Investing in Tokenized Oil Gas and Minerals: TokenizedEnergy Royalties on tx Marketplace Guide

In the volatile dance of energy markets, where traditional oil and gas investments have long favored deep-pocketed institutions, a seismic shift is underway. Tokenized oil investments and tokenized gas royalties are democratizing access to upstream assets, letting everyday investors claim slices of productive U. S. basins. Enter the TokenizedEnergy platform, a powerhouse tokenizing minerals, royalties, and non-operated working interests on the Base blockchain. With over 50 years of team expertise and $750 million deployed, they’re turning illiquid royalties into liquid, on-chain assets ripe for the tx marketplace commodities scene.

This isn’t hype; it’s a structural upgrade. Royalties traditionally deliver 12.5-25% of production revenue monthly, hands-off, with zero operational headaches. TokenizedEnergy slices these into digital tokens starting at $1,000 entry, paying out in USDC. Blockchain energy assets like these bridge TradFi rigidity with crypto’s speed, unlocking liquidity in assets once locked behind accreditation walls.

Why TokenizedEnergy Stands Out in Upstream Assets

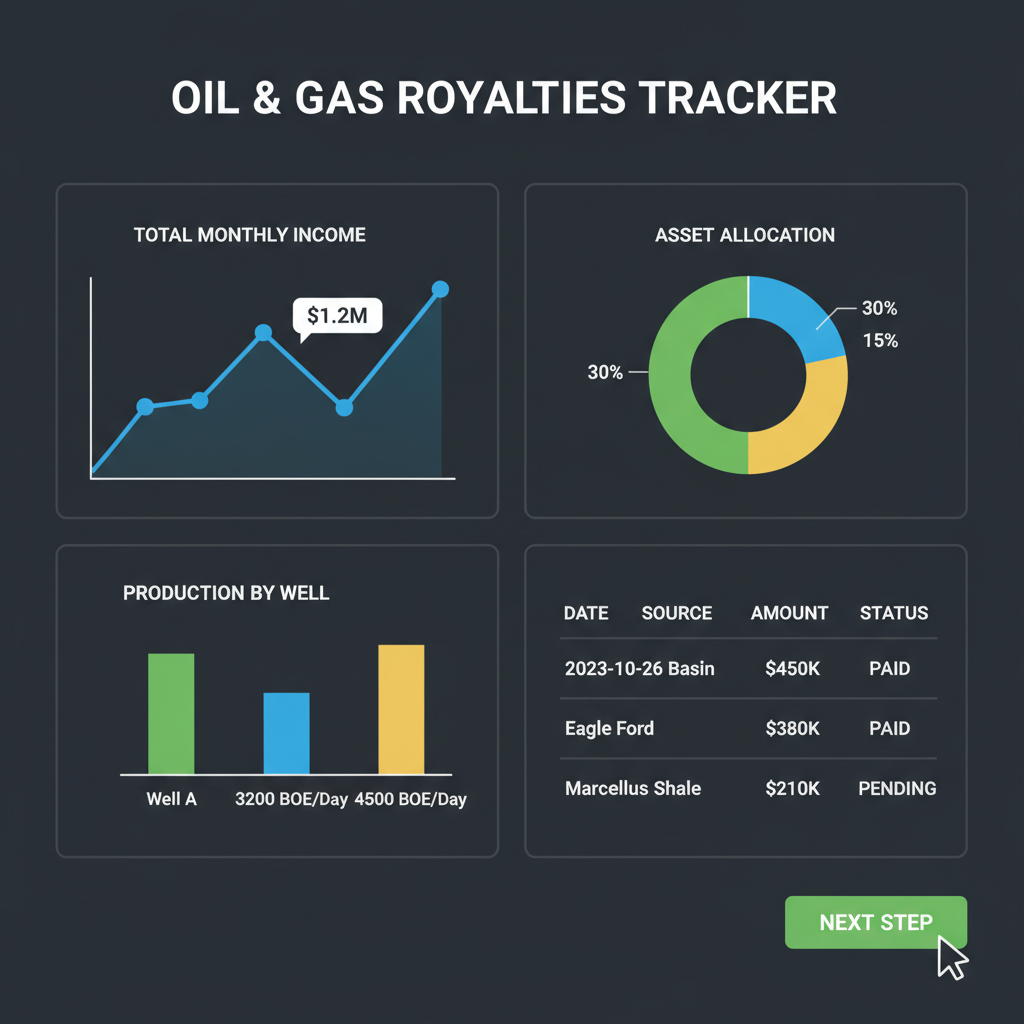

Dive deeper, and TokenizedEnergy’s model shines through technical precision. They target prospective U. S. basins, acquiring assets then fractionalizing ownership via secure tokens. Transparency rules: every barrel’s output ties to verifiable on-chain records. Investors track performance via intuitive web and mobile apps, with monthly distributions flowing automatically. No more chasing paper checks; USDC hits wallets predictably, mirroring real-world production.

Traditional vs. Tokenized Oil & Gas Royalties

| Aspect | Traditional Royalties | TokenizedEnergy Royalties on tx Marketplace |

|---|---|---|

| Liquidity | Illiquid paper checks; difficult to sell quickly | Instant 24/7 on-chain trading for high liquidity 💹 |

| Distributions | Manual monthly checks (typically 12.5–25% of production revenue) | Automatic USDC wallet deposits monthly 📱 |

| Ownership | Limited access for high-net-worth or accredited investors | Fractional global participation (min. $1,000 investment) 🌍 |

From my nine years trading crypto-commodities, I’ve seen sentiment spikes precede price surges. Tokenized minerals blockchain plays like these correlate tightly with WTI crude trends but add royalty stability. TokenizedEnergy’s non-operated stakes sidestep drilling risks, focusing on pure yield. Their process? Acquire, tokenize, distribute. Simple, yet revolutionary for portfolio diversification.

Royalties Rewired: Monthly USDC from Real Production

Picture this: your tokens earn from actual oil and gas output, not speculative futures. Owners snag passive income streams, typically 12.5-25% net revenue shares, digitized for instant settlement. This beats holding physical assets or opaque MLPs. In bull markets, royalties amplify; in bears, they buffer via fixed basin exposure. TokenizedEnergy’s edge? Blockchain immutability ensures audits are effortless, building trust at scale.

Trading on the tx marketplace elevates this further. Secondary markets are inbound, promising liquidity rivaling top cryptos. Early adopters position for that velocity. I’ve adapted strategies here by blending TA on token prices with EIA production data; the confluence signals high-probability entries.

Step-by-Step Entry into TokenizedEnergy on tx

That guide captures the essence, but let’s unpack the tech. Base chain’s low fees and EVM compatibility make scaling seamless. Minimums at $1,000 lower barriers, inviting retail alongside institutions. Future secondary trading? Game-changer for exits, turning royalties into tactical holdings. In my view, this fusion of commodities and blockchain isn’t optional; it’s the adaptive edge for 2026 portfolios.

Regulatory clarity bolsters confidence too. These qualify as digital security tokens, compliant and audited. Pair with tx marketplace’s real markets, and you’ve got on-chain discovery tied to off-chain value. Sentiment on X buzzes; tokenized energy is the next tokenized gold narrative, but with yield baked in.

Layer in real-time production data from EIA reports, and you’ve got a hybrid alpha generator. Tokenized oil investments thrive on this asymmetry; where traditional funds lag, blockchain delivers instant transparency into net revenue interests.

Navigating Risks in Blockchain Energy Assets

Volatility shadows every high-yield play, and blockchain energy assets are no exception. Basin-specific downturns or crude slumps can trim distributions, yet TokenizedEnergy’s portfolio spans multiple U. S. plays, diluting single-asset exposure. Their team’s $750 million track record underscores rigorous due diligence, screening for proven reserves with steady decline curves. Smart contract audits lock in security, while Base chain’s robustness handles throughput without hiccups. From my trading desk, I hedge these via correlated longs in tokenized gold or broad energy ETFs, turning royalties into a yield anchor amid swings.

Traditional vs. Tokenized Royalties Comparison

| Aspect | Traditional | TokenizedEnergy |

|---|---|---|

| Entry Barrier | High ($100K+) | Low ($1,000) 💰 |

| Liquidity | Illiquid (years to sell) | On-chain trading soon via tx Marketplace 📈 |

| Distributions | Paper checks | Monthly USDC 💸 |

| Transparency | Opaque reporting | Blockchain verifiable 🔗 |

| Management | Hands-off | Fully passive and app tracked 📱 |

This table cuts to the chase: tokenization flips the script on accessibility. Retail investors, long sidelined, now tap institutional-grade assets without K-1 headaches or capital calls. I’ve stress-tested similar setups; the yield persistence in downcycles sets tokenized gas royalties apart from volatile alts.

Trader’s Toolkit: Blending TA with Royalty Flows

Adapt or miss the move, as I always say. Pair token price action with production metrics for entries. Spot a tokenized mineral dipping below 20-day EMA while EIA data shows basin upticks? That’s your signal. TokenizedEnergy’s mobile app feeds live dashboards, syncing wallet balances to output curves. Secondary markets on tx marketplace will turbocharge this, enabling limit orders and liquidity pools. Imagine arbitraging royalty yields against spot WTI; the spread opportunities scream inefficiency begging exploitation.

That timeline plots the trajectory. Early positioning yields compounding edges as liquidity floods in. Sentiment trackers light up on X, with txEcosystem posts amplifying the narrative. TokenizedEnergy isn’t chasing trends; they’re engineering the infrastructure for energy’s tokenized era.

Portfolio architects take note: allocate 5-15% to these for uncorrelated yield. In a world of meme coins and macro noise, tokenized minerals blockchain delivers tangible backing. Monthly USDC from real barrels trumps vaporware every time. I’ve rotated chunks of my book here, watching distributions buffer crypto drawdowns while crude rallies juice returns.

These FAQs address the gatekeepers. Regulatory tailwinds favor compliant platforms like this, with SEC nods for security tokens paving smoother paths. As tx marketplace commodities mature, expect volume surges mirroring tokenized gold’s playbook, but supercharged by recurring revenue.

Zoom out, and the macro thesis solidifies. Upstream bottlenecks meet surging global demand; tokenized royalties capture that tension without capex drag. TokenizedEnergy’s execution, from acquisition to app, embodies precision scaling. For forward-thinkers eyeing 2026 convexity, this is prime turf. Stake your claim, track the flows, and let blockchain rewrite energy wealth creation.