How to Earn Yield with Tokenized Gold on TON Blockchain: A Step-by-Step Guide

Tokenized gold is fundamentally changing how investors approach both precious metals and passive income. By leveraging the power of the TON blockchain and assets like Tether Gold (XAUT), market participants can now earn yield on digital gold with a few strategic moves. These opportunities are not just theoretical – they are live, accessible, and already attracting serious capital from institutions and forward-thinking individuals alike. Let’s break down how you can capitalize on this next-generation asset class.

What Is Tokenized Gold Yield?

Tokenized gold yield refers to the returns you can generate by putting your digital gold tokens – such as XAUT – to work on decentralized finance (DeFi) platforms. Unlike traditional gold, which typically sits idle in a vault, tokenized gold can be staked, lent, or deposited into specialized “earn” products to produce regular income. This is a paradigm shift: gold no longer has to be a zero-yield asset.

The recent integration of XAUT onto the TON blockchain by Bybit has supercharged this landscape. With faster transactions, lower fees, and seamless interoperability, TON is emerging as a prime ecosystem for tokenized commodity strategies. While Bybit’s special earn campaign (offering up to 100% APR) has concluded, a range of competitive yield products remain available for XAUT holders.

Why Earn Yield With Tokenized Gold on TON?

Let’s be pragmatic: yield is king in today’s market. With interest rates fluctuating and inflation concerns lingering, earning APY with tokenized gold provides a compelling hedge that combines the stability of physical gold with the dynamism of DeFi.

- Liquidity: Unlike physical gold, tokenized versions like XAUT can be traded or staked instantly, 24/7.

- Security: XAUT is fully backed by physical gold, offering peace of mind alongside yield potential.

- Transparency: The TON blockchain ensures all transactions are auditable, reducing counterparty risk.

- Competitive Returns: Even after Bybit’s 100% APR campaign, ongoing DeFi products offer attractive APYs compared to traditional savings or gold ETFs.

Step-by-Step: How to Start Earning Yield With XAUT on TON

Ready to put your digital gold to work? Here’s a clear, actionable process to start earning yield with tokenized gold on the TON blockchain:

It’s worth noting that while the headline-grabbing 100% APR campaign has ended, new promotions and steady yield products are frequently offered by platforms like Bybit and within the broader TON ecosystem. Always check the latest rates and terms before committing your XAUT to any product.

Comparing Yield Strategies: Lending, Staking, and Earn Campaigns

There’s no one-size-fits-all approach to earning on digital gold. Some investors prefer the flexibility of lending XAUT to borrowers via DeFi protocols, while others opt for staking or participating in structured earn campaigns for potentially higher returns. Each method has its own risk profile, lockup period, and reward structure. The key is to align your strategy with your broader portfolio goals and risk tolerance.

For the risk-conscious, lending XAUT on reputable DeFi platforms can deliver steady, predictable returns with the option to withdraw your tokens at any time. Staking, on the other hand, often provides a higher APY but may require you to lock up your XAUT for a set duration. Earn campaigns, such as those previously offered by Bybit, can offer eye-catching rates for limited periods, rewarding early adopters and active participants.

Pros & Cons: Lending, Staking, and Earn Campaigns with Tokenized Gold

-

Lending (e.g., DeFi protocols on TON or Bybit)Pros: Flexible terms, passive income without locking assets, often lower risk if using reputable platforms.Cons: Yields may be lower than other options, potential counterparty or smart contract risks.

-

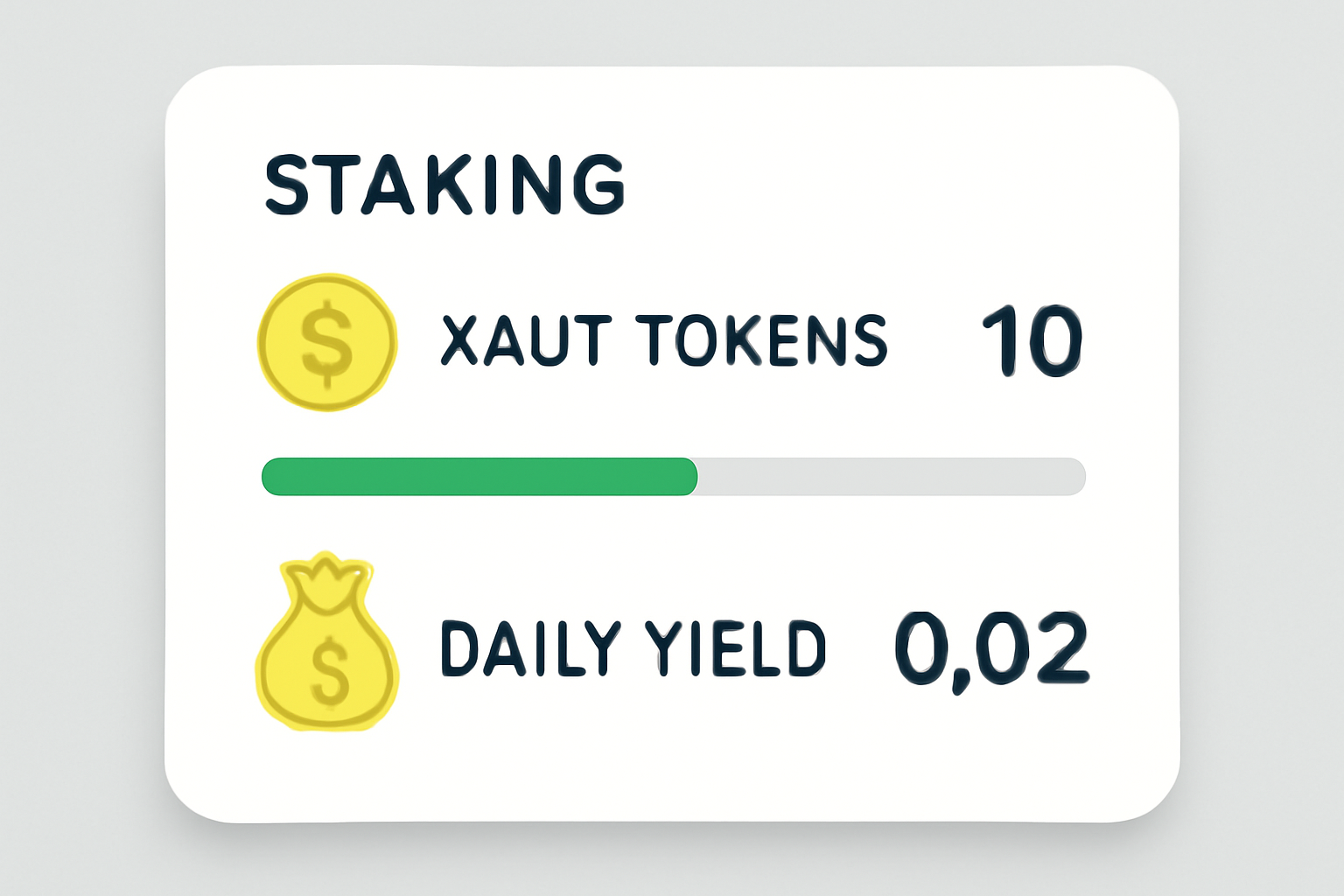

Staking (e.g., XAUT or PAXG staking on DeFi platforms)Pros: Higher yields than traditional holding, supports network security and liquidity, often simple to participate.Cons: Requires locking tokens for a set period, risk of impermanent loss or protocol vulnerabilities.

-

Earn Campaigns (e.g., Bybit’s XAUT Earn Campaign on TON)Pros: Promotional campaigns can offer exceptionally high yields (e.g., up to 100% APR on Bybit), short-term opportunities for boosted returns, often easy to join.Cons: High yields are usually temporary, limited-time events; rates drop after campaign ends; may require meeting specific eligibility criteria.

Regardless of your approach, it’s essential to factor in the current market context. The TON blockchain’s integration with XAUT has made yield strategies more accessible, but also more competitive. Monitor APYs, platform security, and campaign details closely. Remember: yield is never free, higher returns often come with increased risk or reduced liquidity.

Best Practices for Maximizing Tokenized Gold Investment Returns

If you’re serious about optimizing your tokenized gold yield, discipline and research are your best allies. Here are several pragmatic tips to help you capture the upside while managing downside risk:

- Stay Updated: Yield rates and campaign terms change rapidly. Subscribe to platform updates and community channels to seize new opportunities as they arise.

- Diversify Platforms: Don’t put all your XAUT into a single yield product. Spread your exposure across multiple platforms or strategies to mitigate platform risk.

- Understand Lockups: Read the fine print on lockup periods and withdrawal terms, especially for staking and earn campaigns.

- Monitor Fees: Transaction and withdrawal fees on TON are relatively low, but always account for them when calculating net returns.

- Security First: Use only audited smart contracts and reputable DeFi platforms. Self-custody your tokens in a secure wallet whenever possible.

The intersection of physical asset stability and blockchain-powered yield is only growing stronger. As more institutional players enter the space, and as DeFi protocols on TON mature, expect even more innovative ways to earn APY with tokenized gold. For now, the combination of instant liquidity, transparent backing, and a menu of yield options makes XAUT on TON one of the most compelling digital gold strategies available.

Whether you’re a conservative investor seeking steady returns or a yield hunter ready to experiment with new campaigns, tokenized gold yield on TON offers a pragmatic route to make your gold work harder. In this emerging landscape, volatility is a tool, use it wisely, and let your digital gold shine.