How Tokenized Gold Works: Platforms, Yields, and On-Chain Redemption Explained

Tokenized gold has rapidly evolved from a niche experiment into a core pillar of the tokenized commodities market. By merging the timeless value of gold with the efficiency and transparency of blockchain, investors can now access, trade, and even earn yield on vaulted gold tokens 24/7. But how does tokenized gold actually work? What platforms are leading the charge, and how do yields and on-chain redemption processes compare to traditional gold investments?

Platforms Powering Tokenized Gold: PAXG, XAUT, Swarm Markets

At the heart of this innovation are platforms that issue gold-backed tokens, each representing direct ownership of real, physical gold held in secure vaults. Three standout projects define today’s landscape:

- PAX Gold (PAXG): Each PAXG token is backed by one fine troy ounce of London Good Delivery gold, stored in vaults. Paxos Trust Company provides regulatory oversight and allows users to trace their tokens to specific bars for unmatched transparency.

- Tether Gold (XAUT): XAUT tokens equate to legal ownership of physical gold stored in Swiss vaults. Supporting multiple blockchains, XAUT has become a favorite for investors seeking flexibility and security.

- Swarm Markets: Launched in June 2024, Swarm Markets pioneered NFT-based tokenized gold. Each NFT is linked to an individual bar stored with custodians like Brink’s, providing both transparency and fractional ownership options.

This architecture allows anyone with a Web3 wallet to buy fractions of a gold bar without dealing with storage or insurance headaches. Platforms like these have made it possible to trade tokenized gold at any hour – no more waiting days for settlements or delivery.

Understanding Yield Opportunities: Staking and DeFi for Vaulted Gold Tokens

The most compelling evolution is not just digitalizing ownership but enabling passive income from what was once a static asset. Through decentralized finance (DeFi), holders can earn yield on their tokenized gold. Here’s how:

Top Ways to Earn Yield with PAXG and XAUT Tokens

-

Lending PAXG or XAUT on CeFi Platforms: Centralized finance (CeFi) providers such as Nexo and YouHodler enable investors to lend their PAXG or XAUT tokens to earn interest. Yields vary, with some platforms advertising rates above 10% APY for XAUT, though higher returns often come with increased risk.

-

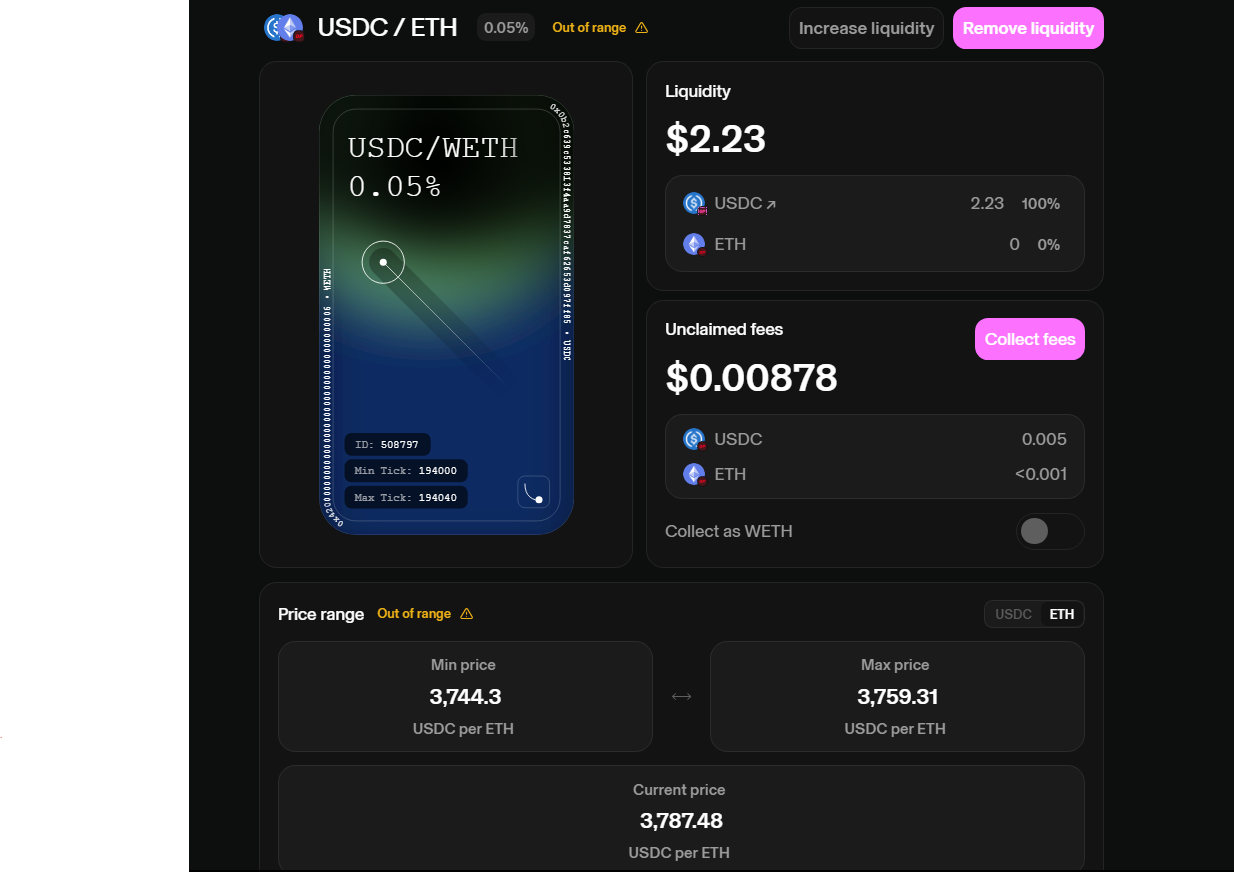

Providing Liquidity on Decentralized Exchanges (DEXs): Investors can supply PAXG or XAUT to liquidity pools on DEXs like Uniswap, earning a share of trading fees. For example, the PAXG/USDC pool allows users to earn passive income by facilitating swaps between tokenized gold and stablecoins.

-

Participating in DeFi Yield Aggregators: Some DeFi platforms and aggregators, such as Yearn Finance, may offer vaults or strategies that include tokenized gold assets like PAXG, enabling users to optimize returns through automated yield farming.

-

Collateralizing PAXG or XAUT for Crypto Loans: Platforms like Nexo and YouHodler accept PAXG and XAUT as collateral for crypto-backed loans. While not a direct yield, this allows investors to access liquidity without selling their gold tokens, potentially using borrowed funds for further yield-generating strategies.

Staking and Lending: Platforms such as Nexo and YouHodler offer annual yields between 3% and 7% for staking PAXG. Meanwhile, some venues advertise yields above 10% for XAUT – though investors should scrutinize risk profiles carefully before chasing high returns. While some platforms tout triple-digit APYs, these often involve significant counterparty or smart contract risk.

Liquidity Provision: By contributing tokenized gold to liquidity pools on decentralized exchanges like Uniswap or Curve, investors earn trading fees every time swaps occur between assets such as PAXG/USDC or XAUT/ETH. This model transforms traditionally illiquid assets into sources of ongoing yield.

If you’re considering adding tokenized gold staking to your portfolio strategy, weigh platform credibility and security protocols alongside headline rates.

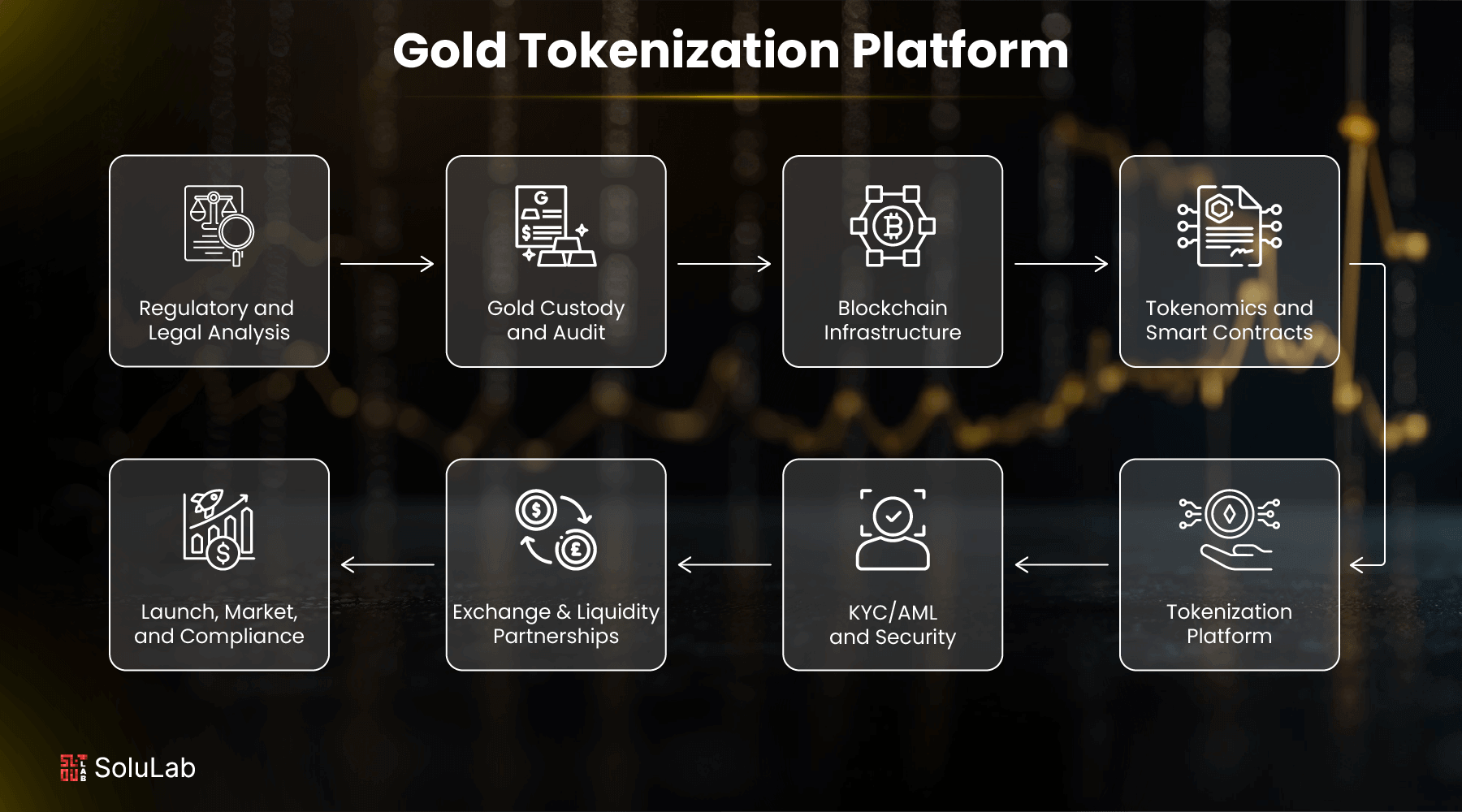

The Mechanics of On-Chain Gold Redemption

The promise of redeemability sets tokenized commodities apart from most digital assets. When you own vaulted gold tokens like XAUT or PAXG, you’re entitled – at least in theory – to swap your tokens back into physical bullion via an on-chain process:

- Initiation: Submit a redemption request specifying delivery location or collection method.

- KYC Verification: Complete identity checks required by the issuing platform.

- Token Transfer and Burn: Send your tokens back; they are burned so total supply matches remaining physical inventory.

- Bullion Release: The corresponding amount of physical gold is released from secure storage for pick-up or shipment.

This process has become increasingly seamless thanks to blockchain automation. For example, Matrixdock’s April 2025 redemption saw XAUm tokens burned on-chain while simultaneously releasing a 1kg LBMA bar from custody (details here). Minimum redemption amounts may apply; for instance, Tether Gold requires at least one full bar (about 430 XAUT) per redemption request (source). Fractional redemptions remain rare but are gaining traction as custody technology advances.

Tokenized gold’s on-chain redemption protocols are setting new standards for transparency and trust in commodity-backed digital assets. Unlike traditional gold ETFs or certificates, where redemption is often cumbersome or unavailable to retail holders, the blockchain-native process provides verifiable proof of both token burning and physical bullion transfer. This dual-layer auditability is a major draw for institutional allocators and compliance-focused investors.

Security, Regulation, and Due Diligence for Gold-Backed Tokens

Despite the promise of seamless ownership and redemption, not all gold-backed tokens are created equal. The quality of custody arrangements, insurance coverage, regulatory oversight, and smart contract security varies widely across platforms. For example, PAXG’s direct traceability to specific bars in London vaults gives it an edge in transparency. XAUT’s use of Swiss vaults appeals to those seeking geopolitical diversification. Swarm Markets’ NFT model introduces further granularity but requires careful review of smart contract code and legal frameworks.

Investors must also consider jurisdictional risk. Some tokenized gold platforms operate under robust regulatory regimes with third-party audits and regular attestations; others may lack meaningful oversight. Always verify whether the platform provides real-time proof-of-reserves and published audit reports before allocating significant capital.

PAX Gold Technical Analysis Chart

Analysis by Colin Bradford | Symbol: BINANCE:PAXGUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

Begin by marking the clear uptrend that started in late August 2025 with a strong trend line from the $3,300 level to the current price near $3,870. Highlight the prior consolidation range between $3,250 and $3,450 from late June through mid-August 2025 using a rectangle. Draw horizontal lines for support at $3,700 (recent breakout level) and $3,500 (prior swing high). Place resistance at the psychological $3,900 level. Use arrow markers to indicate the recent sharp move upward. For potential entries, mark the $3,700-$3,750 zone as a pullback buy area, and for exits, target $3,900 with a stop loss at $3,700. Overlay MACD and volume indicators for confirmation, though volume isn’t visible in this chart. Annotate the chart with brief callouts explaining the breakout and momentum shift.

Risk Assessment: medium

Analysis: Momentum is strong, but price is extended after a sharp rally. Pullbacks to support are likely. Macro backdrop is supportive, but managing risk is prudent after a large move.

Colin Bradford’s Recommendation: Add exposure on retracements to $3,700-$3,750 with a stop below $3,700. Trim profits near $3,900 and rebalance if momentum stalls.

Key Support & Resistance Levels

📈 Support Levels:

-

$3,700 – Recent breakout and consolidation zone, likely to act as strong support on pullbacks.

strong -

$3,500 – Prior swing high and pre-breakout resistance, now support.

moderate

📉 Resistance Levels:

-

$3,900 – Psychological round number and immediate upside target.

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$3,725 – Potential pullback to the breakout area; aligns with hybrid momentum and retracement strategy.

medium risk

🚪 Exit Zones:

-

$3,900 – First upside target; price may stall or reverse at this psychological level.

💰 profit target -

$3,700 – Stop loss below key support to manage risk in case of breakout failure.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume not shown; would normally confirm the strength of the breakout.

If volume was visible, I’d expect to see rising volume on the breakout above $3,700.

📈 MACD Analysis:

Signal: Bullish crossover likely given the momentum surge.

Momentum is very strong; a MACD bullish crossover would confirm trend acceleration.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Colin Bradford is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

The ability to trade tokenized gold 24/7 on global exchanges brings new liquidity to an asset that was historically slow-moving. Yet this liquidity can be a double-edged sword during periods of market stress or blockchain congestion. It’s prudent to test withdrawal processes with small amounts before committing larger sums, especially when planning physical redemption.

Comparing Tokenized Gold Yields: Opportunities and Risks

Yield generation from vaulted gold tokens has become a focal point for forward-thinking portfolio managers. While DeFi protocols offer attractive APYs on PAXG and XAUT through staking or liquidity provision, returns are not risk-free. Counterparty insolvency, smart contract exploits, impermanent loss in AMMs (automated market makers), or sudden changes in platform policy can all impact realized returns.

Key considerations before pursuing tokenized gold yield:

Key Risks When Earning Yield With Tokenized Gold

-

Platform Counterparty Risk: Yield is typically earned by depositing tokenized gold (like PAX Gold (PAXG) or Tether Gold (XAUT)) with centralized or DeFi platforms. If the platform becomes insolvent, is hacked, or mismanages assets, investors may lose their tokens or yields. Always assess the platform’s reputation, transparency, and security track record before depositing assets.

-

Smart Contract Vulnerabilities: DeFi protocols that enable gold token staking or liquidity provision rely on smart contracts. Bugs or exploits in these contracts can result in loss of funds. Even well-audited platforms like Uniswap or Aave are not immune to emerging vulnerabilities.

-

Custodial and Redemption Risk: Tokenized gold is only as secure as the underlying custody arrangement. If the physical gold custodian (e.g., Brink’s for Swarm Markets, or Paxos for PAXG) fails, faces legal trouble, or is compromised, token holders may not be able to redeem tokens for physical gold. Redemption minimums (e.g., 430 XAUT for a full bar) may also limit access.

-

Regulatory and Legal Uncertainty: Regulatory stances on tokenized gold and DeFi yield products are evolving. Platforms could face new rules, enforcement actions, or even bans, impacting your ability to earn or withdraw yield. Regulatory clarity varies widely by jurisdiction and platform (e.g., Paxos is regulated in New York, others may not be).

-

Liquidity and Market Risk: Earning yield often requires providing liquidity to trading pools (e.g., PAXG/USDC on Uniswap). Low trading volume, sudden price swings, or pool imbalances can lead to impermanent loss or difficulty exiting positions at fair value.

-

Yield Sustainability and Risk-Reward Tradeoff: High advertised yields (sometimes exceeding 10% APY for XAUT or even higher on unverified platforms) may not be sustainable and often signal higher risk. Always investigate how yield is generated—excessive returns may involve leverage, unproven protocols, or unsound incentives.

If your priority is capital preservation over yield maximization, consider holding tokens natively rather than deploying them into complex DeFi strategies.

The Road Ahead: Tokenized Gold as a Portfolio Building Block

The convergence of blockchain technology with physical commodities is fundamentally reshaping how investors access hard assets like gold. As custody solutions mature and regulatory clarity improves, expect broader adoption by wealth managers seeking low-cost diversification with transparent audit trails.

The next wave may include multi-asset platforms offering baskets of tokenized commodities, integration with automated rebalancing tools, or even Solana-based gold tokens boasting ultra-low transaction fees for cross-border transfers.

Diversify, adapt, and thrive: In today’s digital-first markets, understanding how tokenized gold works empowers you to blend the resilience of precious metals with the agility of crypto-native finance.