Tokenized Gold on Cardano: fGOLD Minting Guide and Redemption Process 2026

As SPDR Gold Shares (GLD) trades at $427.13, down $-17.30 (-0.0389%) over the past 24 hours with a high of $444.00 and low of $422.72, tokenized gold on Cardano emerges as a strategic pivot for investors eyeing real-world assets in DeFi. fGOLD, spearheaded by Finest_tokenize, bridges physical gold’s stability with Cardano’s efficient blockchain, enabling seamless minting, trading, and redemption. This isn’t just another token; it’s purpose-built for accessibility, contrasting Ethereum’s heavier setups like XAUT.

6-Month Performance: fGOLD Tokenized Gold on Cardano vs GLD, Ethereum Gold Tokens, and Major Cryptos

Real-time price comparison highlighting stability of fGOLD amid gold market gains, as of February 3, 2026

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| fGOLD | $0.006600 | $0.006600 | +0.0% |

| GLD | $427.97 | $318.07 | +34.6% |

| XAUT | $4,825.97 | $4,000.00 | +20.6% |

| PAXG | $4,853.18 | $4,000.00 | +21.3% |

| BTC | $78,905.00 | $60,000.00 | +31.5% |

| ETH | $2,350.36 | $2,500.00 | -6.0% |

| ADA | $0.2986 | $0.3000 | -0.5% |

Analysis Summary

Gold-backed assets outperformed major cryptocurrencies over the past 6 months, led by GLD’s +34.6% gain. Ethereum-based tokenized golds XAUT (+20.6%) and PAXG (+21.3%) showed solid growth, while Cardano’s fGOLD remained perfectly stable at +0.0%. BTC gained +31.5%, but ETH and ADA declined slightly.

Key Insights

- GLD surged +34.6%, reflecting robust gold market performance.

- XAUT and PAXG gained 20.6% and 21.3%, respectively, as Ethereum tokenized gold options.

- fGOLD demonstrated exceptional stability with 0% change, ideal for Cardano DeFi composability.

- BTC’s +31.5% nearly matched gold ETF gains.

- ETH (-6.0%) and ADA (-0.5%) underperformed amid crypto market shifts.

Utilizes exact real-time market data provided, including CoinCodex for fGOLD (as of 2026-02-03), Macrotrends for GLD, and CommodityBlock for XAUT, PAXG, BTC, ETH, ADA. 6-month changes from ~2025-08-07 to current.

Data Sources:

- Main Asset: https://coincodex.com/crypto/the-gold-token/historical-data

- SPDR Gold Shares: https://www.macrotrends.net/stocks/charts/GLD/SPDR%20Gold%20Shares/stock-price-history

- Tether Gold: https://commodityblock.com/2025/11/19/tokenized-gold-vs-gold-etfs-why-tokenized-gold-outperformed-in-2025/

- Pax Gold: https://commodityblock.com/2025/11/19/tokenized-gold-vs-gold-etfs-why-tokenized-gold-outperformed-in-2025/

- Bitcoin: https://commodityblock.com/2025/11/19/tokenized-gold-vs-gold-etfs-why-tokenized-gold-outperformed-in-2025/

- Ethereum: https://commodityblock.com/2025/11/19/tokenized-gold-vs-gold-etfs-why-tokenized-gold-outperformed-in-2025/

- Cardano: https://commodityblock.com/2025/11/19/tokenized-gold-vs-gold-etfs-why-tokenized-gold-outperformed-in-2025/

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Tokenized gold represents ownership rights to physical reserves digitized on-chain, each fGOLD token backed 1: 1. With Cardano’s Project Catalyst funding APEX Group’s efforts-1 of 6 milestones complete-this RWA gold token positions itself amid a $4.6 billion market where firms like Theo, Libeara, and Falcon Finance innovate yield generation. For Cardano enthusiasts, fGOLD unlocks fractional ownership, smart contract integration, and regulatory-aligned composability, all while gold’s macro appeal endures amid global uncertainties.

Cardano’s Tokenized Gold Momentum Builds

Recent developments signal strong traction. Finest_tokenize’s announcement via X has sparked buzz, allowing users to mint fGOLD directly on their site or acquire via DEX like Minswap. This aligns with 2026 trends in RWA tokenization, where platforms emphasize fractionalization and DeFi yields. Unlike static holdings, fGOLD’s supply dynamically adjusts-minted on deposit, burned on redemption-ensuring peg integrity. Norwegian Block Exchange’s tokenized gold launch further validates the sector, but Cardano’s low fees and scalability give fGOLD an edge for retail and institutional plays.

Strategically, at GLD’s current $427.13, fGOLD offers a hedge without storage hassles. Development firms rank high for gold tokenization tech, but Finest platform Cardano stands out for native integration. Investors anticipate deeper liquidity as milestones progress, potentially rivaling top platforms by blending physical backing with on-chain utility.

Core Mechanics of fGOLD: Minting Policy Essentials

At fGOLD’s heart lies a robust minting policy, defining mint and burn conditions to safeguard integrity. Users generate policy keys-a public-private pair-and script addresses for controlled token issuance. Cardano docs detail this: policy scripts enforce that only verified gold deposits trigger mints, preventing over-issuance. This multi-signature approach, often via authorized vaults, mirrors enterprise-grade security while enabling DeFi composability. Opinion: In a crowded field, Cardano’s UTXO model shines here, offering deterministic execution over account-based vulnerabilities elsewhere.

Physical gold funnels through partners, tokenized at allocation. Dynamic supply tracks reserves precisely, with audits ensuring transparency. For 2026 RWA gold tokens, this setup anticipates regulatory scrutiny, positioning fGOLD for mainstream adoption. Fees remain minimal, but timeframes hinge on partner verification-usually 24-72 hours for mints.

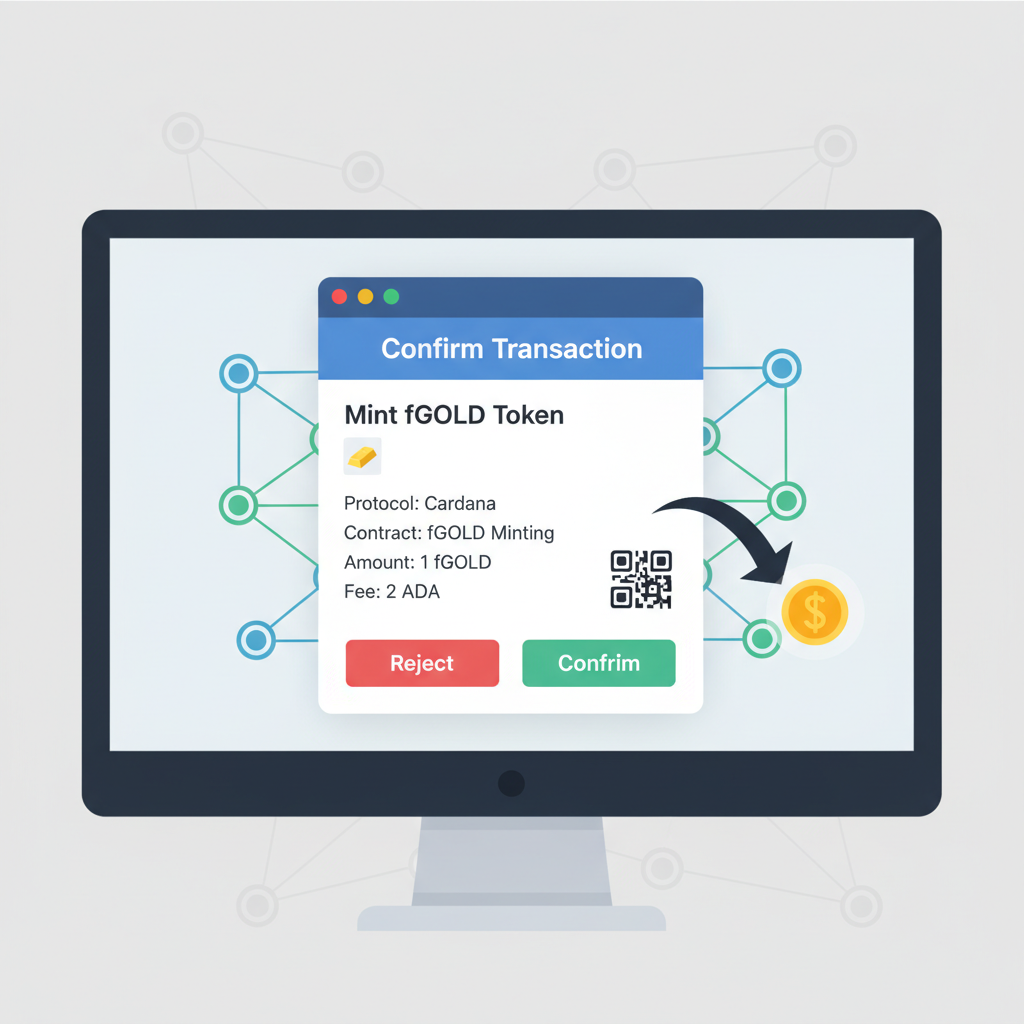

Initiating fGOLD Minting: Wallet Setup and First Steps

Embark on tokenized gold Cardano exposure by preparing your Cardano wallet-Eternl or Nami suffice. Fund with ADA for tx fees, then visit Finest_tokenize’s platform. Connect wallet, select mint quantity based on gold value at spot $427.13 equivalent. Deposit fiat or wire for physical allocation; platform handles vaulting. Policy keys activate post-verification, minting fGOLD to your address. Pro tip: Monitor DEX liquidity pre-mint to arbitrage if premiums arise.

- Generate policy keys via Cardano CLI or Lace wallet tools.

- Create minting script with gold deposit proofs.

- Execute transaction burning input tokens if swapping.

This fGOLD minting guide underscores precision; missteps risk failed tx. Next, we’ll dissect full transactions and redemption nuances for complete control.

Executing the mint transaction demands Cardano CLI proficiency or platform abstraction. Input your policy script, reference deposit proof as datum, and sign with policy keys alongside user wallet. The blockchain validates: gold allocation matches token quantity at $427.13 GLD spot, minting fGOLD seamlessly. Failed attempts often stem from datum mismatches; always simulate via testnet first. Once minted, fGOLD integrates into Cardano DeFi-lend on lending protocols, pair in DEX liquidity, or yield-farm where innovators like Theo and Libeara pioneer returns on tokenized gold.

fGOLD Redemption: Burn to Physical Gold

Redeeming physical gold tokens reverses the flow with equal precision. fGOLD holders initiate via Finest platform Cardano interface, selecting burn quantity. Tokens transfer to redemption script address, triggering burn under policy rules. Authorized partners verify, dispatching physical gold-vault withdrawal, bar delivery, or fiat equivalent. Timeframes span 3-7 days, fees tiered by size: minimal for small lots, negotiated for bulk. At GLD’s $427.13, redemption locks gains sans counterparty drag, ideal amid volatility.

Key: Burns enforce 1: 1 peg, supply contracts dynamically. Unlike Ethereum’s gas-heavy burns, Cardano’s efficiency minimizes costs-0.17 ADA typical. For RWA gold tokens 2026, this redeem physical gold token process anticipates institutional demand, with audits publishing reserve proofs on-chain. Strategic edge: Redeem during spot dips below $427.13 for physical upside, or hold for DeFi yields outpacing traditional storage.

Risks, Fees, and Strategic Positioning

No RWA escapes risks: custodian default, regulatory shifts, or oracle deviations testing pegs. fGOLD mitigates via multi-vault dispersion and Cardano’s verifiable scripts. Fees aggregate 0.5-1.5% round-trip, competitive versus XAUT’s premiums. At $427.13 GLD-24h low $422.72-timing entries via DEX arbitrages premiums, positioning for macro hedges as gold endures fiat debasement.

APEX Group’s Catalyst funding-1/6 milestones-accelerates liquidity, eyeing $4.6 billion tokenized gold market share. Finest_tokenize’s DEX integration via Minswap democratizes access, fractional to whale scales. Opinion: Cardano’s scalability trumps Ethereum for tokenized gold Cardano, fostering composability where yield protocols evolve, per Fortune insights on Theo, Libeara innovations.

Armed with this fGOLD minting guide and redemption blueprint, investors navigate tokenized gold Cardano with confidence. As GLD holds $427.13 amid flux, fGOLD embodies RWA evolution-blending tangible security with blockchain velocity. Anticipate policy upgrades, deeper DeFi hooks, and milestone unlocks propelling adoption. Adapt positions to spot flows; achieve portfolio resilience in 2026’s asset tokenization surge.