Tokenized Gold on Solana: How $GOLD and XAUt are Shaping the Future of Digital Gold Ownership

As gold consolidates its role as a global store of value, the rise of tokenized gold on Solana and other blockchains is fundamentally changing how investors access and manage exposure to the precious metal. With increasing geopolitical uncertainty and inflationary pressures, demand for digital gold assets like $GOLD and XAUt Tether gold has surged. As of September 24,2025, Tether Gold (XAUT) trades at $3,777.49, with the tokenized gold market reaching a record capitalization of $2.57 billion. This evolution is not just about price action – it’s about transparency, accessibility, and new forms of digital ownership that could reshape the landscape for both retail and institutional investors.

XAUt: Tether Gold’s Market Dominance at $3,777.49

Tether’s XAUT has rapidly become the benchmark for tokenized gold assets. Backed by audited reserves held in Swiss vaults, each XAUT token represents one troy ounce of physical gold. According to recent attestations, XAUT is supported by over 7.66 metric tons of allocated bullion (source: Messari). The latest figures show a robust daily trading volume and a transparent structure that appeals to investors seeking both liquidity and verifiable backing.

The surge in market cap – now at $2.57 billion – is driven by several key factors:

- On-chain transparency: Regular third-party audits and real-time attestation reports.

- Sovereign-grade custody: Gold reserves are stored in secure Swiss vaults with specific bar allocation to each token holder.

- DeFi integration: Platforms like Alloy now allow users to mint synthetic assets backed by tokenized gold collateral (see details here).

The Role of Solana in Tokenized Gold Markets

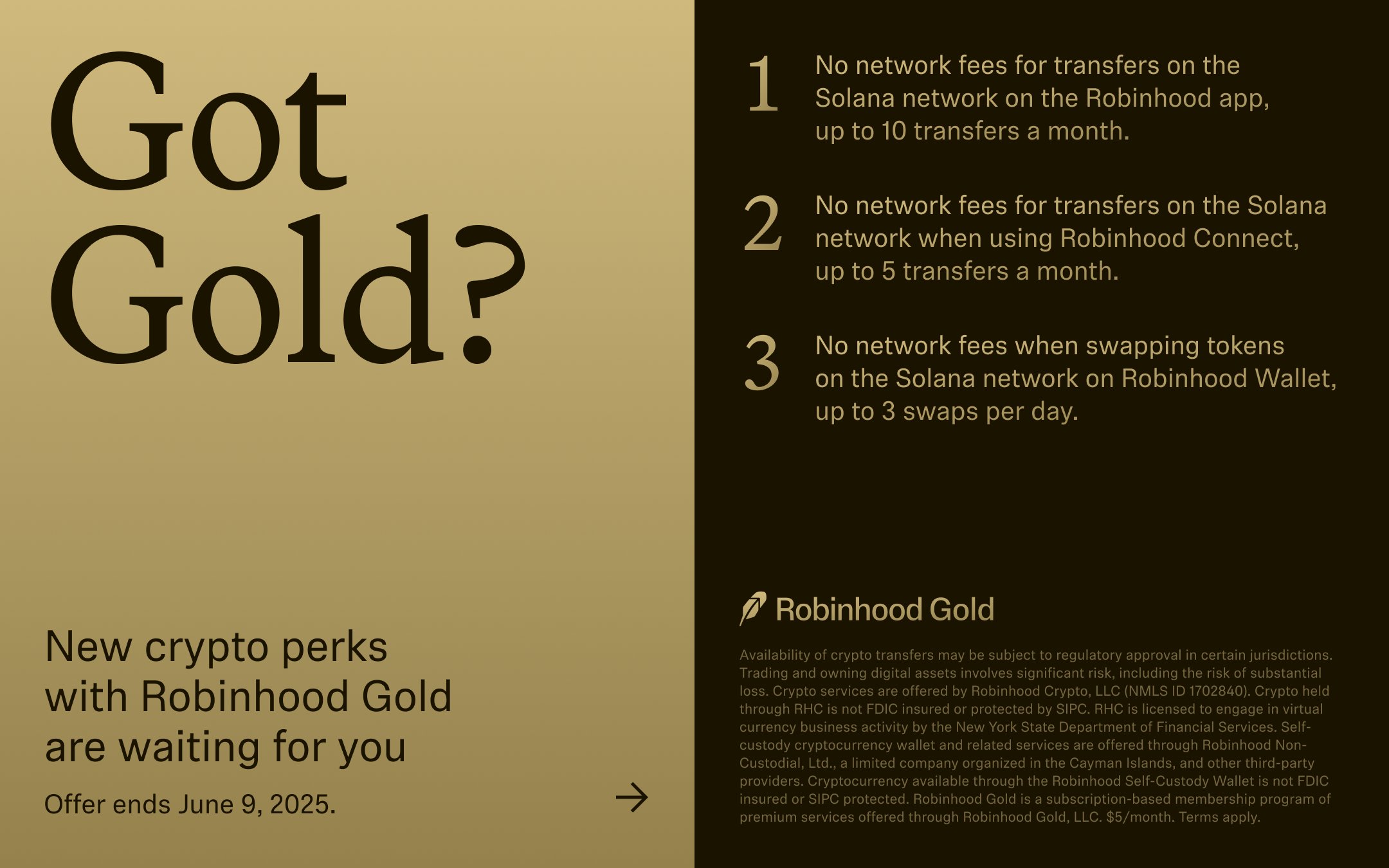

The expansion of tokenized gold onto fast, low-fee blockchains like Solana is accelerating mainstream adoption. While Ethereum pioneered asset tokenization, Solana’s high throughput enables near-instant settlement for fractional gold investment products such as $GOLD tokens. This unlocks new opportunities for both retail users and institutional desks seeking efficient exposure with minimal slippage or custody risk.

The technical advantages of Solana include:

- Sub-second transaction finality for on-chain gold trading

- Dramatically lower fees compared to Ethereum-based tokens

- Easier integration with DeFi protocols supporting lending, staking, and synthetic asset creation using tokenized gold as collateral

XAUt vs Traditional Gold ETFs: Transparency and On-Chain Auditability

A critical distinction between digital gold ownership blockchain solutions like XAUt and legacy instruments such as ETFs lies in auditability and settlement speed. While ETFs offer regulated exposure via traditional markets, they lack real-time proof-of-reserves or direct redemption mechanisms for physical bullion at the individual level.

| XAUt (Tokenized Gold) | Gold ETF (e. g. , GLD) | |

|---|---|---|

| Backing Verification | On-chain attestation and regular third-party audits 🔎 | Semi-annual reports and indirect custodial statements 🗂️ |

| Fractional Ownership? | Yes – down to micro-units ⚖️ | No – whole shares only 💵 |

| Settlement Speed | Seconds ⏱️ (on Solana) | T and 2 days ⏳ (traditional markets) |

| Peg Stability Mechanism | Bullion redemption option and arbitrage window 💰🏦 | Sponsor-managed tracking error mitigation 📉📈 |

| Custody Risk Profile | User-controlled wallets 🔐 and Swiss vaults 🏛️ | Custodian banks 🏦 |

| Lending/Staking Options? | Lending pools and DeFi staking available 🚀 | No native options 🚫 |

| KYC/AML Requirements? | No/Minimal depending on platform 🔓 | KYC/AML required 🔒 |

This shift toward self-custodied digital assets enables true fractional ownership while reducing reliance on financial intermediaries, a significant advantage during periods of market stress or heightened counterparty risk.

The next section will explore how fractionalization via $GOLD tokens on Solana is democratizing access to physical bullion investment globally, including prediction tables showing potential growth scenarios through Q4 2025.

Tether Gold (XAUT) Price Prediction 2026-2031

Professional Forecast Based on Market Trends, Tokenomics, and the Evolving Digital Gold Landscape

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,650 | $3,950 | $4,250 | +4.6% | XAUT tracks global gold price but benefits from growing tokenized gold adoption and DeFi integrations. |

| 2027 | $3,700 | $4,120 | $4,500 | +4.3% | Further integration with DeFi, increased institutional inflows, but volatility tied to macroeconomic factors. |

| 2028 | $3,800 | $4,350 | $4,750 | +5.6% | Broader acceptance of digital gold, potential regulatory clarity boosts investor confidence. |

| 2029 | $3,950 | $4,550 | $5,100 | +4.6% | Continued gold tokenization, increasing cross-chain utility, possible competition from new tokenized metals. |

| 2030 | $4,100 | $4,800 | $5,400 | +5.5% | Growth in tokenized asset infrastructure, stable demand for gold as a hedge, technological improvements. |

| 2031 | $4,200 | $5,050 | $5,750 | +5.2% | Matured tokenized gold market, potential for XAUT to be used as collateral in major DeFi protocols. |

Price Prediction Summary

Tether Gold (XAUT) is poised for steady, moderate appreciation, closely tracking physical gold prices but with upside potential from broader adoption of tokenized assets and integration into decentralized finance. The minimum price forecasts reflect XAUT’s strong asset backing and relative stability, while maximum scenarios account for bullish adoption and technological progress.

Key Factors Affecting Tether Gold Price

- Global gold price trends and macroeconomic environment

- Growth and adoption of tokenized gold and DeFi platforms

- Regulatory clarity and acceptance of digital assets

- Technological advancements in tokenization and blockchain infrastructure

- Institutional interest and inflows into digital gold products

- Competition from other tokenized commodities and gold-backed digital assets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Fractional gold investment through tokenized assets on Solana is rapidly eroding the barriers that once limited physical bullion ownership to large institutions or high-net-worth individuals. Now, investors can acquire exposure to as little as a fraction of a gram, with transactions settling in seconds and at negligible cost. This paradigm shift is not just about accessibility, but also about liquidity: tokenized gold markets are open 24/7 and facilitate seamless peer-to-peer trading, lending, and collateralization across DeFi ecosystems.

Key Benefits of Fractional Gold Investment with $GOLD on Solana

-

Accessibility to High-Value Gold Assets: $GOLD tokens on Solana allow investors to own fractional shares of physical gold, eliminating the need to purchase entire gold bars or coins. This lowers the entry barrier for retail investors seeking exposure to gold’s value.

-

Instant Settlement and 24/7 Liquidity: Trading $GOLD tokens on Solana’s blockchain provides near-instant settlement and continuous liquidity, enabling investors to buy or sell their gold-backed tokens at any time without waiting for traditional market hours.

-

Transparent and Verifiable Backing: Each $GOLD token is backed by physical gold held in secure vaults, with on-chain proof and regular third-party audits ensuring transparency and trust for investors. Tether Gold (XAUT), for example, is fully backed by over 7.66 metric tons of gold as of Q2 2025.

-

Cost-Efficient Transactions: Solana’s low transaction fees make it cost-effective to trade or transfer $GOLD tokens, especially compared to traditional gold investment vehicles that often involve high storage and management costs.

-

Integration with DeFi and Synthetic Assets: $GOLD tokens can be used as collateral in decentralized finance (DeFi) protocols and to mint synthetic assets, such as aUSDT on Tether’s Alloy platform, expanding the utility and earning potential of digital gold holdings.

For those seeking diversification beyond equities or fiat currencies, the ability to hold verifiable digital claims on physical gold – with full audit trails and redemption rights – is a compelling proposition. The ongoing integration of XAUt and $GOLD into decentralized finance protocols further expands their utility. Users can now stake tokenized gold for yield, borrow against it, or use it as pristine collateral for synthetic dollar creation via platforms like Alloy.

Risks and Considerations in Tokenized Gold Adoption

Despite the clear advantages over legacy products, tokenized gold is not without its challenges. Counterparty risk still exists at the vaulting and issuer level; robust audit practices and transparent smart contract code are essential for trust. Regulatory clarity remains uneven across jurisdictions, especially as tokenized commodities gain traction with institutional allocators.

Liquidity concentration is another factor to monitor. While XAUt boasts deep trading pairs on major exchanges and DeFi pools, emerging tokens may face volatility or slippage during periods of stress unless market-making infrastructure keeps pace with demand.

What’s Next for Digital Gold Ownership?

The continued growth in XAUt’s market capitalization – now at $2.57 billion – signals robust confidence in blockchain-based precious metals. With Tether’s recent minting of $437 million worth of new XAUt tokens (source), supply has expanded to meet surging investor demand amid macroeconomic uncertainty.

Platforms like Alloy are showing how tokenized gold can serve as the backbone for new synthetic assets pegged to fiat currencies or other benchmarks (see more). This composability could ultimately position digital gold not only as a store of value but also as an engine for programmable finance – where users move seamlessly between hard asset collateral and stablecoin liquidity without leaving the blockchain.

The competitive landscape will likely intensify as regulatory frameworks evolve and more custodians enter the space with independently verified reserves. Investors should continue to prioritize transparency, auditability, and platform security when evaluating digital gold options.

Ultimately, the convergence of blockchain technology with centuries-old stores of value is unlocking new possibilities for portfolio construction that were unimaginable just a few years ago. As adoption grows and infrastructure matures, tokenized gold on Solana stands poised to become a foundational pillar in both traditional and decentralized finance portfolios worldwide.