How Tokenized Gold Generates Yield: The Rise of Gold-Backed Stablecoins with Passive Income

Gold has long been the cornerstone of wealth preservation, prized for its stability but often criticized for its lack of yield. Now, with the advent of tokenized gold, investors are discovering how blockchain technology can unlock passive income streams from this traditionally non-yielding asset. The rise of gold-backed stablecoins like Paxos Gold (PAXG) and Tether Gold (XAUT) is reshaping the narrative, offering exposure to physical gold while enabling participation in decentralized finance (DeFi) yield strategies.

What Is Tokenized Gold and How Does It Work?

Tokenized gold is a digital asset that represents ownership of real, physical gold, typically stored in secure vaults. Each token is backed 1: 1 by a specific amount of gold, allowing holders to claim, trade, or redeem their digital tokens for the underlying metal. For example, PAX Gold (PAXG) trades at $4,164.20 as of today, directly reflecting the value of one fine troy ounce of gold held in custody.

This innovation brings several advantages: fractional ownership, instant settlement, and global liquidity. But perhaps most compelling for investors seeking more than just capital appreciation is the ability to generate yield by integrating tokenized gold into DeFi protocols.

How Tokenized Gold Generates Yield in DeFi

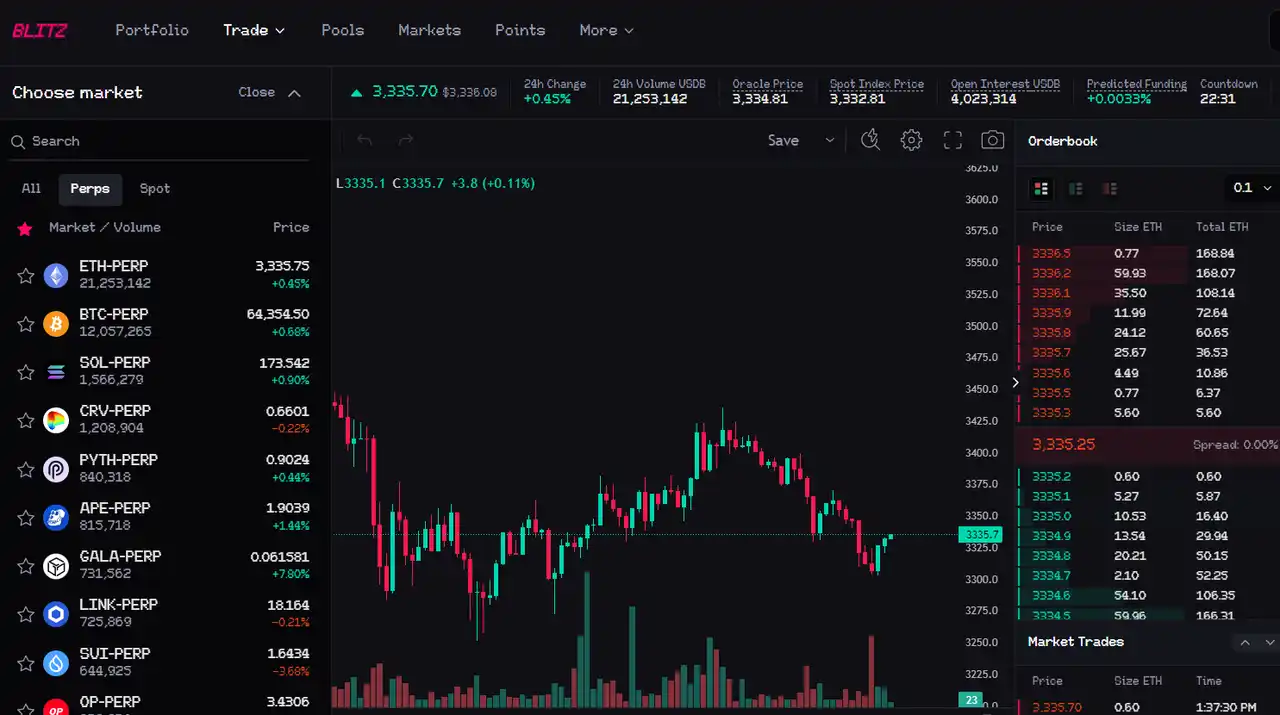

The integration of gold-backed stablecoins into DeFi has opened up new avenues for earning passive income. Here are some of the most popular yield-generating strategies:

DeFi Strategies for Earning Yield with Tokenized Gold

-

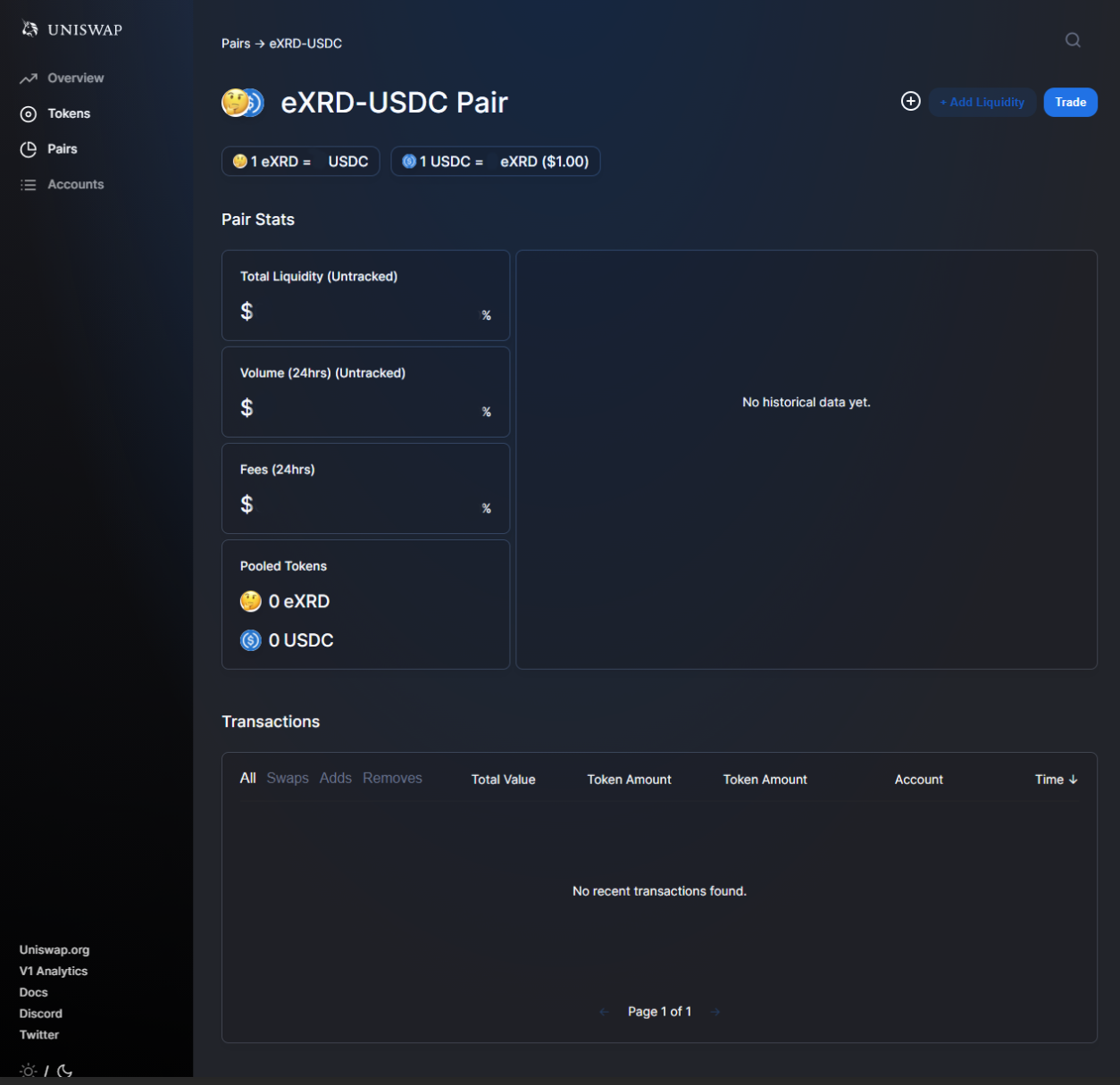

Liquidity Provision on Uniswap (PAXG/USDC): By supplying PAX Gold (PAXG) and USD Coin (USDC) to liquidity pools on Uniswap, investors can earn passive income from trading fees. This strategy lets holders maintain exposure to gold (currently priced at $4,164.20 per PAXG) while benefiting from DeFi market activity.

-

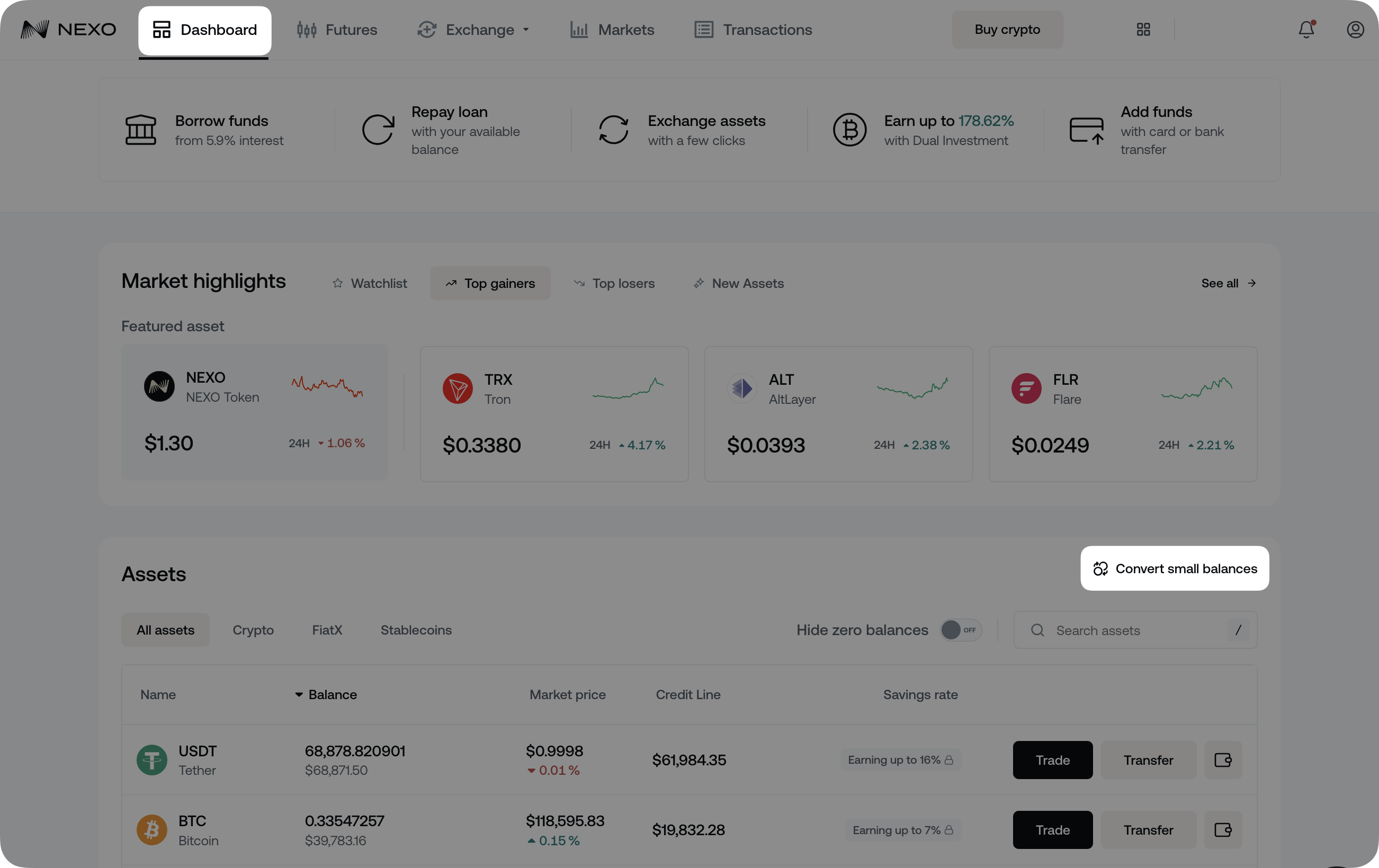

Staking and Lending on Nexo and YouHodler: Platforms like Nexo and YouHodler allow users to stake or lend their PAXG or Tether Gold (XAUT) tokens. Staking yields typically range from 3% to 7% APY for PAXG, while some XAUT offerings advertise yields above 10%—though higher returns often come with increased risk. Always review platform security and terms before participating.

-

Tokenized Gold as DeFi Collateral via SmartGold and Chintai Nexus: In September 2025, SmartGold partnered with Chintai Nexus to tokenize $1.6 billion in IRA-held gold. U.S. investors can now use tokenized gold as collateral in DeFi protocols, generating yield while retaining the tax advantages of their retirement accounts.

-

Market Growth and Diversification: The tokenized gold market reached a capitalization of $2.57 billion in September 2025, with major tokens like PAXG and XAUT leading the way. This growth reflects rising investor confidence in combining gold’s stability with DeFi yield opportunities, making tokenized gold an increasingly popular asset for diversified, income-generating portfolios.

- Liquidity Provision: By providing PAXG or XAUT to liquidity pools on decentralized exchanges like Uniswap, investors earn a share of trading fees from swaps between tokenized gold and stablecoins such as USDC.

- Staking: Platforms like Nexo and YouHodler allow users to stake their PAXG tokens, earning annual percentage yields (APYs) ranging from 3% to 7%. Some platforms even offer higher yields for Tether Gold, though these often involve additional risk.

- Lending: Token holders can lend their gold-backed tokens as collateral to access crypto loans or provide liquidity for others, receiving interest payments in return.

This transformation means that investors can now earn a steady income stream from an asset class that was once considered yield-less. The flexibility of blockchain-based platforms also allows for seamless entry and exit, making it easier than ever to put gold to work.

“Tokenized gold is more than just a store of value – it’s now a productive asset. “

PAX Gold (PAXG) Maintains Strong Position at $4,164.20

The current market price for PAX Gold stands at $4,164.20, reflecting a 24-hour increase of $49.04 ( and 1.19%). This price stability, combined with the ability to generate yield, is drawing both traditional investors and crypto enthusiasts into the market. As of September 2025, the total market capitalization for tokenized gold has surpassed $2.57 billion, with inflows accelerating into both PAXG and XAUT as more investors seek safe-haven assets that offer passive income potential.

This momentum is further fueled by institutional adoption. In September 2025, SmartGold’s partnership with Chintai Nexus enabled the tokenization of $1.6 billion in IRA-held gold, allowing U. S. retirement accounts to generate DeFi yields without sacrificing regulatory compliance or tax advantages (source). This marks a significant milestone in merging traditional wealth management with next-generation blockchain solutions.

PAX Gold (PAXG) and Tether Gold (XAUT) Price & Yield Forecast: 2026-2031

Comprehensive forecast for tokenized gold assets, including projected price ranges and average annual yield (APY) opportunities, based on current market context and future crypto adoption trends.

| Year | Minimum Price (PAXG) | Average Price (PAXG) | Maximum Price (PAXG) | Minimum Price (XAUT) | Average Price (XAUT) | Maximum Price (XAUT) | Estimated APY Range |

|---|---|---|---|---|---|---|---|

| 2026 | $4,050.00 | $4,300.00 | $4,700.00 | $4,040.00 | $4,290.00 | $4,690.00 | 3.0% – 7.5% |

| 2027 | $4,200.00 | $4,550.00 | $5,000.00 | $4,190.00 | $4,540.00 | $4,990.00 | 3.0% – 8.0% |

| 2028 | $4,350.00 | $4,800.00 | $5,350.00 | $4,340.00 | $4,790.00 | $5,340.00 | 3.0% – 8.5% |

| 2029 | $4,500.00 | $5,050.00 | $5,700.00 | $4,490.00 | $5,040.00 | $5,690.00 | 3.0% – 9.0% |

| 2030 | $4,650.00 | $5,300.00 | $6,100.00 | $4,640.00 | $5,290.00 | $6,090.00 | 3.0% – 9.5% |

| 2031 | $4,800.00 | $5,550.00 | $6,500.00 | $4,790.00 | $5,540.00 | $6,490.00 | 3.0% – 10.0% |

Price Prediction Summary

Tokenized gold assets like PAXG and XAUT are expected to see steady appreciation, mirroring gold’s long-term bullish trajectory with an added digital asset premium due to growing adoption and DeFi use cases. Prices should trend upward, with average annual growth rates of 4-6%, and occasional surges in times of economic uncertainty. Yield opportunities through DeFi protocols are likely to remain attractive, with APYs gradually increasing as the market matures and more platforms integrate gold-backed tokens. However, returns will be influenced by risk appetite, platform reliability, and evolving regulation.

Key Factors Affecting Pax Gold Price

- Wider adoption of tokenized gold as a safe haven and yield-bearing asset.

- Expansion of DeFi integration and new yield-generating protocols.

- Macro trends in gold prices, inflation, and global economic conditions.

- Increased institutional participation (e.g., IRA tokenization, ETFs).

- Potential regulatory changes affecting tokenized commodities and DeFi.

- Competition from other tokenized real-world assets and stablecoins.

- Technological advancements in blockchain security and interoperability.

- Market volatility and platform-specific risks (e.g., smart contract vulnerabilities).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Key Considerations Before Earning Yield With Gold Tokens

While the opportunities are enticing, it’s important to approach yield-generating strategies with caution. Not all platforms are created equal; risks include smart contract vulnerabilities, counterparty risk, and regulatory uncertainty. Higher advertised yields may indicate higher risk exposure or lower liquidity pools.

As always, prudent due diligence is essential before allocating significant capital to staking or lending programs involving tokenized gold assets.

Investors should also pay close attention to the underlying custody arrangements. Reputable tokenized gold providers, such as PAXG and XAUT, ensure that each token is fully backed by physical gold held in audited vaults. However, verifying these claims, understanding redemption processes, and checking for transparent third-party audits are all critical steps in safeguarding your investment.

Another consideration is the evolving regulatory landscape. While gold itself is a well-established asset, the intersection with decentralized finance introduces new compliance questions. Some jurisdictions are beginning to clarify rules for digital asset-backed securities, but the pace of regulation varies globally. Investors should stay informed about local laws and seek platforms with robust compliance standards.

Why Tokenized Gold Yield Is Gaining Traction

The appeal of tokenized gold yield lies in the unique blend of stability and growth potential. Unlike traditional gold ETFs or physical bullion, gold-backed stablecoins can be put to work in DeFi protocols, unlocking income streams that were previously inaccessible to gold holders. Institutional moves, such as the $1.6 billion IRA gold tokenization initiative, demonstrate growing confidence in this model and its ability to bridge conventional finance with blockchain innovation.

Top Benefits of Earning Passive Income with Gold Tokens

-

Earn Trading Fees via DeFi Liquidity Pools: By providing tokenized gold like PAX Gold (PAXG) to liquidity pools on platforms such as Uniswap, investors can earn passive income from trading fees, all while maintaining exposure to gold. For example, the PAXG/USDC pool allows holders to benefit from gold price movements and DeFi yield simultaneously.

-

Institutional Access Through IRA Tokenization: In September 2025, SmartGold and Chintai Nexus enabled U.S. investors to tokenize gold held in Individual Retirement Accounts (IRAs). This allows gold to serve as DeFi collateral, generating yield while preserving tax advantages.

-

Fractional Ownership and Global Accessibility: Tokenized gold, such as PAXG and XAUT, lets investors own fractions of a gold bar, making gold investing more accessible and liquid worldwide. This democratizes access to gold’s stability and DeFi yields.

-

Combining Gold’s Stability with DeFi’s Yield Potential: With the market capitalization of tokenized gold reaching $2.57 billion as of September 2025, products like PAXG and XAUT offer a unique blend of gold’s safe-haven qualities and the income-generating opportunities of digital assets.

For individual investors, the process is increasingly accessible. With user-friendly DeFi platforms, even those new to crypto can stake or lend gold tokens with just a few clicks. As always, starting with small allocations and gradually increasing exposure as you gain familiarity is a prudent approach.

The Future of Blockchain Gold Income

Looking ahead, the market for crypto gold staking and blockchain-based gold income is poised to expand further. As more DeFi protocols integrate gold-backed stablecoins, competition among platforms should drive innovation in both yield offerings and risk management. New entrants like GLDY, ORO, and FDGC are experimenting with alternative yield models and enhanced transparency, providing investors with more options than ever before.

Ultimately, tokenized gold is transforming from a passive store of value into an active component of diversified portfolios. By combining the centuries-old appeal of gold with the programmable potential of blockchain, investors can now earn yield without sacrificing the security or reliability of the underlying asset.