Yield Bearing Tokenized Gold Tokens Like thGOLD: Passive Income Guide 2026

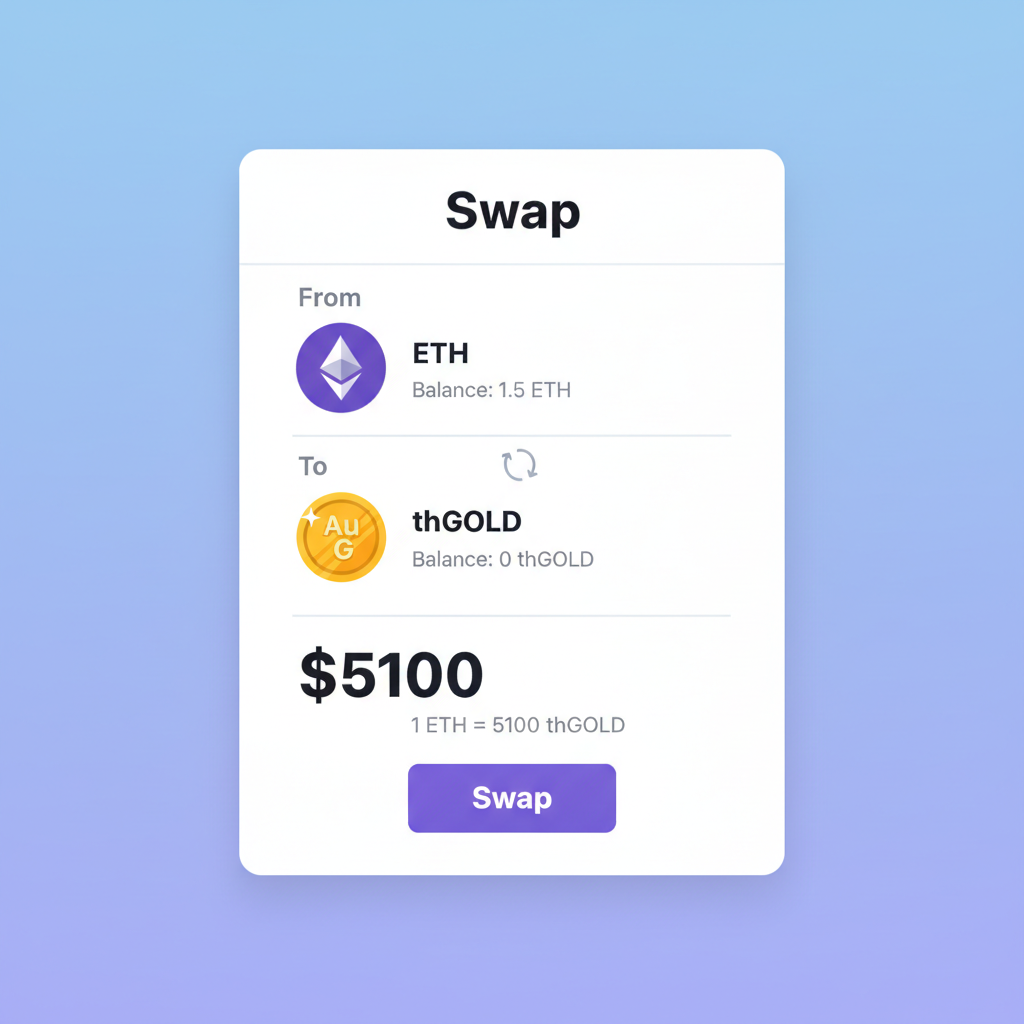

In the evolving landscape of real-world assets on blockchain, yield-bearing tokenized gold tokens like thGOLD represent a pivotal advancement for conservative investors seeking passive income tokenized gold without sacrificing the metal’s storied role as a hedge against inflation and volatility. As of January 30,2026, spot gold holds steady at $5,100.00 per ounce, underscoring its enduring appeal amid geopolitical tensions and monetary policy shifts. Platforms such as Theo Network have transformed this traditional safe haven from a zero-yield store of value into a productive asset class, blending spot price exposure with lending-derived returns.

[price_widget: Real-time price display for spot gold at $5,100.00 and thGOLD token]

This shift addresses a long-standing critique of physical gold: its negative carry cost. By tokenizing gold and deploying it in secured lending protocols, investors now capture yields that rival fixed-income alternatives, all while retaining liquidity and composability in DeFi. Theo’s thGOLD, in particular, exemplifies this innovation, tracking gold prices while generating interest through collateralized loans to verified retailers.

thGOLD and the Rise of Yield-Bearing Tokenized Gold

Theo Network’s launch of thGOLD marks a disciplined entry into yield bearing tokenized gold, partnering with Libeara and leveraging FundBridge Capital’s MG999 On-Chain Gold Fund. This regulated structure lends physical gold inventory to entities like Singapore’s Mustafa Gold, using the metal itself as collateral. Holders benefit from spot exposure at $5,100.00 alongside yields derived from these loans, distributed automatically across DeFi venues including Hyperliquid, Uniswap, Morpho, and Pendle.

From a risk management perspective, this model appeals to my conservative framework. Collateral ratios exceed 100%, with independent audits ensuring transparency. Unlike speculative crypto yields, thGOLD’s returns stem from real economic activity in gold retail, mitigating smart contract risks through battle-tested infrastructure. Early data suggests APYs in the 4-6% range, competitive with historical physical gold leasing rates of around 4.81%, but enhanced by blockchain efficiency.

Mechanics of Passive Income in thGOLD and Peers

At its core, thGOLD operates as a tokenized fund mirroring spot gold at $5,100.00 while deploying reserves into low-risk lending. Borrowers, vetted gold traders, post physical bars as collateral, enabling interest accrual that flows back to holders pro-rata. This tokenized gold staking APY mechanism avoids the pitfalls of over-collateralized crypto lending by anchoring to tangible assets, reducing liquidation cascades in downturns.

Comparable offerings include Falcon Finance’s integration of Tether Gold (XAUT), where staking locks tokens for stablecoin yields, and Libeara’s yield-enhanced wrappers. PAXG holders explore similar DeFi pools, though thGOLD distinguishes itself with on-chain composability and regulatory backing. Investors should prioritize platforms with verifiable reserves and conservative loan-to-value ratios, as I advocate in volatile environments.

For institutions, this evolution supports portfolio diversification. Allocating 5-10% to thGOLD Theo Network tokens provides gold beta with income overlay, hedging equity drawdowns while compounding returns. Retail participants gain access to yields previously reserved for sophisticated lessors, democratizing gold’s productivity.

Evaluating Risks and Returns in 2026

While enticing, XAUT PAXG yield 2026 strategies demand scrutiny. Yield sustainability hinges on lending demand, which correlates with gold’s industrial and retail usage. At $5,100.00, elevated prices bolster collateral values but may compress margins if fabrication costs rise. Counterparty risk, though minimized by physical backing, warrants ongoing due diligence.

Historical precedents inform my cautious optimism. Gold leasing markets have delivered steady, low-double-digit returns for decades, and tokenization amplifies this without introducing undue leverage. Monitor APYs quarterly; dips below 3% signal potential rebalancing. Pair thGOLD with cash equivalents for a fortified carry trade, aligning with the principle that fortune favors the well-prepared.

thGOLD Price Prediction 2027-2032

Yield-Bearing Tokenized Gold Forecasts: Tracking Spot Gold ($5,100 in 2026) with Passive Yield and DeFi Adoption Trends

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $4,900 | $5,700 | $6,800 | +11.8% |

| 2028 | $5,300 | $6,400 | $7,900 | +12.3% |

| 2029 | $5,900 | $7,200 | $9,000 | +12.5% |

| 2030 | $6,600 | $8,100 | $10,200 | +12.5% |

| 2031 | $7,400 | $9,100 | $11,500 | +12.3% |

| 2022 | $8,300 | $10,300 | $13,000 | +13.2% |

Price Prediction Summary

thGOLD is forecasted to grow steadily from an average of $5,700 in 2027 to $10,300 by 2032, benefiting from gold price appreciation, 4-6% yield generation via lending, and surging RWA/DeFi adoption. Min prices account for bearish corrections amid market cycles, while max prices reflect bullish scenarios driven by regulation and institutional inflows.

Key Factors Affecting thGOLD (Theo Network Tokenized Gold) Price

- Gold spot price trends influenced by inflation, geopolitics, and central bank buying

- RWA tokenization boom and DeFi integrations (e.g., Hyperliquid, Uniswap, Pendle)

- Yield mechanisms from gold lending (collateralized by physical inventory)

- Regulatory clarity for tokenized assets and on-chain funds

- Crypto market cycles, Bitcoin halvings, and competition from XAUT/PAXG

- Technological advancements in composability and liquidity for yield-bearing gold

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

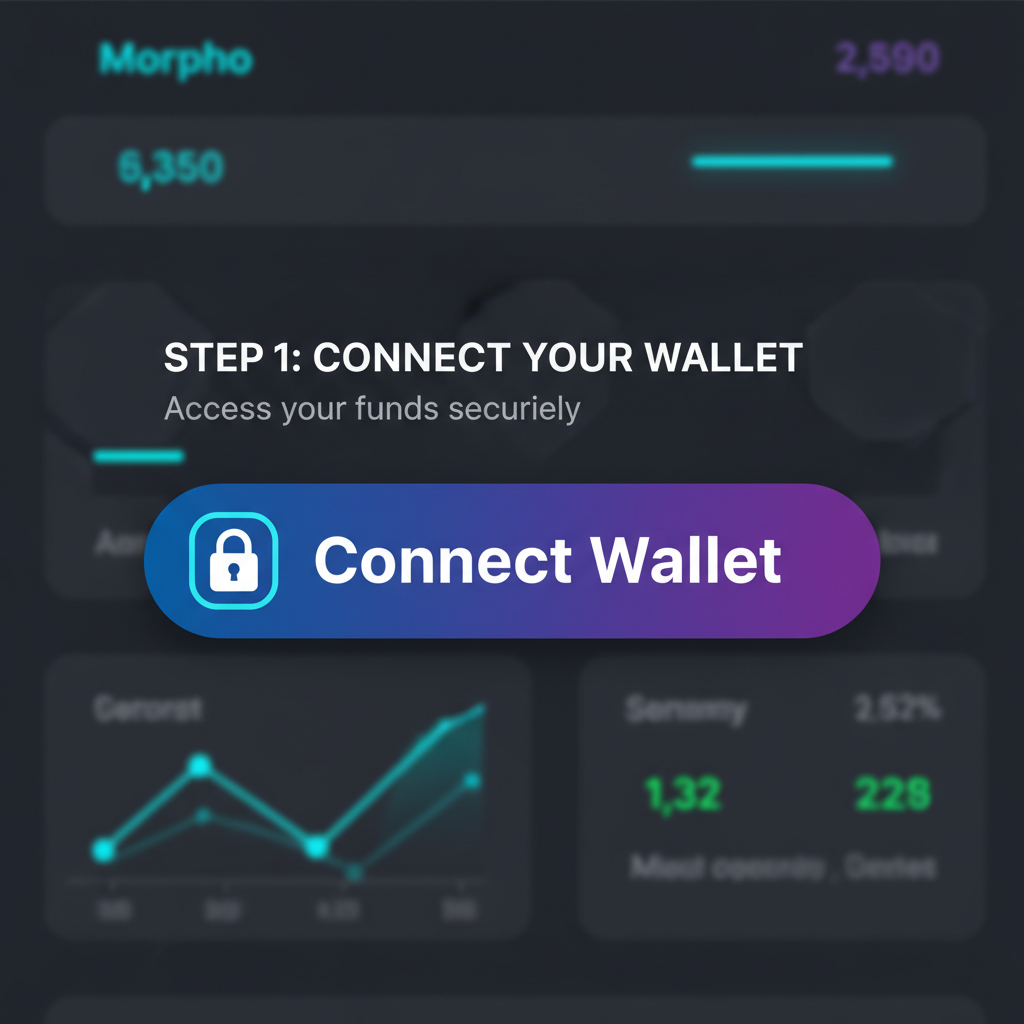

DeFi integrations further unlock utility, from Pendle fixed-yield trades to Morpho optimized lending. Yet, as a strategist, I emphasize gas fees and impermanent loss in liquidity provision; direct holding often proves superior for yield capture.

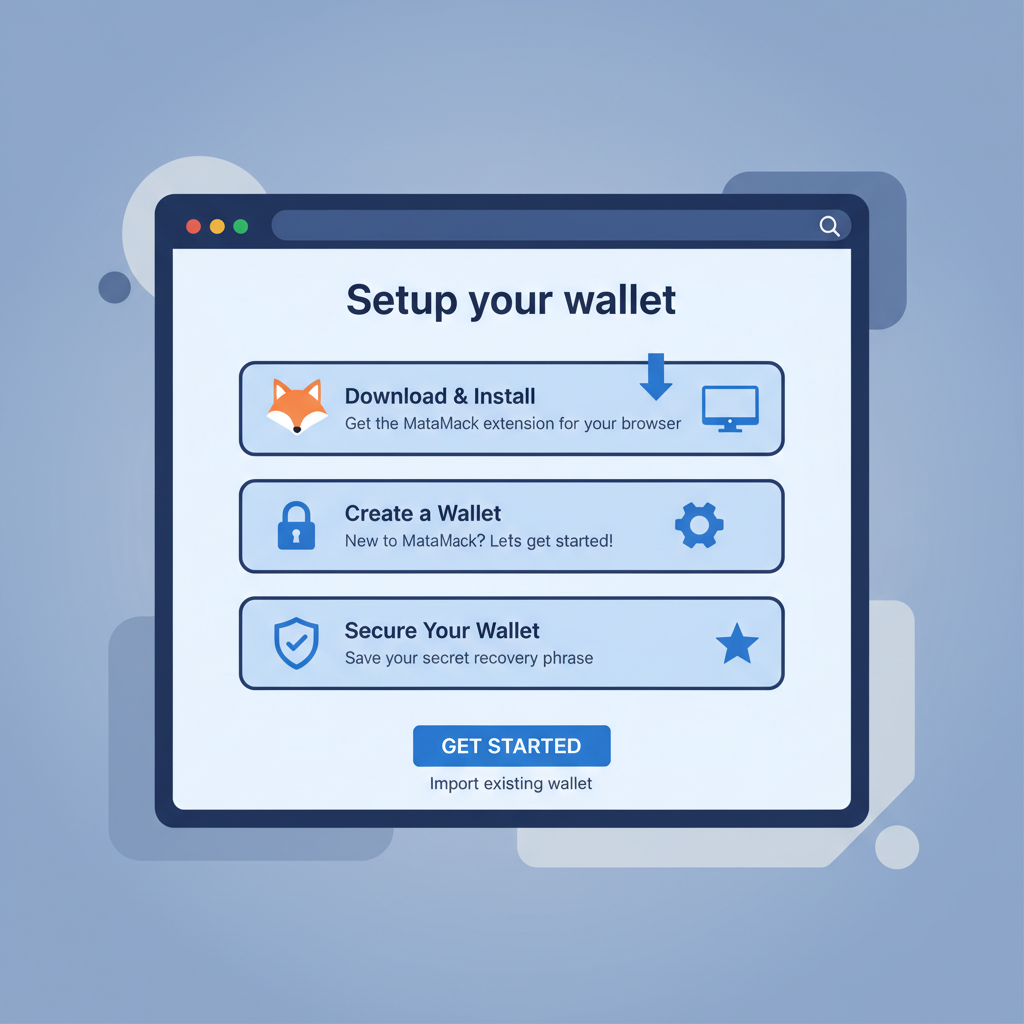

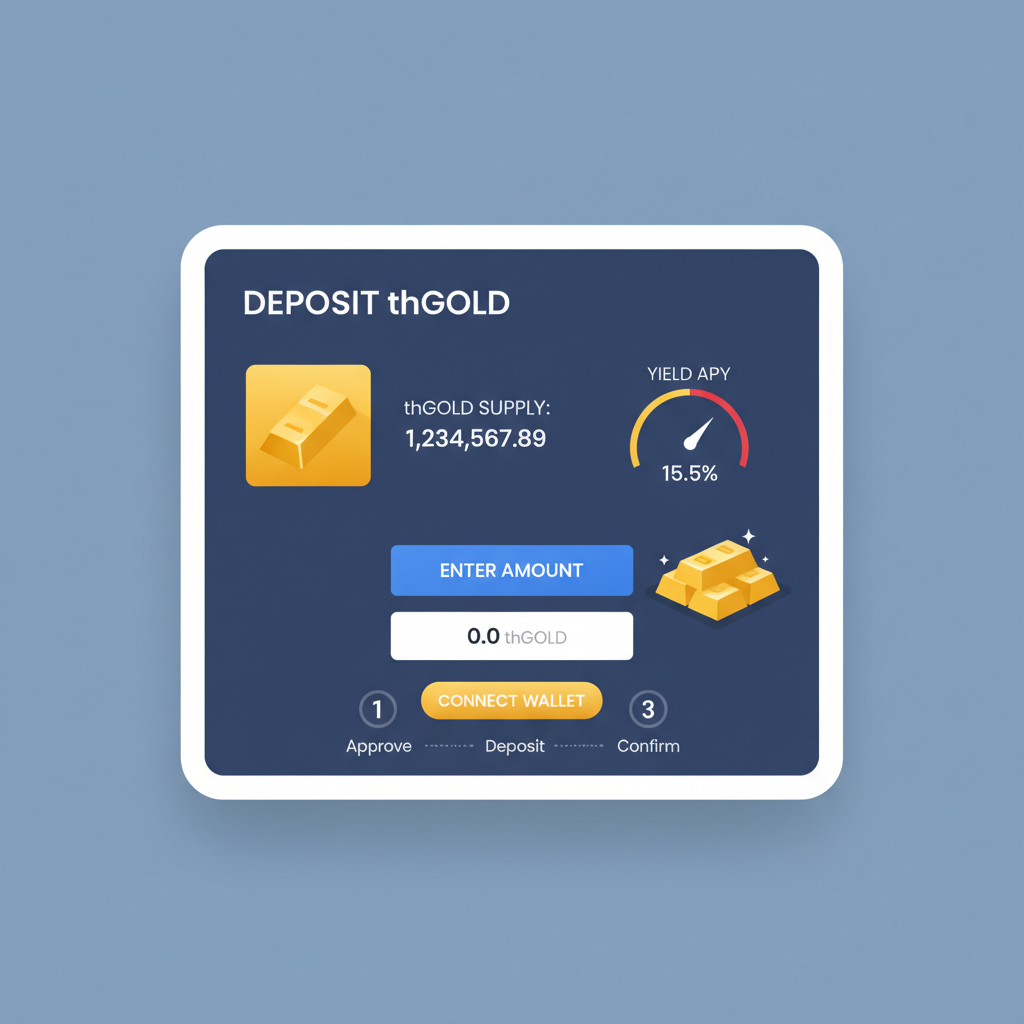

Practical implementation requires a measured approach. Begin by verifying wallet compatibility with chains hosting thGOLD, such as those supporting Hyperliquid or Uniswap. Allocate positions gradually, scaling in over weeks to average costs amid gold’s $5,100.00 stability. This discipline tempers FOMO while capturing yields from day one.

Step-by-Step Path to Earning Tokenized Gold Staking APY

Once positioned, yields accrue seamlessly. Theo’s infrastructure automates distributions, often weekly, shielding holders from operational friction. For enhanced returns, consider Pendle strategies locking future yields, though this introduces basis risk I view skeptically in non-trending markets.

Across peers, XAUT PAXG yield 2026 profiles vary. Tether Gold staking via Falcon Finance offers stablecoin payouts, appealing for fiat repatriation. PAXG integrates into broader DeFi, but fragmented liquidity demands vigilance. thGOLD’s edge lies in unified lending exposure, streamlining risk assessment.

thGOLD vs. XAUT vs. PAXG Comparison

| Token | Current APY Estimate | Collateral Type | Supported Chains | Min. Investment ($5,100 Gold) | Risk Rating |

|---|---|---|---|---|---|

| thGOLD | 4.8-5.5% | Physical gold (lending to retailers, inventory collateral) | Ethereum (Uniswap, Morpho, Pendle), Hyperliquid | $5,100 (1 oz token) | 🟢 Low |

| XAUT (Tether Gold) | 3-5% (via staking on Falcon Finance, DeFi) | Allocated physical gold | Ethereum, Tron | $5,100 (1 oz token) | 🟢 Low |

| PAXG (Pax Gold) | 2-4% (DeFi yield opportunities) | LBMA-accredited physical gold | Ethereum, Polygon, Solana | $5,100 (1 oz token) | 🟢 Low |

Delving deeper, consider macroeconomic tailwinds. Central banks’ gold accumulation, now routine, sustains physical demand underpinning these tokens. At $5,100.00, opportunity costs versus bonds narrow, positioning yield-bearing gold as a superior carry asset. Yet, my FRM lens flags duration mismatch: gold’s infinite maturity clashes with short-term lending tenors, necessitating periodic rollovers.

Institutional adoption accelerates this trend. Pension funds, eyeing RWAs, allocate to tokenized commodities for yield and auditability. Theo’s regulated pathway via MG999 appeals here, bridging TradFi diligence with DeFi speed. Retail investors, meanwhile, access these flows sans minimums once prohibitive.

Regulatory horizons merit attention. As tokenized gold matures, clarity on securities classification could catalyze inflows or impose hurdles. Jurisdictions like Singapore, home to Mustafa Gold, lead with balanced frameworks, favoring thGOLD’s model. U. S. investors navigate via offshore wrappers, a tactic I’ve employed for clients chasing uncorrelated returns.

Frequently Asked Questions on Passive Income Tokenized Gold

Optimizing portfolios demands integration. Pair thGOLD with short volatility hedges, leveraging gold’s negative correlation to risk assets. At 5-10% weighting, it buffers downturns while income offsets storage irrelevance in digital form. Track lending utilization rates; above 80% signals robust demand, below prompts scrutiny.

For derivatives enthusiasts, thGOLD enables structured plays. Sell covered calls on Hyperliquid for premium income atop lending yields, though capping upside in bull runs. My conservative bent favors plain holding, compounding at projected 4-6% amid $5,100.00 steadiness.

Looking ahead, innovations like multi-asset RWA baskets could embed thGOLD, diversifying within commodities. Yet, core appeal endures: transforming gold from inert ballast to income engine. Investors heeding verifiable mechanics over hype position for sustained advantage. Fortune favors the well-prepared, and yield-bearing tokenized gold equips portfolios accordingly.