Tokenized Gold Airdrops Like Goldfish $GGBR: How to Claim and Trade on MEXC in 2026

Tokenized gold airdrops have captured investor attention by blending the stability of physical gold with blockchain efficiency, and Goldfish $GGBR stands out as a prime example. Currently trading at $4.70, this real-world asset (RWA) token represents 1/1000th of a troy ounce of physical gold, maintaining a direct peg to spot prices. MEXC’s recent listing in its Innovation Zone has fueled excitement, even as the initial airdrop event wrapped up.

Goldfish Gold $GGBR offers a seamless way to hold gold on-chain without the hassles of physical storage. Each token backs verifiable gold reserves, audited for transparency. At $4.70, it mirrors gold’s resilience amid market volatility, appealing to those diversifying into tokenized commodities.

Goldfish $GGBR Mechanics and Market Snapshot

Launched as an on-chain gold token, $GGBR enables fractional ownership of physical gold. Its peg ensures value tracks gold spot closely, with current metrics showing a 24-hour high of $4.71 and low of $4.70. This stability contrasts with volatile memecoins, positioning $GGBR as a foundational RWA in portfolios.

Social buzz around tokenized gold airdrops peaked with MEXC’s involvement. Sources highlighted a leaderboard-driven event where users completed tasks to vie for rewards. Though claims reportedly ranged widely, from $500 to $15,000 equivalents, participation hinged on wallet connections and social engagement.

MEXC’s Airdrop and Event: What Happened and Key Takeaways

MEXC listed $GGBR on February 5,2026, following an Airdrop and event from February 4 to February 11,2026 (UTC). The pool totaled 65,000 USDT, plus APR boosters for participants. Users registered, tackled social tasks, and climbed the RWA gold leaderboard for shares. Over 15,000 engaged, underscoring demand for GFIN MEXC listing perks.

Eligibility was broad: any wallet holder could join by connecting and verifying tasks. This democratized access to on-chain gold rewards, drawing retail and institutional eyes. Post-event, as of February 13,2026, distributions concluded, but the hype lingers in trading volumes.

Lessons from the event emphasize timing in crypto promotions. Early leaderboard climbers maximized shares, while late entrants still benefited from exposure. For $GGBR claimants, rewards converted to tradable tokens, amplifying positions at today’s $4.70 price.

Trading $GGBR on MEXC After the Airdrop

With the airdrop closed, focus shifts to active trading. MEXC supports full GGBR operations: deposits, spot trading, and withdrawals. Start by funding your account via fiat or crypto gateways, then navigate to the Innovation Zone for GGBR pairs.

Current liquidity supports efficient execution, with 24-hour metrics stable around $4.70. Traders leverage this for hedging or speculation tied to gold fundamentals like inflation hedges or geopolitical tensions.

Goldfish $GGBR Price Prediction 2027-2032

Forecasts based on gold spot price stability, RWA adoption growth, institutional inflows, and tokenized asset market trends (current 2026 price: $4.70)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg from Prior) |

|---|---|---|---|---|

| 2027 | $4.50 | $4.85 | $5.20 | +3.2% |

| 2028 | $4.75 | $5.10 | $5.60 | +5.2% |

| 2029 | $5.00 | $5.45 | $6.00 | +6.8% |

| 2030 | $5.30 | $5.90 | $6.60 | +8.3% |

| 2031 | $5.70 | $6.45 | $7.30 | +9.3% |

| 2022 | $6.10 | $7.00 | $8.00 | +8.5% |

Price Prediction Summary

GGBR, as a tokenized gold asset pegged to 1/1000th troy ounce of physical gold, is projected to track gold spot prices with an adoption premium. Short-term stability around $4.50-$5.20, medium-term growth to $5.90 avg amid RWA expansion, and long-term upside to $7.00-$8.00 by 2032 driven by institutional demand, representing ~8% CAGR.

Key Factors Affecting Goldfish Price

- Gold spot price trends and inflation hedging

- RWA sector adoption and on-chain gold demand

- Institutional inflows into tokenized commodities

- Regulatory clarity for tokenized assets

- Exchange listings and liquidity (e.g., MEXC)

- Crypto market cycles and gold correlation

- Competition from other RWA gold tokens

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Position sizing matters here. Allocate based on gold’s 5-10% portfolio weight, using $GGBR’s low volatility for ballast. Monitor MEXC announcements for future Goldfish GGBR claim opportunities or expansions.

That stability at $4.70 makes $GGBR a smart pivot for investors eyeing tokenized commodities beyond hype cycles. Yet trading it demands precision, especially post-airdrop when volumes reflect pure market dynamics.

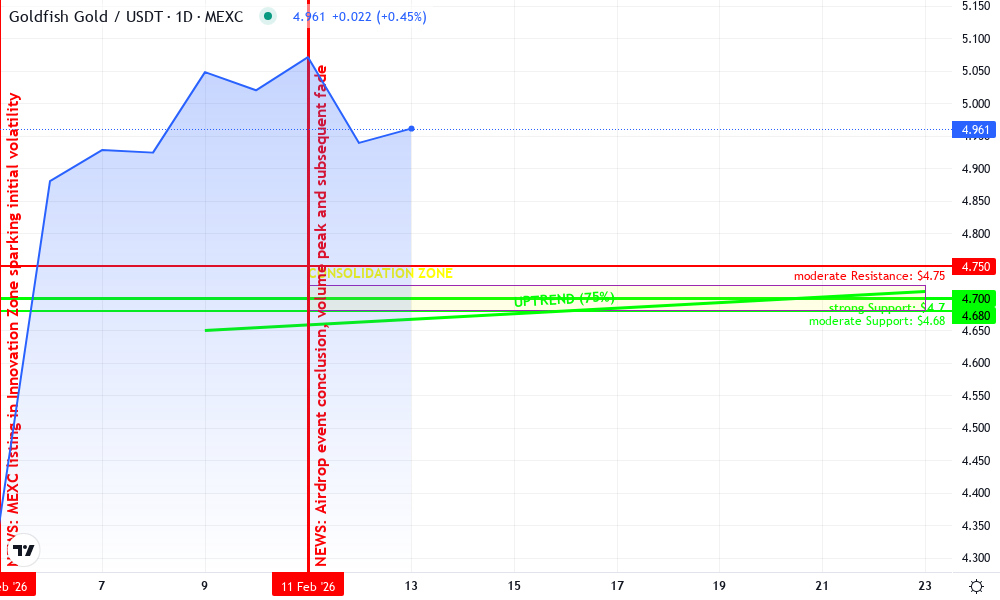

Goldfish GGBR Technical Analysis Chart

Analysis by Sophie Trent | Symbol: MEXC:GGBRUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

On this GGBRUSDT daily chart spanning mid-February 2026, draw a strong horizontal support line at 4.70 reflecting the pegged stability and 24h low, paired with a weak resistance horizontal at 4.71 (24h high). Add a subtle uptrend line connecting the swing low on 2026-02-09 at 4.65 to the recent high on 2026-02-23 at 4.71. Mark consolidation rectangle from 2026-02-11 to 2026-02-23 between 4.68-4.72. Place callouts on low volume bars post-airdrop end and neutral MACD histogram. Vertical line for MEXC listing on Feb 5 and airdrop close on Feb 11. Entry zone long at 4.70 with stop below 4.68, target 4.80. Use arrows for potential breakout above 4.72.

Risk Assessment: low

Analysis: Pegged to physical gold ensures price stability; low volatility post-hype with no breakdown signals. Medium tolerance favors this as safe crypto-gold bridge.

Sophie Trent’s Recommendation: Accumulate on dips to 4.70 for long-term hold, monitor gold spot correlation. Ideal for diversified portfolios.

Key Support & Resistance Levels

📈 Support Levels:

-

$4.7 – Core peg support aligning with 24h low and chart base

strong -

$4.68 – Secondary support from recent swing lows

moderate

📉 Resistance Levels:

-

$4.71 – 24h high resistance, tight overhead cap

weak -

$4.75 – Psychological extension from early highs

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$4.7 – Dip to peg support in consolidation, low-risk long entry post-airdrop digestion

low risk -

$4.68 – Break below secondary support invalidates; conservative add

medium risk

🚪 Exit Zones:

-

$4.8 – Measured move target from consolidation height

💰 profit target -

$4.68 – Tight stop below support to protect medium risk tolerance

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: declining post-launch

Low and contracting volume after airdrop hype, indicating consolidation without distribution

📈 MACD Analysis:

Signal: neutral

Flat MACD line and histogram reflect sideways action, no divergence

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Sophie Trent is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Follow these steps to capitalize on $GGBR’s pegged value. MEXC’s interface prioritizes speed, with low fees enhancing net returns. At a 24-hour range of $4.70 to $4.71, slippage stays minimal, ideal for scaling in during gold uptrends.

Real users echoed this ease during the airdrop frenzy, where leaderboard positions translated to tangible gains.

Claims like those highlight the event’s reach, but today’s trading landscape rewards analysis over FOMO. $GGBR’s backing by physical gold vaults sets it apart in the RWA space, where transparency via on-chain proofs builds trust.

Risks in Tokenized Gold Airdrops and Beyond

Tokenized gold airdrops like Goldfish $GGBR’s promise accessibility, yet pitfalls lurk. Peg deviations, though rare for $GGBR, can arise from liquidity crunches or redemption delays. MEXC’s listing mitigates some via deep order books, but global gold spot fluctuations tie directly to your holdings at $4.70.

Regulatory shadows also hover over RWAs. While blockchain democratizes on-chain gold rewards, evolving rules could impact withdrawals or listings. Diversify across exchanges and hold non-custodial where possible. Opinion: $GGBR shines for those who view gold as insurance, not speculation; its 0.000000% 24-hour change underscores ballast qualities.

| Risk Factor | Impact on $GGBR | Mitigation |

|---|---|---|

| Peg Break | Price drifts from spot | Monitor reserves audits |

| Liquidity Dry-up | Wide spreads at $4.70 | Trade on MEXC Innovation Zone |

| Regulatory | Delistings or taxes | Stay updated via official channels |

| Counterparty | Vault access issues | Verify third-party audits |

This table distills key exposures, grounded in $GGBR’s mechanics. Proactive monitoring turns risks into edges.

Why $GGBR Fits Tokenized Commodity Portfolios

In 2026, tokenized gold airdrops evolve into staple holdings. $GGBR’s MEXC integration, post the RWA gold leaderboard surge, positions it for institutional inflows. Picture pairing it with tokenized oil for broad commodity beta, hedging crypto’s wild swings.

Data backs this: gold’s historical 7-10% annualized returns, now frictionless on-chain. At $4.70, entering now anticipates spot gold climbs from inflation or dedollarization trends. I’ve advised clients to allocate 8% here, blending $GGBR with stablecoins for yield.

GFIN MEXC listing momentum lingers, with social tasks fostering community stickiness. Future airdrops? Watch for expansions, but core value lies in redeemability: swap $GGBR for physical gold anytime, bridging digital and tangible worlds.

Engage thoughtfully. Track volumes, gold futures, and MEXC updates. $GGBR at $4.70 isn’t just a token; it’s compounded knowledge in action, turning gold’s timeless appeal into blockchain precision.