PAXG vs XAUT: Which Tokenized Gold Wins for 2026 Blockchain Investors

Gold’s relentless climb has tokenized versions like PAX Gold (PAXG) and Tether Gold (XAUT) shining brighter than ever for blockchain investors. With PAXG at $5,003.56 after a $66.25 gain in the last 24 hours, these assets deliver the timeless appeal of physical gold minus the vault hassles. But in this PAXG vs XAUT showdown for 2026, which one edges ahead in liquidity, compliance, and DeFi potential? Let’s unpack why tokenized gold is rewriting the rules for portfolios chasing both safety and yield.

Tokenized gold tokens bridge old-school precious metals with blockchain speed. Each PAXG represents one troy ounce of London-vaulted gold, backed by Paxos Trust Company under strict NYDFS oversight. Monthly audits keep everything transparent, drawing in U. S. institutions wary of regulatory gray zones. XAUT mirrors this with Tether’s issuance, storing gold in Swiss vaults and boasting zero custody fees. Yet it skips monthly checks for quarterly BDO audits with bar serial tracking, prioritizing ecosystem liquidity instead.

PAXG’s Regulatory Armor in a Volatile Crypto World

PAXG stands out for compliance hawks. Regulated by New York authorities, it’s accessible to U. S. investors, a rarity in tokenized gold. This NYDFS seal fueled its market cap surge to $2.01 billion by early 2026, with transaction counts hitting a record 36,700. Ethereum-based as an ERC-20, PAXG slots seamlessly into DeFi, letting you lend on Aave or stake for yields. Sure, gas fees bite during congestion, but that Ethereum ecosystem unlocks real opportunities absent in plain gold bars.

Contrast that with physical gold: no 24/7 trading, no fractional buys under an ounce, no on-chain proof. PAXG flips those limits, trading on Binance, Coinbase, and Uniswap with spot premiums often negligible to gold’s spot price. For 2026 investors eyeing hedges against fiat wobbles, this regulatory edge feels like a moat.

PAXG’s monthly audits and U. S. focus make it the choice for institutions building compliant portfolios.

XAUT’s Multi-Chain Speed and Liquidity Lead

XAUT fights back with flexibility. Tether’s powerhouse supports Ethereum, TRON, and TON via LayerZero, slashing fees and boosting speed for traders. Its $2.598 billion market cap dwarfs PAXG’s in some metrics, with 18,300 daily transactions underscoring adoption. El Salvador’s framework adds a sovereignty twist, appealing to global users dodging U. S. restrictions. High liquidity pools, like XAUT/WETH on Uniswap, ensure tight spreads and quick exits.

In tokenized gold comparison 2026, XAUT dominates volume shares, grabbing headlines for 75% of Q4 flows alongside PAXG. Zero custody fees sweeten the deal, letting holdings grow purely on gold’s momentum. Multi-chain means DeFi across ecosystems: borrow on TRON cheaply or bridge to TON for emerging plays. If you’re an active trader, XAUT’s ecosystem feels built for velocity, not just storage.

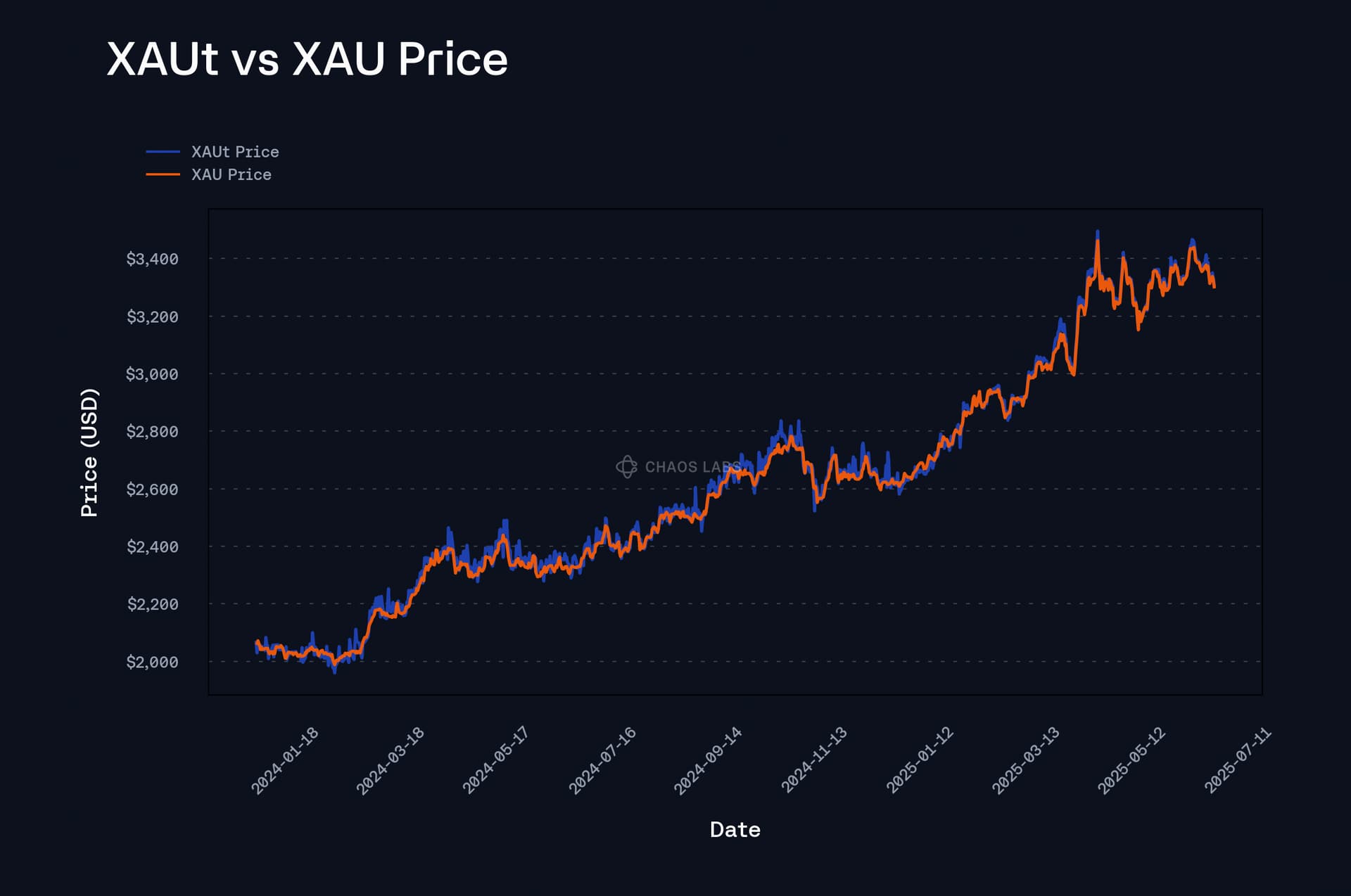

Both track gold’s price so tightly that divergences are fleeting blips, often from arbitrage. PAXG’s Ethereum ties shine for yield farmers, while XAUT’s broad reach suits cost-conscious nomads. Market data screams growth: PAXG’s 24-hour high of $5,020.06 and low of $4,936.34 show resilience amid volatility.

DeFi Yields and Real-World Edges Shaping 2026 Choices

Here’s where innovation bites. PAXG holders tap Ethereum DeFi for 2-5% APYs via lending, turning idle gold into income streams. Liquidity pools amplify this, though impermanent loss lurks. XAUT counters with cross-chain yields, lower barriers for smaller stacks. Both crush gold ETFs on accessibility: fractional ownership, instant settlement, blockchain audits over opaque custodians. As gold hedges inflation in a high-debt world, these tokens add best tokenized gold token perks like composability.

Exchanges like KuCoin and MEXC highlight these dynamics, with XAUT pushing ecosystem depth and PAXG regulatory trust. As volumes climb, expect tighter integration with RWAs, but which pulls ahead hinges on macro shifts and chain wars.

Picture this: you’re stacking digital gold as inflation whispers turn to shouts. PAXG’s Ethereum DeFi playground lets you collateralize holdings for leveraged plays, earning yields that physical gold owners can only dream of. XAUT, meanwhile, thrives in high-velocity trades across chains, where TRON’s low fees make micro-swaps viable. Recent data from MEXC and BingX pegs XAUT’s liquidity edge, with its larger market share drawing traders to tighter spreads.

Head-to-Head Metrics: Liquidity, Fees, and Beyond

PAXG vs XAUT: Key Comparison Metrics (February 2026)

| Metric | PAXG | XAUT |

|---|---|---|

| Market Capitalization | $2.01B | $2.598B |

| 24h Transaction Count | 36,700 | 18,300 |

| Supported Blockchains | Ethereum | Ethereum, TRON, TON |

| Audit Frequency | Monthly | Quarterly |

| Transaction Fees | Gas-dependent (Ethereum) | Low (multi-chain) |

| Issuer | Paxos Trust Company | Tether |

| Regulation | NYDFS-regulated | El Salvador digital assets framework |

These numbers don’t lie. PAXG’s transaction peak screams institutional hunger, while XAUT’s cap lead signals retail firepower. Both crush physical gold on liquidity, trading 24/7 without premiums eating gains. For tokenized gold comparison 2026, factor in storage: PAXG’s London vaults versus XAUT’s Swiss precision, both audited but with different cadences. Zero custody fees on XAUT tilt it for long-haul holders watching gold hover around $5,000 per ounce.

DeFi integration amps the stakes. PAXG/WETH pools on Uniswap offer deep liquidity for yield farming, though Ethereum congestion demands timing. XAUT’s LayerZero bridges unlock TRON DeFi for pennies, ideal if you’re flipping positions amid volatility. As blockchain gold tokens mature, expect RWAs to blend these further, maybe even cross-collateral yields.

PAXG & XAUT Key Pros

-

PAXG: NYDFS Regulation – Issued by Paxos Trust Company, regulated by NYDFS for ultimate trust and stability.

-

PAXG: Monthly Audits – Transparent proof-of-reserves every month, ensuring gold backing you can verify.

-

PAXG: Ethereum DeFi Yields – ERC-20 token earns yields via lending/staking on Uniswap, Aave, and more.

-

PAXG: U.S. Investor Access – Fully accessible to U.S. users thanks to NYDFS oversight.

-

XAUT: Multi-Chain Low Fees – Seamless on Ethereum, TRON, TON via LayerZero for cheap, fast txns.

-

XAUT: Higher Liquidity – $2.6B market cap edges out PAXG’s $2B for smoother trades.

-

XAUT: Zero Custody Costs – No storage fees, maximizing your gold exposure.

-

XAUT: Global Reach – Tether-backed with El Salvador framework for worldwide accessibility.

Risks linger, though. Smart contract exploits haunt DeFi wrappers, and gold’s dollar peg exposes both to fiat swings. Regulatory wildcards could crimp XAUT for U. S. folks, while PAXG’s Ethereum anchor ties it to ETH’s fate. Diversify smart: pair with stables or BTC for balance. Platforms like Binance spotlight their edge over ETFs, with fractional ounces starting at $50.

2026 Playbook: Matching Tokens to Your Strategy

Institutional types, lean PAXG. Its compliance fortress shields against crackdowns, fueling that $2.01 billion cap. Active traders? XAUT’s multi-chain rocket propels Tether Gold investment through chain-agnostic speed. Hybrids work too: hold PAXG for yield, swap to XAUT for liquidity spikes. Gold’s surge past $5,000 underscores why tokenized versions lead, blending scarcity with blockchain utility.

Explore top tokenized gold tokens for broader context, or dive into tokenized gold vs physical. As 2026 unfolds, these aren’t just hedges; they’re yield engines in a portfolio revolution. Pick your champion based on where you trade, comply, and yield-chase. The blockchain gold rush favors the bold and informed.

Ultimately, both elevate gold beyond bars and ETFs. PAXG’s steady trust pairs with XAUT’s dynamic flow, letting you hedge smart in crypto’s wild ride. With transaction volumes soaring, 2026 blockchain investors win by choosing fit over fad.