Risks and Rewards of Commodity-Backed Tokens for Institutional Investors

Institutional investors are increasingly turning their attention to commodity-backed tokens as a way to blend the stability of traditional assets with the efficiency and innovation of blockchain technology. These digital representations of physical commodities, ranging from gold and silver to oil and agricultural products, promise new opportunities for portfolio diversification, market access, and operational efficiency. Yet, as with any emerging asset class, the path is lined with both rewards and significant risks that demand careful scrutiny.

Why Institutions Are Exploring Commodity-Backed Tokens

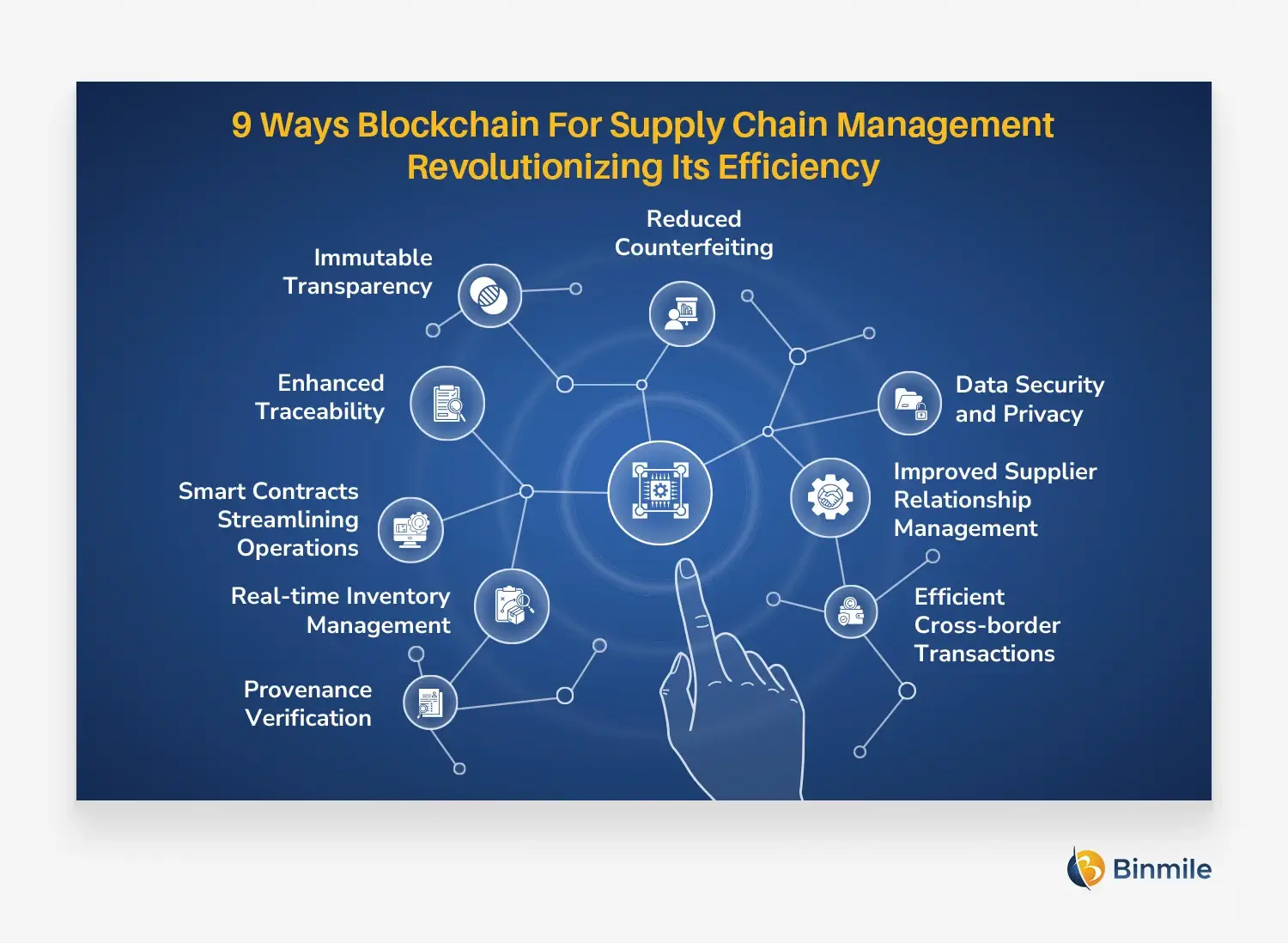

The allure of tokenized commodities lies in their potential to solve longstanding inefficiencies in traditional commodity markets. Historically, commodities have been challenging for institutional investors due to their illiquidity, high transaction costs, and opaque settlement processes. Blockchain-based tokens address many of these pain points by enabling fractional ownership, round-the-clock trading, and transparent recordkeeping.

Consider the case of tokenized gold: rather than dealing with cumbersome physical delivery or complex derivatives contracts, an investor can now hold a blockchain token representing a specific quantity of gold securely stored in a vault. This unlocks new avenues for risk management and portfolio construction.

The Rewards: Efficiency, Transparency, and Market Expansion

Key Benefits of Commodity-Backed Tokens

-

Enhanced Liquidity and Market Access: Tokenization allows institutional investors to trade fractions of physical commodities, such as gold or oil, on blockchain platforms. This increases liquidity and enables 24/7 global market access, surpassing the limitations of traditional commodity markets.

-

Reduced Transaction Costs: Blockchain-based settlement and smart contracts minimize the need for intermediaries, resulting in lower transaction fees and faster settlement times for commodity trades.

-

Transparency and Security: The use of blockchain’s immutable ledger ensures transparent and auditable records of ownership and transactions, reducing fraud risk and enhancing trust among institutional participants.

-

Portfolio Diversification and Inflation Hedge: Commodity-backed tokens provide exposure to real-world assets, offering diversification benefits and a potential hedge against inflation for institutional portfolios.

-

Programmability and Customization: Smart contracts enable the creation of tailored investment products, such as automated yield strategies or compliance controls, giving institutions greater flexibility in structuring commodity exposure.

1. Enhanced Liquidity: Tokenization transforms previously illiquid assets into tradable instruments available 24/7 on global exchanges. Fractionalization allows institutions to tailor exposures more precisely than ever before.

2. Reduced Transaction Costs: By automating settlement via smart contracts and removing unnecessary intermediaries, tokenized commodities can dramatically lower trading expenses and settlement times. According to Zoniqx Inc, these efficiencies translate directly into cost savings for large-scale market participants.

3. Increased Transparency: Every transaction is immutably recorded on the blockchain ledger. This not only reduces fraud but also increases trust among counterparties, a crucial consideration in markets where verifying asset authenticity is paramount (source).

4. Global Accessibility: By lowering minimum investment thresholds through fractionalization, tokenized commodities open up new pools of capital from around the world, potentially deepening liquidity even further.

Navigating the Risks: Regulation, Volatility, and Custody Complexities

No discussion of institutional investors commodity tokens would be complete without addressing the formidable risks associated with this evolving sector.

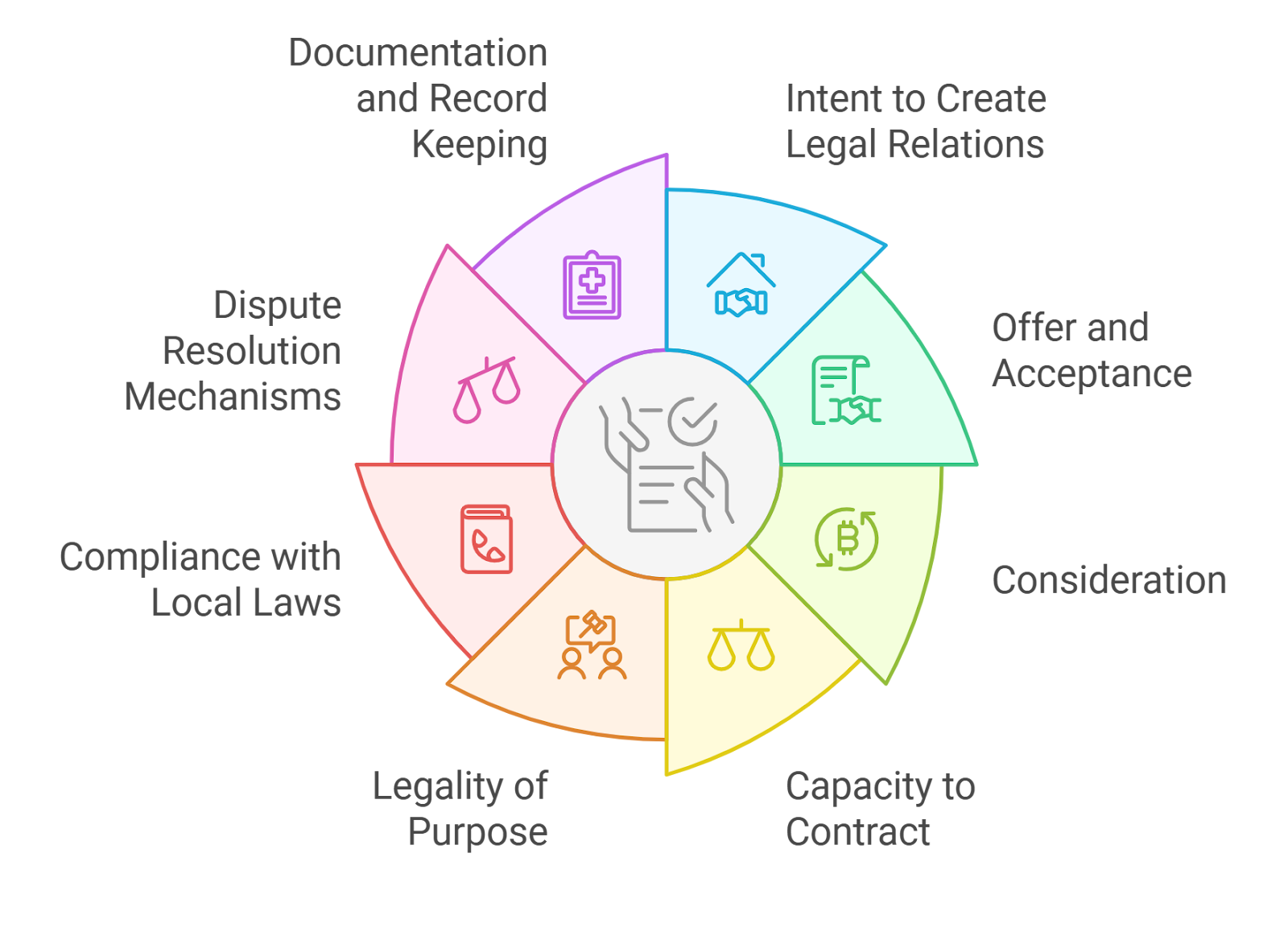

Regulatory Uncertainty: The lack of harmonized regulation across jurisdictions creates legal ambiguity that can complicate compliance strategies for even the most sophisticated institutions (MindsofCapital.com). A single misstep could expose investors to enforcement actions or reputational damage.

Market Volatility and Liquidity Gaps: While tokenization aims to enhance liquidity, actual trading volumes may remain thin for certain assets, especially during periods of stress. Moreover, price swings in the underlying commodity are directly reflected in token values; this dual exposure demands robust risk management protocols (source). Recent research also highlights that some agricultural tokens show only weak linkage to their physical counterparts, a reminder that price discovery mechanisms are still maturing.

Custody and Security Risks: The digital nature of commodity-backed tokens introduces novel custody challenges. Institutions must ensure that both the physical commodity reserves and their digital representations are securely managed. Weaknesses in smart contract code, insufficient audit trails, or lapses in physical storage protocols can expose investors to theft or loss, a risk profile quite distinct from traditional custody arrangements. As noted by industry experts, transparency and frequent third-party audits are non-negotiable for institutional-grade products.

Technological and Operational Hurdles: Integrating tokenized commodities into legacy financial systems is far from seamless. Interoperability between blockchain platforms, scalability constraints, and the ongoing threat of cyberattacks all contribute to operational complexity. Even minor disruptions can have outsized impacts on market functioning and investor confidence.

Market Manipulation and Fraud: The relative nascency and sometimes limited oversight of tokenized commodity markets can make them attractive targets for manipulation schemes. Thin liquidity, lack of standardized reporting, and insufficient surveillance mechanisms may allow bad actors to distort prices or misrepresent asset backing, potentially eroding trust in the entire ecosystem.

Top Five Risks of Commodity-Backed Tokens

-

Regulatory Uncertainty: The evolving legal landscape for tokenized commodities poses significant compliance challenges. Institutional investors face potential exposure to shifting regulations across jurisdictions, increasing the risk of legal disputes or operational disruptions. (Financial Stability Board)

-

Market Volatility and Liquidity Concerns: Despite promises of enhanced liquidity, many commodity-backed tokens trade on relatively illiquid markets. Combined with the inherent price fluctuations of underlying commodities, this can result in difficulty entering or exiting positions at favorable prices. (Cointelegraph)

-

Custody and Security Risks: Safeguarding both the physical commodity reserves and their digital representations is crucial. Weaknesses in custody solutions or smart contract vulnerabilities can expose investors to theft, fraud, or irreversible loss. (Shipping and Commodity Academy)

-

Technological and Operational Challenges: Integrating tokenized commodities into institutional workflows requires robust infrastructure. Issues like blockchain interoperability, scalability limitations, and smart contract bugs can disrupt trading and settlement processes. (Wikipedia: Asset Tokenization)

-

Market Manipulation and Fraud: The nascent and sometimes unregulated nature of tokenized commodity markets increases vulnerability to manipulation schemes and fraudulent activities, undermining investor confidence and market stability. (BlockApps)

Best Practices for Institutional Investors

Institutions considering an allocation to commodity-backed tokens should approach with a disciplined framework that includes:

- Rigorous Due Diligence: Scrutinize token issuers’ credibility, audit procedures, reserve management practices, and smart contract codebases.

- Diversification: Avoid overconcentration in any single token or commodity class; spread exposures across multiple assets and platforms.

- Regulatory Monitoring: Stay abreast of evolving legal requirements across jurisdictions; engage with legal counsel experienced in digital assets.

- Custody Solutions: Partner with reputable custodians offering insurance coverage, regular audits, and robust cybersecurity protocols.

- Stress Testing and Scenario Analysis: Model potential liquidity crunches or extreme price movements to gauge portfolio resilience under adverse conditions.

This emerging asset class is not for the complacent. The fusion of blockchain innovation with real-world commodities offers significant promise, but only for those who pair optimism with vigilance. As regulatory clarity improves and market infrastructure matures, institutional participation will likely accelerate. For now, successful navigation demands a careful balance between seizing new opportunities and mitigating complex risks unique to this frontier.