How to Buy Tokenized Gold: Step-by-Step Guide for 2024

Tokenized gold is rapidly reshaping how investors access one of the world’s oldest stores of value. By combining the physical security of gold with the speed and flexibility of blockchain, tokenized gold offers a compelling alternative to traditional bullion or ETFs. As of October 9,2025, leading assets in this space include PAX Gold (PAXG), currently priced at $4,045.31, and Tether Gold (XAUT), trading at $4,027.47. These tokens are fully backed by physical gold stored in secure vaults and can be bought or sold digitally, 24/7.

Why Buy Tokenized Gold in 2025?

The appeal of tokenized gold is straightforward: you get the stability and inflation-hedging power of physical gold along with the liquidity and divisibility of crypto assets. Unlike traditional gold investments that often require large minimums or involve complex logistics, tokenized platforms let you purchase as little as a fraction of a gram – instantly, on-chain, and with transparent proof-of-reserves.

- Accessibility: Buy or sell any amount, anytime – no need to handle bars or coins.

- Transparency: Public blockchains provide real-time auditability for token reserves.

- Liquidity: Trade on major crypto exchanges or redeem for physical bullion if desired.

- Cost Efficiency: Lower storage fees and tighter spreads compared to legacy methods.

PAXG at $4,045.31: How Does Tokenized Gold Work?

Every PAXG or XAUT token represents direct ownership of real, allocated gold held in professional vaults. For example, each PAXG token equals one fine troy ounce of London Good Delivery gold stored by Paxos Trust Company. You can verify these holdings on-chain at any time. When you buy a token like PAXG at its current market price (see live data here), you’re not just speculating on price movements – you’re acquiring a digital claim on real metal that can be redeemed for physical delivery if needed.

Step-by-Step: How to Buy Tokenized Gold Today

If you’re ready to add blockchain-based gold exposure to your portfolio in 2025, here’s a practical step-by-step guide using PAX Gold (PAXG) as an example:

Step 1: Choose Your Platform

Select a reputable cryptocurrency exchange that lists PAXG or XAUT. Leading options include Binance, Kraken, and Coinbase. Verify that your chosen exchange supports both deposits and withdrawals for these tokens – some platforms only allow internal trading without external transfers.

Step 2: Complete KYC Verification

You’ll need to register an account and complete identity verification (KYC). This is standard practice for regulated platforms handling asset-backed tokens like PAXG/XAUT. Have your government-issued ID ready; approval typically takes minutes to hours.

The next steps will walk you through funding your account, placing your first buy order at the current market price ($4,045.31 for PAXG), securing your tokens in a private wallet, and monitoring ongoing price trends.

PAX Gold (PAXG) Price Prediction 2026-2031

Forecast based on current market data, tokenized gold adoption trends, and crypto market analysis (2025 baseline: $4,045.31)

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $4,210 | $4,500 | +4% | Stable growth with increasing tokenized gold adoption and steady gold prices; minor crypto market volatility. |

| 2027 | $3,900 | $4,310 | $4,650 | +2.4% | Conservative increase as gold prices stabilize, but further adoption of tokenized assets drives gradual demand. |

| 2028 | $3,850 | $4,400 | $4,800 | +2.1% | Potential for regulatory clarity in major markets; tokenized gold platforms expand, supporting slow price appreciation. |

| 2029 | $3,800 | $4,520 | $5,000 | +2.7% | Gold price uptrend and blockchain integration in traditional finance boost PAXG demand; some market corrections possible. |

| 2030 | $3,950 | $4,660 | $5,250 | +3.1% | Bullish scenario with increased investor trust in digital gold and global macroeconomic uncertainty favoring safe-haven assets. |

| 2031 | $4,000 | $4,820 | $5,500 | +3.4% | Mature adoption phase; tokenized gold becomes a standard investment tool, with price tracking physical gold and slight crypto premium. |

Price Prediction Summary

PAX Gold (PAXG) is expected to maintain a stable upward trend from 2026 to 2031, closely tracking the underlying price of physical gold with additional benefits from blockchain adoption. The minimum price predictions reflect bearish scenarios with potential gold price dips or regulatory headwinds, while maximum predictions consider bullish gold cycles and wider tokenization adoption. Overall, average prices suggest a consistent, moderate growth rate, making PAXG an attractive, lower-volatility option in the crypto space.

Key Factors Affecting PAX Gold Price

- Physical gold price fluctuations (macroeconomic environment, inflation, central bank policies)

- Adoption rate of tokenized gold by retail and institutional investors

- Regulatory developments in major jurisdictions (e.g., US, EU, Asia)

- Competition from other tokenized commodity assets (e.g., XAUT, new entrants)

- Advancements in blockchain technology and security standards

- Integration with traditional finance and wealth management platforms

- Market sentiment towards crypto assets and digital commodities

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Step 3: Fund Your Account

Deposit fiat currency (like USD or EUR) or crypto (such as USDT or BTC) into your exchange account. Most platforms support a range of funding methods, including bank transfers and stablecoins. Double-check fees and processing times, these can vary widely depending on your region and payment method.

Step 4: Place Your Buy Order

Navigate to the PAXG/USD or XAUT/USD trading pair. Decide how much tokenized gold you want to purchase. Remember, you can buy fractional amounts, no need to commit to a full ounce. Enter your order at the current market price ($4,045.31 for PAXG or $4,027.47 for XAUT as of October 9,2025) or set a limit order if you prefer to wait for a specific price level.

Essential Security Tips for Storing Tokenized Gold

-

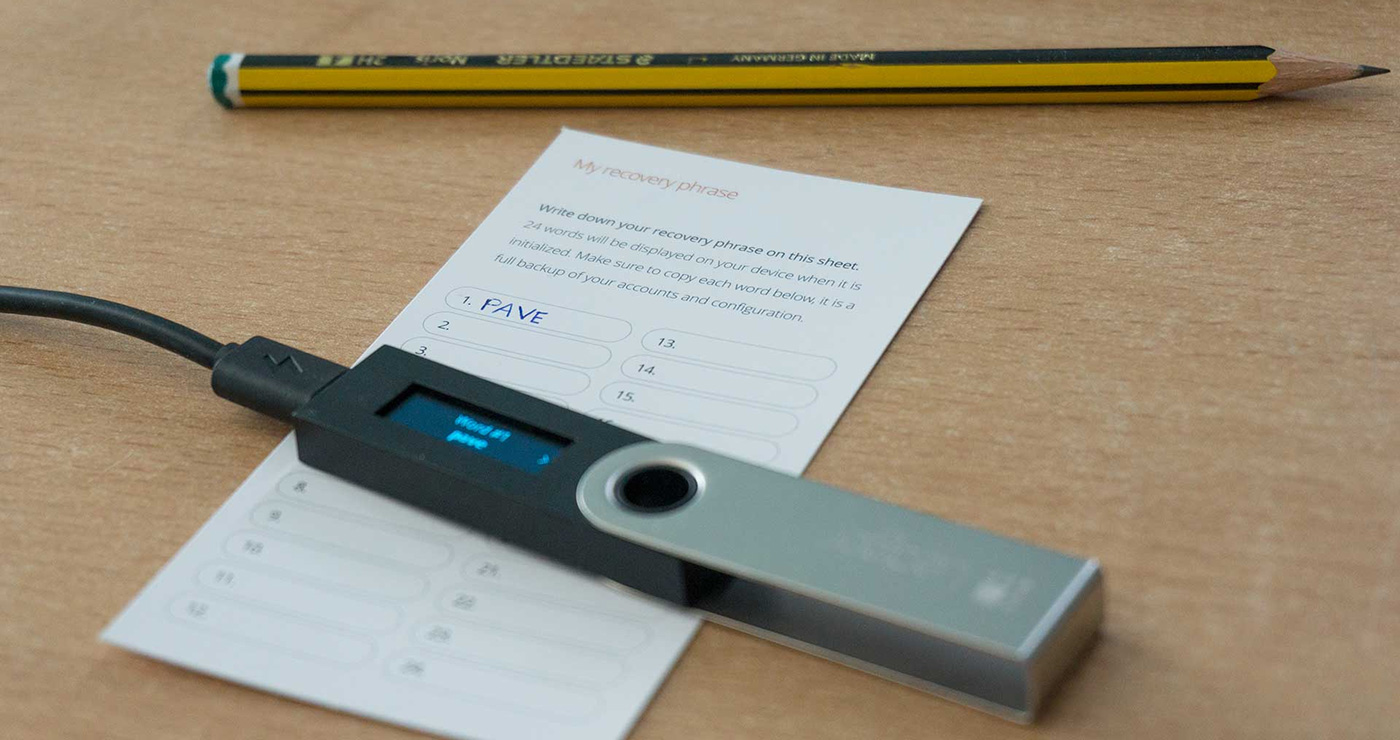

Safeguard Private Keys and Recovery Phrases: Store your wallet’s private keys and recovery phrases offline in a secure location (such as a hardware wallet or a physical safe). Never share or store them digitally where they could be compromised.

-

Regularly Update Software and Enable Security Features: Keep your wallet apps, browser extensions, and device operating systems up to date. Enable features like biometric authentication and transaction alerts for added protection.

-

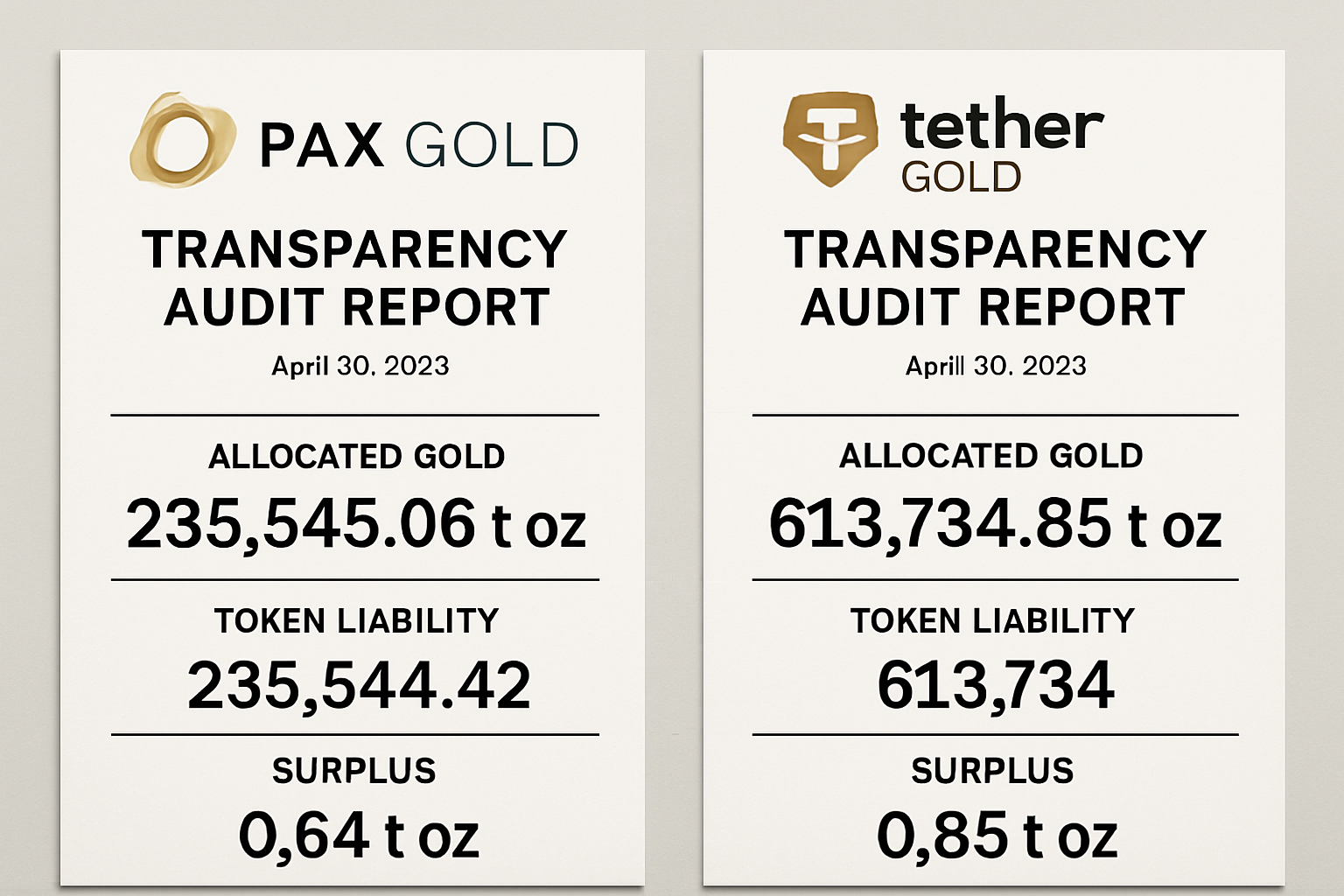

Monitor Token Backing and Issuer Transparency: Ensure your tokenized gold is fully backed by physical gold by checking official audits from issuers like PAX Gold and Tether Gold. Review transparency reports and vault locations on their official websites.

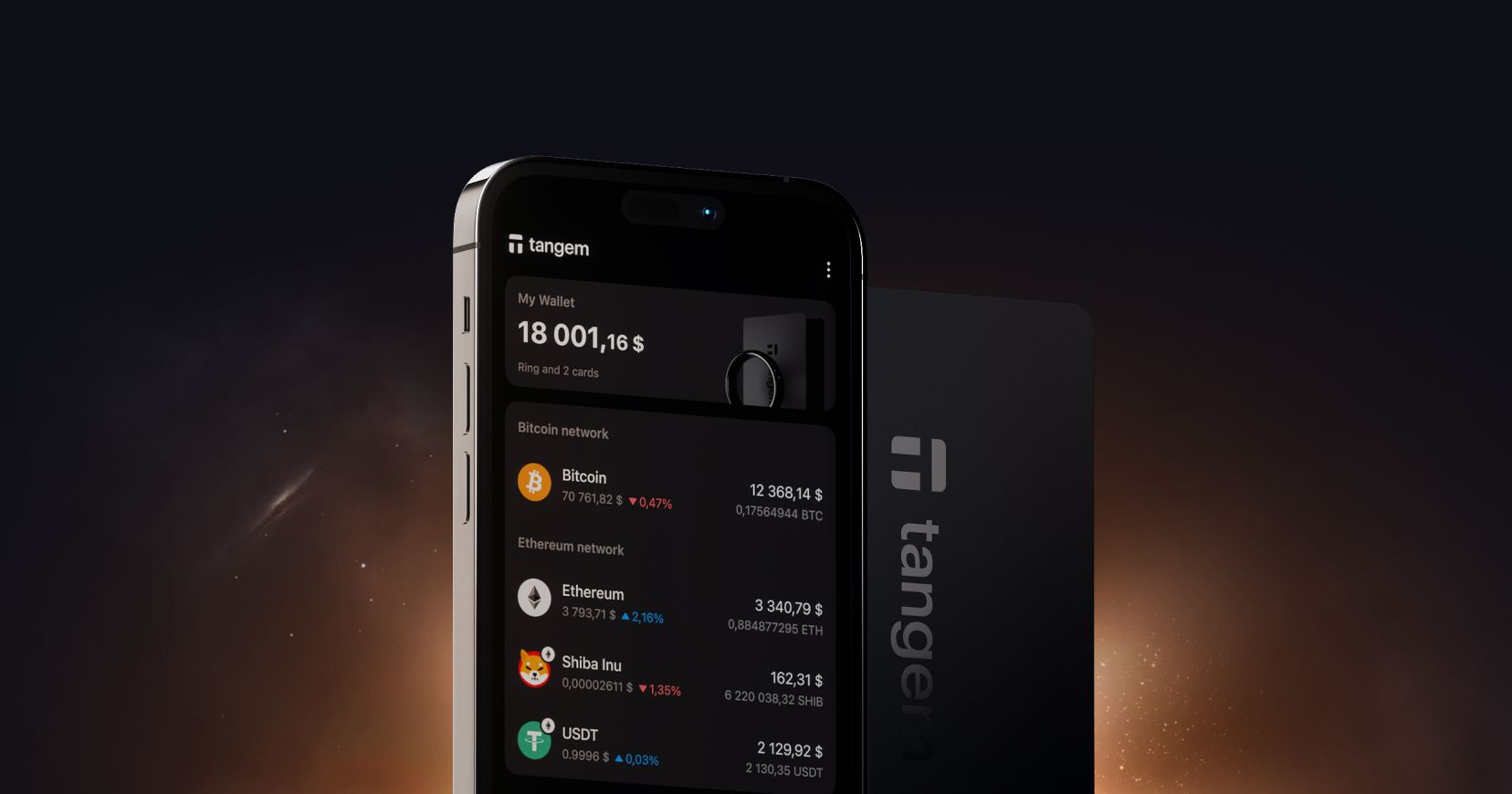

Step 5: Secure Your Tokens

Once your purchase is complete, transfer your tokens off the exchange to a self-custody wallet that supports ERC-20 tokens (like MetaMask or Ledger). This step is critical, holding tokens in your own wallet reduces counterparty risk and gives you full control over your assets. Always back up your wallet’s recovery phrase securely.

Step 6: Monitor and Manage Your Investment

Track live prices and performance using real-time dashboards on reputable sites like CoinGecko. Both PAXG and XAUT offer transparent on-chain proof-of-reserves, so you can periodically verify that every token remains fully backed by physical gold in custody.

What Sets Tokenized Gold Apart?

The combination of blockchain transparency and direct physical backing makes tokenized gold unique among digital assets. Unlike unbacked stablecoins or synthetic gold products, PAXG and XAUT holders can request redemption for actual bullion if needed, subject to minimums set by issuers. This tangible link provides an extra layer of security during times of market stress.

Your Next Move: Practical Strategies for Blockchain Gold Investment

If you’re seeking inflation protection while maintaining liquidity, tokenized gold is one of the most versatile tools available in 2025. Consider dollar-cost averaging into PAXG/XAUT positions to smooth out volatility, especially given recent price action around $4,045.31. For advanced users, these tokens can also be used as collateral in DeFi protocols, just be sure to assess smart contract risks before deploying significant capital.

Tip: Always check that the platform’s custody arrangements are independently audited and that redemption terms are clearly disclosed before making large purchases.

The bottom line? With robust infrastructure now in place across major exchanges and custodians, buying tokenized gold is more accessible than ever, whether you’re hedging macro risks or simply diversifying beyond fiat currencies. As always, control risk first, and seize opportunity where transparency meets timeless value.