How Tokenized Gold Is Changing Wealth Building: From Meme Coins to Real Asset-Backed Tokens

Across the Web3 landscape, the convergence of meme coin culture and the enduring value of gold is rapidly redrawing the boundaries of wealth building. While digital gold meme coins like $GOLDN capture the viral energy of online communities, a deeper transformation is underway: tokenized gold is emerging as a cornerstone for serious investors seeking both security and blockchain-powered flexibility. In 2025, as speculative assets ebb and flow, tokenized gold’s market capitalization has surged to a record $2.57 billion, signaling a profound shift in how individuals and institutions approach wealth preservation through crypto assets.

From Memecoins to Real Asset-Backed Tokens: A New Era in Wealth Preservation Crypto

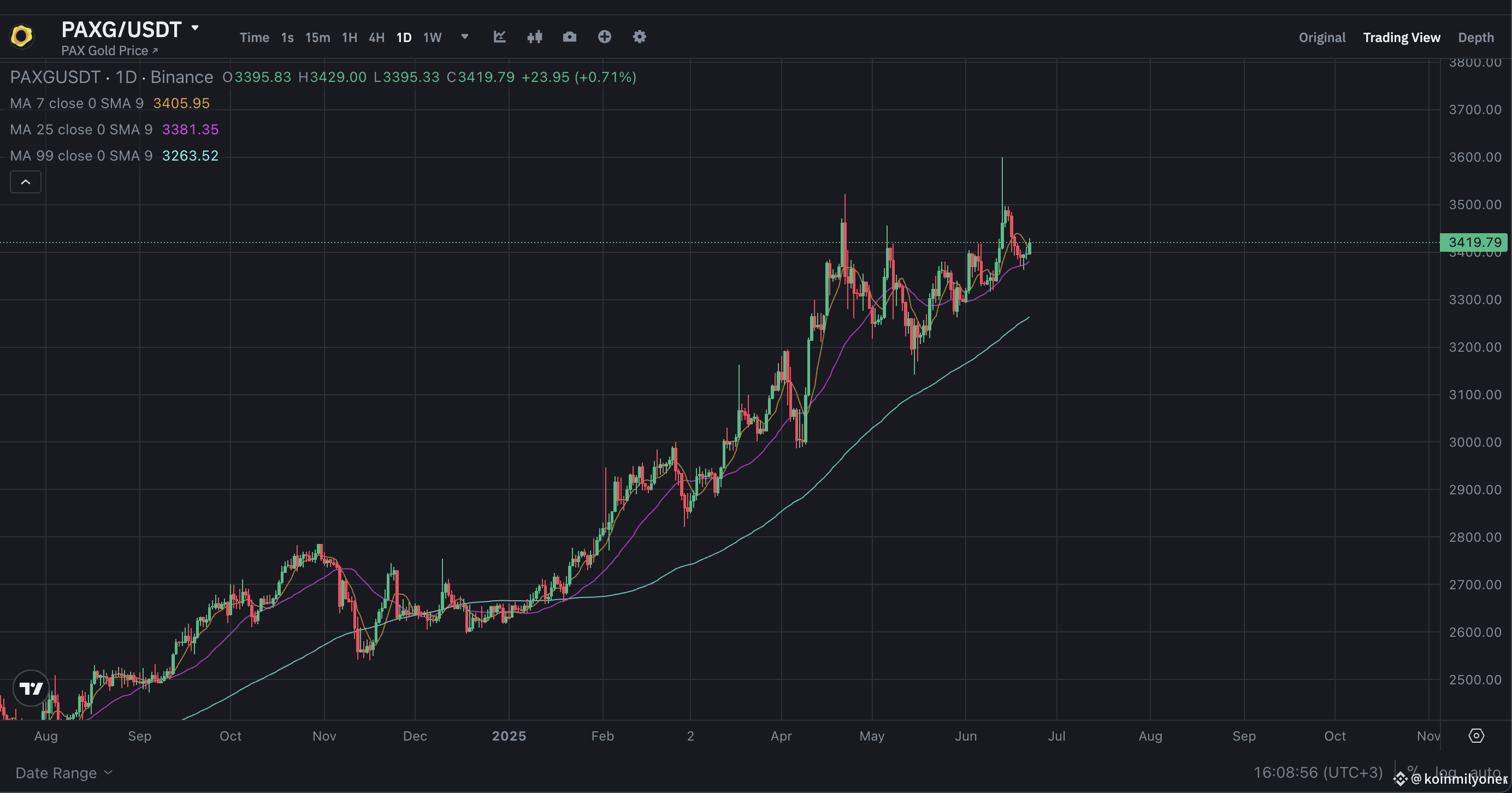

The rise of meme coins has democratized access to digital assets but often left investors exposed to extreme volatility and hype cycles. In contrast, gold-backed tokens offer an antidote: each token is fully collateralized by physical gold held in secure vaults, with transparent proof of reserves and regular audits. Leading examples include PAX Gold (PAXG), trading at $3,745.11 as of September 25,2025, and Tether Gold (XAUt), which boasts a market cap near $770 million.

Unlike traditional gold ETFs such as SPDR Gold Shares (GLD), currently priced at $343.32 per share, tokenized gold enables 24/7 trading on blockchain platforms with fractional ownership down to mere grams or even milligrams. This accessibility is unlocking new avenues for both retail and institutional investors who previously found physical gold cumbersome or cost-prohibitive.

PAX Gold (PAXG) and Tether Gold (XAUt): Setting the Standard for Blockchain Gold

PAXG, issued by Paxos Trust Company, represents one fine troy ounce of London Good Delivery gold per token. Each unit is fully backed by bullion stored in LBMA-accredited vaults in London under strict regulatory oversight, with monthly third-party audits ensuring transparency and security for holders. Similarly, XAUt by TG Commodities Limited ties each token to one troy ounce of Swiss-vaulted gold – both projects exemplify how blockchain can deliver tangible assurances that were once exclusive to large-scale investors or financial institutions.

PAXG vs XAUt vs GLD: Pricing and Features Comparison (September 2025)

| Feature | PAX Gold (PAXG) | Tether Gold (XAUt) | SPDR Gold Shares (GLD) |

|---|---|---|---|

| Price per Token/Share | $3,745.11 | Not provided | $343.32 |

| Backing | 1 troy ounce of physical gold (London vaults) | 1 troy ounce of physical gold (Swiss vaults) | Fractional ownership of gold held in trust |

| Issuer | Paxos Trust Company | TG Commodities Limited | SPDR (State Street) |

| Blockchain | Ethereum | Ethereum | Traditional ETF (NYSE Arca) |

| Regulatory Oversight | Regulated by NYDFS, monthly audits | Not specified, but claims full backing | SEC-regulated ETF |

| Fractional Ownership | Yes (up to 0.01 PAXG) | Yes (up to 0.0001 XAUt) | Yes |

| Liquidity | 24/7 on crypto exchanges | 24/7 on crypto exchanges | Market hours (NYSE) |

| Storage Location | London (LBMA-accredited vaults) | Switzerland (secure vaults) | Multiple vaults (London, New York, etc.) |

| Redemption for Physical Gold | Yes (minimum redemption applies) | Yes (minimum redemption applies) | No |

| Market Capitalization | Not specified | ~$770 million | Over $60 billion (approximate) |

| Use in DeFi / Web3 | Yes | Yes | No |

| Minimum Purchase | Very low (fractional) | Very low (fractional) | 1 share |

The impact on wealth-building strategies is significant:

- Increased Accessibility: Fractionalization lowers entry barriers for everyday investors (source)

- Enhanced Liquidity: On-chain trading provides instant settlement and global reach

- Cost Efficiency: No need for physical storage or intermediaries reduces friction (source)

- Transparency: Regular audits and public on-chain data build investor confidence

The Role of Tokenized Gold in the Modern Portfolio: Data-Driven Insights

The numbers tell a compelling story: PAXG’s current price at $3,745.11, near its 24-hour high of $3,780.19, reflects robust demand as investors seek stability amid crypto market swings. Meanwhile, total market capitalization across all tokenized gold products stands at $2.57 billion, underscoring growing trust in these instruments not just as hedges but as active components within diversified portfolios.

PAX Gold (PAXG) Price Prediction 2026-2031

Short-term and Mid-term Outlook for Tokenized Gold Amid Growing Adoption and Market Maturity

| Year | Minimum Price | Average Price | Maximum Price | Expected % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,600.00 | $3,850.00 | $4,100.00 | +2.8% | Continued gold stability, moderate tokenized gold adoption, potential for slight price dips during global market corrections. |

| 2027 | $3,700.00 | $4,000.00 | $4,350.00 | +3.9% | Expanded adoption among institutional investors, increased DeFi integration, regulatory clarity boosts confidence. |

| 2028 | $3,850.00 | $4,200.00 | $4,600.00 | +5.0% | Global economic uncertainty drives gold demand; tokenized gold benefits from on-chain liquidity and new RWA platforms. |

| 2029 | $4,000.00 | $4,400.00 | $4,900.00 | +4.8% | Enhanced interoperability, more tokenized commodities; competition from other gold tokens, but PAXG maintains leading role. |

| 2030 | $4,100.00 | $4,600.00 | $5,200.00 | +4.5% | Mainstream acceptance of tokenized assets, increased use in wealth management products, robust regulatory frameworks. |

| 2031 | $4,250.00 | $4,800.00 | $5,500.00 | +4.3% | Tokenized gold seen as a stable on-chain store of value; macroeconomic factors and gold price cycles drive upper/lower bounds. |

Price Prediction Summary

PAX Gold (PAXG) is expected to steadily appreciate in line with gold’s price trajectory, benefiting from increased adoption of tokenized assets, improved liquidity, and cost efficiency. While PAXG’s price will largely mirror physical gold, the growing ecosystem for real-world assets (RWA) on blockchain and regulatory clarity are likely to support progressive price growth, with average annual gains in the 3-5% range. Downside risk remains limited due to gold backing, but price dips can occur during periods of global market volatility.

Key Factors Affecting PAX Gold Price

- Physical gold price trends and global macroeconomic conditions.

- Regulatory developments impacting stablecoins and tokenized assets.

- Institutional and retail adoption of tokenized gold for wealth management.

- Expansion of DeFi and RWA platforms integrating PAXG.

- Competition from other gold-backed tokens (e.g., XAUt) and traditional gold ETFs.

- Technological improvements in blockchain infrastructure and token custody.

- Liquidity and trading volume on major exchanges and DeFi protocols.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

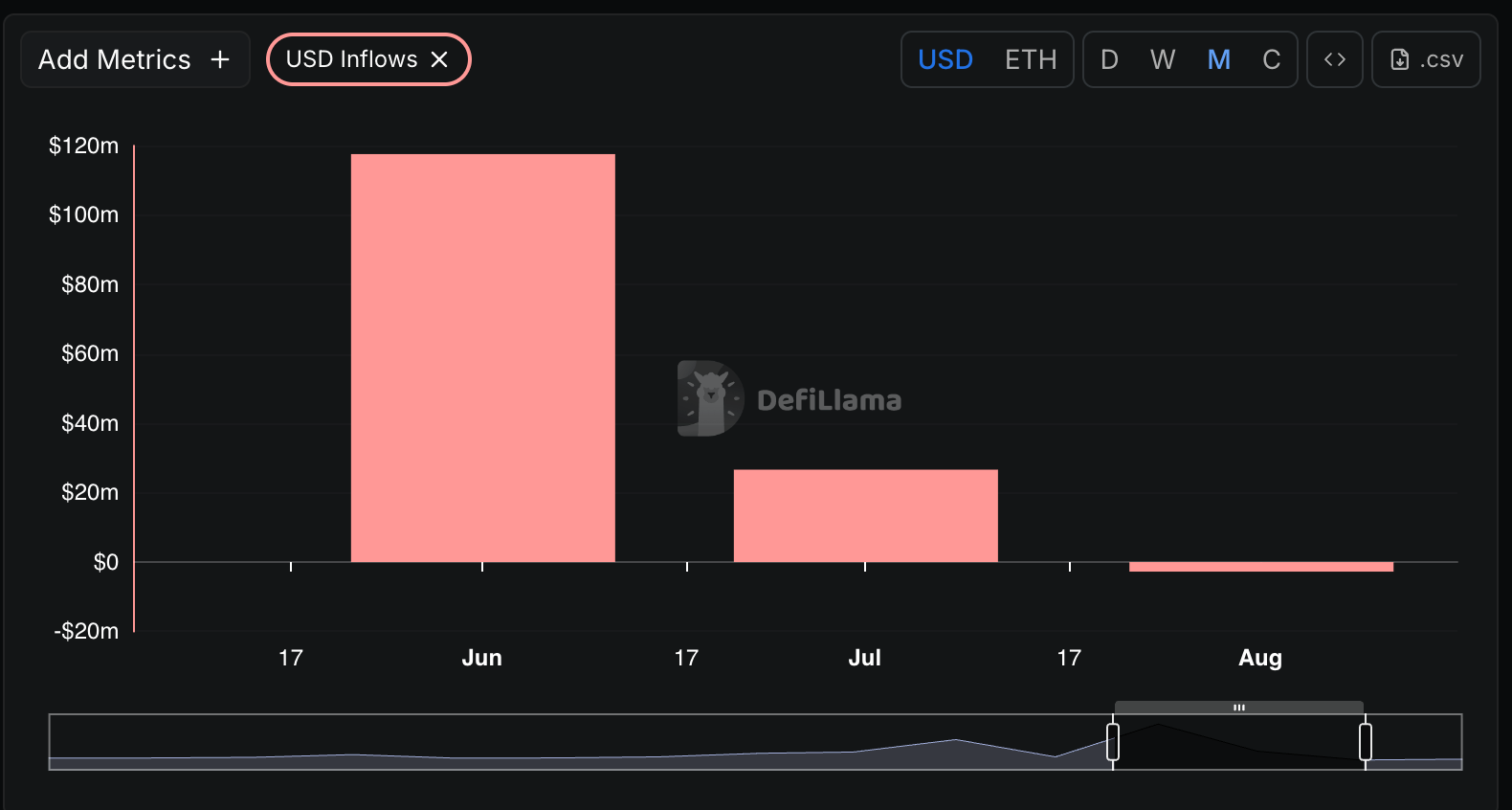

This surge isn’t happening in isolation – it’s part of a broader movement toward real-world asset tokenization on platforms like SolanaVelo and Ethereum Layer 2s (source). By bridging traditional commodities with next-gen DeFi protocols, on-chain gold unlocks new possibilities for lending, yield generation, collateralization, and seamless cross-border transfer – all while retaining the intrinsic value that has made gold a wealth preservation icon for centuries.

As tokenized gold cements its position in the digital asset ecosystem, investors are increasingly leveraging these instruments not only for long-term wealth preservation but also for tactical opportunities. The blockchain’s programmability enables gold-backed tokens to serve as collateral in decentralized lending protocols, participate in liquidity pools, or underpin stablecoins, functions previously unimaginable for physical gold. This evolution is transforming gold from a static store of value into a dynamic asset with real yield potential.

Additionally, platforms like Solana are accelerating the integration of real-world assets by offering fast, low-cost transactions and developer-friendly infrastructure. The ability to tokenize and trade fractions of gold 24/7 on-chain means investors can respond nimbly to market events or rebalance portfolios without waiting for traditional market hours. This flexibility is especially attractive during periods of macroeconomic uncertainty when quick shifts between risk assets and safe havens are essential.

Key Advantages Over Meme Coins and Legacy Gold Products

Tokenized Gold vs Meme Coins & ETFs: Security and Utility

-

Asset Backing & Security: Tokenized gold assets like PAX Gold (PAXG) and Tether Gold (XAUt) are fully backed by physical gold stored in secure, audited vaults (e.g., LBMA-accredited vaults in London for PAXG, Swiss vaults for XAUt). In contrast, meme coins such as Dogecoin or Shiba Inu lack any real-world asset backing, making them highly speculative. Traditional gold ETFs like SPDR Gold Shares (GLD) are also backed by physical gold, but ownership is indirect and subject to management fees.

-

Transparency & Auditing: PAXG and XAUt undergo regular third-party audits and provide on-chain proof of reserves, ensuring each token is matched by physical gold. Meme coins generally offer no such transparency or audits. GLD publishes daily holdings reports but does not offer on-chain transparency.

-

Utility & Accessibility: Tokenized gold enables fractional ownership (e.g., buying a fraction of a PAXG token), 24/7 trading, and seamless transferability on blockchain networks like Ethereum and Solana. Meme coins offer high liquidity and fast transfers but lack intrinsic value. GLD is traded on traditional stock exchanges with limited trading hours and higher minimum investment thresholds.

-

Cost Efficiency: Tokenized gold eliminates the need for intermediaries and physical storage for individual investors, reducing costs. PAXG and XAUt typically have lower fees compared to GLD, which charges management fees and may incur brokerage costs. Meme coins have low transaction fees but do not provide real asset exposure.

-

Market Performance & Stability: As of September 25, 2025, PAXG is priced at $3,745.11 and GLD at $343.32, both reflecting gold’s relative price stability. Meme coins are highly volatile, often driven by social sentiment rather than underlying value, making them riskier for wealth building.

Unlike meme coins, whose value often derives from community sentiment or viral trends, tokenized gold is anchored in physical reserves, audited monthly and transparently tracked on-chain. This foundation offers a layer of trust that pure speculative tokens lack. Compared to legacy products like GLD, which require intermediaries and operate within limited trading windows, blockchain-based gold provides instant settlement and direct ownership without custodial risk.

The trend toward on-chain commodity-backed crypto assets is also reshaping investor psychology. Where once digital assets were synonymous with volatility, projects like PAXG and XAUt demonstrate that blockchain infrastructure can deliver both innovation and stability. As more institutional players enter the space, drawn by regulatory clarity, audit transparency, and operational efficiency, the narrative is shifting from speculation to strategic allocation.

“Tokenized gold isn’t just about digitizing an old asset, it’s about unlocking new forms of liquidity, access, and composability that were never possible before. “

What’s Next for Blockchain Gold?

Looking ahead, expect continued growth as tokenized gold products expand into new DeFi use cases, ranging from automated portfolio rebalancing to synthetic yield strategies. Regulatory frameworks are evolving in tandem with technology; projects operating under strict oversight (such as Paxos) set the benchmark for compliance while inspiring confidence among both retail users and institutions.

For those navigating the intersection of crypto innovation and time-tested wealth preservation strategies, tokenized gold stands out as a data-driven choice. With PAXG holding firm at $3,745.11 and total market capitalization at $2.57 billion, the numbers speak for themselves: real asset-backed tokens are redefining what it means to build, and protect, wealth in the Web3 era.