Real-Time Market Data Tools for Tokenized Commodities: What to Use

Access to accurate, real-time market data is the foundation of any successful strategy in the tokenized commodities space. As institutional and retail interest accelerates, so does the demand for robust tools that deliver live price feeds, liquidity data, and actionable analytics for assets like tokenized gold, oil, and agricultural products. The landscape in 2025 is defined by precision and speed: investors expect sub-second latency, comprehensive coverage across both traditional and digital commodities, and seamless integration with trading platforms.

Why Real-Time Data Matters for Tokenized Commodities

Unlike legacy commodity markets where end-of-day settlement was once the norm, tokenized commodities trade around the clock on blockchain-based platforms. Price discovery is continuous. This means that even a small lag in market data can result in significant slippage or missed arbitrage opportunities. For example, Chainlink’s recent Data Streams innovation now provides sub-second latency pricing across 37 blockchains, a benchmark that underscores how critical low-latency data has become for DeFi protocols developing synthetic ETFs and perpetual futures.

But navigating this new era requires more than just speed. Investors need tools tailored to the nuances of tokenized assets: APIs that handle both spot and derivative products, dashboards that visualize on-chain flows alongside off-chain benchmarks, and analytics that cut through noise to reveal genuine trends.

The Top 5 Real-Time Market Data Tools for Tokenized Commodities

Top 5 Real-Time Market Data Tools for Tokenized Commodities

-

Alpaca Market Data API: A leading API offering real-time stock and crypto market data, including support for tokenized commodities. Alpaca provides unlimited access to accurate price feeds and advanced charting tools, making it ideal for developers and traders seeking seamless integration with trading platforms.

-

AllTick Real-Time Market Data API: AllTick delivers comprehensive, real-time tick data for commodities, stocks, forex, and cryptocurrencies. Its robust API infrastructure ensures up-to-the-second pricing, empowering users to track and analyze tokenized commodity assets efficiently.

-

dxFeed Market Data Platform: dxFeed stands out with its multi-asset real-time and historical data feeds for commodities, derivatives, and digital assets. The platform supports advanced analytics and on-demand data access, tailored for institutional and retail investors in tokenized commodities.

-

CoinGecko API (Tokenized Commodities Section): CoinGecko’s API provides live price feeds and analytics for a wide range of tokenized commodities. Its dedicated section enables developers and analysts to access market data, historical trends, and liquidity metrics for digital assets backed by real-world commodities.

-

Securitize Markets Dashboard: Securitize offers a comprehensive dashboard for trading and tracking tokenized commodities, integrating real-time price data, compliance tools, and market analytics. The platform is trusted by institutional investors for its secure and transparent approach to digital asset markets.

Here’s a curated selection of platforms leading the charge in real-time commodity token price intelligence:

- Alpaca Market Data API: Renowned for its best-in-class charting and trading infrastructure, Alpaca offers real-time feeds not only for stocks but also select crypto assets. The platform’s API is optimized for high-frequency strategies and supports business accounts seeking scalable access to market data.

- AllTick Real-Time Market Data API: AllTick stands out for its granular tick-level data across forex, US and HK equities, cryptocurrencies, and crucially, commodities. Its comprehensive API enables developers to pull live price updates or historical data for backtesting algorithmic models.

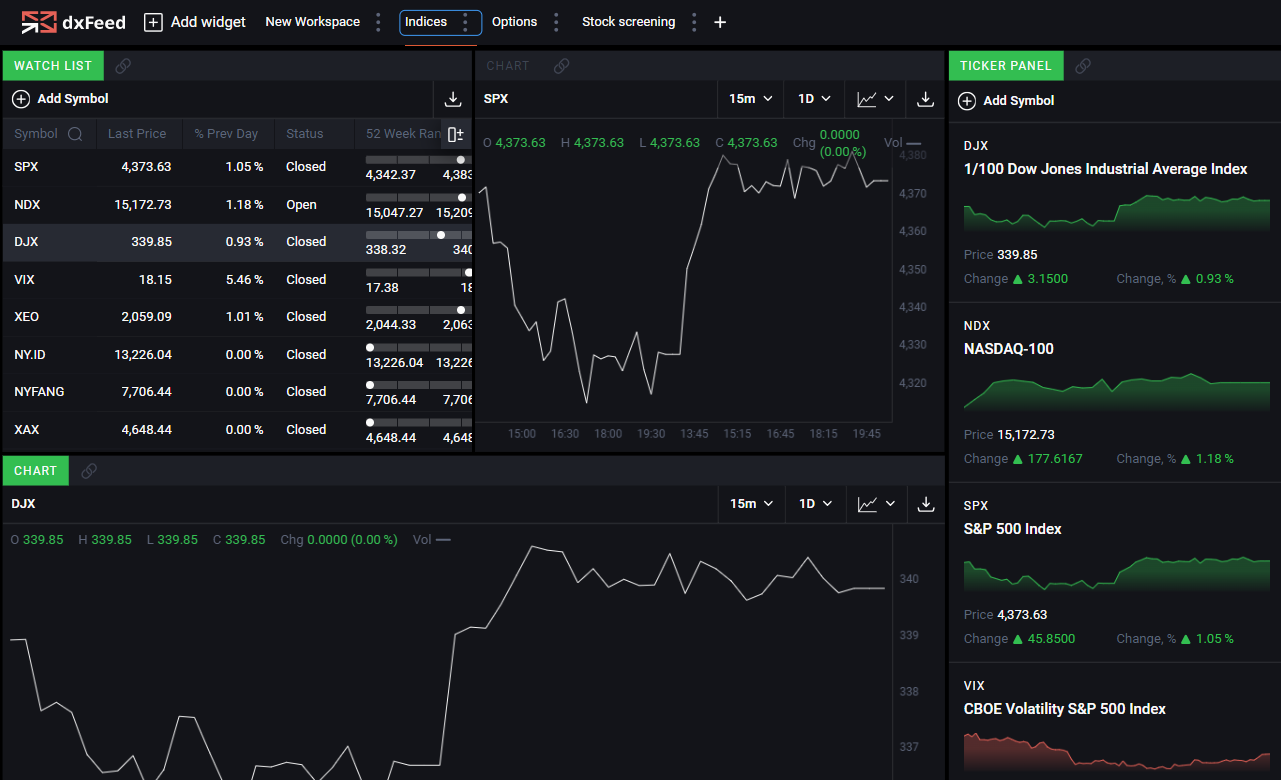

- dxFeed Market Data Platform: dxFeed delivers institutional-grade feeds covering stocks, derivatives, commodities (including energy and precious metals), indices, forex pairs, and more. With multi-API support (REST/WebSocket/FIX), dxFeed is a go-to resource for funds requiring both real-time and historical depth.

- CoinGecko API (Tokenized Commodities Section): CoinGecko remains a staple in crypto analytics thanks to its broad asset coverage, including a dedicated section tracking tokenized commodities. The API supplies up-to-date prices, volumes, market caps, and even on-chain metrics where available.

- Securitize Markets Dashboard: Securitize brings regulatory rigor to digital securities, including commodity-backed tokens, via its integrated dashboard. Investors can monitor live prices of listed RWAs (real-world assets), track order books in real time, and access compliance-ready reporting features.

Differentiators: What Sets These Tools Apart?

The platforms above aren’t interchangeable, they each have unique strengths depending on your use case:

- If you’re building automated trading bots or require lightning-fast execution, Alpaca’s low-latency infrastructure is hard to beat.

- If your focus is on comprehensive asset coverage with deep historical context, AllTick’s tick-level granularity provides a distinct edge.

- If you manage institutional portfolios or need cross-asset analytics at scale, dxFeed shines with its breadth of instruments and customizable APIs.

- If you want broad visibility into both crypto-native tokens and RWA-backed coins, CoinGecko’s API bridges traditional commodities with emerging digital formats.

- If regulatory compliance is paramount or you’re tracking securities-grade tokens, Securitize’s dashboard offers transparency alongside required reporting capabilities.

The Role of Analytics and Visualization in Decision-Making

A high-quality feed is only as good as your ability to interpret it. Modern platforms now offer advanced visualization tools, think heatmaps of liquidity flows or volatility surfaces mapped against macro events, to help traders make sense of fast-moving markets. For instance:

- Securitize Markets Dashboard integrates compliance alerts directly into price charts so investors can act quickly if an asset moves out of regulatory bounds.

- CoinGecko’s Tokenized Commodities Section overlays price action with supply changes or protocol upgrades, giving users context beyond raw numbers.