Goldfish $GGBR Tokenized Gold on MEXC: Airdrop Eligibility and Trading Guide

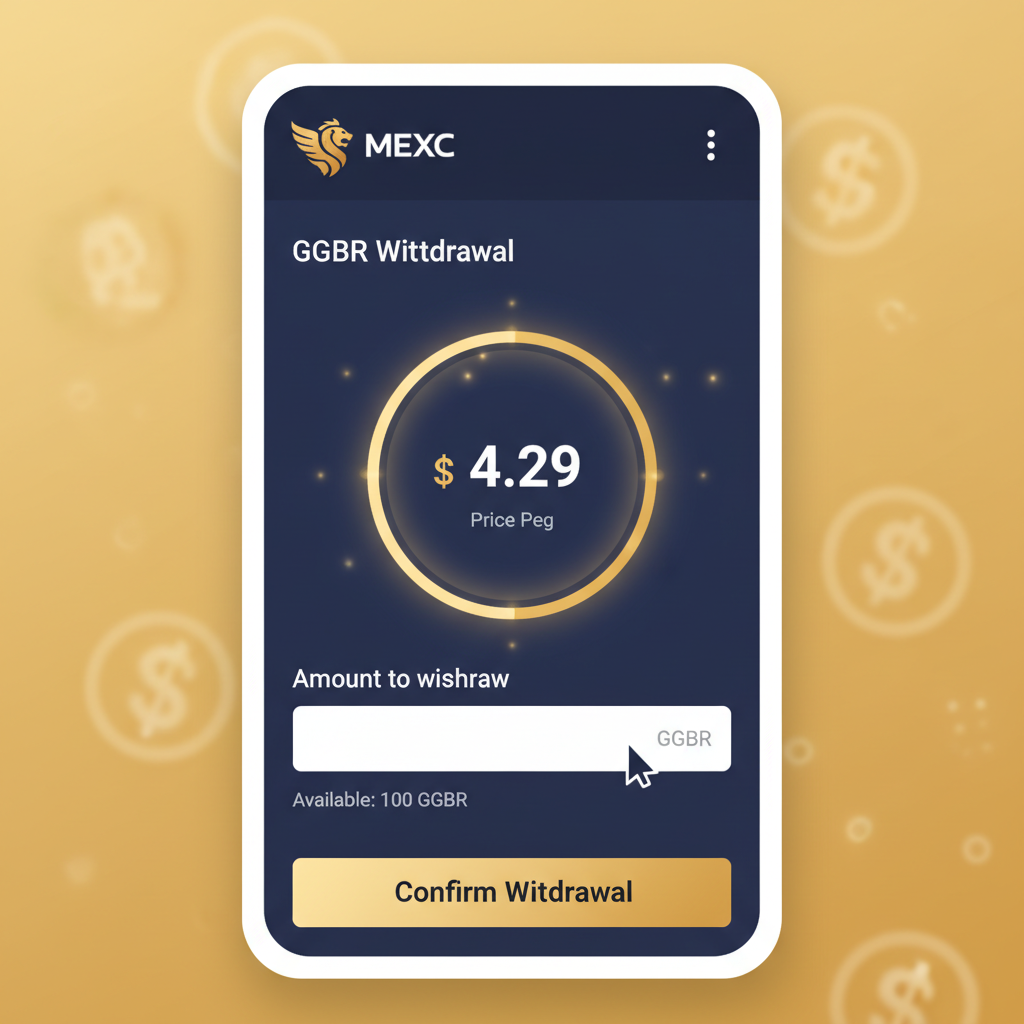

Picture this: tokenized gold that’s as real as it gets, now blasting onto MEXC with a massive 65,000 USDT airdrop pool. Goldfish Gold $GGBR, trading at $4.29 after a -1.09% dip from its 24-hour high of $4.35, represents the future of on-chain commodities. If you’re chasing Goldfish GGBR tokenized gold, this MEXC listing on February 5,2026, is your golden gateway, backed by physical assets and buzzing with community rewards.

I’ve been trading tokenized assets for years, and $GGBR stands out because each token equals 1/1000th of a troy ounce of independently audited physical gold. Pegged directly to spot prices, it delivers institutional gold on-chain without the vaults or paperwork. MEXC’s Innovation Zone debut, complete with GGBR/USDT trading, kicked off right after deposits opened, drawing new users into the fray with futures volume challenges.

Airdrop Alert: Snag Your Share of 65,000 USDT in GGBR MEXC Rewards

The event ran from February 4 to 11,2026, but the momentum lingers. New users only, folks, register, deposit goldfish-gold, and ramp up your futures trading volume on MEXC. Higher volume meant bigger slices of the pie, turning trades into airdrop gold. Imagine stacking $GGBR at $4.29 while earning extra from this pool; it’s the kind of incentive that respects the tide while you ride the wave.

Pro tip: Even post-event, MEXC’s trading tournaments and reward programs keep the $GGBR party going strong.

Goldfish isn’t stopping at $GGBR. Enter $GFIN, the governance token fueling community decisions and more tokenized gold GFIN rewards. With 15k and users already earning both, this duo positions Goldfish as a powerhouse in DeFi commodities.

How Goldfish $GGBR Pegs Physical Gold to Blockchain Brilliance

Diving deeper, $GGBR’s beauty lies in its transparency. Audited reserves ensure every token mirrors gold’s spot value, trading seamlessly at $4.29 today amid a tight 24-hour range of $4.23 to $4.35. No more middlemen; you hold fractional gold on-chain, ready for DeFi yields or swaps. MEXC’s first-mover listing amplifies this, blending traditional safe-haven appeal with crypto speed.

- Direct Peg: 1 $GGBR = 1/1000th troy ounce gold.

- Audited Reserves: Independent verification for trust.

- MEXC Edge: GGBR/USDT pair live, low fees, high liquidity.

For investors eyeing portfolio diversification, $GGBR on MEXC offers stability in volatile markets. Gold’s enduring strength, tokenized for the blockchain era, makes it a no-brainer amid today’s $4.29 price point.

Step-by-Step Trading Guide: Get Into GGBR on MEXC Now

Ready to trade? Start by signing up on MEXC if you’re new, that’s your ticket to any lingering rewards. Deposit USDT or supported assets, head to the Innovation Zone, and spot the GGBR/USDT pair. With the token at $4.29 and fresh off its listing high, timing feels prime for entries.

- Register and verify your account swiftly.

- Fund with USDT via quick deposit channels.

- Navigate to Spot trading, search GGBR/USDT.

- Place market or limit orders, watching that $4.29 level.

Pro traders, eye futures for leverage, but keep volume in mind for future events. $GGBR’s low volatility today signals consolidation before potential breakouts.

Goldfish Gold (GGBR) Price Prediction 2027-2032

Forecasts based on gold spot price peg, MEXC trading volume, tokenized asset adoption, and market cycles (prices in USD)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg)* |

|---|---|---|---|---|

| 2027 | $3.80 | $5.20 | $6.50 | +15.6% |

| 2028 | $4.50 | $6.10 | $8.00 | +17.3% |

| 2029 | $5.20 | $7.30 | $10.20 | +19.7% |

| 2030 | $6.00 | $8.80 | $12.50 | +20.5% |

| 2031 | $7.00 | $10.50 | $15.00 | +19.3% |

| 2032 | $8.00 | $12.50 | $18.00 | +19.0% |

Price Prediction Summary

GGBR, pegged to 1/1000th troy ounce of physical gold, is projected to follow gold’s bullish long-term trends with added volatility and upside from crypto adoption, MEXC ecosystem growth, and airdrop incentives. Average prices expected to grow 15-20% annually, reaching $12.50 by 2032 in base case, with bullish max scenarios driven by institutional demand and DeFi integration.

Key Factors Affecting Goldfish Gold Price

- Direct peg to audited physical gold spot price (~$4,290/oz baseline in 2026)

- MEXC Innovation Zone listing, airdrops (65K USDT pool), and trading volume surges

- Gold market cycles: inflation hedging, central bank buying, geopolitical tensions

- Tokenized gold adoption in crypto/DeFi, governance token (GFIN) synergies

- Regulatory progress for RWA (real-world assets) tokens

- Competition from other gold-backed tokens and broader crypto market cap expansion

- Macro factors: USD strength, interest rates, and gold supply constraints

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

That prediction table isn’t just hype; with gold spot holding steady and MEXC volume spiking post-listing, $GGBR at $4.29 could test those upper bounds if sentiment flips bullish. I’ve seen tokenized assets like this consolidate before mooning, especially with governance perks incoming.

GFIN Governance Boost: Unlock Tokenized Gold GFIN Rewards

Goldfish levels up with $GFIN, the governance token designed to put power in community hands. While $GGBR delivers the physical gold punch at $4.29, $GFIN lets holders vote on protocol upgrades, fee structures, and expansion plays. Over 15,000 users are already stacking both, per social buzz, chasing airdrops that reward loyalty and participation. This isn’t your average utility token; it’s the engine driving tokenized gold GFIN rewards, blending DeFi democracy with real asset backing.

Post the February 11 cutoff, eyes shift to $GFIN’s rollout. Early adopters from the $GGBR frenzy get priority, turning MEXC trades into governance clout. Picture influencing the next big reserve audit or yield farm while your $GGBR holds at $4.29 amid that slim $4.23-$4.35 range. It’s institutional gold on-chain, accessible to anyone with a wallet and a strategy.

Respect the tide: $GFIN airdrops favor active traders, so volume on GGBR/USDT keeps you in the rewards loop.

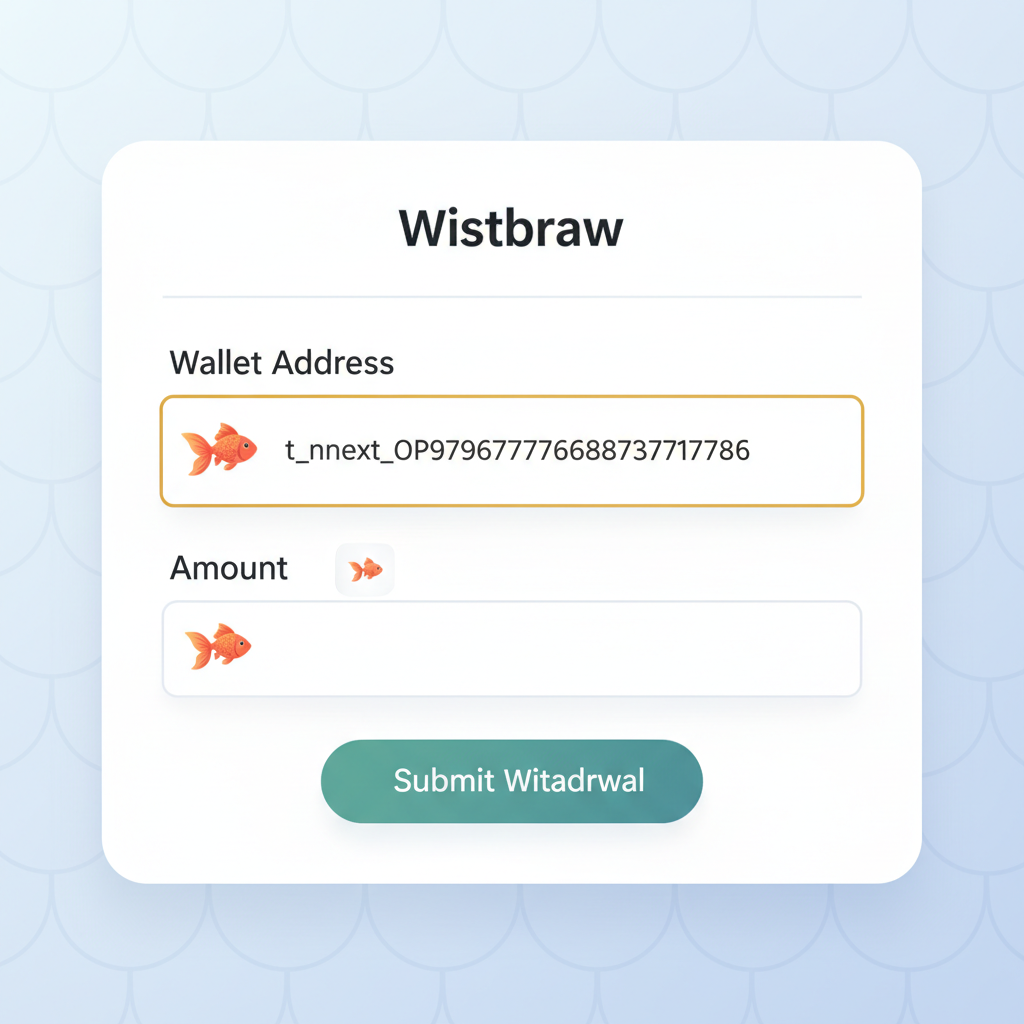

Mastering $GGBR Wallet Claims and Storage

Securing your $GGBR means more than buying; it’s about seamless on-chain custody. Once you’ve traded on MEXC at $4.29, withdraw to a compatible wallet for DeFi action. Goldfish emphasizes audited reserves, so claims tie directly to physical backing, no smoke and mirrors.

From there, bridge to ecosystems like Ethereum or Solana for yields, or hold for spot parity. I’ve moved thousands in tokenized gold this way, dodging custody risks while riding blockchain efficiency. At today’s $4.29 mark with a -1.09% 24-hour tweak, it’s prime for long-term stacks.

Trading tournaments on MEXC keep the fire lit, pitting you against others for $GGBR shares. New users crushed the initial futures volume ladders, but ongoing pools ensure veterans stay rewarded. Pair this with $GFIN voting rights, and you’ve got a diversified play: stability from gold at $4.29, upside from governance.

Why $GGBR Fits Your Portfolio Like a Glove

In a sea of meme coins and hype cycles, $GGBR on MEXC shines as institutional gold on-chain. Its tight 24-hour range signals resilience, perfect for hedging crypto volatility. I’ve allocated 10-15% of portfolios to tokenized commodities for years, watching them outperform during uncertainty. With $GFIN layering in utility, Goldfish isn’t just a token; it’s a movement.

- Low Volatility Play: $4.29 holds firm post-dip.

- DeFi Ready: Lend, stake, or swap fractional gold.

- Community Driven: Airdrops and tournaments fuel growth.

Jump in via the Innovation Zone, track that $4.29 price, and position for the next leg up. Tokenized gold like $GGBR doesn’t chase pumps; it builds empires, one audited ounce at a time. Ride this wave smartly, and watch your assets gleam.