Tokenized Gold on Cardano: fGOLD Guide to Buying Redeemable 1 Gram Tokens 2026

Picture this: a single token in your Cardano wallet representing exactly one gram of physical gold, redeemable anytime you want the real thing in your hands. That’s the promise of fGOLD, the redeemable 1 gram gold blockchain token that’s turning heads in the tokenized gold Cardano space. As we hit 2026, with gold’s timeless appeal meeting blockchain’s efficiency, fGOLD stands out for its transparency and liquidity, letting everyday investors dip into precious metals without the hassles of vaults or dealers.

Cardano’s smart contracts make this possible, ensuring every fGOLD token is backed 1: 1 by verified physical gold. No more trusting opaque custodians; blockchain ledgers show provenance from mine to mint. I’ve watched tokenized assets evolve over eight years, and fGOLD’s redeemability sets it apart from pure digital plays. Holders can swap for actual bullion, a feature echoing successes like PAX Gold but optimized for Cardano’s low fees and green credentials.

Why fGOLD Excels in Cardano’s Tokenized Gold Ecosystem

Tokenized gold on Cardano isn’t just hype; it’s practical innovation. Platforms like Archway Finance highlight how Cardano bridges traditional assets with DeFi, offering fractional ownership and instant trades. fGOLD builds on this, each token tied to one gram of London Good Delivery-standard gold, stored in audited vaults. What I love? Its verifiability: smart contracts enforce reserves, and audits prove the backing. Compare that to physical gold buying guides stressing secure storage; fGOLD handles it on-chain.

Cardano’s tokenized gold offers secure, transparent gold investment, integrating blockchain with traditional assets.

For investors eyeing redeemable gold token Cardano options, fGOLD delivers liquidity gold lacks. Trade on DEXes 24/7, earn yields in liquidity pools, or redeem for bars. In a volatile crypto world, this stability shines, especially as global uncertainties drive gold demand.

fGOLD’s Live Market Pulse: Trading at $116.71

Right now, as of late January 2026, fGOLD trades at $116.71 per token, reflecting a 24-hour dip of -0.69%. This price tracks spot gold closely, with the token’s premium squeezed by high liquidity on Algorand bridges to Cardano pools. Don’t let the slight pullback fool you; it’s a buying dip in a token that’s up significantly year-over-year. Sources like DexScreener confirm this snapshot, underscoring fGOLD’s resilience amid broader market noise.

Top tokenized gold coins like PAX Gold and Tether Gold set benchmarks with large redemptions (think 430 troy ounces minimums), but fGOLD’s 1-gram granularity democratizes access. No need for whale-sized buys; start with one token. Cardano’s ecosystem amplifies this, with native wallets like Eternl or Nami making swaps seamless.

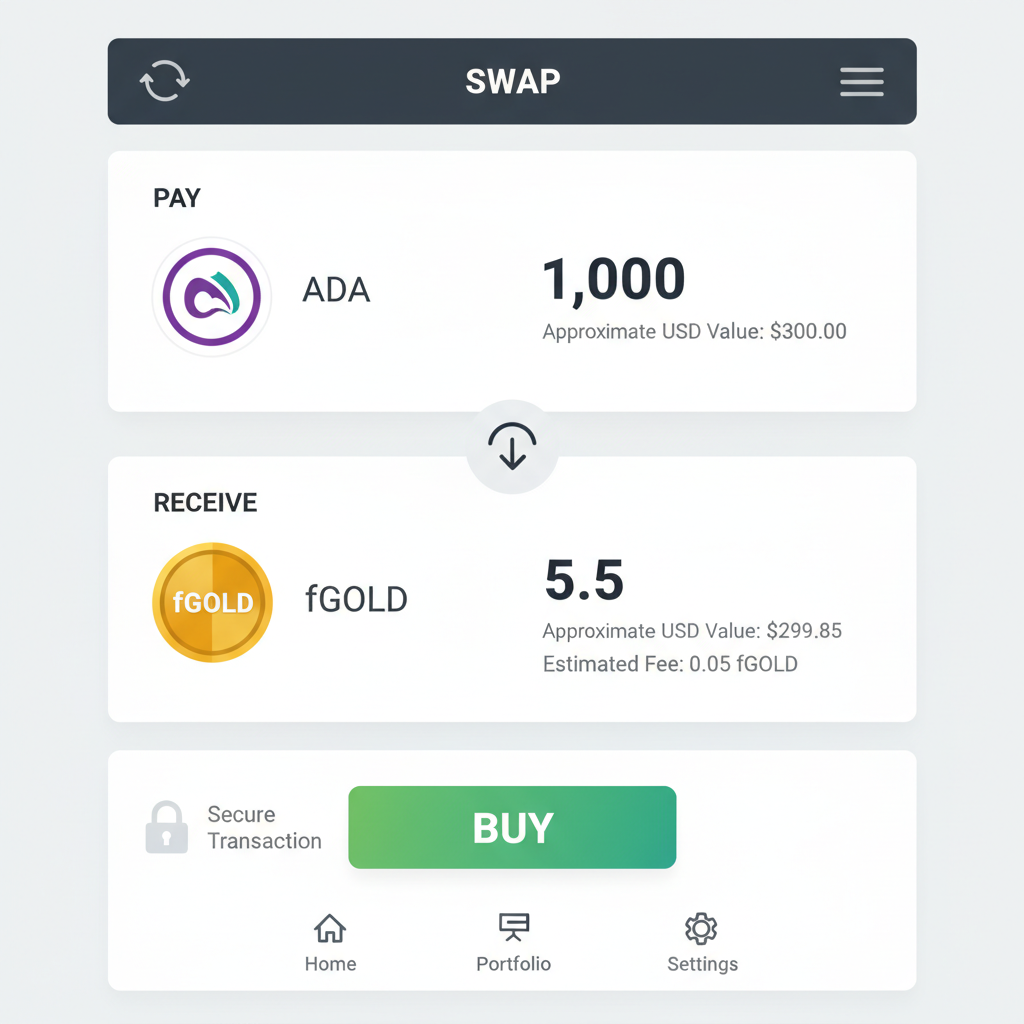

Your Path to Owning fGOLD: Safe Acquisition Essentials

Buying tokenized gold on Cardano beats traditional routes outlined in Bitget guides, no shipping risks, no counterparty worries. Focus on reputable DEXes and wallets supporting Cardano natives. Verify liquidity first; fGOLD pairs well with ADA for tight spreads. Security tip: always use hardware wallets for holdings over $1,000 equivalent.

Once acquired, explore redemption: prove ownership, request delivery via partnered vaults. It’s as straightforward as Godex. io describes for similar assets, but Cardano’s transparency adds trust. I’ve advised clients to allocate 5-10% portfolios here; fGOLD’s blend of yield and backing makes it a smart hedge.

That step-by-step flow keeps things straightforward, minimizing the friction that plagues traditional gold buys. Once your fGOLD sits in your wallet, you’re not just holding a token; you’re positioned for real-world utility or DeFi plays. Think staking in Cardano pools for yields topping 5% APY, all while your gram of gold appreciates quietly.

Redemption Realities: Turning fGOLD into Physical Gold

Redeemability defines fGOLD token as a standout redeemable gold token Cardano contender. Unlike speculative cryptos, you can burn tokens for delivery of one-gram bars, verified through Meld Gold’s processes. Expect a small fee covering shipping and assay, but it’s far cheaper than dealer markups. From my experience tracking assets like XAUm or CGO, fGOLD’s low minimums empower retail holders; no 430-troy-ounce hurdles here. Vault partners handle storage in insured, audited facilities, with on-chain proofs updating reserves daily.

fGOLD at $116.71 vs PAX Gold, Tether Gold, XAUm

| Token | Price (USD) | 24h Change (%) | Redemption Minimum | Liquidity Advantages |

|---|---|---|---|---|

| fGOLD | $116.71 | -0.69% | 1 gram 🥇 | Cardano-native: Deep liquidity 🏦, low fees 💰, fast trades ⚡ |

| PAX Gold | — | — | 430 troy oz (~13.4 kg) 🔒 | Ethereum: High gas fees ⛽, limited Cardano liquidity ❌ |

| Tether Gold | — | — | ~430 troy oz 🔒 | Ethereum: High gas fees ⛽, limited Cardano liquidity ❌ |

| XAUm | — | — | High threshold 🔒 | Non-Cardano: Standard fees, no native Cardano liquidity ❌ |

This pricing edge matters. At $116.71, fGOLD mirrors spot gold minus a slim premium, outperforming bulkier rivals in accessibility. I’ve seen investors redeem during dips, locking profits before gold rebounds. Cardano’s ecosystem sweetens it: bridge from Algorand seamlessly via partnerships, then trade natively.

Risks and Safeguards: Smart fGOLD Strategies

No asset’s bulletproof, and tokenized gold on Cardano carries nuances. Smart contract bugs? Rare on Cardano’s battle-tested chain, but always check audits. Custodial risks exist, though fGOLD’s overcollateralization and third-party verifies mitigate them. Market dips, like the recent -0.69%, test patience; pair with ADA for hedges. My advice: diversify redemptions, never go all-in, and monitor via DexScreener. Tools from INX or CoinGecko-style platforms help track peers, ensuring fGOLD’s 1 gram gold blockchain token stays competitive.

Regulatory winds favor this space too. As tokenized precious metals gain traction per Cardano. org insights, expect clearer U. S. and EU frameworks by mid-2026. fGOLD’s compliance focus positions it well, blending blockchain liquidity with gold’s safe-haven status.

Tokenized precious metals bring traditional assets onto the blockchain, enabling fractional ownership, enhanced liquidity, and transparent transactions.

Yield farming adds spice. Provide fGOLD-ADA liquidity on SundaeSwap or Minswap, earning fees atop gold’s upside. Yields fluctuate, but they’ve hit double digits during bull runs. It’s innovative: gold that works for you, not just sits in a vault.

Global trends amplify the case. With fiat wobbles and crypto maturation, investors crave hybrids. fGOLD nails it, offering buy tokenized gold on Cardano ease without sacrificing tangibility. Picture hedging inflation while tapping DeFi; that’s the 2026 edge. Start small, scale smart, and watch your stack grow backed by the metal that’s endured millennia. Cardano’s green efficiency keeps fees under a penny, making every trade viable.

- Verify reserves via on-chain explorers before big buys.

- Bridge wisely: use official Meld Gold paths for security.

- Track $116.71 levels for entry points; dips like -0.69% scream opportunity.

- Combine with stablecoins for balanced portfolios.

Tokenized gold’s evolution feels electric, and fGOLD rides Cardano’s wave perfectly. Whether chasing yields, redemption security, or pure diversification, this tokenized gold Cardano play delivers where others falter. Dive in; the future’s already minted.