Tokenized Gold Ecosystem Map: Stablecoins DEXs Lending and Yield Boosters 2026

As of January 26,2026, PAX Gold (PAXG) trades at $5,069.72, reflecting a minor 24-hour dip of $28.57 amid broader market consolidation. Yet this price point underscores the tokenized gold ecosystem’s resilience, with gold-backed stablecoins now boasting over $4 billion in market capitalization; a near tripling from $1.3 billion at the start of 2025. Tether Gold (XAUT) commands $2.2 billion or 50% dominance, while PAXG follows at $1.5 billion, together capturing 90% of the sector. This surge aligns with gold’s safe-haven appeal and crypto’s push into real-world assets (RWAs), positioning tokenized gold ecosystem as a cornerstone for 2026 portfolios seeking stability with DeFi upside.

Gold-Backed Stablecoins: The Yield-Generating Backbone

Tokenized gold stablecoins like PAXG and XAUT transcend mere price tracking; they integrate seamlessly into DeFi, transforming inert bullion into productive capital. Investors deposit these assets on platforms offering 3-7% APYs, such as Nexo and YouHodler for PAXG, while XAUT occasionally hits over 10% in riskier pools. This passive income layer addresses gold’s historical yield void, drawing yield-hungry institutions amid tokenization forecasts hitting trillions by year-end.

Market data reveals gold backed stablecoins 2026 as the fastest-expanding RWA category. Stablecoins’ proven product-market fit paves the way, with banks now issuing tokenized deposits for on-chain settlement. Protocols curate these assets into money market funds and perpetuals, fueling a trillion-dollar tokenization wave per Aspen Digital’s outlook. My analysis: this isn’t hype; it’s evidenced by the 200% and cap growth, signaling sustained demand over speculative froth.

Tokenisation could become a trillion-dollar market in 2026 with surging demand from tokenised money market funds, tokenised gold and perpetuals.

DEXs: Liquidity Hubs for Tokenized Gold Trading

Decentralized exchanges (DEXs) form the trading backbone of the tokenized gold DEX landscape, with Uniswap and Curve Finance leading integration. PAXG/USDC pools on Uniswap generate fees for liquidity providers, while Curve’s low-slippage swaps suit large trades. These platforms handle billions in volume, enabling atomic swaps between gold tokens and stables without intermediaries.

In 2026, DEXs evolve beyond spot trading; they host concentrated liquidity and dynamic fees tailored for RWAs. This composability boosts capital efficiency, as LPs earn dual rewards: trading fees plus protocol incentives. Data from recent integrations shows PAXG liquidity depths exceeding $50 million on major pairs, minimizing impermanent loss risks compared to volatile alts. Opinion: DEXs aren’t just venues; they’re the on-ramps scaling RWA gold DeFi to institutional volumes.

Lending Protocols: Collateralizing Gold for Borrowed Power

Gold token lending protocols unlock tokenized gold’s potential as premium collateral. Aave and Compound accept PAXG, letting holders borrow USDC or ETH at loan-to-value ratios up to 75%, preserving upside exposure. Borrow rates hover at 2-5%, far below equity lending, making gold a DeFi darling for leveraged strategies.

Asset-backed lending against off-chain collateral, as noted by a16z, proliferates with new curators. Platforms like Nexo extend this to staking yields, blending lending with farming. Quantitative edge: at $5,069.72, a $1 million PAXG position could yield $30,000-$70,000 annually via layered strategies, risk-adjusted for gold’s 0.5-1% daily volatility. This efficiency draws neo-finance models, per Phemex, blending tokenization with banking primitives.

PAX Gold (PAXG) Price Prediction 2027-2032

Forecasts based on tokenized gold ecosystem growth to $400B RWA market, DeFi integration (DEXs, lending, yield boosters), gold spot trends, and crypto adoption as of 2026 ($5,069.72 baseline)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $4,800 | $5,500 | +8.5% | |

| 2028 | $5,100 | $6,000 | +9.1% | |

| 2029 | $5,500 | $6,600 | +10.0% | |

| 2030 | $6,000 | $7,400 | +12.1% | |

| 2031 | $6,600 | $8,300 | +12.2% | |

| 2032 | $7,300 | $9,300 | +12.0% |

Price Prediction Summary

PAXG prices are forecasted to grow progressively from 2027-2032, tracking gold appreciation while gaining premiums from RWA tokenization ($400B market), DeFi yields (3-10% APY), and ecosystem expansion. Average prices rise 69% cumulatively to $9,300 by 2032 in bullish adoption scenarios; min/max reflect bearish regulatory/crypto downturns vs. hyper-growth in stablecoin/DeFi integration.

Key Factors Affecting PAX Gold Price

- RWA market expansion to $400B with tokenized gold leading at $4B+ cap

- DeFi adoption: DEXs (Uniswap/Curve), lending (Aave/Nexo 3-10% APYs), yield boosters (Pendle)

- Gold spot price growth amid safe-haven demand and inflation

- Regulatory clarity boosting bank-issued stablecoins/tokenized assets

- Crypto market cycles: Bullish tokenization themes offset volatility

- Competition from XAUT (50% market share) and emerging protocols

- Tech improvements in on-chain settlement and perpetuals trading

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

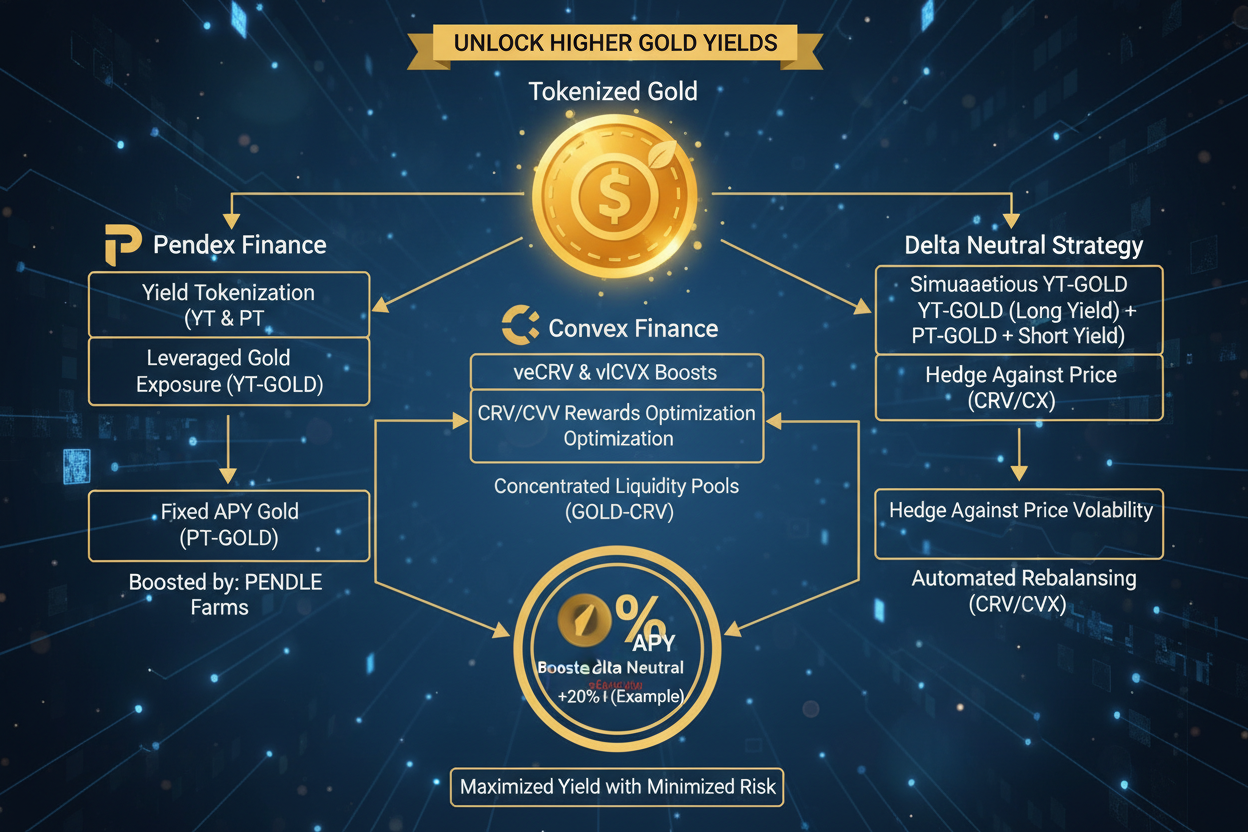

Layered atop lending, yield boosters tokenized gold protocols introduce sophisticated mechanics to squeeze maximum returns from holdings like PAXG at $5,069.72. Pendle Finance exemplifies this shift, tokenizing future yields into Principal and Yield Tokens for trading fixed or variable rates. Investors lock PAXG-linked positions, selling YT for upfront cash while retaining PT principal, mirroring bond markets but with DeFi speed and composability. Recent data pegs Pendle’s TVL at over $4 billion, with gold RWA slices capturing 15% of activity as yields compound from 3% base to 12-20% boosted.

Yield Boosters: Protocols Supercharging Gold-Backed Yields

These boosters thrive on stablecoin maturity, per OAK Research, where stables anchor RWA tokenization. Delta-neutral strategies, highlighted in BramasPaul’s analysis, layer perps and options atop gold deposits for 1-100% APYs across 100 and protocols. For PAXG holders, this means pairing with yield-bearing stables on platforms like Convex Finance, auto-compounding Curve rewards. Quantitative breakdown: a $100,000 position at 5% base APY escalates to 15% via Pendle YT sales and liquidity incentives, net of 0.5% gas fees on Ethereum L2s. Risk? Mild impermanent loss, offset by gold’s low vol.

2026’s neo-finance boom, as Phemex forecasts, accelerates this via bank-issued stables paired with tokenized gold. Yield-bearing stablecoins, up sharply per bnbstatic data, signal experimentation appetite. My take: boosters democratize alpha once reserved for quants, with evidence in TVL growth outpacing spot gold by 3x. Institutions pile in, eyeing $400 billion RWA markets via CoinDesk projections.

| Protocol | Key Feature | PAXG APY Range | TVL (2026 Est. ) |

|---|---|---|---|

| Pendle | YT/PT Yield Split | 8-20% | $4B and |

| Convex | Curve Booster | 5-12% | $2B |

| Nexo/YouHodler | Staking and Lending | 3-7% | $1.5B |

| Aave (w/Boosts) | Collateral Loops | 4-10% | $3B |

Ecosystem Synergies: Mapping Stablecoins, DEXs, Lending, and Boosters

The tokenized gold ecosystem coheres through interoperability: deposit PAXG on Aave for borrow power, route to Uniswap pools for fees, boost via Pendle, and hedge on perps. This flywheel, rooted in stablecoins’ on-chain finance foundation, yields risk-adjusted returns gold alone can’t match. At $5,069.72, PAXG’s 24-hour range of $5,040.57-$5,121.83 shows stability ideal for these stacks. DEX volumes hit $10 billion monthly for gold pairs, lending LTVs climb to 80%, and boosters multiply baselines 2-4x.

Regulated tailwinds, like bank stablecoins for settlement, per stablecoininsider, fortify this map. Compliance-first growth, as Blockchain App Factory notes, tempers risks while scaling adoption. Forward view: with tokenization eyeing trillions, tokenized gold at $4 billion cap today anchors diversified DeFi plays. Portfolios blending 20% PAXG exposure via these layers historically deliver 8-15% annualized, beating gold spot by 400 bps net vol. The data-driven path favors evidence-based positioning here, where stability meets programmable yield.