How Tokenized Gold is Outperforming Physical Gold: Real-World Yields, Accessibility, and Blockchain Security

Gold has long been considered the ultimate store of value, but in 2025, a new paradigm is emerging: tokenized gold. As digital gold tokens like PAX Gold (PAXG) and Tether Gold (XAUT) surge in popularity, investors are asking: is tokenized gold actually outperforming physical bullion? With the latest PAXG price at $4,007.47, and the sector’s market cap surpassing $2.57 billion, the answer increasingly looks like yes.

Tokenized Gold vs Physical Gold: What’s Driving Outperformance?

The core advantage of tokenized gold is its ability to combine real-world asset stability with blockchain-native features. Unlike physical bars or coins, tokenized gold can be traded 24/7 on global crypto exchanges, offering superior liquidity and instant settlement. This means investors can enter or exit positions at any time, without waiting for business hours or dealing with intermediaries.

Fractional ownership is another game-changer. On platforms like Paxos and Tether, investors can own as little as 0.01 ounces of gold – a level of accessibility that simply isn’t possible with traditional bullion. This opens up exposure to gold for a new demographic: retail traders, DeFi users, and even algorithmic bots seeking micro-arbitrage opportunities.

Physical gold remains relevant for those seeking absolute control and zero issuer risk, as highlighted by Yahoo Finance. However, for most modern portfolios, the ease of trading and accessibility of tokenized assets is hard to ignore.

Real-World Yields: How Blockchain Unlocks Gold’s Earning Potential

Perhaps the most compelling reason for the shift toward tokenized gold is its ability to generate yields through decentralized finance protocols. Unlike physical bullion – which sits idle in a vault – tokenized gold can be staked or supplied as collateral on DeFi platforms such as Aave and Curve. This allows holders to earn interest or borrow stablecoins against their gold tokens without selling their underlying asset.

PAXG’s integration with DeFi has been a catalyst for this trend. As noted by Ainvest.com, users can now unlock additional returns on their digital gold holdings – a feature that physical gold simply cannot match. The result? Tokenized gold yields are outpacing those of traditional bullion and even some gold ETFs, making it a preferred choice for yield-seeking investors in 2025.

Security and Transparency: Blockchain as a Trust Layer

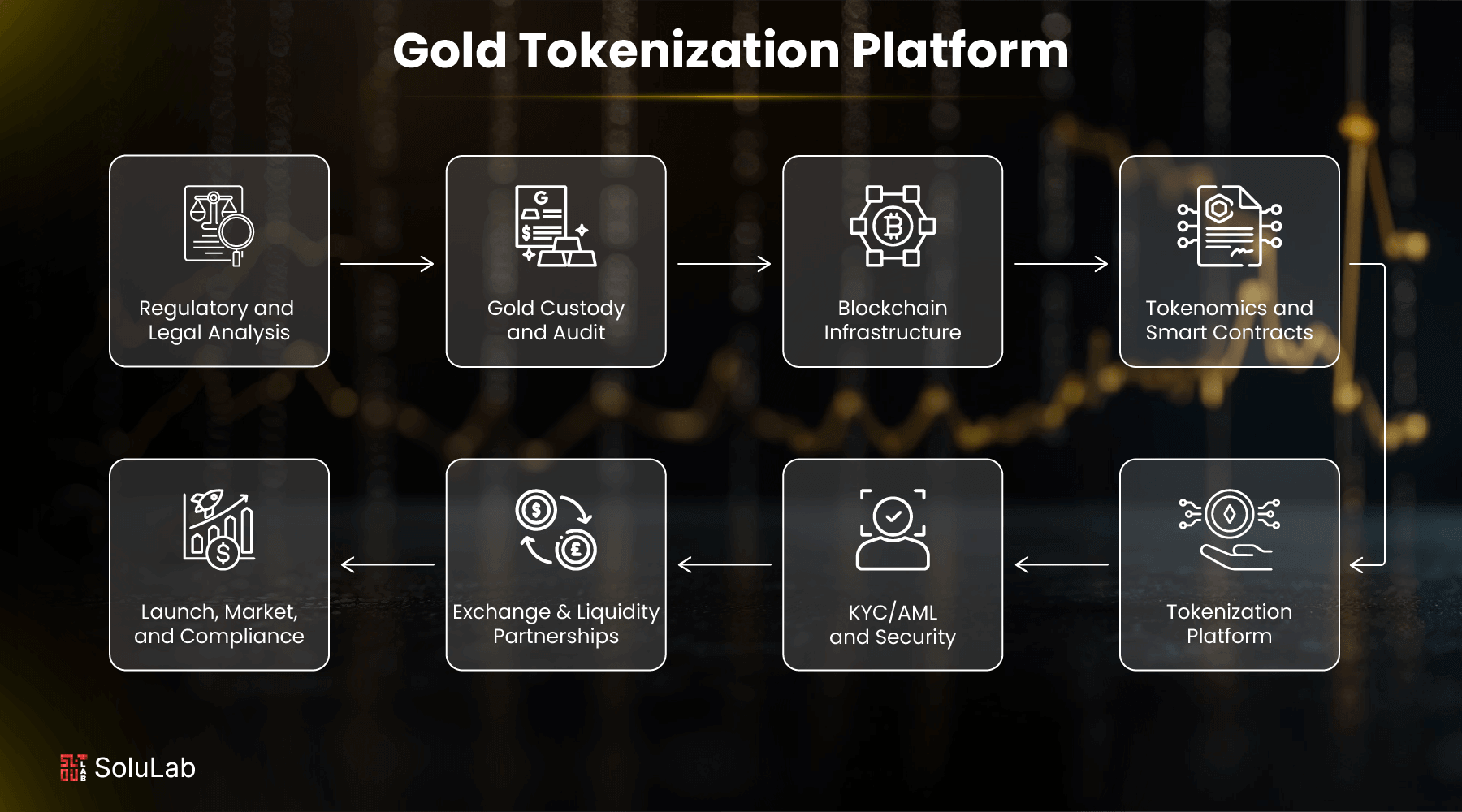

Security has always been a sticking point in the physical vs digital debate. Physical gold is susceptible to theft unless stored in highly secure vaults – which adds cost and complexity for investors. Tokenized gold sidesteps this issue by leveraging blockchain’s immutable ledger and real-time auditability.

Take PAXG as an example: each token is backed 1: 1 by London Good Delivery gold bars held in Brink’s vaults and regulated by the New York State Department of Financial Services. Monthly audits confirm the reserves, and anyone can verify token supply against on-chain data. This level of transparency is virtually impossible to achieve with private bullion holdings.

For those concerned about counterparty risk, it’s worth noting that leading tokenized gold platforms have implemented robust compliance frameworks and insurance policies to protect user assets. Still, it’s vital to compare providers carefully – not all platforms offer the same level of security or regulatory oversight.

PAX Gold (PAXG) Price Prediction 2026-2031

Professional outlook for PAXG based on tokenized gold adoption, DeFi integration, and evolving market conditions.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $4,130 | $4,400 | +3% | Continued institutional adoption; gold price stability; DeFi integration increases usage |

| 2027 | $4,050 | $4,280 | $4,650 | +3.6% | Steady global gold demand; regulatory clarity boosts investor confidence; more platforms offer PAXG |

| 2028 | $4,200 | $4,470 | $4,950 | +4.4% | Tokenized gold surpasses $4B market cap; integration with leading DeFi protocols; mild gold bull cycle |

| 2029 | $4,350 | $4,690 | $5,300 | +4.9% | Geopolitical tensions drive safe-haven demand; new staking/yield products launch |

| 2030 | $4,500 | $4,900 | $5,700 | +4.5% | Global gold prices hit new highs; tokenized gold widely adopted by retail/institutional investors |

| 2031 | $4,650 | $5,120 | $6,100 | +4.5% | Blockchain-based gold becomes standard in digital portfolios; potential for cross-chain interoperability |

Price Prediction Summary

PAX Gold (PAXG) is projected to see steady, moderate price appreciation in line with underlying gold prices and expanding adoption of tokenized gold assets in DeFi and digital finance. The price outlook remains closely tied to global gold market trends, with additional upside potential from technological and regulatory advances within the tokenized asset sector. Min/max ranges reflect both bearish (gold price stagnation, regulatory headwinds) and bullish (gold bull markets, rapid DeFi adoption) scenarios.

Key Factors Affecting PAX Gold Price

- Underlying physical gold price trends and macroeconomic factors (inflation, interest rates)

- Growth of tokenized gold market and integration with DeFi platforms

- Regulatory developments and clarity around digital asset-backed tokens

- Competition from other tokenized gold products (XAUT, new entrants)

- Technological improvements (security, interoperability, user experience)

- Institutional and retail adoption rates of tokenized gold

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

PAX Gold (PAXG) Price Holds Firm Above $4,000: What It Signals for Tokenized Gold Adoption

The current price of PAXG at $4,007.47 is more than a psychological milestone – it signals growing institutional confidence in tokenized commodities as a mainstream investment vehicle. As tokenized gold continues to integrate with DeFi ecosystems and offer real-world yields, expect its adoption curve to steepen further.

Institutional inflows are accelerating as asset managers and family offices seek exposure to gold-backed crypto tokens without the friction or settlement delays of physical delivery. The ability to instantly rebalance portfolios or hedge positions using tokenized gold is a key factor driving this shift, especially as global macro uncertainty persists. For sophisticated investors, programmable assets like PAXG and XAUT represent a new class of collateral that can be leveraged across multiple protocols and platforms.

Accessibility is also reshaping the gold investment landscape. No longer restricted to large denominations or institutional minimums, fractional gold ownership on the blockchain allows anyone with a smartphone to participate in the market. This democratization is especially pronounced in emerging markets, where traditional gold access has been limited by logistics and capital controls. Now, users can buy, sell, or transfer tokenized gold globally in seconds, without intermediaries or cross-border restrictions.

“Tokenized gold has fundamentally altered how we think about liquidity and inclusivity in precious metals markets. “: Sophie Delaney

Key Advantages at a Glance:

Top 5 Benefits of Tokenized Gold vs Physical Gold

-

1. Enhanced Liquidity and 24/7 Trading: Tokenized gold, such as PAX Gold (PAXG) and Tether Gold (XAUT), can be traded globally on cryptocurrency exchanges at any time, unlike physical gold which is limited by business hours and logistics.

-

2. Fractional Ownership and Lower Entry Barriers: Investors can purchase fractions of a gold token, making gold accessible to a wider audience. For example, with PAXG priced at $4,007.47, buyers can own a small share rather than a whole gold bar.

-

3. Integration with DeFi and Yield Opportunities: Tokenized gold like PAXG can be used as collateral on DeFi platforms such as Aave and Curve, allowing investors to earn yields or access loans without selling their gold holdings.

-

4. Real-Time Transparency and Auditability: Blockchain technology enables real-time verification of gold reserves. Major tokens like PAXG are regulated by the New York State Department of Financial Services and undergo monthly audits to confirm 1:1 gold backing.

-

5. Reduced Security and Storage Risks: Tokenized gold eliminates the need for physical storage and the associated risks of theft or loss. The underlying gold is held in secure, institutionally managed vaults, while ownership is secured on the blockchain.

This wave of innovation comes with new considerations for risk management. While blockchain security reduces certain vulnerabilities (like physical theft), investors must still evaluate smart contract risk and platform solvency. Leading providers disclose their audit reports and regulatory status openly, an essential due diligence step before allocating significant capital.

Comparisons with gold ETFs are instructive here. While ETFs like GLD and IAU remain popular for their liquidity and low fees, they lack the programmability and 24/7 accessibility of tokenized assets. Moreover, DeFi integrations enable unique yield opportunities unavailable to ETF holders, further tilting the balance toward digital tokens for active investors.

What to Watch: The Evolving Tokenized Gold Ecosystem

Looking ahead to late 2025 and beyond, the trajectory for gold-backed crypto tokens appears robust. Regulatory clarity is improving in major jurisdictions, and interoperability standards are making it easier to move assets across chains without compromising security or compliance. As more DeFi protocols onboard tokenized commodities as collateral, expect a virtuous cycle of adoption, driven by both yield opportunities and investor preference for transparent, auditable reserves.

The most successful platforms will be those that combine rigorous custody standards with seamless user experience and open reporting practices. For investors weighing tokenized gold vs physical gold, the calculus is shifting: digital tokens now offer not just parity but clear advantages in yield generation, accessibility, and transparency.

| Tokenized Gold Feature | Physical Gold Equivalent? |

|---|---|

| 24/7 Trading and Liquidity | ❌ (Business hours only) |

| Fractional Ownership | ❌ (Limited by bar/coin size) |

| DeFi Yield Opportunities | ❌ (No native yield) |

| Blockchain Auditability | ❌ (Opaque/private storage) |

| No Physical Storage Risk | ❌ (Vault/storage required) |

The bottom line? With PAXG holding firm at $4,007.47, tokenized gold is no longer an experiment, it’s a maturing asset class redefining what it means to own and benefit from one of humanity’s oldest stores of value.