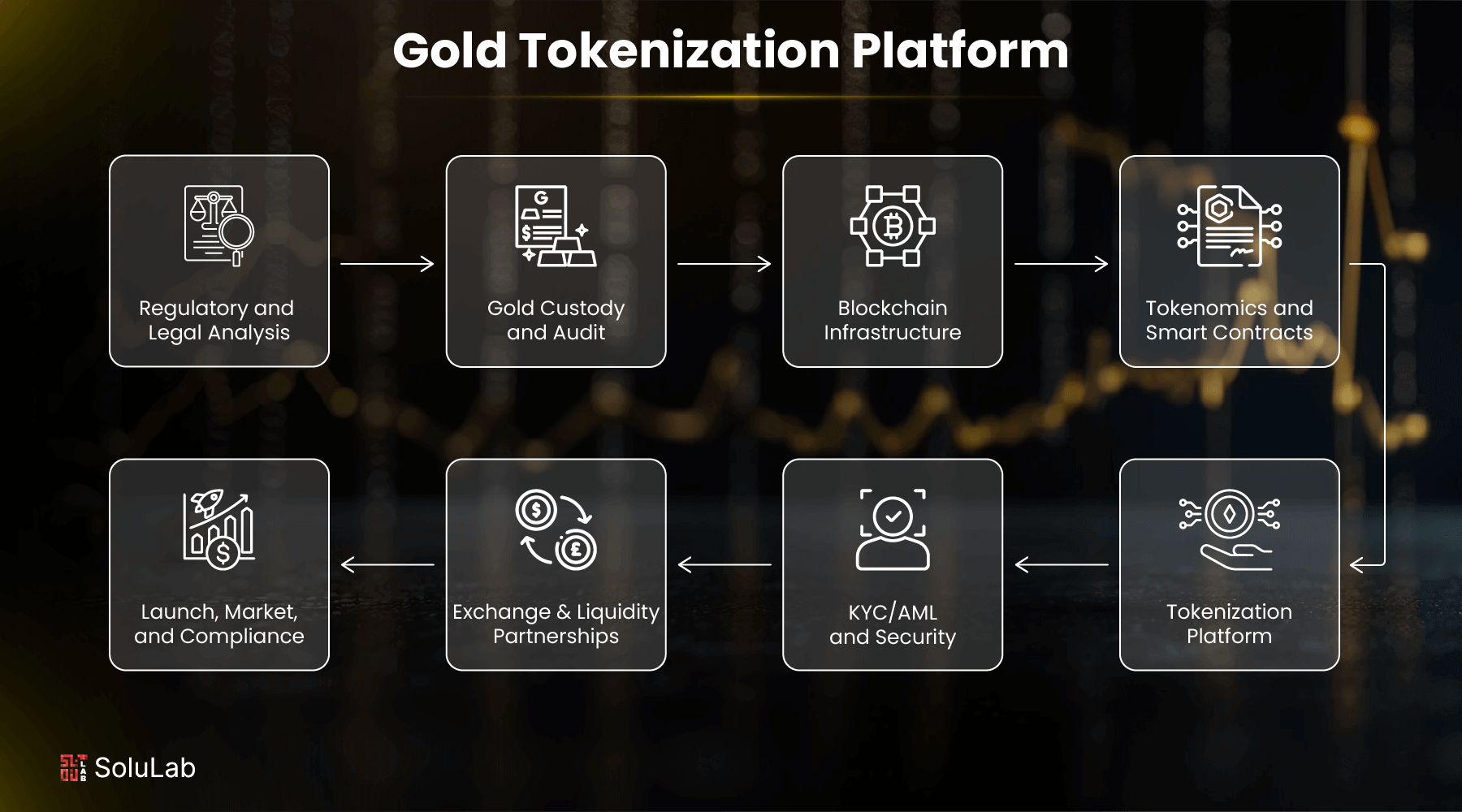

How Does Physical Gold Become an On-Chain Asset?

The journey from vaulted bullion to on-chain yield starts with trusted custodians, think Brinks or Loomis, who store the underlying metal in secure facilities. Issuers like Tether Gold (XAUt) and PAX Gold (PAXG) then create digital tokens on public blockchains such as Ethereum or Tron. Each token is backed 1: 1 by actual gold reserves; transparency is ensured through regular audits and publicly accessible records of serial numbers and bar weights.

This process isn’t just about digitizing ownership, it’s about unlocking new financial possibilities. Once minted, these gold-backed tokens can be transferred peer-to-peer globally within minutes. Holders aren’t limited to passive storage; they gain access to programmable features enabled by smart contracts.

The Rise of On-Chain Yield: Earning Income from Tokenized Gold

The most transformative aspect? Tokenized gold doesn’t have to sit idle like its physical counterpart. Thanks to integration with decentralized finance (DeFi) platforms, holders can deploy their assets in innovative ways:

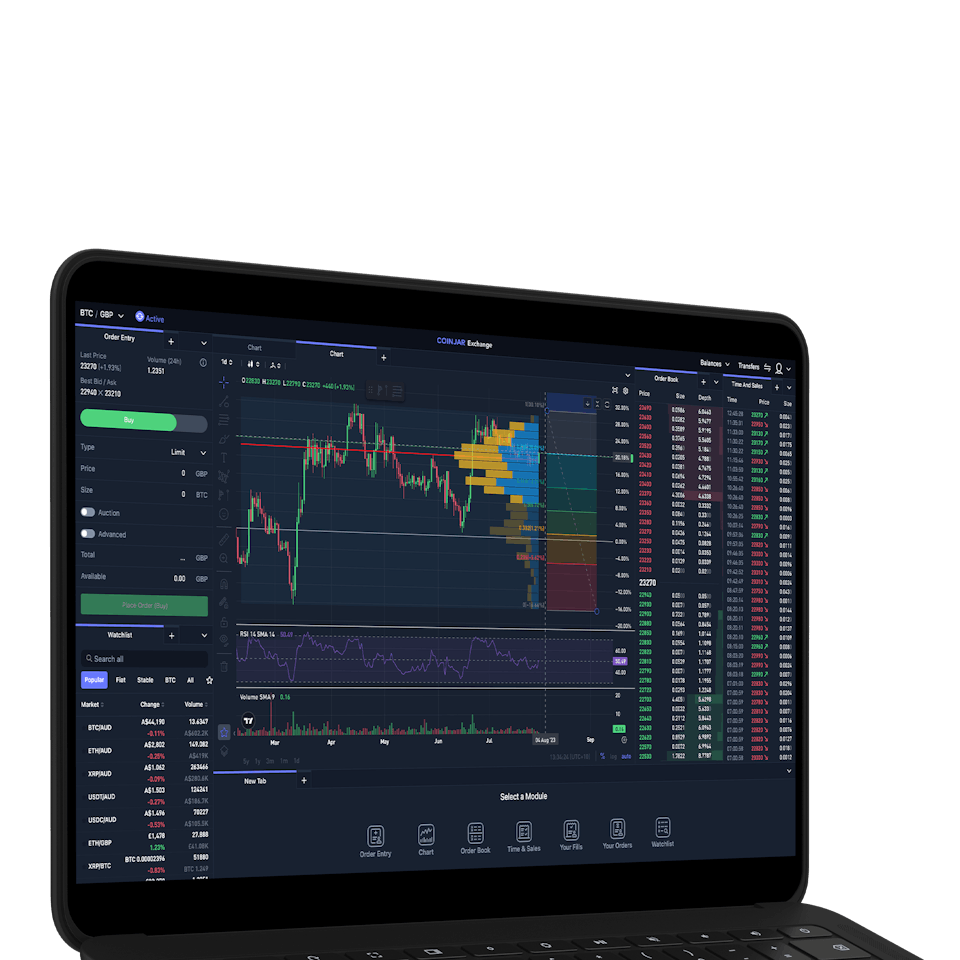

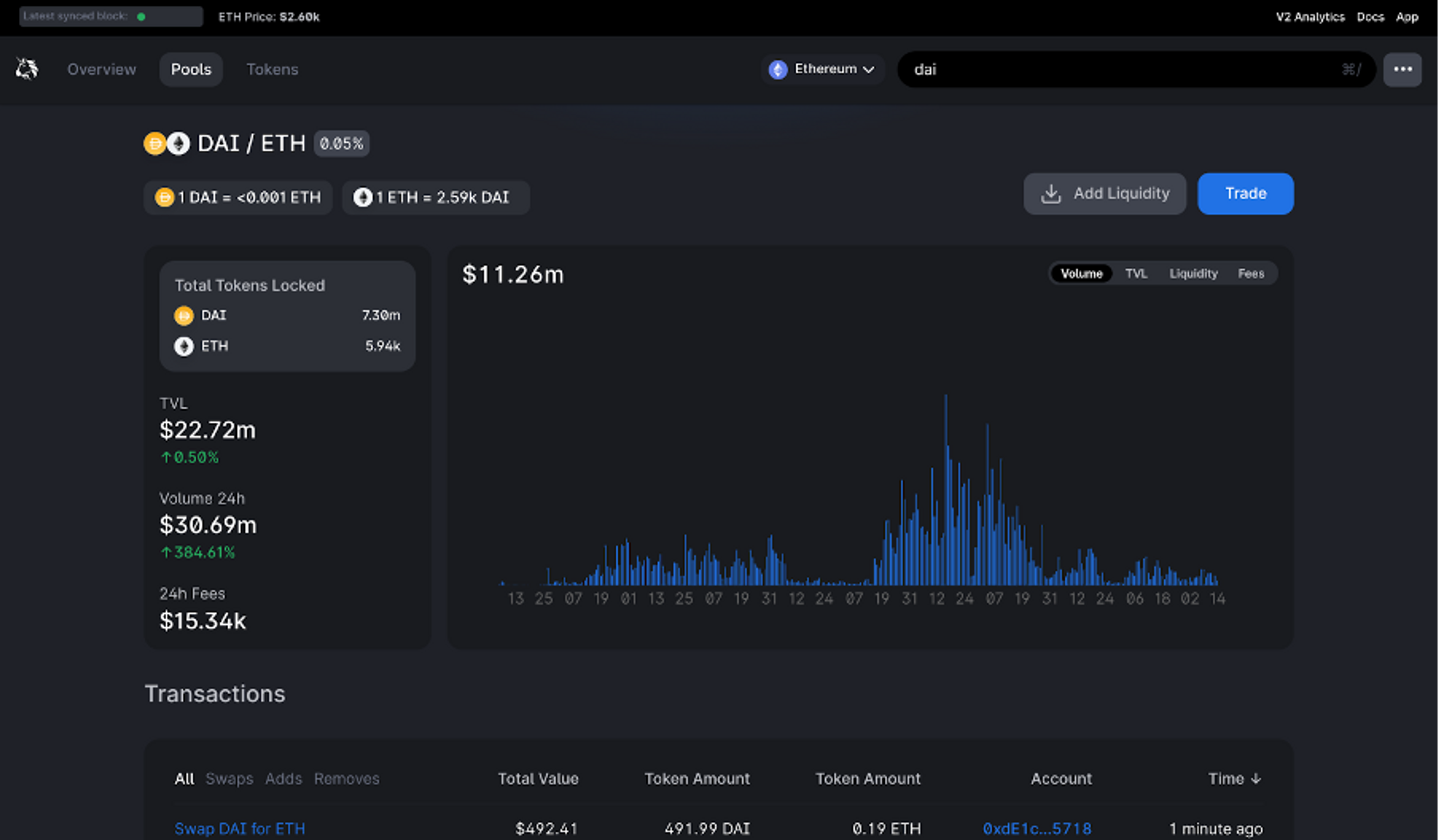

- Liquidity provision: Platforms like Uniswap offer PAXG/USDC pools where users provide liquidity and earn trading fees, effectively generating yield on their digital gold holdings.

- Lending and borrowing: DeFi protocols allow users to stake XAUt or PAXG as collateral for loans in stablecoins or other crypto assets without selling their exposure to gold.

- Staking and yield farming: Some platforms integrate XAUt into staking programs where participants earn additional rewards simply by holding their tokens within certain protocols.

This programmability marks a stark departure from traditional bullion investments where your asset simply sits in storage accruing no interest or income. Now your “gold” can work for you around the clock, all while retaining its intrinsic link to real-world reserves.

PAX Gold (PAXG) Price Prediction 2026-2031

Professional outlook for PAXG based on current market data, adoption trends, and tokenized gold sector growth.

| Year | Minimum Price | Average Price | Maximum Price | Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,780 | $3,950 | $4,120 | +1.4% | Stable gold demand; tokenized gold market growth, DeFi utility expansion |

| 2027 | $3,830 | $4,050 | $4,200 | +2.5% | Broader DeFi integration, increased institutional adoption |

| 2028 | $3,900 | $4,180 | $4,350 | +3.2% | Improved regulation, gold price uptrend, competition from other assets |

| 2029 | $3,950 | $4,310 | $4,520 | +3.1% | Tokenized gold surpasses $2B market cap, wider retail use |

| 2030 | $4,000 | $4,420 | $4,700 | +2.5% | Advanced blockchain tech, growing demand for alternative assets |

| 2031 | $4,050 | $4,540 | $4,900 | +2.7% | Mainstream acceptance, robust gold and crypto markets |

Price Prediction Summary

PAX Gold (PAXG) is projected to maintain a stable, gradual upward price trend, largely tracking the underlying gold market with added utility from blockchain adoption. As DeFi integration and regulatory clarity improve, PAXG’s use cases and market cap are expected to grow, supporting higher price ranges. However, minimum prices reflect potential periods of macroeconomic uncertainty or increased competition from other tokenized assets.

Key Factors Affecting PAX Gold Price

- Underlying gold price trends and macroeconomic environment

- Adoption of tokenized gold in DeFi and broader financial markets

- Regulatory developments affecting stablecoins and tokenized assets

- Competition from other tokenized commodities and stablecoins

- Technological advances in blockchain and security

- Institutional and retail investor demand for digital gold products

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

PAX Gold Maintains Position Above $3,800 Amid Growing Interest

The current price action around PAXG underscores growing confidence in tokenized commodities as both a hedge against economic volatility and a source of on-chain opportunities. With prices holding steady above $3,800, and recent 24-hour highs matching the present rate at $3,896.82, the appetite for blockchain-powered exposure to precious metals is only accelerating.

What’s fueling this demand? For many, it’s the unique combination of security, transparency, and flexibility. Every PAXG or XAUt token is backed by actual gold reserves, with public audits and blockchain records ensuring that what you own is always verifiable. This level of transparency is a leap forward compared to opaque gold ETFs or complex derivatives, where tracking the true underlying asset can be challenging.

Top 5 Reasons Investors Prefer Tokenized Gold

-

1. Fractional Ownership & Lower Barriers: Tokenized gold platforms like PAX Gold (PAXG) and Tether Gold (XAUt) allow investors to buy as little as a fraction of a troy ounce, making gold accessible without the need to purchase whole bars or coins.

-

3. On-Chain Yield Opportunities: Gold-backed tokens like PAXG and XAUt can be used in DeFi protocols (e.g., Uniswap PAXG/USDC pools), letting holders earn passive income through staking, lending, or liquidity provision—something traditional bullion can’t offer.

-

4. Secure, Transparent Backing: Each token is backed by physical gold stored in insured, audited vaults. For example, PAXG is fully backed by gold held at Brink’s vaults in London, and XAUt is backed by gold in Swiss vaults, with serial numbers and audit reports publicly available.

-

5. Seamless Global Access & Transfers: Tokenized gold can be sent and received instantly across borders using blockchain networks, eliminating the logistical challenges of shipping or storing physical bullion and making gold investment more accessible worldwide.

Another factor driving adoption is the ease of global transfers and redemption. Unlike physical bullion, which requires costly shipping and insurance for cross-border movement, tokenized gold can be sent anywhere in the world in minutes. Some issuers even allow direct redemption: holders can swap their tokens for physical bars (subject to minimums), bridging the digital-physical divide. This optionality appeals to both crypto-native users and traditional investors seeking a modern hedge against inflation.

Risks, Regulation, and What to Watch

Of course, no innovation comes without its caveats. Investors should scrutinize the credibility of custodians and issuers, ensure that vaults are audited frequently and that redemption mechanisms work as promised. Regulatory frameworks for tokenized commodities are evolving rapidly; while jurisdictions like Switzerland have embraced digital gold tokens under clear guidelines, others remain in flux. Always check if your chosen product meets relevant compliance standards.

Smart contract risk also deserves mention. Although major tokens like PAXG have undergone external audits, vulnerabilities in DeFi protocols or bridges could expose assets to exploits. As always in crypto: do your due diligence before deploying significant capital.

The Future of Gold: Programmable Wealth on Blockchain

The trajectory for on-chain gold looks promising. As more DeFi platforms integrate gold-backed tokens as collateral or liquidity instruments, and as new products like Oro Token emerge, the ecosystem will only deepen. The ability to earn yield on traditionally static assets could reshape portfolio strategies for both individuals and institutions.

Already, we’re seeing creative use cases such as automated rebalancing between stablecoins and tokenized gold during periods of market stress, or algorithmic strategies that tap into real-world asset yields without ever leaving the blockchain environment.

If you’re considering exposure to on-chain gold, keep an eye on pricing dynamics, like PAXG’s current value at $3,896.82: and monitor how regulatory clarity evolves in your jurisdiction. The seamless blend of age-old value with next-gen programmability means we’re only just beginning to see what’s possible when commodities meet code.